HINGHAM INSTITUTION FOR SAVINGS (NASDAQ: HIFS), Hingham,

Massachusetts announced earnings for the fourth quarter and the

year ended December 31, 2021.

Earnings

Net income for the year ended December 31, 2021

was $67,458,000 or $31.50 per share basic and $30.65 per share

diluted, as compared to $50,771,000 or $23.76 per share basic and

$23.25 per share diluted for the same period last year. The Bank’s

return on average equity for the year ended December 31, 2021 was

20.62%, and the return on average assets was 2.25%, as compared to

18.96% and 1.88% for the same period in 2020. Net income per share

(diluted) for 2021 increased by 32% over the same period in

2020.

Core net income for the year ended December 31,

2021, which represents net income excluding the after-tax gains and

losses on securities, both realized and unrealized, and the

after-tax gains on the disposal of fixed assets, was $56,563,000 or

$26.42 per share basic and $25.70 per share diluted, as compared to

$44,443,000 or $20.80 per share basic and $20.36 per share diluted

for the same period last year. The Bank’s core return on average

equity for the year ended December 31, 2021 was 17.29%, and the

core return on average assets was 1.89%, as compared to 16.60% and

1.65% for the same period in 2020. Core net income per share

(diluted) for 2021 increased by 26% over the same period in

2020.

Net income for the quarter ended December 31,

2021 was $16,674,000 or $7.78 per share basic and $7.56 per share

diluted, as compared to $17,042,000 or $7.97 per share basic and

$7.78 per share diluted for the same period last year. The Bank’s

annualized return on average equity for the fourth quarter of 2021

was 19.14%, and the annualized return on average assets was 2.05%,

as compared to 23.83% and 2.46% for the same period in 2020. Net

income per share (diluted) for the fourth quarter of 2021 decreased

by 3% over the same period in 2020.

Core net income for the quarter ended December

31, 2021, which represents net income excluding the after-tax gains

and losses on securities, both realized and unrealized, was

$15,033,000 or $7.02 per share basic and $6.81 per share diluted,

as compared to $12,791,000 or $5.99 per share basic and $5.84 per

share diluted for the same period last year. The Bank’s annualized

core return on average equity for the fourth quarter of 2021 was

17.26%, and the annualized core return on average assets was 1.85%,

as compared to 17.89% and 1.85% for the same period in 2020. Core

net income per share (diluted) for the fourth quarter of 2021

increased by 17% over the same period in 2020.

In calculating core net income, the Bank has not

traditionally made any adjustments other than those relating to

after-tax gains and losses on securities, both realized and

unrealized. However, net income for the year ended December 31,

2021 included a $2.3 million pre-tax gain on the sale of the Bank’s

former branch properties located in Weymouth and South Hingham,

included in gain on disposal of fixed assets. This compares to a

$218,000 pre-tax gain recorded in the year ended December 31, 2020,

related to the sale of the Bank’s former branch property in

Scituate. Given the significant gains on disposal of fixed assets

recorded in the current year, the Bank has also excluded these

gains from the calculation of core net income. The prior year core

net income, core net income per share basic and diluted, core

return on average assets and core return on average equity figures

have been adjusted accordingly to exclude such gains. See Page 9

for a Non-GAAP reconciliation between net income and core net

income.

Balance Sheet

Total assets increased to $3.431 billion at

December 31, 2021, representing 20% growth from December 31,

2020.

Net loans totaled $2.999 billion at December 31,

2021, representing 20% growth from December 31, 2020. Growth was

concentrated in the Bank’s commercial real estate portfolio.

Total deposits, including wholesale deposits,

increased to $2.393 billion at December 31, 2021, representing 12%

growth from December 31, 2020. Total retail and business deposits

increased to $1.709 billion at December 31, 2021, representing 7%

growth from December 31, 2020. Non-interest bearing deposits,

included in retail and business deposits, increased to $389.1

million at December 31, 2021, representing 24% growth from December

31, 2020. This growth was offset by a significant decline in retail

time deposits, as the Bank allowed higher rate maturing time

deposits to roll off. In 2021, the Bank continued to reduce the

balance of excess reserves held at the Federal Reserve Bank as a

percentage of assets and managed its wholesale funding mix between

wholesale time deposits and Federal Home Loan Bank advances in

order to reduce the cost of funds.

