Hanmi Financial Corporation (NASDAQ:HAFC) (�we,� �our� or

�Hanmi�), the holding company for Hanmi Bank (the �Bank�), reported

a first-quarter net loss of $5.2 million, or ($0.11) per share,

compared to net income of $2.9 million, or $0.06 per diluted share,

in the first quarter of 2008.

�First-quarter results reflect a continuation of the exceedingly

difficult environment in which we have operated for the last

several quarters,� said Jay S. Yoo, Hanmi�s President and Chief

Executive Officer. �In particular, credit quality deteriorated as

we continued to experience higher delinquency rates and an increase

in non-performing loans as a result of the prolonged economic

slowdown. Our ongoing program to stay abreast of problematic

credits includes third-party loan review, quarterly third-party

stress testing of the entire loan portfolio, and, where considered

appropriate, third-party re-appraisal of collateral on commercial

real estate loans.�

�Despite the challenging economic environment and the

disappointing first-quarter operating results,� Mr. Yoo added, �I

am encouraged that during the quarter we have reduced wholesale

funding, such as broker deposits and FHLB advances, on our balance

sheet with a substantial increase in customer deposits through a

successful deposit campaign, which has improved our liquidity.�

Results of Operations

First-quarter 2009 net interest income before provision for

credit losses decreased by $7.4 million, or 24.3 percent, to $23.1

million, compared to $30.5 million in the fourth quarter of 2008.

Interest and fees on loans declined by $6.2 million, or 12.1

percent, from the fourth quarter of 2008, reflecting a lower yield

on the loan portfolio primarily due to the low interest rate

environment, whereas interest paid on deposits increased by $3.1

million, or 15.9 percent, from the fourth quarter of 2008.

The increase in the total cost of average interest-bearing

deposits was primarily due to a sequential increase of $364.4

million, or 15.8 percent, in total average interest-bearing

deposits, which in turn was due in large part to an aggressive

promotion (commenced in December 2008 and concluded in early March

2009) of flexible time deposits with attractive rates; the average

cost of interest-bearing deposits increased by 7 basis points to

3.45 percent in the first quarter of 2009 from 3.38 percent in the

fourth quarter of 2008.

The average yield on the loan portfolio was 5.46 percent in the

first quarter of 2009, a decline of 60 basis points compared to

6.06 percent in the fourth quarter of 2008, as a result of the

declining interest rate environment. Given the lower asset yields

and higher liability costs, net interest margin declined by 88

basis points, to 2.46 percent in the first quarter of 2009 from

3.34 percent in the fourth quarter of 2008. Although we expect to

see some margin improvement by the third quarter, we continue to

believe that a significant expansion in net interest margin is

unlikely to occur until late 2009.

The provision for credit losses in the first quarter of 2009 was

$25.0 million compared to $25.5 million in the prior quarter and

$17.8 million in the first quarter of 2008. First-quarter

charge-offs, net of recoveries, were $11.8 million compared to

$18.6 million in the prior quarter and $7.3 million in the first

quarter of 2008. First-quarter charge-offs consisted primarily of a

number of commercial and industrial loans, as well as some property

loans, tied to small businesses, which continue to be adversely

affected by the recession.

Total non-interest income in the first quarter of 2009 was $8.4

million compared to $7.4 million in the fourth quarter of 2008 and

$9.8 million in the first quarter of 2008. The increase in

non-interest income over the fourth quarter is primarily

attributable to a $1.2 million gain on the sale of $37.3 million of

investment securities.

Total non-interest expense in the first quarter of 2009 was

$18.3 million compared to $21.1 million in the fourth quarter of

2008, a decrease of $2.8 million, or 13.3 percent, and $21.6

million in the first quarter of 2008, a decrease of $3.3 million,

or 15.5 percent. A sequential decrease of $1.3 million in salaries

and employee benefits reflects the first-quarter 2009 reversal of a

$2.5 million post-retirement benefit obligation related to

bank-owned life insurance as a result of an amendment to the policy

to remove a post-retirement death benefit and a $1.1 million

increase in bonus accruals due to a fourth-quarter 2008 reversal of

$860,000 in bonus accruals and a first-quarter 2009 bonus accrual

of $200,000. A $1.5 million decline in all other non-interest

expense reflects reductions in professional fees and advertising

and promotion in the first quarter of 2009, as well as the impact

from an accrual of $1.0 million in severance payments to retired

directors in the fourth quarter of 2008.

