Innovative Solutions & Support, Inc. (NASDAQ: ISSC) today

announced its financial results for the second quarter of fiscal

2011 ended March 31, 2011.

Net revenues for the second quarter of fiscal 2011 were $6.7

million, up 26% from $5.4 million in the year ago quarter. The

Company reported fiscal 2011 second quarter net income of $499,000,

or $0.03 per diluted share, up from a loss of ($746,000), or

($0.04) per diluted share, in the second quarter of last year. The

Company also generated $600,000 of cash flow from operating

activities in the second quarter. Second quarter 2011 revenues and

earnings are up sequentially compared to first quarter 2011

revenues of $6.5 million and earnings of $0.02 per diluted

share.

Geoffrey Hedrick, Chairman and Chief Executive Officer of

Innovative Solutions & Support, Inc., said, “Our improved

financial performance reflects the success we have achieved in

enhancing the value our products deliver to the markets. For the

quarter, gross margins improved compared to last year’s second

quarter, driven by productivity and efficiency improvements. We are

pleased that the quarter’s earnings growth was achieved while we

were increasing our investment in new product research and

development to the highest level in two years, $1.6 million. We

believe that this strategy builds value for shareholders by

broadening our product offering and expanding the number and type

of aircraft we serve.”

At March 31, 2011 the Company had $42.5 million of cash on hand,

no long-term debt and a backlog of approximately $25 million. The

Company noted that the decrease in backlog coincided with an

increase in the value of outstanding proposals, in excess of $100

million, primarily due to unusually long delays being experienced

between proposals and contract awards, especially in the military

market where the effect of the federal budget impasse has been

particularly acute.

Six Month Results

Revenues for the six months ended March 31, 2011 were $13.3

million compared to $10.0 million for the six months ended March

31, 2010. For the six months ended March 31, 2011, net income was

$784,000, or $0.05 per diluted share, compared to a net loss of

($1.9) million, or ($0.11) per diluted share, for the first half of

last fiscal year. Cash flow from operating activities for the first

half of the year was $1.6 million compared to $0.3 million for the

same period in 2010.

Roman Ptakowski, President of ISSC, added, “Innovative Solutions

& Support’s Cockpit/IP continues to be recognized as the best

value in the industry. This quarter our Flight Management System

and GPS receiver for the Eclipse Twin-Jet received FAA

certification. The resulting avionics suite on the E500 is now one

of the most advanced cockpits available on any aircraft and has

been well received by Eclipse operators. This is a demonstration of

our ability to develop new technologies that cost-effectively

enhance the safety, reliability and performance of aircraft.”

Business Outlook

The U.S. Federal budget stalemate has deferred military orders;

however, we are beginning to see an increase in activity now that

the budget has been resolved. Higher fuel prices have caused us

concern that they may affect the timing of airline discretionary

spending decisions. We are working to minimize the timing effect of

these unforeseen delays. We now anticipate financial performance in

the second half of fiscal year 2011 to be similar to the first half

of this year. We will provide additional commentary on the balance

of the fiscal year during our earnings conference call.

The Company will be hosting a conference call Thursday, April

28, 2011 at 10:00 a.m. EDT time to discuss these results and its

business outlook. Please use the following dial in number to

register your name and company affiliation for the conference call:

800-946-0706. The conference ID# is 1023062. The call will also be

carried live on the Investor Relations page of the Company web site

at www.innovative-ss.com.

About Innovative Solutions &

Support, Inc.

Headquartered in Exton, PA. Innovative Solutions & Support,

Inc. (www.innovative-ss.com) is a systems integrator engaged in the

design, manufacture and marketing of Flat Panel Display Systems,

Air Data equipment, Flight Information Computers, Engine and Fuel

Measurement and Control Computers, and advanced monitoring systems

that measure and display critical flight information. This includes

data relative to aircraft separation, airspeed and altitude as well

as fuel and critical engine parameters.

Certain matters contained herein that are not descriptions of

historical facts are “forward-looking” (as such term is defined in

the Private Securities Litigation Reform Act of 1995). Because such

statements include risks and uncertainties, actual results may

differ materially from those expressed or implied by such

forward-looking statements. Factors that could cause results to

differ materially from those expressed or implied by such

forward-looking statements include, but are not limited to, those

discussed in filings made by the Company with the Securities and

Exchange Commission. Many of the factors that will determine the

Company’s future results are beyond the ability of management to

control or predict. Readers should not place undue reliance on

forward-looking statements, which reflects management’s views only

as of the date hereof. The Company undertakes no obligation to

revise or update any forward-looking statements, or to make any

other forward-looking statements, whether as a result of new

information, future events or otherwise.

