0001104506false--12-312024Q1http://fasb.org/us-gaap/2023#ProductMemberhttp://fasb.org/us-gaap/2023#ProductMemberhttp://fasb.org/us-gaap/2023#ProductMemberhttp://fasb.org/us-gaap/2023#ProductMemberhttp://fasb.org/us-gaap/2023#ProductMemberhttp://fasb.org/us-gaap/2023#ProductMemberhttp://fasb.org/us-gaap/2023#ProductMemberhttp://fasb.org/us-gaap/2023#ProductMember0.02553840.0307692122168511352xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:pureinsm:reportingUnitinsm:saleinsm:dayinsm:days00011045062024-01-012024-03-3100011045062024-05-0600011045062024-03-3100011045062023-12-3100011045062023-01-012023-03-310001104506us-gaap:CommonStockMember2022-12-310001104506us-gaap:AdditionalPaidInCapitalMember2022-12-310001104506us-gaap:RetainedEarningsMember2022-12-310001104506us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-3100011045062022-12-310001104506us-gaap:RetainedEarningsMember2023-01-012023-03-310001104506us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001104506us-gaap:CommonStockMember2023-01-012023-03-310001104506us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001104506us-gaap:CommonStockMember2023-03-310001104506us-gaap:AdditionalPaidInCapitalMember2023-03-310001104506us-gaap:RetainedEarningsMember2023-03-310001104506us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-3100011045062023-03-310001104506us-gaap:CommonStockMember2023-12-310001104506us-gaap:AdditionalPaidInCapitalMember2023-12-310001104506us-gaap:RetainedEarningsMember2023-12-310001104506us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001104506us-gaap:RetainedEarningsMember2024-01-012024-03-310001104506us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001104506us-gaap:CommonStockMember2024-01-012024-03-310001104506us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001104506us-gaap:CommonStockMember2024-03-310001104506us-gaap:AdditionalPaidInCapitalMember2024-03-310001104506us-gaap:RetainedEarningsMember2024-03-310001104506us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001104506insm:VertuisBioIncMember2024-01-012024-03-310001104506insm:VertuisBioIncMember2023-01-012023-03-310001104506insm:CustomerAMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueProductLineMember2024-01-012024-03-310001104506insm:CustomerAMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueProductLineMember2023-01-012023-03-310001104506insm:CustomerBMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueProductLineMember2024-01-012024-03-310001104506insm:CustomerBMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueProductLineMember2023-01-012023-03-310001104506insm:CustomerCMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueProductLineMember2024-01-012024-03-310001104506insm:CustomerCMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueProductLineMember2023-01-012023-03-3100011045062023-01-012023-12-310001104506us-gaap:EmployeeStockOptionMember2024-01-012024-03-310001104506us-gaap:EmployeeStockOptionMember2023-01-012023-03-310001104506us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310001104506us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-310001104506us-gaap:PerformanceSharesMember2024-01-012024-03-310001104506us-gaap:PerformanceSharesMember2023-01-012023-03-310001104506us-gaap:EmployeeStockOptionMember2024-01-012024-03-310001104506us-gaap:EmployeeStockOptionMember2023-01-012023-03-310001104506us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310001104506us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-310001104506us-gaap:PerformanceSharesMember2024-01-012024-03-310001104506us-gaap:PerformanceSharesMember2023-01-012023-03-310001104506us-gaap:ConvertibleDebtSecuritiesMember2024-01-012024-03-310001104506us-gaap:ConvertibleDebtSecuritiesMember2023-01-012023-03-310001104506us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2024-03-310001104506us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-03-310001104506us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-03-310001104506us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-03-310001104506us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001104506us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001104506us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001104506us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001104506insm:MotusBiosciencesIncMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2021-08-012021-08-310001104506insm:MotusBiosciencesIncMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2021-08-012021-08-310001104506insm:MotusBiosciencesIncMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2021-08-012021-08-310001104506insm:MotusBiosciencesIncMember2022-08-012022-08-310001104506insm:MotusBiosciencesIncMember2023-08-012023-08-310001104506insm:AccruedLiabilitiesCurrentMember2024-03-310001104506us-gaap:FairValueInputsLevel2Memberus-gaap:MeasurementInputSharePriceMember2024-03-310001104506insm:MotusBiosciencesIncMember2021-08-012021-08-310001104506insm:AlgaeneXIncMember2021-08-042021-08-040001104506insm:MeasurementInputProbabilityOfSuccessMember2024-03-310001104506insm:MotusBiosciencesIncMemberinsm:DevelopmentAndRegulatoryMilestonesMember2021-08-310001104506insm:MotusBiosciencesIncMemberinsm:DevelopmentAndRegulatoryMilestonesMember2021-08-012021-08-310001104506insm:MotusBiosciencesIncMemberus-gaap:FairValueInputsLevel3Member2024-03-310001104506insm:MotusBiosciencesIncMemberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueInputsLevel3Member2024-03-310001104506insm:DevelopmentAndRegulatoryMilestonesMember2024-03-310001104506insm:MeasurementInputProbabilityOfSuccessMembersrt:MinimumMemberus-gaap:FairValueInputsLevel3Memberinsm:DevelopmentAndRegulatoryMilestonesMember2024-03-310001104506insm:MeasurementInputProbabilityOfSuccessMembersrt:MaximumMemberus-gaap:FairValueInputsLevel3Memberinsm:DevelopmentAndRegulatoryMilestonesMember2024-03-310001104506insm:PriorityReviewVoucherMilestoneMember2024-03-310001104506insm:MeasurementInputProbabilityOfSuccessMemberinsm:PriorityReviewVoucherMilestoneMemberus-gaap:FairValueInputsLevel3Member2024-03-310001104506insm:PriorityReviewVoucherMilestoneMemberus-gaap:MeasurementInputDiscountRateMemberus-gaap:FairValueInputsLevel3Member2024-03-310001104506us-gaap:FairValueInputsLevel2Member2022-12-310001104506us-gaap:FairValueInputsLevel3Member2022-12-310001104506us-gaap:FairValueInputsLevel2Member2023-01-012023-03-310001104506us-gaap:FairValueInputsLevel3Member2023-01-012023-03-310001104506us-gaap:FairValueInputsLevel2Member2023-03-310001104506us-gaap:FairValueInputsLevel3Member2023-03-310001104506us-gaap:FairValueInputsLevel2Member2023-12-310001104506us-gaap:FairValueInputsLevel3Member2023-12-310001104506us-gaap:FairValueInputsLevel2Member2024-01-012024-03-310001104506us-gaap:FairValueInputsLevel3Member2024-01-012024-03-310001104506us-gaap:FairValueInputsLevel2Member2024-03-310001104506us-gaap:FairValueInputsLevel3Member2024-03-310001104506insm:ZeroPointSevenFivePercentConvertibleSeniorNoteDue2028Memberus-gaap:ConvertibleNotesPayableMember2024-03-310001104506us-gaap:FairValueMeasurementsRecurringMemberinsm:ZeroPointSevenFivePercentConvertibleSeniorNoteDue2028Memberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-03-310001104506us-gaap:ConvertibleNotesPayableMemberinsm:OnePointSevenFivePercentConvertibleSeniorNoteDue2025Member2024-03-310001104506us-gaap:SecuredDebtMemberus-gaap:RoyaltyAgreementsMember2022-10-012022-10-310001104506insm:ARIKAYCEGlobalNetSalesMemberus-gaap:RoyaltyAgreementsMember2022-10-010001104506srt:ScenarioForecastMemberinsm:ARIKAYCEGlobalNetSalesMemberus-gaap:RoyaltyAgreementsMember2025-09-010001104506insm:BrensocatibGlobalNetSalesMemberus-gaap:RoyaltyAgreementsMember2022-10-310001104506us-gaap:SecuredDebtMemberus-gaap:RoyaltyAgreementsMember2022-10-310001104506country:US2024-01-012024-03-310001104506country:US2023-01-012023-03-310001104506country:JP2024-01-012024-03-310001104506country:JP2023-01-012023-03-310001104506insm:EuropeAndTheRestOfTheWorldMember2024-01-012024-03-310001104506insm:EuropeAndTheRestOfTheWorldMember2023-01-012023-03-310001104506insm:AcquiredResearchAndDevelopmentMember2023-12-310001104506insm:AcquiredResearchAndDevelopmentMember2024-01-012024-03-310001104506insm:AcquiredResearchAndDevelopmentMember2024-03-310001104506us-gaap:InProcessResearchAndDevelopmentMember2023-12-310001104506us-gaap:InProcessResearchAndDevelopmentMember2024-01-012024-03-310001104506us-gaap:InProcessResearchAndDevelopmentMember2024-03-310001104506us-gaap:LicensingAgreementsMember2023-12-310001104506us-gaap:LicensingAgreementsMember2024-01-012024-03-310001104506us-gaap:LicensingAgreementsMember2024-03-310001104506insm:AcquiredResearchAndDevelopmentMember2022-12-310001104506insm:AcquiredResearchAndDevelopmentMember2023-01-012023-03-310001104506insm:AcquiredResearchAndDevelopmentMember2023-03-310001104506us-gaap:InProcessResearchAndDevelopmentMember2022-12-310001104506us-gaap:InProcessResearchAndDevelopmentMember2023-01-012023-03-310001104506us-gaap:InProcessResearchAndDevelopmentMember2023-03-310001104506us-gaap:LicensingAgreementsMember2022-12-310001104506us-gaap:LicensingAgreementsMember2023-01-012023-03-310001104506us-gaap:LicensingAgreementsMember2023-03-310001104506us-gaap:EquipmentMember2024-03-310001104506us-gaap:EquipmentMember2023-12-310001104506us-gaap:FurnitureAndFixturesMember2024-03-310001104506us-gaap:FurnitureAndFixturesMember2023-12-310001104506srt:MinimumMemberinsm:ComputerHardwareAndSoftwareMember2024-03-310001104506srt:MaximumMemberinsm:ComputerHardwareAndSoftwareMember2024-03-310001104506insm:ComputerHardwareAndSoftwareMember2024-03-310001104506insm:ComputerHardwareAndSoftwareMember2023-12-310001104506us-gaap:OfficeEquipmentMember2024-03-310001104506us-gaap:OfficeEquipmentMember2023-12-310001104506insm:ManufacturingEquipmentMember2024-03-310001104506insm:ManufacturingEquipmentMember2023-12-310001104506srt:MinimumMemberus-gaap:LeaseholdImprovementsMember2024-03-310001104506us-gaap:LeaseholdImprovementsMembersrt:MaximumMember2024-03-310001104506us-gaap:LeaseholdImprovementsMember2024-03-310001104506us-gaap:LeaseholdImprovementsMember2023-12-310001104506us-gaap:ConstructionInProgressMember2024-03-310001104506us-gaap:ConstructionInProgressMember2023-12-310001104506srt:MinimumMember2024-01-012024-03-310001104506srt:MaximumMember2024-01-012024-03-310001104506us-gaap:ConvertibleNotesPayableMember2024-03-310001104506us-gaap:ConvertibleNotesPayableMember2023-12-310001104506insm:TermLoanMember2024-03-310001104506insm:TermLoanMember2023-12-310001104506insm:ZeroPointSevenFivePercentConvertibleSeniorNoteDue2028Memberus-gaap:ConvertibleNotesPayableMember2021-05-310001104506insm:ZeroPointSevenFivePercentConvertibleSeniorNoteDue2028Memberus-gaap:ConvertibleNotesPayableMember2021-05-012021-05-310001104506us-gaap:ConvertibleNotesPayableMemberinsm:OnePointSevenFivePercentConvertibleSeniorNoteDue2025Member2018-01-310001104506us-gaap:ConvertibleNotesPayableMemberinsm:OnePointSevenFivePercentConvertibleSeniorNoteDue2025Member2018-01-012018-01-310001104506us-gaap:ConvertibleNotesPayableMemberinsm:OnePointSevenFivePercentConvertibleSeniorNoteDue2025Member2021-05-310001104506us-gaap:ConvertibleNotesPayableMemberinsm:OnePointSevenFivePercentConvertibleSeniorNoteDue2025Member2021-05-012021-05-310001104506insm:OnePointSevenFivePercentConvertibleSeniorNoteDue2025Member2018-01-012018-01-310001104506insm:ZeroPointSevenFivePercentConvertibleSeniorNoteDue2028Member2018-01-012018-01-310001104506us-gaap:ConvertibleNotesPayableMemberinsm:DebtInstrumentConversionTermOneMemberinsm:OnePointSevenFivePercentConvertibleSeniorNoteDue2025Member2018-01-012018-01-310001104506insm:ZeroPointSevenFivePercentConvertibleSeniorNoteDue2028Memberus-gaap:ConvertibleNotesPayableMemberinsm:DebtInstrumentConversionTermOneMember2021-05-012021-05-310001104506insm:ZeroPointSevenFivePercentConvertibleSeniorNoteDue2028Memberus-gaap:ConvertibleNotesPayableMemberinsm:DebtInstrumentConversionTermTwoMember2021-05-012021-05-310001104506us-gaap:ConvertibleNotesPayableMemberinsm:DebtInstrumentConversionTermTwoMemberinsm:OnePointSevenFivePercentConvertibleSeniorNoteDue2025Member2018-01-012018-01-310001104506insm:ZeroPointSevenFivePercentConvertibleSeniorNoteDue2028Memberus-gaap:ConvertibleNotesPayableMemberinsm:DebtInstrumentConversionTermThreeMember2021-05-012021-05-310001104506us-gaap:ConvertibleNotesPayableMemberinsm:DebtInstrumentConversionTermThreeMemberinsm:OnePointSevenFivePercentConvertibleSeniorNoteDue2025Member2018-01-012018-01-310001104506insm:DebtInstrumentConversionTermFourMemberinsm:ZeroPointSevenFivePercentConvertibleSeniorNoteDue2028Memberus-gaap:ConvertibleNotesPayableMember2021-05-012021-05-310001104506insm:DebtInstrumentConversionTermFourMemberus-gaap:ConvertibleNotesPayableMemberinsm:OnePointSevenFivePercentConvertibleSeniorNoteDue2025Member2018-01-012018-01-310001104506us-gaap:ConvertibleNotesPayableMember2018-01-310001104506us-gaap:ConvertibleNotesPayableMember2021-05-310001104506us-gaap:ConvertibleNotesPayableMemberinsm:OnePointSevenFivePercentConvertibleSeniorNoteDue2025Member2024-01-012024-03-310001104506insm:ZeroPointSevenFivePercentConvertibleSeniorNoteDue2028Memberus-gaap:ConvertibleNotesPayableMember2024-01-012024-03-310001104506us-gaap:FairValueMeasurementsRecurringMemberinsm:ZeroPointSevenFivePercentConvertibleSeniorNoteDue2028Memberus-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2024-03-310001104506us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberinsm:OnePointSevenFivePercentConvertibleSeniorNoteDue2025Member2024-03-310001104506us-gaap:ConvertibleNotesPayableMember2024-03-310001104506us-gaap:ConvertibleNotesPayableMember2023-12-310001104506us-gaap:SecuredDebtMemberinsm:TermLoanMember2022-10-310001104506us-gaap:SecuredDebtMemberinsm:TermLoanMemberinsm:SecuredOvernightFinancingRateSOFRMember2022-10-012022-10-310001104506us-gaap:SecuredDebtMemberinsm:VariableRateComponentTwoMemberinsm:TermLoanMemberinsm:SecuredOvernightFinancingRateSOFRMember2022-10-012022-10-310001104506us-gaap:SecuredDebtMemberinsm:TermLoanMember2022-10-012022-10-310001104506us-gaap:SecuredDebtMemberinsm:TermLoanMember2024-03-310001104506us-gaap:SecuredDebtMemberinsm:TermLoanMember2023-12-310001104506us-gaap:ConvertibleDebtMember2024-01-012024-03-310001104506us-gaap:ConvertibleDebtMember2023-01-012023-03-310001104506insm:TermLoanMember2024-01-012024-03-310001104506insm:TermLoanMember2023-01-012023-03-310001104506us-gaap:RoyaltyAgreementsMember2024-01-012024-03-310001104506us-gaap:RoyaltyAgreementsMember2023-01-012023-03-310001104506insm:OnePointSevenFivePercentConvertibleSeniorNoteDue2025Member2021-05-012021-05-310001104506insm:ZeroPointSevenFivePercentConvertibleSeniorNoteDue2028Member2021-05-012021-05-310001104506us-gaap:RoyaltyAgreementsMember2022-10-310001104506srt:MaximumMemberus-gaap:RoyaltyAgreementsMember2022-10-310001104506us-gaap:SecuredDebtMemberus-gaap:RoyaltyAgreementsMember2023-12-310001104506us-gaap:SecuredDebtMemberus-gaap:RoyaltyAgreementsMember2022-12-310001104506us-gaap:SecuredDebtMemberus-gaap:RoyaltyAgreementsMember2024-01-012024-03-310001104506us-gaap:SecuredDebtMemberus-gaap:RoyaltyAgreementsMember2023-01-012023-12-310001104506us-gaap:SecuredDebtMemberus-gaap:RoyaltyAgreementsMember2024-03-310001104506us-gaap:SecuredDebtMember2024-01-012024-03-310001104506us-gaap:SecuredDebtMember2023-01-012023-12-310001104506us-gaap:RoyaltyAgreementsMember2024-03-310001104506us-gaap:RoyaltyAgreementsMember2023-12-310001104506us-gaap:EmployeeStockOptionMember2024-03-310001104506us-gaap:RestrictedStockUnitsRSUMember2024-03-310001104506us-gaap:PerformanceSharesMember2024-03-310001104506insm:MotusBiosciencesIncMember2024-03-310001104506insm:MotusBiosciencesIncMember2021-09-300001104506insm:MotusBiosciencesIncMember2021-07-012021-09-300001104506insm:MotusBiosciencesIncMember2022-07-012022-09-300001104506insm:MotusBiosciencesIncMember2023-07-012023-09-300001104506insm:AdrestiaTherapeuticsLtdMember2023-04-012023-06-300001104506insm:VertuisBioIncMember2023-01-310001104506insm:VertuisBioIncMember2023-01-012023-01-310001104506insm:VertuisBioIncMember2023-12-310001104506insm:PublicStockOfferingMember2022-10-012022-10-3100011045062022-10-3100011045062022-10-012022-10-310001104506insm:AtTheMarketAgreementMember2021-01-012021-03-310001104506insm:AtTheMarketAgreementMember2023-01-012023-12-310001104506insm:AtTheMarketAgreementMember2023-12-310001104506insm:AtTheMarketAgreementMember2024-01-012024-03-310001104506insm:A2019IncentivePlanMember2020-05-122020-05-120001104506insm:A2019IncentivePlanThirdAmendmentMember2024-03-310001104506insm:EmployeeStockPurchasePlan2018Member2018-05-150001104506insm:EmployeeStockPurchasePlan2018Member2018-05-152018-05-150001104506insm:StockOptionsAndRestrictedStockUnitsMemberus-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-03-310001104506insm:StockOptionsAndRestrictedStockUnitsMemberus-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-03-310001104506insm:StockOptionsAndRestrictedStockUnitsMemberus-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-03-310001104506insm:StockOptionsAndRestrictedStockUnitsMemberus-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-03-310001104506insm:StockOptionsAndRestrictedStockUnitsMember2024-01-012024-03-310001104506insm:StockOptionsAndRestrictedStockUnitsMember2023-01-012023-03-310001104506insm:AdrestiaTherapeuticsLtdMember2023-06-012023-06-3000011045062023-06-300001104506insm:VertuisBioIncMember2023-01-012023-01-3100011045062023-01-310001104506insm:MilestoneEvent1Memberinsm:VertuisBioIncMember2023-01-012023-01-310001104506insm:MilestoneEvent2Memberinsm:VertuisBioIncMember2023-01-012023-01-310001104506insm:MilestoneEvent3Memberinsm:VertuisBioIncMember2023-01-012023-01-310001104506insm:MotusBiosciencesIncMember2021-08-042021-08-040001104506insm:MotusBiosciencesIncMember2021-08-040001104506insm:AlgaeneXIncMember2021-08-012021-08-310001104506insm:AlgaeneXIncMember2021-08-310001104506insm:MotusBiosciencesIncMember2021-08-3100011045062021-05-242021-05-240001104506insm:MotusBiosciencesIncAndAlgaeneXIncMember2021-08-012021-08-310001104506insm:WilliamLewisMember2024-01-012024-03-310001104506insm:WilliamLewisMember2024-03-310001104506insm:SaraBonsteinMember2024-01-012024-03-310001104506insm:SaraBonsteinMember2024-03-310001104506insm:DraytonWiseMember2024-01-012024-03-310001104506insm:DraytonWiseMember2024-03-310001104506insm:S.NicoleSchaefferMember2024-01-012024-03-310001104506insm:S.NicoleSchaefferMember2024-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 000-30739