For the first quarter of 2009, due mainly to the decrease in net

interest income before provision for credit losses, the efficiency

ratio (non-interest expense divided by the sum of net interest

income before provision for credit losses and non-interest income)

increased to 57.92 percent, compared to 55.49 percent in the fourth

quarter of 2008 and 49.11 percent in the comparable period a year

ago.

Balance Sheet and Asset Quality

At March 31, 2009, total assets were $3.89 billion compared to

$3.88 billion at December 31, 2008 and $3.94 billion at March 31,

2008, an increase of $17.1 million, or 0.4 percent, and a decrease

of $47.5 million, or 1.2 percent, respectively. At March 31, 2009,

gross loans, net of deferred loan fees decreased by $43.7 million,

or 1.3 percent, to $3.32 billion, compared to gross loans of $3.36

billion at December 31, 2008, and increased by $14.3 million, or

0.4 percent, compared to gross loans of $3.30 billion at March 31,

2008. The sequential decline in gross loans in the first quarter is

indicative of the Bank�s close attention to actively managing its

balance sheet in light of continuing weakness in the economy.

Total deposits increased by $126.0 million, or 4.1 percent, to

$3.20 billion at March 31, 2009, compared to $3.07 billion at

December 31, 2008, and increased by $168.3 million, or 5.6 percent,

compared to total deposits of $3.03 billion at March 31, 2008. We

are successfully replacing wholesale funds such as FHLB advances

and broker deposits with customer deposits as planned. FHLB

advances and other borrowings decreased by $110.1 million, or 26.0

percent, to $312.8 million at March 31, 2009, compared to $423.0

million at December 31, 2008, and decreased by $102.7 million, or

24.7 percent, compared to $415.6 at March 31, 2008. At March 31,

2009, broker deposits were $577.8 million compared to $874.2

million at December 31, 2008.

Delinquent loans were $164.4 million (4.95 percent of total

gross loans) at March 31, 2009, compared to $128.5 million (3.82

percent of total gross loans) at December 31, 2008, and $105.8

million (3.20 percent of total gross loans) at March 31, 2008. The

majority of the increase in delinquencies was attributable to a

number of commercial and industrial loans totaling $21.7 million in

aggregate, of which $12.8 million were owner/user business property

loans. Non-performing loans at March 31, 2009 were $132.1 million

(3.98 percent of total gross loans), compared to $121.9 million

(3.62 percent of total gross loans) at December 31, 2008, and $88.7

million (2.68 percent of total gross loans) at March 31, 2008.

At March 31, 2009, the allowance for loan losses was $83.9

million, or 2.53 percent of total gross loans (63.52 percent of

total non-performing loans), compared to $71.0 million, or 2.11

percent of total gross loans (58.23 percent of total non-performing

loans), at December 31, 2008, and $53.0 million, or 1.60 percent of

total gross loans (59.72 percent of total non-performing loans), at

March 31, 2008.

Capital Adequacy

The Bank�s capital ratios exceeded levels defined as

�well-capitalized� by our regulators. At March 31, 2009, the Bank�s

Tier 1 Leverage, Tier 1 Risk-Based Capital and Total Risk-Based

Capital ratios were 8.40 percent, 9.52 percent and 10.79 percent,

respectively, compared to 8.85 percent, 9.44 percent and 10.71

percent, respectively, at December 31, 2008.

Forward-Looking Statements

This release contains forward-looking statements, which are

included in accordance with the �safe harbor� provisions of the

Private Securities Litigation Reform Act of 1995. In some cases,

you can identify forward-looking statements by terminology such as

�may,� �will,� �should,� �could,� �expects,� �plans,� �intends,�

�anticipates,� �believes,� �estimates,� �predicts,� �potential,� or

�continue,� or the negative of such terms and other comparable

terminology. Although we believe that the expectations reflected in

the forward-looking statements are reasonable, we cannot guarantee

future results, levels of activity, performance or achievements.