Book value per share was $165.52 as of December

31, 2021, representing 21% growth from December 31, 2020. In

addition to the increase in book value per share, the Bank has

declared $2.83 in dividends per share since December 31, 2020,

including a special dividend of $0.75 per share declared during the

fourth quarter of 2021. The Bank increased its regular dividend per

share in each of the last four quarters. The trailing five year

compound annual growth rate in book value per share, an important

measure of long-term value creation, was 17%.

Operational Performance

Metrics

The net interest margin for the year ended

December 31, 2021 increased 26 basis points to 3.48%, as compared

to 3.22% in the prior year. The net interest margin for the quarter

ended December 31, 2021 increased 3 basis points to 3.46%, as

compared to 3.43% for the same period last year. In the year ended

December 31, 2021, and to a lesser extent, in the quarter ended

December 31, 2021, the Bank benefited from a decline in the cost of

interest-bearing liabilities, including retail and commercial

deposits and wholesale funding, when compared to the same periods

in the prior year. The Bank also benefited from consistent growth

in non-interest-bearing deposit balances. These benefits were

partially offset by a decline in the yield on interest-earning

assets, driven primarily by a lower yield on loans and a decrease

in Federal Home Loan Bank stock dividends declared during the same

periods.

Key credit and operational metrics remained

satisfactory in the fourth quarter. At December 31, 2021,

non-performing assets totaled 0.01% of total assets, as compared to

0.27% at December 31, 2020. Non-performing loans as a percentage of

the total loan portfolio totaled 0.01% at December 31, 2021, as

compared to 0.16% at December 31, 2020.

At December 31, 2021, the Bank did not own any

foreclosed property, as compared to $3.8 million at December 31,

2020. This balance consisted of a single residential property which

was sold during the first quarter of 2021.

The Bank recorded $1,000 of net charge-offs in

2021, as compared to $260,000 in 2020. The prior year net

charge-off related primarily to the foreclosed property discussed

above.

The efficiency ratio, as defined on page 4

below, fell to 21.31% in 2021, as compared to 25.48% in 2020.

Operating expenses as a percentage of average assets fell to 0.74%

in 2021, as compared to 0.82% in 2020. The Bank remains focused on

reducing waste through an ongoing process of continuous

improvement.

Chairman and Chief Executive Officer Robert H.

Gaughen Jr. stated, “Returns on equity and assets were strong in

2021, although such performance must be viewed cautiously,

especially when tailwinds have blown strongly in our favor. We must

be prepared for considerably more adverse conditions in the future.

We remain focused on careful capital allocation, defensive

underwriting and disciplined cost control - the building blocks for

compounding shareholder capital through all stages of the economic

cycle. These remain constant, regardless of the macroeconomic

environment in which we operate.”

The Bank’s annual financial results are

summarized in the earnings release, but shareholders are encouraged

to read the Bank’s annual report on Form 10-K, which is generally

available several weeks after the earnings release. The Bank

expects to file Form 10-K for the year ended December 31, 2021 with

the Federal Deposit Insurance Corporation (FDIC) on or about March

9, 2022.

Incorporated in 1834, Hingham Institution for

Savings is one of America’s oldest banks. The Bank maintains

offices in Boston, Nantucket, and Washington, D.C., and provides

commercial mortgage and banking services in the San Francisco Bay

Area.

The Bank’s shares of common stock are listed and

traded on The NASDAQ Stock Market under the symbol HIFS.