INSMED INCORPORATED

(Exact name of registrant as specified in its charter) | | | | | | | | |

| Virginia | | 54-1972729 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. employer identification no.) |

| | |

700 US Highway 202/206, | | |

Bridgewater, New Jersey | | 08807 |

| (Address of principal executive offices) | | (Zip Code) |

(908) 977-9900

(Registrant’s telephone number including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbols | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | INSM | Nasdaq Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | | | | | | | | |

Large accelerated filer x | | Accelerated filer o |

| | |

Non-accelerated filer o | | Smaller reporting company ☐ |

Emerging growth company ☐

| | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

As of May 6, 2024, there were 148,604,548 shares of the registrant’s common stock outstanding.

INSMED INCORPORATED

FORM 10-Q

FOR THE QUARTER ENDED MARCH 31, 2024

Unless the context otherwise indicates, references in this Form 10-Q to “Insmed Incorporated” refers to Insmed Incorporated, a Virginia corporation, and the “Company,” “Insmed,” “we,” “us” and “our” refer to Insmed Incorporated together with its consolidated subsidiaries. INSMED, PULMOVANCE, ARIKARES and ARIKAYCE are trademarks of Insmed Incorporated. This Form 10-Q also contains trademarks of third parties. Each trademark of another company appearing in this Form 10-Q is the property of its owner.

PART I. FINANCIAL INFORMATION

ITEM 1. CONSOLIDATED FINANCIAL STATEMENTS

INSMED INCORPORATED

Consolidated Balance Sheets

(in thousands, except par value and share data) | | | | | | | | | | | |

| As of | | As of |

| March 31, 2024 | | December 31, 2023 |

| | (unaudited) | | |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 595,729 | | | $ | 482,374 | |

| Marketable securities | — | | | 298,073 | |

| Accounts receivable | 37,162 | | | 41,189 | |

| Inventory | 82,957 | | | 83,248 | |

| Prepaid expenses and other current assets | 42,874 | | | 24,179 | |

| Total current assets | 758,722 | | | 929,063 | |

| | | |

| Fixed assets, net | 68,660 | | | 65,384 | |

| Finance lease right-of-use assets | 20,307 | | | 20,985 | |

| Operating lease right-of-use assets | 17,157 | | | 18,017 | |

| Intangibles, net | 62,441 | | | 63,704 | |

| Goodwill | 136,110 | | | 136,110 | |

| Other assets | 95,698 | | | 96,574 | |

| Total assets | $ | 1,159,095 | | | $ | 1,329,837 | |

| | | |

| Liabilities and shareholders’ equity | | | |

| Current liabilities: | | | |

| Accounts payable and accrued liabilities | $ | 189,362 | | | $ | 214,987 | |

| Current portion of long-term debt | 224,194 | | | — | |

| | | |

| Finance lease liabilities | 2,695 | | | 2,610 | |

| Operating lease liabilities | 4,609 | | | 8,032 | |

| | | |

| Total current liabilities | 420,860 | | | 225,629 | |

| | | |

| Debt, long-term | 939,081 | | | 1,155,313 | |

| Royalty financing agreement | 156,967 | | | 155,034 | |

| Contingent consideration | 63,700 | | | 84,600 | |

| Finance lease liabilities, long-term | 26,320 | | | 27,026 | |

| Operating lease liabilities, long-term | 13,809 | | | 11,013 | |

| Other long-term liabilities | 3,166 | | | 3,145 | |

| Total liabilities | 1,623,903 | | | 1,661,760 | |

| | | |

| Shareholders’ equity: | | | |

Common stock, $0.01 par value; 500,000,000 authorized shares, 148,560,882 and 147,977,960 issued and outstanding shares at March 31, 2024 and December 31, 2023, respectively | 1,486 | | | 1,480 | |

| Additional paid-in capital | 3,138,578 | | | 3,113,487 | |

| Accumulated deficit | (3,603,236) | | | (3,446,145) | |

| Accumulated other comprehensive loss | (1,636) | | | (745) | |

| Total shareholders’ deficit | (464,808) | | | (331,923) | |

| Total liabilities and shareholders’ deficit | $ | 1,159,095 | | | $ | 1,329,837 | |

See accompanying notes to the unaudited consolidated financial statements

INSMED INCORPORATED

Consolidated Statements of Comprehensive Loss (unaudited)