These statements involve known and unknown risks, uncertainties and

other factors that may cause our actual results, levels of

activity, performance or achievements to differ from those

expressed or implied by the forward-looking statement. These

factors include the following:

� failure to maintain adequate levels of capital and liquidity

to support our operations;

� the effect of regulatory orders we have entered into and

potential future supervisory action against us or Hanmi Bank;

� general economic and business conditions internationally,

nationally and in those areas in which we operate;

� volatility and deterioration in the credit and equity

markets;

� changes in consumer spending, borrowing and savings

habits;

� availability of capital from private and government

sources;

� demographic changes;

� competition for loans and deposits and failure to attract or

retain loans and deposits;

� fluctuations in interest rates and a decline in the level of

our interest rate spread;

� risks of natural disasters related to our real estate

portfolio;

� risks associated with SBA loans;

� failure to attract or retain key employees;

� changes in governmental regulation, including, but not limited

to, any increase in FDIC insurance premiums;

� ability to receive regulatory approval for Hanmi Bank to

declare dividends to Hanmi Financial;

� adequacy of our allowance for loan losses, credit quality and

the effect of credit quality on our provision for credit losses and

allowance for loan losses;

� changes in the financial performance and/or condition of our

borrowers and the ability of our borrowers to perform under the

terms of their loans and other terms of credit agreements;

� our ability to successfully integrate acquisitions we may

make;

� our ability to control expenses; and

� changes in securities markets.

In addition, we set forth certain risks in our reports filed

with the Securities and Exchange Commission, including our Annual

Report on Form 10-K for the fiscal year ended December 31, 2008 and

current and periodic reports filed with the Securities and Exchange

Commission thereafter, which could cause actual results to differ

from those projected. You should understand that it is not possible

to predict or identify all such risks. Consequently, you should not

consider such disclosures to be a complete discussion of all

potential risks or uncertainties. We undertake no obligation to

update such forward-looking statements except as required by

law.

About Hanmi Financial Corporation

Headquartered in Los Angeles, Hanmi Bank, a wholly owned

subsidiary of Hanmi Financial Corporation, provides services to the

multi-ethnic communities of California, with 27 full-service

offices in Los Angeles, Orange, San Bernardino, San Francisco,

Santa Clara and San Diego counties, and two loan production offices

in Virginia and Washington State. Hanmi Bank specializes in

commercial, Small Business Administration (�SBA�) and trade finance

lending, and is a recognized community leader. Hanmi Bank�s mission

is to provide a full range of quality products and premier services

to its customers and to maximize shareholder value. Additional

information is available at www.hanmifinancial.com.

HANMI FINANCIAL CORPORATION AND SUBSIDIARIES CONDENSED

CONSOLIDATED BALANCE SHEETS (UNAUDITED) (Dollars in Thousands)

� � � � � � � � � � � � �

March 31, December 31, %

March 31, % �

2009 � �

2008 �

Change �

2008 �

Change

ASSETS Cash and Due from Banks $ 230,950 $

85,188 171.1 % $ 101,306 128.0 % Federal Funds Sold �

90,000 � �

130,000 �

(30.8

)% �

2,000 �

4,400.0

% Cash and Cash Equivalents �

320,950 � �

215,188 �

49.1 % �

103,306 �

210.7 % Investment

Securities 164,412 197,876 (16.9 )% 323,636 (49.2 )% Loans: Gross

Loans, Net of Deferred Loan Fees 3,318,382 3,362,111 (1.3 )%

3,304,039 0.4 % Allowance for Loan Losses �

(83,943

) �

(70,986 )

