Kaiser Aluminum Announces Pricing of Secondary Stock Offering

January 26 2007 - 9:30AM

Business Wire

Kaiser Aluminum Corporation (NASDAQ: KALU) today announced the

pricing of an offering of 5,461,870 shares of common stock, all of

which are being offered by existing stockholders, at $61.25 per

share. One selling stockholder, a voluntary employees� beneficiary

association trust that provides benefits to eligible retirees

represented by certain unions, has agreed to sell 2,517,955 shares

and has granted the underwriters a 30-day option to purchase up to

819,280 additional shares, to cover over-allotments, if any. The

company will not sell any shares in, and will not receive any of

the proceeds from, this offering. UBS Securities LLC and Bear,

Stearns�& Co. Inc. acted as joint book-running managers and

Lehman Brothers Inc. and Lazard Capital Markets LLC acted as

co-managers of the offering. This press release does not constitute

an offer to sell or the solicitation of an offer to buy these

securities, nor will there be any sale of these securities in any

state or jurisdiction in which the offer, solicitation or sale

would be unlawful prior to registration or qualification under the

securities laws of such state or jurisdiction. The offering of

these securities will be made only by means of a prospectus, copies

of which may be obtained by contacting UBS Securities LLC,

Attention: Prospectus Department, 299 Park Avenue, New York, NY

10171 or from Bear, Stearns & Co. Inc., c/o Prospectus

Department, 383 Madison Avenue, New York, NY 10179. Kaiser Aluminum

is a leading independent aluminum products manufacturing company,

operating 11 production facilities in North America. The company

produces rolled, extruded, drawn and forged aluminum products

within three categories consisting of aerospace and high strength

products, general engineering products and custom automotive and

industrial products. F-1063 Kaiser Aluminum press releases may

contain statements that constitute �forward-looking statements�

within the meaning of the Private Securities Litigation Reform Act

of 1995. The company cautions that such forward-looking statements

are not guarantees of future performance or events and involve

significant risks and uncertainties, and that actual results or

events may vary from those in the forward-looking statements as a

result of various factors. Factors potentially affecting the events

contemplated by the forward-looking statements contained in this

press release include: (a)�general economic and business

conditions, (b)�changing stock prices and equity market conditions,

and (c)�factors that could adversely affect the company�s business

prospects, financial condition, results of operations and cash

flows, which are summarized in the company�s registration statement

on Form�S-1 and other reports filed by the company with the

Securities and Exchange Commission. Accordingly, no assurance can

be given that the proposed public offering will be completed or as

to the impact of the proposed offering on the market for the

company�s common stock.

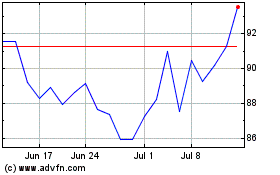

Kaiser Aluminum (NASDAQ:KALU)

Historical Stock Chart

From Jun 2024 to Jul 2024

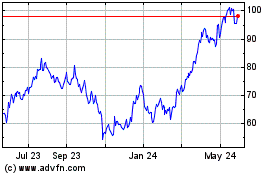

Kaiser Aluminum (NASDAQ:KALU)

Historical Stock Chart

From Jul 2023 to Jul 2024