(in thousands, except per share data)

| | | | | | | | | | | | | | | |

| | Three Months Ended March 31, | | |

| | 2024 | | 2023 | | | | |

| | | | | | | |

| Product revenues, net | $ | 75,500 | | | $ | 65,214 | | | | | |

| | | | | | | |

| Operating expenses: | | | | | | | |

| Cost of product revenues (excluding amortization of intangible assets) | 17,457 | | | 13,830 | | | | | |

| Research and development | 121,083 | | | 127,865 | | | | | |

| Selling, general and administrative | 93,102 | | | 79,914 | | | | | |

| Amortization of intangible assets | 1,263 | | | 1,263 | | | | | |

| Change in fair value of deferred and contingent consideration liabilities | (11,900) | | | (9,500) | | | | | |

| Total operating expenses | 221,005 | | | 213,372 | | | | | |

| | | | | | | |

| Operating loss | (145,505) | | | (148,158) | | | | | |

| | | | | | | |

| Investment income | 8,783 | | | 10,524 | | | | | |

| Interest expense | (21,042) | | | (20,003) | | | | | |

| Change in fair value of interest rate swap | 2,362 | | | (1,533) | | | | | |

| | | | | | | |

| Other expense, net | (1,100) | | | (111) | | | | | |

| Loss before income taxes | (156,502) | | | (159,281) | | | | | |

| | | | | | | |

| Provision for income taxes | 589 | | | 483 | | | | | |

| | | | | | | |

| Net loss | $ | (157,091) | | | $ | (159,764) | | | | | |

| | | | | | | |

| Basic and diluted net loss per share | $ | (1.06) | | | $ | (1.17) | | | | | |

| | | | | | | |

Weighted average basic and diluted common shares outstanding | 148,456 | | | 136,355 | | | | | |

| | | | | | | |

| Net loss | $ | (157,091) | | | $ | (159,764) | | | | | |

| Other comprehensive income (loss): | | | | | | | |

| Foreign currency translation losses | (855) | | | (171) | | | | | |

| Unrealized (loss) gain on marketable securities | (36) | | | 498 | | | | | |

| Total comprehensive loss | $ | (157,982) | | | $ | (159,437) | | | | | |

| | | | | | | |

| | | | | | | |

See accompanying notes to the unaudited consolidated financial statements

INSMED INCORPORATED

Consolidated Statements of Shareholders' Deficit (unaudited)

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Additional

Paid-in

Capital | | Accumulated

Deficit | | Accumulated

Other

Comprehensive

Income (Loss) | | Total |

| Shares | | Amount | |

| Balance at December 31, 2022 | 135,654 | | | $ | 1,357 | | | $ | 2,782,416 | | | $ | (2,696,578) | | | $ | 756 | | | $ | 87,951 | |

| Comprehensive loss: | | | | | | | | | | | |

| Net loss | | | | | | | (159,764) | | | | | (159,764) | |

| Other comprehensive income | | | | | | | | | 327 | | | 327 | |

| Exercise of stock options and ESPP shares | 82 | | | 1 | | | 1,138 | | | | | | | 1,139 | |

| | | | | | | | | | | |

| Issuance of common stock for vesting of RSUs | 193 | | | 1 | | | | | | | | | 1 | |

| | | | | | | | | | | |

| Issuance of common stock for asset acquisition | 500 | | 5 | | 9,245 | | | | | | | 9,250 | |

| Stock-based compensation expense | | | | | 16,443 | | | | | | | 16,443 | |

| Balance at March 31, 2023 | 136,429 | | | $ | 1,364 | | | $ | 2,809,242 | | | $ | (2,856,342) | | | $ | 1,083 | | | $ | (44,653) | |

| | | | | | | | | | | |

| Balance at December 31, 2023 | 147,978 | | | $ | 1,480 | | | $ | 3,113,487 | | | $ | (3,446,145) | | | $ | (745) | | | $ | (331,923) | |

| Comprehensive loss: | | | | | | | | | | | |

| Net loss | | | | | | | (157,091) | | | | | (157,091) | |

| Other comprehensive loss | | | | | | | | | (891) | | | (891) | |

| Exercise of stock options and ESPP shares issuance | 217 | | | 2 | | | 4,050 | | | | | | | 4,052 | |

| Net proceeds from issuance of common stock | | | | | (409) | | | | | | | (409) | |

| Issuance of common stock for vesting of RSUs | 366 | | | 4 | | | | | | | | | 4 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Stock-based compensation expense | | | | | 21,450 | | | | | | | 21,450 | |

| Balance at March 31, 2024 | 148,561 | | | $ | 1,486 | | | $ | 3,138,578 | | | $ | (3,603,236) | | | $ | (1,636) | | | $ | (464,808) | |

See accompanying notes to the unaudited consolidated financial statements

INSMED INCORPORATED

Consolidated Statements of Cash Flows (unaudited)

(in thousands)

| | | | | | | | | | | |

| | Three Months Ended March 31, |

| | 2024 | | 2023 |

| Operating activities | | | |

| Net loss | $ | (157,091) | | | $ | (159,764) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation | 1,588 | | | 1,248 | |

| Amortization of intangible assets | 1,263 | | | 1,263 | |

| Stock-based compensation expense | 21,450 | | | 16,443 | |

| | | |

| Amortization of debt issuance costs | 1,851 | | | 1,724 | |

| Paid-in-kind interest capitalized | 6,242 | | | 5,456 | |

| Royalty financing non-cash interest expense | 4,822 | | | 2,615 | |

| Accretion of discount on marketable securities, net | (1,963) | | | — | |

| Finance lease amortization expense | 678 | | | 678 | |

| Non-cash operating lease expense | 6,516 | | | 2,491 | |

| Change in fair value of deferred and contingent consideration liabilities | (11,900) | | | (9,500) | |

| Change in fair value of interest rate swap | (2,362) | | | 1,533 | |

| Vertuis acquisition | — | | | 10,250 | |

| | | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 2,955 | | | (860) | |

| Inventory | (598) | | | (1,187) | |

| Prepaid expenses and other current assets | (19,330) | | | (3,199) | |

| Other assets | 333 | | | (5,231) | |

| Accounts payable and accrued liabilities | (32,345) | | | (8,841) | |

| Other liabilities | (6,144) | | | (1,422) | |

| | | |

| Net cash used in operating activities | (184,035) | | | (146,303) | |

| Investing activities | | | |

| Purchase of fixed assets | (4,679) | | | (3,398) | |

| | | |

| | | |

| Maturities of marketable securities | 300,000 | | | 45,000 | |

| Net cash provided by investing activities | 295,321 | | | 41,602 | |

| Financing activities | | | |

| Proceeds from exercise of stock options and ESPP | 4,052 | | | 1,139 | |

| Payments of equity issuance costs | (409) | | | — | |

| | | |

| | | |

| | | |

| | | |

| Payments of finance lease principal | (621) | | | (320) | |

| | | |

| Payment of debt issuance costs | — | | | (1,218) | |

| Net cash provided by (used in) financing activities | 3,022 | | | (399) | |

| Effect of exchange rates on cash and cash equivalents | (953) | | | (29) | |

| Net increase (decrease) in cash and cash equivalents | 113,355 | | | (105,129) | |

| Cash and cash equivalents at beginning of period | 482,374 | | | 1,074,036 | |

| Cash and cash equivalents at end of period | $ | 595,729 | | | $ | 968,907 | |

| Supplemental disclosures of cash flow information: | | | |

| Cash paid for interest | $ | 8,210 | | | $ | 11,589 | |

| Cash paid for income taxes | $ | 1,208 | | | $ | 1,004 | |

| | | |

See accompanying notes to the unaudited consolidated financial statements

INSMED INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. The Company and Basis of Presentation

Insmed is a global biopharmaceutical company on a mission to transform the lives of patients with serious and rare diseases. The Company's first commercial product, ARIKAYCE, is approved in the United States (US) as ARIKAYCE® (amikacin liposome inhalation suspension), in Europe as ARIKAYCE Liposomal 590 mg Nebuliser Dispersion and in Japan as ARIKAYCE inhalation 590 mg (amikacin sulfate inhalation drug product). ARIKAYCE received accelerated approval in the US in September 2018 for the treatment of Mycobacterium avium complex (MAC) lung disease as part of a combination antibacterial drug regimen for adult patients with limited or no alternative treatment options in a refractory setting. In October 2020, the European Commission (EC) approved ARIKAYCE for the treatment of nontuberculous mycobacterial (NTM) lung infections caused by MAC in adults with limited treatment options who do not have cystic fibrosis (CF). In March 2021, Japan's Ministry of Health, Labour and Welfare (MHLW) approved ARIKAYCE for the treatment of patients with NTM lung disease caused by MAC who did not sufficiently respond to prior treatment with a multidrug regimen. NTM lung disease caused by MAC (which the Company refers to as MAC lung disease) is a rare and often chronic infection that can cause irreversible lung damage and can be fatal.

