- Current report filing (8-K)

April 30 2010 - 5:08PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15 (d) of The

Securities

Exchange Act of 1934

|

Date

of Report (Date of earliest event reported):

|

April

26, 2010

|

|

ICONIX

BRAND GROUP, INC.

|

|

(Exact

name of registrant as specified in its

charter)

|

|

Delaware

|

|

0-10593

|

|

11-2481903

|

|

(State

or Other

|

|

(Commission

|

|

(IRS

Employer

|

|

Jurisdiction

of

|

|

File

Number)

|

|

Identification

No.)

|

|

Incorporation)

|

|

|

|

|

|

1450

Broadway, New York, New York

|

10018

|

|

(Address

of Principal Executive Offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area code

(212)

730-0030

|

Not

Applicable

|

|

(Former

Name or Former Address, if Changed Since Last

Report)

|

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (

see

General Instruction A.2. below):

o

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

o

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

o

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

o

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

|

Item

1.01

|

Entry

Into a Material Definitive

Agreement.

|

On April

26, 2010, Iconix Brand Group, Inc., a Delaware corporation (the “Registrant” or

“Iconix”), entered into an Interest Purchase Agreement (the “Purchase

Agreement”) with United Feature Syndicate, Inc., a New York corporation (“UFS”)

and The E.W. Scripps Company, an Ohio corporation (the “Parent”) (Parent and

UFS, collectively, the “Sellers”).

Pursuant

to the Purchase Agreement, the Registrant has agreed to buy all of the

issued and outstanding Interests (“Interests”) of Character Licensing, LLC, a

newly formed Delaware limited liability company (“CL”), which will own the

Peanuts Assets (as defined below). On or prior to the Closing Date,

Iconix will assign its right to buy all of the Interests to a joint venture (the

“JV”) owned 80% by Iconix’ wholly-owned subsidiary, Icon Entertainment LLC, a

Delaware limited liability company (“IE”), and 20% by Beagle Scout LLC,

a Delaware limited liability company (“Beagle”) owned by certain

Schulz family trusts. The Interests will be purchased by the Registrant through

the JV.

On or

prior to the date of the closing of the transactions contemplated by the

Purchase Agreement (the

“

Closing Date

”

), UFS shall

contribute and transfer to CL all of its right, title and interest in, to and

under (i) any and all of the assets used exclusively in UFS’ licensing business,

which includes the Peanuts brand and related assets; (ii) the licensing and

character representation business of United Media Licensing, a division of UFS,

which includes Dilbert and Fancy Nancy; (iii) certain assets of UFS’ syndication

and web businesses; and (iv) all of the issued and outstanding shares of each of

United Media Kabushiki Kaisha and UMNet Y.K., each a corporation formed under

the laws of Japan (collectively, the “Peanuts Assets”). In addition,

Iconix has agreed to hire certain employees of Seller as of the Closing

Date.

On

or prior to the Closing Date, IE and Beagle will enter into an operating

agreement with respect to the JV. Iconix will contribute $141,000,000

in cash to the JV in exchange for its 80% ownership interest. Beagle

will contribute $34,000,000 to the JV in cash and promissory notes.

The

purchase price for the Interests will be $175,000,000 in cash, subject to a

working capital adjustment on the Closing Date.

The

Purchase Agreement contains customary representations, warranties and covenants,

and the transactions contemplated by the Purchase Agreement are subject to

customary closing conditions, including the expiration or termination of waiting

periods applicable to the transactions contemplated in the Purchase Agreement

under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and

any other antitrust or similar clearance that may be required by foreign

jurisdictions. Iconix, on the one hand, and the Sellers on the other hand, have

each agreed, subject to certain limitations, to indemnify the other for damages

arising from the breach of its representations, warranties, covenants or

obligations in the Purchase Agreement.

The

description of the Purchase Agreement above does not purport to be complete and

is qualified in its entirety by reference to the full text of the Purchase

Agreement, which is filed as an exhibit to this Report. The Purchase Agreement

has been included to provide investors and security holders with information

regarding its terms. It is not intended to provide any other factual information

about the Registrant or the other parties thereto. The Purchase Agreement

contains customary representations and warranties the parties thereto made to,

and solely for the benefit of, the other parties thereto. Accordingly, investors

and security holders should not rely on the representations and warranties as

characterizations of the actual state of facts, since they were only made as of

the date of such agreement. In addition, the Purchase Agreement is modified by

the underlying disclosure schedules. Moreover, information concerning the

subject matter of the representations and warranties may change after the date

of such agreement, which subsequent information may or may not be fully

reflected in the Registrant’s public disclosures.

|

Item

2.02

|

Results

of Operations and Financial Condition. and

Exhibits.

|

On April

27, 2010, Iconix issued a press release announcing its financial results for the

fiscal quarter and ended March 31, 2010. As noted in the press

release, Iconix has provided certain non-U.S. generally accepted accounting

principles (“GAAP”) financial measures, the reasons it provides such measures

and a reconciliation of the non-U.S. GAAP measures to U.S. GAAP measures.

Readers should consider non-GAAP measures in addition to, and not as a

substitute for, measures of financial performance prepared in accordance with

U.S. GAAP. A copy of Iconix’ press release is attached hereto as Exhibit 99.1

and is incorporated herein by reference.

|

Item

9.01

|

Financial

Statements and Exhibits.

|

|

10.1

|

Purchase

Agreement dated as of April 26, 2010 by and among Iconix Brand Group,

Inc., United FeatureSyndicate, Inc. and The E.W. Scripps

Company.

|

|

99.1

|

Press

Release dated April 27, 2010.

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has

duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

ICONIX

BRAND GROUP, INC.

|

|

|

(Registrant)

|

|

|

|

|

|

|

By:

|

/s/ Warren Clamen

|

|

|

|

Name:

Warren Clamen

|

|

|

|

Title: Executive

Vice President and Chief Financial

Officer

|

Date:

April 30, 2010

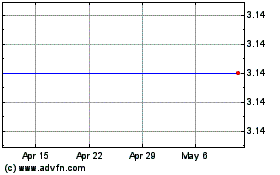

Icon Energy (NASDAQ:ICON)

Historical Stock Chart

From Oct 2024 to Nov 2024

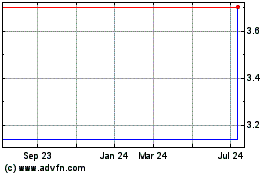

Icon Energy (NASDAQ:ICON)

Historical Stock Chart

From Nov 2023 to Nov 2024