Current Report Filing (8-k)

May 05 2023 - 4:17PM

Edgar (US Regulatory)

false000183019700018301972023-05-012023-05-01

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 1, 2023

Home Point Capital Inc.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

001-39964

|

90-1116426

|

|

(State or other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

2211 Old Earhart Road

, Suite 250

Ann Arbor, Michigan 48105

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (888) 616-6866

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Name of each exchange on which registered

|

Common Stock, par value $0.0000000072 per share |

|

HMPT

|

|

The Nasdaq Stock Market LLC

(The Nasdaq Global Select Market)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.02 |

Termination of a Material Definitive Agreement

|

On May 1, 2023, Home Point Financial Corporation (“HPF”), a wholly owned subsidiary of Home Point Capital Inc. (the “Company”), terminated the Master

Repurchase Agreement (the “Amherst Gestation Agreement”), dated as of October 1, 2020, by and between HPF, as seller and Santander US Capital Markets LLC (fka Amherst Pierpont Securities LLC), as buyer. The Amherst Gestation Agreement had no stated

contractual limit on the maximum aggregate purchase price. The parties mutually agreed to terminate the Amherst Gestation Agreement. HPF did not incur any early termination penalties.

On May 5, 2023, HPF terminated the Master Repurchase Agreement and Securities Contract

(the “Wells Master Repurchase Agreement”), dated as of November 23, 2015, by and between HPF, as seller and Wells Fargo Bank, N.A., as buyer. The Wells Master Repurchase Agreement provided for a maximum aggregate purchase price of $400

million. The parties mutually agreed to terminate the Wells Master Repurchase Agreement. HPF did not incur any early termination penalties.

On May 5, 2023, HPF terminated the Second Master Repurchase Agreement (the “TIAA Master Repurchase Agreement”), dated as of September 16, 2022, by and

between HPF, as seller and TIAA, FSB, as buyer. The TIAA Master Repurchase Agreement provided for a maximum aggregate purchase price of $200 million. The parties mutually agreed to terminate the TIAA Master Repurchase Agreement prior to its

scheduled maturity date of September 17, 2023. HPF did not incur any early termination penalties.

Each of Wells Fargo Bank, N.A., TIAA, FSB, Santander US Capital Markets LLC and certain

of their respective affiliates may, from time to time, engage in transactions with and perform services for the Company in the ordinary course of its business for which they may receive customary fees and reimbursement of expenses.

Sale of Mortgage Servicing Rights

On May 2, 2023, HPF completed the sale of servicing rights relating to certain single family mortgage loans serviced for the Government

National Mortgage Association (“Ginnie Mae”) with an aggregate unpaid principal balance of approximately $1.504 billion (the “Servicing Rights”) to an approved Ginnie Mae issuer. The total purchase price for the Servicing Rights was approximately

$21.33 million, which is subject to certain customary holdbacks and adjustments. The sales represent approximately 1.702% of HPF’s total mortgage servicing portfolio as of December 31, 2022, and approximately 32.185% percent of HPF’s total Ginnie

Mae mortgage servicing portfolio as of December 31, 2022. Ginnie Mae consented to the transfer of the Servicing Rights.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

HOME POINT CAPITAL INC.

|

| |

|

|

|

Date: May 5, 2023

|

By:

|

/s/ Jean Weng

|

| |

Name:

|

Jean Weng

|

| |

Title:

|

General Counsel

|

Home Point Capital (NASDAQ:HMPT)

Historical Stock Chart

From Apr 2024 to May 2024

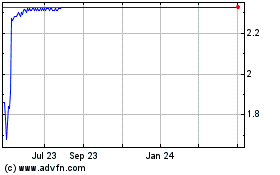

Home Point Capital (NASDAQ:HMPT)

Historical Stock Chart

From May 2023 to May 2024