The Company's pipeline includes clinical-stage programs, brensocatib and treprostinil palmitil inhalation powder (TPIP), as well as other early-stage research programs. Brensocatib is a small molecule, oral, reversible inhibitor of dipeptidyl peptidase 1 (DPP1), which the Company is developing for the treatment of patients with bronchiectasis and other neutrophil-mediated diseases, including chronic rhinosinusitis without nasal polyps (CRSsNP). TPIP is an inhaled formulation of the treprostinil prodrug treprostinil palmitil which may offer a differentiated product profile for pulmonary hypertension associated with interstitial lung disease (PH-ILD) and pulmonary arterial hypertension (PAH). The Company's early-stage research programs encompass a wide range of technologies and modalities, including gene therapy, artificial intelligence-driven protein engineering, protein manufacturing, RNA-end joining, and synthetic rescue.

The Company was incorporated in the Commonwealth of Virginia on November 29, 1999 and its principal executive offices are located in Bridgewater, New Jersey. The Company has legal entities in the US, France, Germany, Ireland, Italy, the Netherlands, Switzerland, the United Kingdom (UK), and Japan.

The accompanying unaudited interim consolidated financial statements have been prepared pursuant to the rules and regulations for reporting on Form 10-Q. Accordingly, certain information and disclosures required by accounting principles generally accepted in the US (GAAP) for complete consolidated financial statements are not included herein. The unaudited interim consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in the Company's Annual Report on Form 10-K for the year ended December 31, 2023. Any references in these notes to applicable accounting guidance are meant to refer to GAAP as found in the Accounting Standards Codification (ASC) and Accounting Standards Updates (ASU) of the Financial Accounting Standards Board (FASB). The results of operations of any interim period are not necessarily indicative of the results of operations for the full year. The unaudited interim consolidated financial information presented herein reflects all normal adjustments that are, in the opinion of management, necessary for a fair statement of the financial position, results of operations and cash flows for the periods presented. All intercompany transactions and balances have been eliminated in consolidation.

The Company had $595.7 million in cash and cash equivalents as of March 31, 2024 and reported a net loss of $157.1 million for the three months ended March 31, 2024. The Company has funded its operations through public offerings of equity securities, debt financings and revenue interest financings. The Company expects to continue to incur consolidated operating losses, including losses in its US and certain international entities, while funding research and development (R&D) activities for ARIKAYCE, brensocatib, TPIP and its other pipeline programs, continuing commercialization and regulatory activities for ARIKAYCE and pre-commercial, regulatory and, if approved, commercialization activities for brensocatib, and funding other general and administrative activities.

The Company expects its future cash requirements to be substantial. While the Company currently has sufficient funds to meet its financial needs for at least the next 12 months, the Company may raise additional capital in the future to fund its operations, its ongoing commercialization and clinical trial activities, and its future product candidates, and to develop, acquire, in-license or co-promote other products or product candidates, including those that address orphan or rare diseases. The source, timing and availability of any future financing or other transaction will depend principally upon continued progress in the Company’s commercial, regulatory and development activities. Any future financing will also be contingent upon market

INSMED INCORPORATED

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

1. The Company and Basis of Presentation (Continued)

conditions. If the Company is unable to obtain sufficient additional funds when required, the Company may be forced to delay, restrict or eliminate all or a portion of its development programs or commercialization efforts.

The consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries, Celtrix Pharmaceuticals, Inc., Insmed Holdings Limited, Insmed Gene Therapy LLC, Insmed Ireland Limited, Insmed France SAS, Insmed Germany GmbH, Insmed Limited, Insmed Netherlands Holdings B.V., Insmed Netherlands B.V., Insmed Godo Kaisha, Insmed Switzerland GmbH, Insmed Italy S.R.L., Insmed Innovation UK Limited, and Adrestia Therapeutics Inc. All intercompany transactions and balances have been eliminated in consolidation.

2. Summary of Significant Accounting Policies

Use of Estimates—The preparation of the consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. The Company bases its estimates and judgments on historical experience and on various other assumptions. The amounts of assets and liabilities reported in the Company's balance sheets and the amounts of revenues and expenses reported for each period presented are affected by estimates and assumptions, which are used for, but not limited to, the accounting for revenue allowances, stock-based compensation, income taxes, loss contingencies, acquisition related intangibles including in process research and development (IPR&D) and goodwill, fair value of contingent consideration, and accounting for research and development costs. Actual results could differ from those estimates.

Concentration of Credit Risk—Financial instruments that potentially subject the Company to concentrations of credit risk consist primarily of cash and cash equivalents. The Company places its cash equivalents with high credit-quality financial institutions and may invest its investments in US treasury securities, mutual funds and government agency bonds. The Company has established guidelines relative to credit ratings and maturities that seek to maintain safety and liquidity.

The Company is exposed to risks associated with extending credit to customers related to the sale of products. The Company does not require collateral to secure amounts due from its customers. The Company uses an expected loss methodology to calculate allowances for trade receivables. The Company's measurement of expected credit losses is based on relevant information about past events, including historical experience, current conditions, and reasonable and supportable forecasts that affect the collectability of the reported amount. The Company does not currently have a material allowance for uncollectible trade receivables. The following table presents the percentage of gross product revenue represented by the Company's three largest customers as of the three months ended March 31, 2024 and their respective percentages for the three months ended March 31, 2023.

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | | | |

| 2024 | | 2023 | | | | |

| Customer A | 35% | | 36% | | | | |

| Customer B | 34% | | 36% | | | | |

| Customer C | 16% | | 17% | | | | |

The Company relies on third-party manufacturers and suppliers for manufacturing and supply of its products. The inability of the suppliers or manufacturers to fulfill supply requirements of the Company could materially impact future operating results. A change in the relationship with the suppliers or manufacturers, or an adverse change in their business, could materially impact future operating results.

Finite-lived Intangible Assets—Finite-lived intangible assets are measured at their respective fair values on the date they were recorded. The fair values assigned to the Company's intangible assets are based on reasonable estimates and assumptions given available facts and circumstances. See Note 6 - Intangibles, Net and Goodwill for further details.

Impairment Assessment—The Company reviews the recoverability of its finite-lived intangible assets and long-lived assets for indicators of impairments. Events or circumstances that may require an impairment assessment include negative clinical trial results, a significant decrease in the market price of the asset, or a significant adverse change in legal factors or the manner in which the asset is used. If such indicators are present, the Company assesses the recoverability of affected assets by

INSMED INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2. Summary of Significant Accounting Policies (Continued)

determining if the carrying value of such assets is less than the sum of the undiscounted future cash flows of the assets. If such assets are found to not be recoverable, the Company measures the amount of the impairment by comparing the carrying value of the assets to the fair value of the assets.

Business Combinations and Asset Acquisitions—The Company evaluates acquisitions of assets and other similar transactions to assess whether or not the transaction should be accounted for as a business combination or asset acquisition by first applying a screen to determine if substantially all of the fair value of the gross assets acquired is concentrated in a single identifiable asset or group of similar identifiable assets. If the screen is met, the transaction is accounted for as an asset acquisition. If the screen is not met, further determination is required as to whether or not the Company has acquired inputs and processes that have the ability to create outputs, which would meet the requirements of a business. If determined to be a business combination, the Company accounts for the transaction under the acquisition method of accounting as indicated in ASU 2017-01, Business Combinations (Topic 805): Clarifying the Definition of a Business, which requires the acquiring entity in a business combination to recognize the fair value of all assets acquired, liabilities assumed, and any non-controlling interest in the acquiree and establishes the acquisition date as the fair value measurement point. Accordingly, the Company recognizes assets acquired and liabilities assumed in business combinations, including contingent assets and liabilities, and non-controlling interest in the acquiree based on the fair value estimates as of the date of acquisition. In accordance with ASC 805, Business Combinations, the Company recognizes and measures goodwill as of the acquisition date, as the excess of the fair value of the consideration paid over the fair value of the identified net assets acquired.

The consideration for the Company’s business acquisitions may include future payments that are contingent upon the occurrence of a particular event or events. The obligations for such contingent consideration payments are recorded at fair value on the acquisition date. The contingent consideration obligations are then evaluated each reporting period. Changes in the fair value of contingent consideration, other than changes due to payments, are recognized as a gain or loss and recorded within change in the fair value of deferred and contingent consideration liabilities in the consolidated statements of comprehensive loss.

If determined to be an asset acquisition, the Company accounts for the transaction under ASC 805-50, which requires the acquiring entity in an asset acquisition to recognize assets acquired and liabilities assumed based on the cost to the acquiring entity on a relative fair value basis, which includes transaction costs in addition to consideration given. No gain or loss is recognized as of the date of acquisition unless the fair value of non-cash assets given as consideration differs from the assets’ carrying amounts on the acquiring entity’s books. Consideration transferred that is non-cash will be measured based on either the cost (which shall be measured based on the fair value of the consideration given) or the fair value of the assets acquired and liabilities assumed, whichever is more reliably measurable. Goodwill is not recognized in an asset acquisition and any excess consideration transferred over the fair value of the net assets acquired is allocated to the identifiable assets based on relative fair values. If the in-licensed agreement for IPR&D does not meet the definition of a business and the assets have not reached technological feasibility and therefore have no alternative future use, the Company expenses payments made under such license agreements as acquired IPR&D expense in its consolidated statements of comprehensive loss.