HINGHAM INSTITUTION FOR

SAVINGSSelected Financial Ratios

| |

Three Months EndedDecember

31, |

|

Twelve Months EndedDecember

31, |

| |

2020 |

|

2021 |

|

2020 |

|

2021 |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Key Performance

Ratios |

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets (1) |

2.46 |

% |

|

2.05 |

% |

|

1.88 |

% |

|

2.25 |

% |

| Return on average equity (1) |

23.83 |

|

|

19.14 |

|

|

18.96 |

|

|

20.62 |

|

| Core return on average assets

(1) (5) |

1.85 |

|

|

1.85 |

|

|

1.65 |

|

|

1.89 |

|

| Core return on average equity

(1) (5) |

17.89 |

|

|

17.26 |

|

|

16.60 |

|

|

17.29 |

|

| Interest rate spread (1) (2) |

3.31 |

|

|

3.39 |

|

|

3.03 |

|

|

3.40 |

|

| Net interest margin (1) (3) |

3.43 |

|

|

3.46 |

|

|

3.22 |

|

|

3.48 |

|

| Operating expenses to average

assets (1) |

0.80 |

|

|

0.71 |

|

|

0.82 |

|

|

0.74 |

|

| Efficiency ratio (4) |

23.57 |

|

|

20.62 |

|

|

25.48 |

|

|

21.31 |

|

| Average equity to average

assets |

10.34 |

|

|

10.73 |

|

|

9.93 |

|

|

10.93 |

|

|

Average interest-earning assets to average interest-bearing

liabilities |

125.62 |

|

|

127.01 |

|

|

123.64 |

|

|

127.22 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2020 |

|

December

31, 2021 |

|

|

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Asset Quality

Ratios |

|

|

|

|

|

|

|

|

|

|

|

| Allowance for loan losses/total

loans |

|

0.69 |

% |

|

|

0.68 |

% |

|

|

|

|

| Allowance for loan

losses/non-performing loans |

|

438.28 |

|

|

|

4,784.78 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Non-performing loans/total

loans |

|

0.16 |

|

|

|

0.01 |

|

|

|

|

|

| Non-performing loans/total

assets |

|

0.14 |

|

|

|

0.01 |

|

|

|

|

|

| Non-performing assets/total

assets |

|

0.27 |

|

|

|

0.01 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Share

Related |

|

|

|

|

|

|

|

|

|

|

|

| Book value per share |

$ |

137.02 |

|

|

$ |

165.52 |

|

|

|

|

|

| Market value per share |

$ |

216.00 |

|

|

$ |

419.88 |

|

|

|

|

|

| Shares outstanding at end of

period |

|

2,137,900 |

|

|

|

2,142,400 |

|

|

|

|

|

(1) Annualized for the three months ended

December 31, 2020 and 2021.

(2) Interest rate spread represents the

difference between the yield on interest-earning assets and the

cost of interest-bearing liabilities.

(3) Net interest margin represents net interest

income divided by average interest-earning assets.

(4) The efficiency ratio represents total

operating expenses, divided by the sum of net interest income and

total other income, excluding gain on equity securities, net and

gain on disposal of fixed assets. Prior to the first quarter of

2021, the Bank’s calculation of the efficiency ratio included gains

on disposal of fixed assets. This had the impact of slightly

improving the efficiency ratio in periods in which the Bank

recognized gains on the sale of former branch locations. The Bank

believes it is more conservative to exclude such transactions. The

efficiency ratio for the twelve months ended December 31, 2020

stated above has been recalculated using this method.

(5) Non-GAAP measurements that represent return

on average assets and return on average equity, excluding the

after-tax gain on equity securities, net, and the after-tax gain on

disposal of fixed assets. Core return on average assets and core

return on average equity for twelve months ended December 31, 2020

have been recalculated accordingly.