18.3 % �

(52,986

) 58.4 % Loans Receivable,

Net �

3,234,439 � �

3,291,125 �

(1.7 )% �

3,251,053 �

(0.5 )% Customers� Liability on

Acceptances 2,176 4,295 (49.3 )% 7,119 (69.4 )% Premises and

Equipment, Net 20,269 20,279

--

20,679 (2.0 )% Accrued Interest Receivable 11,702 12,347 (5.2 )%

15,417 (24.1 )% Other Real Estate Owned 1,206 823 46.5 %

--

--

Servicing Assets 3,630 3,791 (4.2 )% 4,220 (14.0 )% Goodwill

--

--

--

107,393 (100.0 )% Other Intangible Assets 4,521 4,950 (8.7 )% 6,384

(29.2 )% Federal Home Loan Bank and Federal Reserve Bank Stock

40,925 40,925

--

33,718 21.4 % Bank-Owned Life Insurance 25,710 25,476 0.9 % 24,760

3.8 % Other Assets �

62,955 � �

58,741 �

7.2 % �

42,710 �

47.4 % TOTAL ASSETS

$ 3,892,895 �

$ 3,875,816 �

0.4 % $

3,940,395 �

(1.2 )% �

LIABILITIES AND STOCKHOLDERS� EQUITY

Liabilities: Deposits: Noninterest-Bearing $ 542,521 $ 536,944 1.0

% $ 676,471 (19.8 )% Interest-Bearing �

2,653,588 � �

2,533,136 �

4.8 % �

2,351,297 �

12.9 % Total

Deposits 3,196,109 3,070,080 4.1 % 3,027,768 5.6 % Accrued Interest

Payable 27,234 18,539 46.9 % 17,857 52.5 % Acceptances Outstanding

2,176 4,295 (49.3 )% 7,119 (69.4 )% Federal Home Loan Bank Advances

and Other Borrowings 312,836 422,983 (26.0 )% 415,553 (24.7 )%

Junior Subordinated Debentures 82,406 82,406

--

82,406

--

Other Liabilities �

11,891 � �

13,598 �

(12.6 )% �

19,328 �

(38.5 )% Total Liabilities 3,632,652

3,611,901 0.6 % 3,570,031 1.8 % Stockholders� Equity �

260,243 � �

263,915 �

(1.4

)% �

370,364 �

(29.7

)% TOTAL LIABILITIES AND STOCKHOLDERS� EQUITY

$ 3,892,895 �

$ 3,875,816 �

0.4 % $

3,940,395 �

(1.2 )%

HANMI FINANCIAL CORPORATION AND SUBSIDIARIES CONSOLIDATED

STATEMENTS OF OPERATIONS (UNAUDITED) (Dollars in Thousands,

Except Per Share Data) � � � � � � � � � � � � � �

Three

Months Ended March 31, December 31, %

March 31, % �

2009 � �

2008 �

Change �

2008 Change INTEREST AND DIVIDEND

INCOME: Interest and Fees on Loans $ 45,085 $ 51,305 (12.1 )% $

60,598 (25.6 )% Taxable Interest on Investments 1,352 1,649 (18.0

)% 3,116 (56.6 )% Tax-Exempt Interest on Investments 643 646 (0.5

)% 759 (15.3 )% Dividends on Federal Home Loan Bank and Federal

Reserve Bank Stock 153 437 (65.0 )% 414 (63.0 )% Interest on

Federal Funds Sold 82 29 182.8 % 83 (1.2 )% Interest on Term

Federal Funds Sold �

700 � �

43 �

1,527.9 % �

--

--

� Total Interest and Dividend Income �

48,015 � �

54,109 �

(11.3 )% �

64,970 (26.1 )% � INTEREST

EXPENSE: Interest on Deposits 22,785 19,654 15.9 % 24,847 (8.3 )%

Interest on Federal Home Loan Bank Advances and Other Borrowings

1,112 2,623 (57.6 )% 4,477 (75.2 )% Interest on Junior Subordinated

Debentures �

988 � �

1,293 �

(23.6 )% �

1,449

(31.8 )% Total Interest Expense �

24,885 � �

23,570 �

5.6

% �

30,773 (19.1

)% � NET INTEREST INCOME BEFORE PROVISION FOR CREDIT

LOSSES 23,130 30,539 (24.3 )% 34,197 (32.4 )%

--

--

Provision for Credit Losses �

24,953 � �

25,450 �

(2.0 )% �

17,821 40.0 % � NET INTEREST

INCOME (LOSS) AFTER PROVISION FOR CREDIT LOSSES �

(1,823 ) �

5,089 �

(135.8 )% �

16,376

(111.1 )% � NON-INTEREST INCOME: Service

Charges on Deposit Accounts 4,315 4,559 (5.4 )% 4,717 (8.5 )%

Insurance Commissions 1,182 1,174 0.7 % 1,315 (10.1 )% Remittance

Fees 523 651 (19.7 )% 505 3.6 % Trade Finance Fees 506 614 (17.6 )%

865 (41.5 )% Other Service Charges and Fees 483 513 (5.8 )% 716

(32.5 )% Bank-Owned Life Insurance Income 234 237 (1.3 )% 240 (2.5

)% Gain (Loss) on Sales of Securities Available for Sale 1,167 (58

) (2,112.1 )% 618 88.8 % Gain on Sales of Loans 2

--

--

213 (99.1 )% Other-Than-Temporary Impairment Loss on Securities (98

) (494 ) (80.2 )%

--

--

Other Income �

66 � �

208 �

(68.3 )% �

576

(88.5 )% Total Non-Interest Income �

8,380 � �

7,404 �

13.2

% �

9,765 (14.2

)% � NON-INTEREST EXPENSE: Salaries and Employee

Benefits 7,503 8,846 (15.2 )% 11,280 (33.5 )% Occupancy and

Equipment 2,884 2,798 3.1 % 2,782 3.7 % Data Processing 1,536 1,069

43.7 % 1,534 0.1 % Professional Fees 616 912 (32.5 )% 985 (37.5 )%

Supplies and Communications 570 510 11.8 % 704 (19.0 )% Advertising

and Promotion 569 904 (37.1 )% 812 (29.9 )% Amortization of Other

Intangible Assets 429 454 (5.5 )% 524 (18.1 )% Other Operating

Expenses �

4,145 � �

5,563 �

(25.5 )% �

2,967

39.7 % Total Non-Interest Expense �

18,252 � �

21,056 �

(13.3

)% �

21,588 (15.5

)% � INCOME (LOSS) BEFORE PROVISION (BENEFIT) FOR

INCOME TAXES (11,695 ) (8,563 ) 36.6 % 4,553 (356.9 )% Provision

(Benefit) for Income Taxes �

(6,499 ) �

(4,748 ) 36.9 %

�

1,632 (498.2 )% �

NET

INCOME (LOSS) $ (5,196

) $

(3,815 ) 36.2

% $ 2,921

(277.9 )% �

EARNINGS (LOSS) PER

SHARE: Basic $ (0.11 ) $ (0.08 ) 37.5 % $ 0.06 (283.3 )%

Diluted $ (0.11 ) $ (0.08 ) 37.5 % $ 0.06 (283.3 )% �

WEIGHTED-AVERAGE SHARES OUTSTANDING: Basic 45,891,043

45,884,462 45,842,376 Diluted 45,891,043 45,884,462 45,918,143 �

SHARES OUTSTANDING AT PERIOD-END 45,940,967 45,905,549

45,905,549

HANMI FINANCIAL CORPORATION AND SUBSIDIARIES

SELECTED FINANCIAL DATA (UNAUDITED) (Dollars in Thousands) �

� � �

Three Months Ended March 31, � � �

December 31, � � � % � � �

March 31, � � � % �

2009 � �

2008 �

Change � �

2008 �

Change �

AVERAGE BALANCES: Average Gross Loans,

Net of Deferred Loan Fees $ 3,349,085 $ 3,366,601 (0.5 )% $

3,303,141 1.4 % Average Investment Securities 182,284 205,305 (11.2

)% 342,123 (46.7 )% Average Interest-Earning Assets 3,806,186

3,637,232 4.6 % 3,689,650 3.2 % Average Total Assets 3,946,860