Contingent consideration payments in asset acquisitions are recognized when the contingency is resolved and the consideration is paid or becomes payable, unless the contingent consideration meets the definition of a derivative, in which case the amount becomes part of the basis in the asset acquired. None of the Company's contingent consideration met the definition of a derivative as of March 31, 2024. Upon recognition of a contingent consideration payment, the amount is included in the cost of the acquired asset or group of assets.

Indefinite-lived Intangible Assets—Indefinite-lived intangible assets consist of IPR&D. IPR&D acquired directly in a transaction other than a business combination is capitalized if the projects will be further developed or have an alternative future use; otherwise, they are expensed. The fair values of IPR&D project assets acquired in business combinations are capitalized. The Company generally utilizes the Multi-Period Excess Earning Method to determine the estimated fair value of the IPR&D assets acquired in a business combination. The projections used in this valuation approach are based on many factors, such as relevant market size, patent protection, and expected pricing and industry trends. The estimated future net cash flows are then discounted to the present value using an appropriate discount rate. These assets are treated as indefinite-lived intangible assets until completion or abandonment of the projects, at which time the assets are amortized over the remaining useful life or written off, as appropriate. Intangible assets with indefinite lives, including IPR&D, are tested for impairment if impairment indicators arise and, at a minimum, annually. However, an entity is permitted to first assess qualitative factors to determine if a quantitative impairment test is necessary. Further testing is only required if the entity determines, based on the qualitative assessment, that it is more likely than not that an indefinite-lived intangible asset’s fair value is less than its carrying amount. The indefinite-lived intangible asset impairment test consists of a one-step analysis that compares the fair value of the

INSMED INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2. Summary of Significant Accounting Policies (Continued)

intangible asset with its carrying amount. If the carrying amount of an intangible asset exceeds its fair value, an impairment loss is recognized in an amount equal to that excess. The Company considers many factors in evaluating whether the value of its intangible assets with indefinite lives may not be recoverable, including, but not limited to, expected growth rates, the cost of equity and debt capital, general economic conditions, the Company’s outlook and market performance of the Company’s industry and recent and forecasted financial performance. The Company performs a qualitative test for its indefinite-lived intangible assets annually as of October 1.

Goodwill—Goodwill represents the amount of consideration paid in excess of the fair value of net assets acquired as a result of the Company’s business acquisitions accounted for using the acquisition method of accounting. Goodwill is not amortized and is subject to impairment testing at a reporting unit level on an annual basis or when a triggering event occurs that may indicate the carrying value of the goodwill is impaired. An entity is permitted to first assess qualitative factors to determine if a quantitative impairment test is necessary. Further testing is only required if the entity determines, based on the qualitative assessment, that it is more likely than not that the fair value of the reporting unit is less than its carrying amount. As of March 31, 2024 and December 31, 2023, the Company continues to operate as one reporting unit. The Company will perform its next annual impairment testing for goodwill as of October 1, 2024. See Note 6 - Intangibles, Net and Goodwill for further details.

Leases—A lease is a contract, or part of a contract, that conveys the right to control the use of explicitly or implicitly identified property, plant or equipment in exchange for consideration. Control of an asset is conveyed to the Company if the Company obtains the right to obtain substantially all of the economic benefits of the asset or the right to direct the use of the asset. The Company recognizes right-of-use (ROU) assets and lease liabilities at the lease commencement date based on the present value of future, fixed lease payments over the term of the arrangement. ROU assets are amortized on a straight-line basis over the term of the lease or are amortized based on consumption, if this approach is more representative of the pattern in which benefit is expected to be derived from the underlying asset. Lease liabilities accrete to yield and are reduced at the time when the lease payment is payable to the vendor. Variable lease payments are recognized at the time when the event giving rise to the payment occurs and are recognized in the consolidated statements of comprehensive loss in the same line item as expenses arising from fixed lease payments.

Leases are measured at present value using the rate implicit in the lease or, if the implicit rate is not determinable, the lessee's implicit borrowing rate. As the implicit rate is not typically available, the Company uses its implicit borrowing rate based on the information available at the lease commencement date to determine the present value of future lease payments. The implicit borrowing rate approximates the rate the Company would pay to borrow on a collateralized basis over a similar term an amount equal to the lease payments. See Note 9 - Leases for further details.

Debt Issuance Costs—Debt issuance costs are amortized to interest expense using the effective interest rate method over the term of the debt. Unamortized debt issuance costs paid to the lender and third parties are reflected as a discount to the debt in the consolidated balance sheets. Unamortized debt issuance costs associated with extinguished debt are expensed in the period of the extinguishment.

Foreign Currency—The Company has operations in the US, France, Germany, Ireland, Italy, the Netherlands, Switzerland, the UK, and Japan. The results of the Company's non-US dollar based functional currency operations are translated to US dollars at the average exchange rates during the period. Assets and liabilities are translated at the exchange rate prevailing at the balance sheet date. Equity is translated at the prevailing exchange rate at the date of the equity transaction. Translation adjustments are included in total shareholders' deficit, as a component of accumulated other comprehensive loss.

The Company realizes foreign currency transaction gains and losses in the normal course of business based on movements in the applicable exchange rates. These gains and losses are included as a component of other expense, net.

Derivatives—In the normal course of business, the Company is exposed to the effects of interest rate changes. The Company may enter into derivative instruments, including interest rate swaps and caps, to manage or hedge interest rate risk. Derivative instruments are recorded at fair value on the balance sheet date. The Company has not elected hedge accounting treatment for the changes in the fair value of derivatives. Changes in the fair value of derivatives are recorded each period and are included in change in fair value of interest rate swap in the consolidated statements of comprehensive loss and consolidated statements of cash flows.

Inventory and Cost of Product Revenues (excluding amortization of intangible assets)—Inventory is stated at the lower of cost and net realizable value. Inventory is sold on a first-in, first-out (FIFO) basis. The Company periodically reviews inventory for expiry and obsolescence and, if necessary, writes down accordingly. If quality specifications are not met during

INSMED INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2. Summary of Significant Accounting Policies (Continued)

the manufacturing process, such inventory is written off to cost of product revenues (excluding amortization of intangible assets) in the period identified.

Cost of product revenues (excluding amortization of intangible assets) consist primarily of direct and indirect costs related to the manufacturing of ARIKAYCE sold, including third-party manufacturing costs, packaging services, freight, and allocation of overhead costs, in addition to royalty expenses. Cost is determined using a standard cost method, which approximates actual cost, and assumes a FIFO flow of goods. Inventory used for clinical development purposes is expensed to R&D expense when consumed.

Net Loss Per Share—Basic net loss per share is computed by dividing net loss by the weighted average number of common shares outstanding during the period. Diluted net loss per share is computed by dividing net loss by the weighted average number of common shares and other dilutive securities outstanding during the period. Potentially dilutive securities from stock options, restricted stock (RS), restricted stock units (RSUs), performance stock units (PSUs) and convertible debt securities would be anti-dilutive as the Company incurred a net loss. Potentially dilutive common shares resulting from the assumed exercise of outstanding stock options and from the assumed conversion of the Company's convertible notes are determined based on the treasury stock method.