HINGHAM INSTITUTION FOR

SAVINGSConsolidated Balance Sheets

| (In thousands, except share

amounts) |

|

December 31, 2020 |

|

December 31, 2021 |

|

(Unaudited) |

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Cash and due from banks |

|

$ |

6,798 |

|

$ |

5,428 |

| Federal Reserve and other

short-term investments |

|

|

227,188 |

|

|

265,733 |

|

Cash and cash equivalents |

|

|

233,986 |

|

|

271,161 |

| |

|

|

|

|

|

|

| CRA investment |

|

|

9,580 |

|

|

9,306 |

| Other marketable equity

securities |

|

|

56,282 |

|

|

79,167 |

|

Securities, at fair value |

|

|

65,862 |

|

|

88,473 |

| Securities available for sale, at

fair value |

|

|

6 |

|

|

— |

| Securities held to maturity, at

amortized cost |

|

|

— |

|

|

3,500 |

| Federal Home Loan Bank stock, at

cost |

|

|

19,345 |

|

|

29,908 |

| Loans, net of allowance for loan

losses of $17,404 at December 31, 2020 and $20,431 at December 31,

2021 |

|

|

2,495,331 |

|

|

2,999,096 |

| Foreclosed assets |

|

|

3,826 |

|

|

— |

| Bank-owned life insurance |

|

|

12,657 |

|

|

12,980 |

| Premises and equipment, net |

|

|

15,248 |

|

|

15,825 |

| Accrued interest receivable |

|

|

5,267 |

|

|

5,467 |

| Deferred income tax asset,

net |

|

|

763 |

|

|

— |

| Other assets |

|

|

4,802 |

|

|

4,755 |

|

Total assets |

|

$ |

2,857,093 |

|

$ |

3,431,165 |

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

| Interest-bearing deposits |

|

$ |

1,825,700 |

|

$ |

2,003,717 |

| Non-interest-bearing

deposits |

|

|

313,497 |

|

|

389,148 |

|

Total deposits |

|

|

2,139,197 |

|

|

2,392,865 |

| Federal Home Loan Bank

advances |

|

|

408,031 |

|

|

665,000 |

| Mortgagors’ escrow accounts |

|

|

8,770 |

|

|

9,183 |

| Accrued interest payable |

|

|

252 |

|

|

198 |

| Deferred income tax liability,

net |

|

|

— |

|

|

536 |

| Other liabilities |

|

|

7,900 |

|

|

8,771 |

|

Total liabilities |

|

|

2,564,150 |

|

|

3,076,553 |

| |

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

Preferred stock, $1.00 par value, 2,500,000 shares authorized, none

issued |

|

|

— |

|

|

— |

|

Common stock, $1.00 par value, 5,000,000 shares authorized;

2,137,900 shares issued and outstanding at December 31, 2020 and

2,142,400 shares issued and outstanding at December 31, 2021 |

|

|

2,138 |

|

|

2,142 |

|

Additional paid-in capital |

|

|

12,460 |

|

|

12,728 |

|

Undivided profits |

|

|

278,345 |

|

|

339,742 |

|

Total stockholders’ equity |

|

|

292,943 |

|

|

354,612 |

|

Total liabilities and stockholders’ equity |

|

$ |

2,857,093 |

|

$ |

3,431,165 |

HINGHAM INSTITUTION FOR

SAVINGSConsolidated Statements of Net

Income

| |

|

|

|

|

|

Three Months Ended |

|

Twelve Months Ended |

| |

|

|

|

|

|

December 31, |

|

December 31, |

| (In thousands,

except per share amounts) |

|

|

2020 |

|

|

2021 |

|

2020 |

|

2021 |

|

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

| Interest and

dividend income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Loans |

|

|

|

$ |

26,038 |

|

$ |

29,182 |

|

$ |

103,797 |

|

$ |

109,449 |

|

| |

Debt

securities |

|

|

|

|

— |

|

|

33 |

|

|

— |

|

|

84 |

|

| |

Equity

securities |

|

|

|

|

264 |

|

|

134 |

|

|

1,666 |

|

|

696 |

|

| |

Federal Reserve

and other short-term investments |

|

55 |

|

|

78 |

|

|

899 |

|

|

262 |

|

| |

|

Total interest and

dividend income |

|

|

26,357 |

|

|

29,427 |

|

|

106,362 |

|

|

110,491 |

|

| Interest

expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Deposits |

|

|

|

|

2,568 |

|

|

1,518 |

|

|

16,186 |

|

|

6,868 |

|

| |

Federal Home Loan

Bank and Federal Reserve Bank advances |

|

|

|

|

513 |

|

|

300 |

|

|

4,969 |

|

|

1,158 |

|

| |

Mortgage

payable |

|

|

|

— |

|

|

— |

|

|

3 |

|

|

— |

|

| |

|

Total interest

expense |

|

|

|

3,081 |

|

|

1,818 |

|

|

21,158 |

|

|

8,026 |

|

| |

|

Net interest

income |

|

|

|

23,276 |

|

|

27,609 |

|

|

85,204 |

|

|

102,465 |

|

| Provision for loan

losses |

|

|

|

175 |

|

|

1,200 |

|

|

2,288 |

|

|

3,028 |

|

| Net interest

income, after provision for loan losses |

|

23,101 |

|

|

26,409 |

|

|

82,916 |

|

|

99,437 |

|

| Other income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Customer service