3,789,435 4.2 % 3,965,425 (0.5 )% Average Deposits 3,202,032

2,879,674 11.2 % 2,995,315 6.9 % Average Borrowings 440,053 602,838

(27.0 )% 553,138 (20.4 )% Average Interest-Bearing Liabilities

3,115,332 2,913,723 6.9 % 2,897,209 7.5 % Average Stockholders�

Equity 263,686 271,544 (2.9 )% 377,411 (30.1 )% Average Tangible

Equity 258,908 266,333 (2.8 )% 263,624 (1.8 )% � �

PERFORMANCE

RATIOS (Annualized): Return on Average Assets (0.53 )% (0.40 )%

0.30 % Return on Average Stockholders� Equity (7.99 )% (5.59 )%

3.11 % Return on Average Tangible Equity (8.14 )% (5.70 )% 4.46 %

Efficiency Ratio 57.92 % 55.49 % 49.11 % Net Interest Spread 1.88 %

2.70 % 2.81 % Net Interest Margin 2.46 % 3.34 % 3.73 % � �

ALLOWANCE FOR LOAN LOSSES: Balance at Beginning of Period $

70,986 $ 63,948 11.0 % $ 43,611 62.8 % Provision Charged to

Operating Expense 24,770 25,660 (3.5 )% 16,672 48.6 % Charge-Offs,

Net of Recoveries �

(11,813 ) �

(18,622 ) (36.6

)% �

(7,297 )

61.9 % Balance at End of Period

$ 83,943 �

$

70,986 �

18.3 %

$ 52,986 �

58.4

% � Allowance for Loan Losses to Total Gross Loans

2.53 % 2.11 % 1.60 % Allowance for Loan Losses to Total

Non-Performing Loans 63.52 % 58.23 % 59.72 % � �

ALLOWANCE FOR

OFF-BALANCE SHEET ITEMS: Balance at Beginning of Period $ 4,096

$ 4,306 (4.9 )% $ 1,765 132.1 % Provision Charged to Operating

Expense �

183 � �

(210 )

(187.1 )% �

1,149 �

(116.3 )% Balance at End of Period

$ 4,279 �

$

4,096 �

4.5 % $

2,914 �

46.8 % HANMI

FINANCIAL CORPORATION AND SUBSIDIARIES � � � � � � � �

SELECTED FINANCIAL DATA (UNAUDITED) (Continued) (Dollars in

Thousands) � � � �

March 31, December 31, %

March

31, % �

2009 � �

2008 �

Change � �

2008 �

Change NON-PERFORMING ASSETS: Non-Accrual Loans

$ 131,323 $ 120,823 8.7 % $ 88,529 48.3 % Loans 90 Days or More

Past Due and Still Accruing �

823 � �

1,075 �

(23.4 )% �

191 �

330.9 % Total

Non-Performing Loans 132,146 121,898 8.4 % 88,720 48.9 % Other Real

Estate Owned �

1,206 � �

823 �

46.5 % �

--

�

--

� Total Non-Performing Assets

$ 133,352 �

$ 122,721 �

8.7

% $ 88,720 �

50.3 % � Total Non-Performing Loans/Total

Gross Loans 3.98 % 3.62 % 2.68 % Total Non-Performing Assets/Total

Assets 3.43 % 3.17 % 2.25 % Total Non-Performing Assets/Allowance

for Loan Losses 158.9 % 172.9 % 167.4 % �

DELINQUENT LOANS

$ 164,402 �

$

128,469 �

28.0 %

$ 105,842 �

55.3

% � Delinquent Loans/Total Gross Loans 4.95 % 3.82 %

3.20 % �

LOAN PORTFOLIO: Real Estate Loans $ 1,185,054 $

1,180,114 0.4 % $ 1,092,121 8.5 % Commercial and Industrial Loans

2,055,209 2,099,732 (2.1 )% 2,123,741 (3.2 )% Consumer Loans �

79,459 � �

83,525 �

(4.9

)% �

90,087 �

(11.8

)% Total Gross Loans 3,319,722 3,363,371 (1.3 )%

3,305,949 0.4 % Deferred Loan Fees �

(1,340

) �

(1,260 )