The following table sets forth the reconciliation of the weighted average number of common shares used to compute basic and diluted net loss per share for the three months ended March 31, 2024 and 2023:

| | | | | | | | | | | | | | | |

| | Three Months Ended March 31, | | |

| | 2024 | | 2023 | | | | |

| | | | | | |

| Numerator: | | | | | | | |

| Net loss | $ | (157,091) | | | $ | (159,764) | | | | | |

| Denominator: | | | | | | | |

| Weighted average common shares used in calculation of basic net loss per share: | 148,456 | | | 136,355 | | | | | |

| Effect of dilutive securities: | | | | | | | |

| Common stock options | — | | | — | | | | | |

| RS and RSUs | — | | | — | | | | | |

| PSUs | — | | | — | | | | | |

| Convertible debt securities | — | | | — | | | | | |

| Weighted average common shares outstanding used in calculation of diluted net loss per share | 148,456 | | | 136,355 | | | | | |

| Net loss per share: | | | | | | | |

| Basic and diluted | $ | (1.06) | | | $ | (1.17) | | | | | |

The following potentially dilutive securities have been excluded from the computations of diluted weighted average common shares outstanding as of March 31, 2024 and 2023, respectively, as their effect would have been anti-dilutive (in thousands):

| | | | | | | | | | | |

| As of March 31, |

| | 2024 | | 2023 |

| Common stock options | 24,098 | | | 19,156 | |

| Unvested RS and RSUs | 3,059 | | | 2,058 | |

| PSUs | 666 | | | 671 | |

| Convertible debt securities | 23,438 | | | 23,438 | |

Recent Accounting Pronouncements (Not Yet Adopted)—In December 2023, the FASB issued ASU 2023-09, Income Taxes—Improvements to Income Tax Disclosures, in order to enhance the transparency and decision usefulness of income tax disclosures. ASU 2023-09 requires greater disaggregation of income tax disclosures related to the income tax rate

INSMED INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2. Summary of Significant Accounting Policies (Continued)

reconciliation and income taxes paid. ASU 2023-09 will be effective for fiscal years beginning after December 15, 2024. The Company is currently evaluating the impact of adoption of ASU 2023-09 on its consolidated financial statements.

3. Fair Value Measurements

The Company categorizes its financial assets and liabilities measured and reported at fair value in the financial statements on a recurring basis based upon the level of judgment associated with the inputs used to measure their fair value. Hierarchical levels, which are directly related to the amount of subjectivity associated with the inputs used to determine the fair value of financial assets and liabilities, are as follows:

•Level 1—Inputs are unadjusted, quoted prices in active markets for identical assets or liabilities at the measurement date.

•Level 2—Inputs (other than quoted prices included in Level 1) are either directly or indirectly observable for the assets or liability through correlation with market data at the measurement date and for the duration of the instrument’s anticipated life.

•Level 3—Inputs reflect management’s best estimate of what market participants would use in pricing the asset or liability at the measurement date. Consideration is given to the risk inherent in the valuation technique and the risk inherent in the inputs to the model.

Each major category of financial assets and liabilities measured at fair value on a recurring basis is categorized based upon the lowest level of significant input to the valuations. The fair value hierarchy also requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. Financial instruments in Level 1 generally include US treasuries and mutual funds listed in active markets. The Company's cash and cash equivalents permit daily redemption and the fair values of these investments are based upon the quoted prices in active markets provided by the holding financial institutions.

The following table shows assets and liabilities that are measured at fair value on a recurring basis and their carrying value (in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| As of March 31, 2024 |

| | | Fair Value |

| Carrying Value | | Level 1 | | Level 2 | | Level 3 |

| Assets | | | | | | | |

| Cash and cash equivalents | $ | 595.7 | | | $ | 595.7 | | | $ | — | | | $ | — | |

| | | | | | | |

| Collateral for interest rate swap | $ | 6.0 | | | $ | 6.0 | | | $ | — | | | $ | — | |

| Liabilities | | | | | | | |

| Interest rate swap | $ | (1.2) | | | $ | — | | | $ | (1.2) | | | $ | — | |

| Deferred consideration | $ | 5.0 | | | $ | — | | | $ | 5.0 | | | $ | — | |

| Contingent consideration | $ | 73.4 | | | $ | — | | | $ | — | | | $ | 73.4 | |

| | | | | | | |

INSMED INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

3. Fair Value Measurements (Continued)

| | | | | | | | | | | | | | | | | | | | | | | |

| As of December 31, 2023 |

| | | Fair Value |

| Carrying Value | | Level 1 | | Level 2 | | Level 3 |

| Assets | | | | | | | |

| Cash and cash equivalents | $ | 482.4 | | | $ | 482.4 | | | $ | — | | | $ | — | |

| Marketable securities | $ | 298.1 | | | $ | 298.1 | | | $ | — | | | $ | — | |

| Collateral for interest rate swap | $ | 6.0 | | | $ | 6.0 | | | $ | — | | | $ | — | |

| Liabilities | | | | | | | |

| Interest rate swap | $ | 1.2 | | | $ | — | | | $ | 1.2 | | | $ | — | |

| Deferred consideration | $ | 5.7 | | | $ | — | | | $ | 5.7 | | | $ | — | |

| Contingent consideration | $ | 84.6 | | | $ | — | | | $ | — | | | $ | 84.6 | |

| | | | | | | |

During the three months ended March 31, 2024, $300.0 million of marketable securities, consisting of US Treasury Notes, matured.

The Company recognizes transfers between levels within the fair value hierarchy, if any, at the end of each quarter. The collateral for interest rate swap and the interest rate swap are recorded in other assets and accounts payable and accrued liabilities, respectively, in the consolidated balance sheet as of March 31, 2024 and December 31, 2023. The collateral for interest rate swap is cash, a Level 1 asset. The interest rate swap is a Level 2 liability as it uses observable inputs other than quoted market prices in an active market. There were no transfers in or out of Level 1, Level 2 or Level 3 during the three months ended March 31, 2024.

As of March 31, 2024, the Company held no available-for-sale securities. Marketable securities maturing in one year or less are classified as current assets and marketable securities maturing in more than one year are classified as non-current assets.

The Company reviews the status of each security quarterly to determine whether an other-than-temporary impairment has occurred. In making its determination, the Company considers a number of factors, including: (1) the significance of the decline; (2) whether the security was rated below investment grade; (3) failure of the issuer to make scheduled interest or principal payments; and (4) the Company's ability and intent to retain the investment for a sufficient period of time for it to recover. The Company has determined that there were no other-than-temporary impairments during the three months ended March 31, 2024.

Deferred Consideration

The deferred consideration arose from the acquisitions of Motus Biosciences, Inc. (Motus) and AlgaeneX, Inc. (AlgaeneX) (the Business Acquisition) in August 2021. The Company is obligated to issue to Motus equityholders an aggregate of 184,433 shares of the Company’s common stock on each of the first, second and third anniversaries of the closing date, subject to certain reductions. During August 2022 and August 2023, the Company fulfilled the payments due on the first and second anniversaries of the closing date by issuing 171,427 shares and 177,203 shares of the Company's common stock, respectively, after certain reductions. A valuation of the deferred consideration is performed quarterly with gains and losses included within change in fair value of deferred and contingent consideration liabilities in the consolidated statements of comprehensive loss. As the deferred consideration is settled in shares, there is no discount rate applied in the fair value calculation.

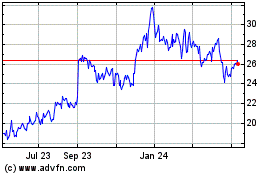

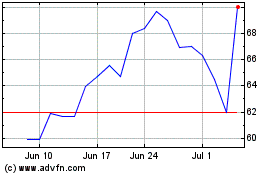

The deferred consideration has been classified as a Level 2 recurring liability as its valuation utilizes an input, the Insmed share price, which is a directly observable input at the measurement date and for the duration of the liabilities' anticipated lives. Deferred consideration expected to be settled within twelve months or less is classified as a current liability within accounts payable and accrued liabilities. As of March 31, 2024, the fair value of deferred consideration included in accounts payable and accrued liabilities was $5.0 million.

The following observable input was used in the valuation of the deferred consideration as of March 31, 2024:

INSMED INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

3. Fair Value Measurements (Continued)

| | | | | | | | | | | |

| Fair Value as of March 31, 2024 (in millions) | Observable Input | Input Value |

| Deferred consideration | $5.0 | Insmed share price as of March 31, 2024 | $27.13 |

Contingent Consideration

The contingent consideration liabilities arose from the Business Acquisition in August 2021 (see Note 16 - Acquisitions). The contingent consideration liabilities consist of developmental and regulatory milestones, a priority review voucher milestone and net sales milestones. Upon the achievement of certain development and regulatory milestone events, the Company is obligated to issue to Motus equityholders up to 5,348,572 shares in the aggregate and AlgaeneX equityholders up to 368,867 shares in the aggregate. The fair value of the development and regulatory milestones are estimated utilizing a probability-adjusted approach. At March 31, 2024, the weighted average probability of success was 42%. The development and regulatory milestones will be settled in shares of the Company's common stock. As such, there is no discount rate applied in the fair value calculation.

If the Company were to receive a priority review voucher, the Company is obligated to pay to the Motus equityholders a portion of the value of the priority review voucher, subject to certain reductions. The potential payout will be either 50% of the after tax net proceeds received by the Company from a sale of the priority review voucher or 50% of the average of the sales prices for the last three publicly disclosed priority review voucher sales, less certain adjustments. The fair value of the priority review voucher milestone is estimated utilizing a probability-adjusted discounted cash flow approach. This obligation will be settled in cash.