Innovative Solutions and Support,

Inc. Consolidated Statement of Operations

(unaudited) Three months ended Six months

ended March 31 March 31, 2011

2010 2011 2010

Sales $ 6,746,070 $ 5,372,957 13,275,881 9,980,196 Cost of

Sales 2,873,414 2,942,496

5,809,069 5,779,269 Gross Profit

3,872,656 2,430,461 7,466,812 4,200,927 Operating expenses:

Research and development 1,556,827 1,404,705 2,910,434 2,569,410

Selling, general and administrative 1,849,143

1,876,326 3,938,492 4,027,465

Total operating expenses 3,405,970 3,281,031 6,848,926 6,596,875

Operating (loss) income 466,686 (850,570 ) 617,886

(2,395,948 ) Interest income 45,263 27,636 92,855 50,610

Interest expense (404 ) (614 ) (862 ) (1,278 ) Other income

- - 150,003 50,000

(Loss) income before income taxes 511,545 (823,548 ) 859,882

(2,296,616 ) Income tax (benefit) expense 12,393

(77,783 ) 75,950 (405,678 )

Net (loss) income $ 499,152 $ (745,765 ) $ 783,932

$ (1,890,938 ) Net (loss) income per Common Share

Basic $ 0.03 $ (0.04 ) $ 0.05 $ (0.11 ) Diluted $

0.03 $ (0.04 ) $ 0.05 $ (0.11 ) Weighted

Average Shares Outstanding Basic 16,782,684 16,752,563 16,782,684

16,749,080 Diluted 16,838,662 16,752,563 16,829,918 16,749,080

Innovative Solutions and Support, Inc.

Condensed Consolidated Balance Sheet (unaudited)

March 31, September 30, 2011 2010

ASSETS

Current Assets Cash and cash equivalents $ 42,477,085 $ 40,916,346

Accounts receivable, net 2,573,426 2,529,976 Inventories 4,514,475

4,656,392 Deferred income taxes 402,266 522,352 Prepaid expenses

and other current assets 931,512 982,768

Total current assets 50,898,764 49,607,834

Property and equipment, net 7,566,448 7,761,538 Other assets

279,989 221,150 Total Assets $

58,745,201 $ 57,590,522

LIABILITIES AND

SHAREHOLDERS' EQUITY

Current Liabilities Current portion of capitalized lease

obligations $ 9,908 $ 9,908 Accounts payable 773,445 543,877

Accrued expenses 2,457,548 2,585,060 Deferred revenue

362,298 157,933 Total current

liabilities 3,603,199 3,296,778 Long-term portion of

capitalized lease obligations 9,528 15,560 Deferred revenue - 8,688

Deferred income taxes 530,218 649,929 Other liabilities

171,866 151,530 Total Liabilities

4,314,811 4,122,485 Commitments

and contingencies - - Shareholders' Equity

Preferred Stock, 10,000,000 shares

authorized, $.001 par value, of which 200,000 shares are authorized

as Class A Convertible stock. No shares issued and outstanding at

March 31, 2011 and September 30, 2010

- -

Common stock, $.001 par value: 75,000,000

shares authorized, 18,265,194 and 18,244,701 issued at March 31,

2011 and September 30, 2010

18,265 18,245 Additional paid-in capital 47,010,047

46,831,646 Retained earnings 26,693,584 25,909,652

Treasury stock, at cost, 1,482,510 and

1,482,510 shares at March 31, 2011 and September 30, 2010,

respectively

(19,291,506 ) (19,291,506 ) Total

Shareholders' Equity 54,430,390 53,468,037

Total Liabilities and Shareholders' Equity $

58,745,201 $ 57,590,522

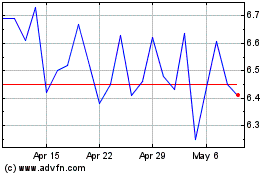

Innovative Solutions and... (NASDAQ:ISSC)

Historical Stock Chart

From May 2024 to Jun 2024

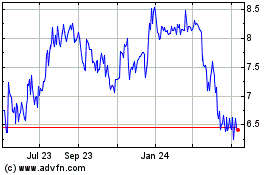

Innovative Solutions and... (NASDAQ:ISSC)

Historical Stock Chart

From Jun 2023 to Jun 2024