fees on deposits |

|

|

177 |

|

|

192 |

|

|

678 |

|

|

746 |

|

| |

Increase in cash

surrender value of bank-owned life insurance |

|

|

|

|

51 |

|

|

79 |

|

|

219 |

|

|

323 |

|

| |

Gain on equity

securities, net |

|

|

|

|

5,453 |

|

|

2,105 |

|

|

7,916 |

|

|

11,820 |

|

| |

Gain on disposal

of fixed assets |

|

|

|

|

— |

|

|

— |

|

|

218 |

|

|

2,337 |

|

| |

Miscellaneous |

|

|

|

|

47 |

|

|

22 |

|

|

161 |

|

|

82 |

|

| |

|

Total other

income |

|

|

|

5,728 |

|

|

2,398 |

|

|

9,192 |

|

|

15,308 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Salaries and

employee benefits |

|

|

|

3,278 |

|

|

3,566 |

|

|

13,155 |

|

|

13,988 |

|

| |

Occupancy and

equipment |

|

|

|

|

422 |

|

|

368 |

|

|

1,854 |

|

|

1,450 |

|

| |

Data

processing |

|

|

|

|

443 |

|

|

571 |

|

|

1,909 |

|

|

2,003 |

|

| |

Deposit

insurance |

|

|

|

|

211 |

|

|

252 |

|

|

860 |

|

|

933 |

|

| |

Foreclosure and

related |

|

|

|

|

207 |

|

|

2 |

|

|

528 |

|

|

(49 |

) |

| |

Marketing |

|

|

|

|

145 |

|

|

140 |

|

|

545 |

|

|

563 |

|

| |

Other general and

administrative |

|

|

|

|

846 |

|

|

855 |

|

|

3,127 |

|

|

3,188 |

|

| |

|

Total operating

expenses |

|

|

|

5,552 |

|

|

5,754 |

|

|

21,978 |

|

|

22,076 |

|

| Income before

income taxes |

|

|

|

23,277 |

|

|

23,053 |

|

|

70,130 |

|

|

92,669 |

|

| Income tax

provision |

|

|

|

|

6,235 |

|

|

6,379 |

|

|

19,359 |

|

|

25,211 |

|

|

|

|

Net income |

|

|

|

$ |

17,042 |

|

$ |

16,674 |

|

$ |

50,771 |

|

$ |

67,458 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash dividends

declared per share |

|

$ |

1.17 |

|

$ |

1.30 |

|

$ |

2.47 |

|

$ |

2.83 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average

shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic |

|

|

|

|

2,137 |

|

|

2,142 |

|

|

2,137 |

|

|

2,141 |

|

| |

Diluted |

|

|

|

|

2,189 |

|

|

2,206 |

|

|

2,183 |

|

|

2,201 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic |

|

|

|

$ |

7.97 |

|

$ |

7.78 |

|

$ |

23.76 |

|

$ |

31.50 |

|

| |

Diluted |

|

|

|

$ |

7.78 |

|

$ |

7.56 |

|

$ |

23.25 |

|

$ |

30.65 |

|

HINGHAM INSTITUTION FOR

SAVINGSNet Interest Income Analysis

| |

Three Months Ended December 31, |

|

| |

2020 |

|

|

2021 |

|

| |

AVERAGE BALANCE |

|

INTEREST |

|

YIELD/ RATE (8) |

|

|

AVERAGE BALANCE |

|

INTEREST |

|

YIELD/ RATE (8) |

|

|

(Dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans (1) (2) |

$ |

2,440,571 |

|

$ |

26,038 |

|

4.27 |

% |

|

$ |

2,908,433 |

|

$ |

29,182 |

|

4.01 |

% |

| Securities (3) (4) |

|

62,966 |

|

|

264 |

|

1.68 |

|

|

|

82,113 |

|

|

167 |

|

0.81 |

|

| Federal Reserve and other

short-term investments |

|

214,403 |

|

|

55 |

|

0.10 |

|

|

|

204,815 |

|

|

78 |

|

0.15 |

|

|

Total interest-earning assets |

|

2,717,940 |

|

|

26,357 |

|

3.88 |

|

|

|

3,195,361 |

|

|

29,427 |

|

3.68 |

|

| Other assets |

|

48,848 |

|

|

|

|

|

|

|

|

52,128 |

|

|

|

|

|

|

|

Total assets |

$ |

2,766,788 |

|

|

|

|

|

|

|

$ |

3,247,489 |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing deposits

(5) |

$ |

1,843,689 |

|

|

2,568 |

|

0.56 |

|

|

$ |

2,087,523 |

|

|

1,518 |

|

0.29 |

|

| Borrowed funds |

|

319,931 |

|

|

513 |

|

0.64 |

|

|

|

428,315 |

|

|

300 |

|

0.28 |

|

|

Total interest-bearing liabilities |

|

2,163,620 |

|

|

3,081 |

|

0.57 |

|

|

|

2,515,838 |

|

|

1,818 |

|

0.29 |

|

| Non-interest-bearing

deposits |

|

309,975 |

|

|

|

|

|

|

|

|

375,139 |

|

|

|

|

|

|

| Other liabilities |

|

7,153 |

|

|

|

|

|

|

|

|

8,022 |

|

|

|

|

|

|

|

Total liabilities |

|

2,480,748 |

|

|

|

|

|

|

|

|

2,898,999 |

|

|

|

|

|

|

| Stockholders’ equity |

|

286,040 |

|

|

|

|

|

|

|

|

348,490 |

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

$ |

2,766,788 |

|

|

|

|

|

|

|

$ |

3,247,489 |

|

|

|

|

|

|

| Net interest income |

|

|

|

$ |

23,276 |

|

|

|

|

|

|

|

$ |

27,609 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average spread |

|

|

|

|

|

|

3.31 |

% |

|

|

|

|

|

|

|

3.39 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest margin (6) |

|

|

|

|

|

|

3.43 |

% |

|

|

|

|

|

|

|

3.46 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average interest-earning assets