The contingent consideration liabilities for net sales milestones were valued using an option pricing model with Monte Carlo simulation. As of March 31, 2024, the fair value of these net sales milestones were deemed immaterial to the overall fair value of the contingent consideration.

The contingent consideration liabilities have been classified as a Level 3 recurring liability as its valuation requires substantial judgment and estimation of factors that are not currently observable in the market. If different assumptions were used for the inputs to the valuation approach, the estimated fair value could be significantly different than the fair value the Company determined. Contingent consideration expected to be settled within twelve months or less is classified as a current liability within accounts payable and accrued liabilities. Contingent consideration expected to be settled in more than twelve months is classified as a non-current liability. As of March 31, 2024, the fair value of the current and non-current contingent consideration was $9.7 million and $63.7 million, respectively.

A valuation of the contingent consideration liabilities is performed quarterly with gains and losses included within change in fair value of contingent consideration liabilities in the consolidated statements of comprehensive loss. The following significant unobservable inputs were used in the valuation of the development and regulatory milestones and the priority review voucher milestone as of March 31, 2024:

| | | | | | | | | | | | | | |

| Fair Value as of March 31, 2024 (in millions) | Valuation Technique | Unobservable Inputs | Values |

| Development and regulatory milestones | $65.5 | Probability-adjusted | Probabilities of success | 14% - 97% |

| Priority review voucher milestone | $5.1 | Probability-adjusted discounted cash flow | Probability of success | 16.4% |

| Discount rate | 15.7% |

The following table is a summary of the changes in the fair value of the Company's valuations for the deferred and contingent consideration liabilities for the three months ended March 31, 2024 and 2023 (in thousands):

INSMED INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

3. Fair Value Measurements (Continued)

| | | | | | | | | | | |

| Deferred

Consideration

(Level 2 Liabilities) | | Contingent Consideration

(Level 3 Liabilities) |

| Balance as of December 31, 2022 | $ | 7,400 | | | $ | 58,100 | |

| Additions | — | | | — | |

| Change in Fair Value | (1,200) | | | (8,300) | |

| Payments | — | | | — | |

| Balance as of March 31, 2023 | $ | 6,200 | | | $ | 49,800 | |

| | | |

| Balance as of December 31, 2023 | $ | 5,700 | | | $ | 84,600 | |

| Additions | — | | | — | |

| Change in Fair Value | (700) | | | (11,200) | |

| Payments | — | | | — | |

| Balance as of March 31, 2024 | $ | 5,000 | | | $ | 73,400 | |

Convertible Notes

The fair value of the convertible notes, which differs from their carrying value, is influenced by interest rates, the Company's stock price and stock price volatility (collectively, the Current Market Factors), and is determined by prices for the convertible notes observed in market trading which are Level 2 inputs.

The estimated fair value of the Company's 0.75% convertible senior notes due 2028 (the 2028 Convertible Notes) (categorized as a Level 2 liability for fair value measurement purposes) as of March 31, 2024 was $620.1 million, determined using Current Market Factors and the ability of the Company to obtain debt on comparable terms to the 2028 Convertible Notes.

The estimated fair value of the Company's 1.75% convertible senior notes due 2025 (the 2025 Convertible Notes) (categorized as a Level 2 liability for fair value measurement purposes) as of March 31, 2024 was $238.7 million, determined using Current Market Factors, and the ability of the Company to obtain debt on comparable terms to the 2025 Convertible Notes. See Note 10 - Debt for further details on the Company's convertible notes.

Synthetic Royalty Financing Agreement

In October 2022, the Company entered into a revenue interest purchase agreement (the Royalty Financing Agreement) with OrbiMed Royalty & Credit Opportunities IV, LP (OrbiMed). Under the Royalty Financing Agreement, OrbiMed paid the Company $150 million in exchange for the right to receive, on a quarterly basis, royalties in an amount equal to 4% of ARIKAYCE global net sales prior to September 1, 2025 and 4.5% of ARIKAYCE global net sales on or after September 1, 2025, as well as 0.75% of brensocatib global net sales, if approved (the Revenue Interest Payments). In the event that OrbiMed has not received aggregate Revenue Interest Payments of at least $150 million on or prior to March 31, 2028, the Company must make a one-time payment to OrbiMed for the difference between the $150 million and the aggregated Revenue Interest Payments that have been paid. In addition, the royalty rate for ARIKAYCE will be increased beginning March 31, 2028 to the rate which would have resulted in aggregate Revenue Interest Payments as of March 31, 2028 equaling $150 million. The total Revenue Interest Payments payable by the Company to OrbiMed are capped at 1.8x of the purchase price or up to a maximum of 1.9x of the purchase price under certain conditions.

The fair value of the Royalty Financing Agreement at the time of the transaction was based on the Company’s estimates of future royalties expected to be paid to OrbiMed over the life of the arrangement, which was determined using forecasts from market data sources, which are considered Level 3 inputs. This liability is being amortized using the effective interest method over the life of the arrangement, in accordance with ASC 470, Debt and ASC 835, Interest. The Company will utilize the prospective method to account for subsequent changes in the estimated future payments to be made to OrbiMed and will update the effective interest rate on a quarterly basis. For more information, see Note 11 - Royalty Financing Agreement.

4. Product Revenues, Net

In accordance with ASC 606, Revenue from Contracts with Customers, the Company recognizes revenue when a customer obtains control of promised goods or services, in an amount that reflects the consideration the Company expects to

INSMED INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

4. Product Revenues, Net (Continued)

receive in exchange for the goods or services provided. To determine revenue recognition for arrangements within the scope of ASC 606, the Company performs the following five steps: (1) identify the contracts with a customer; (2) identify the performance obligations in the contract; (3) determine the transaction price; (4) allocate the transaction price to the performance obligations in the contract; and (5) recognize revenue when or as the entity satisfies a performance obligation. At contract inception, the Company assesses the goods or services promised within each contract to determine which are performance obligations and to assess whether each promised good or service is distinct. The Company then recognizes as revenue the amount of the transaction price that is allocated to the respective performance obligation when or as the performance obligation is satisfied. For all contracts that fall into the scope of ASC 606, the Company has identified one performance obligation: the sale of ARIKAYCE to its customers. The Company has not incurred or capitalized any incremental costs associated with obtaining contracts with customers.

Product revenues, net consist of net sales of ARIKAYCE. The Company's customers in the US include specialty pharmacies and specialty distributors. In December 2020, the Company began recognizing product revenue from commercial sales of ARIKAYCE in Europe. In July 2021, the Company began recognizing product revenue from commercial sales of ARIKAYCE in Japan. Globally, product revenues are recognized once the Company performs and satisfies all five steps of the revenue recognition criteria mentioned above.

The following table presents a geographic summary of the Company's product revenues, net, for the three months ended March 31, 2024 and 2023 (in thousands):

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| US | $ | 56,349 | | | $ | 49,067 | | | | | |

| Japan | 14,891 | | | 13,156 | | | | | |

| Europe and rest of world | 4,260 | | | 2,991 | | | | | |

| Total product revenues, net | $ | 75,500 | | | $ | 65,214 | | | | | |

Revenue is recorded at net selling price (transaction price), which includes estimates of variable consideration for which reserves are established for (a) customer credits, such as invoice discounts for prompt pay, (b) estimated government rebates, such as Medicaid and Medicare Part D reimbursements, and estimated managed care rebates, (c) estimated chargebacks, and (d) estimated costs of co-payment assistance. These reserves are based on the amounts earned or to be claimed on the related sales and are classified as reductions of accounts receivable (prompt pay discounts and chargebacks), prepaid expenses (co-payment assistance), or as a current liability (rebates). Where appropriate, these estimates take into consideration a range of possible outcomes which are probability-weighted for relevant factors such as the Company's historical experience, current contractual and statutory requirements, and forecasted customer buying and payment patterns. Overall, these reserves reflect the Company's best estimates of the amount of consideration to which it is entitled based on the terms of the applicable contract. The amount of variable consideration included in the transaction price may be constrained and is included in the net sales price only to the extent that it is probable that a significant reversal in the amount of the cumulative revenue recognized will not occur in a future period. Actual amounts of consideration ultimately received may differ from the Company's estimates. If actual results in the future vary from estimates, the Company adjusts these estimates, which would affect net product revenue and earnings in the period such variances become known.

Customer credits: Certain of the Company's customers are offered various forms of consideration, including prompt payment discounts. The payment terms for sales to specialty pharmacies and specialty distributors for prompt payment discounts are based on contractual rates agreed with the respective specialty pharmacies and distributors. The Company anticipates that its customers will earn these discounts and, therefore, deducts the full amount of these discounts from total gross product revenues at the time such revenues are recognized.