to average interest-bearing liabilities (7) |

|

125.62 |

% |

|

|

|

|

|

|

|

127.01 |

% |

|

|

|

|

|

|

(1 |

) |

Before allowance for loan

losses. |

|

(2 |

) |

Includes non-accrual loans. |

|

(3 |

) |

Excludes the impact of the

average net unrealized gain or loss on securities. |

|

(4 |

) |

Includes Federal Home Loan Bank

stock. |

|

(5 |

) |

Includes mortgagors' escrow

accounts. |

|

(6 |

) |

Net interest income divided by

average total interest-earning assets. |

|

(7 |

) |

Total interest-earning assets

divided by total interest-bearing liabilities. |

|

(8 |

) |

Annualized. |

HINGHAM INSTITUTION FOR

SAVINGSNet Interest Income Analysis

| |

Twelve Months Ended December 31, |

|

| |

2020 |

|

|

2021 |

|

| |

AVERAGE BALANCE |

|

INTEREST |

|

YIELD/ RATE |

|

|

AVERAGE BALANCE |

|

INTEREST |

|

YIELD/ RATE |

|

|

(Dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans (1) (2) |

$ |

2,370,869 |

|

$ |

103,797 |

|

4.38 |

% |

|

$ |

2,667,812 |

|

$ |

109,449 |

|

4.10 |

% |

| Securities (3) (4) |

|

65,318 |

|

|

1,666 |

|

2.55 |

|

|

|

70,419 |

|

|

780 |

|

1.11 |

|

| Federal Reserve and other

short-term investments |

|

212,490 |

|

|

899 |

|

0.42 |

|

|

|

204,500 |

|

|

262 |

|

0.13 |

|

|

Total interest-earning assets |

|

2,648,677 |

|

|

106,362 |

|

4.02 |

|

|

|

2,942,731 |

|

|

110,491 |

|

3.75 |

|

| Other assets |

|

46,986 |

|

|

|

|

|

|

|

|

51,635 |

|

|

|

|

|

|

|

Total assets |

$ |

2,695,663 |

|

|

|

|

|

|

|

$ |

2,994,366 |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing deposits

(5) |

$ |

1,677,107 |

|

|

16,186 |

|

0.97 |

|

|

$ |

1,993,863 |

|

|

6,868 |

|

0.34 |

|

| Borrowed funds |

|

465,161 |

|

|

4,972 |

|

1.07 |

|

|

|

319,193 |

|

|

1,158 |

|

0.36 |

|

|

Total interest-bearing liabilities |

|

2,142,268 |

|

|

21,158 |

|

0.99 |

|

|

|

2,313,056 |

|

|

8,026 |

|

0.35 |

|

| Non-interest-bearing

deposits |

|

277,924 |

|

|

|

|

|

|

|

|

346,992 |

|

|

|

|

|

|

| Other liabilities |

|

7,748 |

|

|

|

|

|

|

|

|

7,147 |

|

|

|

|

|

|

|

Total liabilities |

|

2,427,940 |

|

|

|

|

|

|

|

|

2,667,195 |

|

|

|

|

|

|

| Stockholders’ equity |

|

267,723 |

|

|

|

|

|

|

|

|

327,171 |

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

$ |

2,695,663 |

|

|

|

|

|

|

|

$ |

2,994,366 |

|

|

|

|

|

|

| Net interest income |

|

|

|

$ |

85,204 |

|

|

|

|

|

|

|

$ |

102,465 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average spread |

|

|

|

|

|

|

3.03 |

% |

|

|

|

|

|

|

|

3.40 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest margin (6) |

|

|

|

|

|

|

3.22 |

% |

|

|

|

|

|

|

|

3.48 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average interest-earning assets to average interest-bearing

liabilities (7) |

|

123.64 |

% |

|

|

|

|

|

|

|

127.22 |

% |

|

|

|

|

|

|

(1 |

) |

Before allowance for loan

losses. |

|

(2 |

) |

Includes non-accrual loans. |

|

(3 |

) |

Excludes the impact of the

average net unrealized gain or loss on securities. |

|

(4 |

) |

Includes Federal Home Loan Bank

stock. |

|

(5 |

) |

Includes mortgagors' escrow

accounts. |

|

(6 |

) |

Net interest income divided by

average total interest-earning assets. |

|

(7 |

) |

Total interest-earning assets

divided by total interest-bearing liabilities. |

HINGHAM INSTITUTION FOR

SAVINGS Non-GAAP Reconciliation

The table below presents the reconciliation between net income

and core net income, a non-GAAP measurement that represents net

income excluding the after-tax gain on equity securities, net, and

after-tax gain on disposal of fixed assets.

| |

|

|

|

|

|

Three Months Ended |

|

Twelve Months Ended |

| |

|

|

|

|

|

December 31, |

|

December 31, |

| (In thousands,

unaudited) |

|

|

2020 |

|

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP

reconciliation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

$ |

17,042 |

|

|

$ |

16,674 |

|

|

$ |

50,771 |

|

|

$ |

67,458 |

|

|

Gain on equity securities, net |

|

|

|

(5,453 |

) |

|

|

(2,105 |

) |

|

|

(7,916 |

) |

|

|

(11,820 |

) |

|

Income tax expense (1) |

|

|

|

1,202 |

|

|

|

464 |

|

|

|

1,745 |

|

|

|

2,605 |

|

|

Gain on disposal of fixed assets |

|

|

|

— |

|

|

|

— |

|

|

|

(218 |

) |

|

|

(2,337 |

) |

|

Income tax expense |

|

|

|

|

— |

|

|

|

— |

|

|

|

61 |

|

|

|

657 |

|

| Core net

income |

|

|

$ |

12,791 |

|

|

$ |

15,033 |

|

|

$ |

44,443 |

|

|

$ |

56,563 |

|

(1) The equity securities are held in a

tax-advantaged subsidiary corporation. The income tax effect of the

gain on equity securities, net, was calculated using the effective

tax rate applicable to the subsidiary.

CONTACT: Patrick R. Gaughen, President and Chief Operating

Officer (781) 783-1761

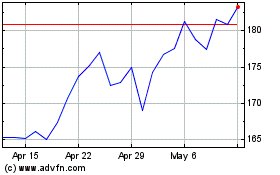

Hingham Institution for ... (NASDAQ:HIFS)

Historical Stock Chart

From Apr 2024 to May 2024

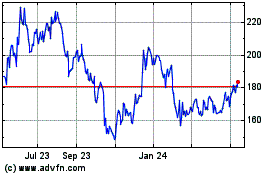

Hingham Institution for ... (NASDAQ:HIFS)

Historical Stock Chart

From May 2023 to May 2024