6.3 % �

(1,910

) (29.8 )% Gross Loans, Net

of Deferred Loan Fees 3,318,382 3,362,111 (1.3 )% 3,304,039 0.4 %

Allowance for Loan Losses �

(83,943 ) �

(70,986 ) 18.3

% �

(52,986 )

58.4 % Loans Receivable, Net

$ 3,234,439 �

$

3,291,125 �

(1.7 )%

$ 3,251,053 �

(0.5

)% �

LOAN MIX: Real Estate Loans 35.7 % 35.1 %

33.0 % Commercial and Industrial Loans 61.9 % 62.4 % 64.2 %

Consumer Loans �

2.4 % �

2.5

% �

2.8 % Total Gross Loans

�

100.0 % �

100.0

% �

100.0 % �

DEPOSIT

PORTFOLIO: Noninterest-Bearing $ 542,521 $ 536,944 1.0 % $

676,471 (19.8 )% Savings 82,824 81,869 1.2 % 92,189 (10.2 )% Money

Market Checking and NOW Accounts 308,383 370,401 (16.7 )% 696,552

(55.7 )% Time Deposits of $100,000 or More 1,218,826 849,800 43.4 %

1,248,853 (2.4 )% Other Time Deposits �

1,043,555 � �

1,231,066 �

(15.2 )% �

313,703 �

232.7 % Total

Deposits

$ 3,196,109 �

$

3,070,080 �

4.1 %

$ 3,027,768 �

5.6

% �

DEPOSIT MIX: Noninterest-Bearing 17.0 %

17.5 % 22.3 % Savings 2.6 % 2.7 % 3.0 % Money Market Checking and

NOW Accounts 9.6 % 12.1 % 23.0 % Time Deposits of $100,000 or More

38.1 % 27.7 % 41.2 % Other Time Deposits �

32.7

% �

40.0 % �

10.5 % Total Deposits �

100.0 % �

100.0

% �

100.0 % �

CAPITAL

RATIOS (Bank Only): Total Risk-Based 10.79 % 10.71 % 10.79 %

Tier 1 Risk-Based 9.52 % 9.44 % 9.54 % Tier 1 Leverage 8.40 % 8.85

% 8.74 %

HANMI FINANCIAL CORPORATION AND SUBSIDIARIES

AVERAGE BALANCES, AVERAGE YIELDS EARNED AND AVERAGE RATES

PAID (UNAUDITED) (Dollars in Thousands) � �

Three

Months Ended March 31, 2009 � �

December 31, 2008 � �

March 31,

2008

Average Balance �

Interest Income/

Expense �

Average Yield/ Rate �

Average Balance �

Interest Income/

Expense �

Average Yield/ Rate �

AverageBalance

�

Interest Income/ Expense �

Average

Yield/ Rate �

INTEREST-EARNING ASSETS

�

Loans: Real Estate Loans: Commercial Property $ 914,632 $

12,937 5.74 % $ 902,367 $ 14,074 6.20 % $ 790,350 $ 14,480 7.37 %

Construction 180,026 1,547 3.49 % 186,080 1,881 4.02 % 217,609

2,893 5.35 % Residential Property �

90,490 � �

1,163 �

5.21 % �

91,366 � �

1,174 5.11

% �

89,512 � �

1,170

5.26 % Total Real Estate Loans 1,185,148

15,647 5.35 % 1,179,813 17,129 5.78 % 1,097,471 18,543 6.80 %

Commercial and Industrial Loans 2,083,951 28,237 5.50 % 2,104,820

32,691 6.18 % 2,117,501 40,125 7.62 % Consumer Loans �

81,244 � �

1,153 �

5.76

% �

83,411 � �

1,353

6.45 % �

90,280 � �

1,625 7.24 % Total Gross

Loans 3,350,343 45,037 5.45 % 3,368,044 51,173 6.04 % 3,305,252

60,293 7.34 % Prepayment Penalty Income

--

48

--

--

132

--

--

305

--

Unearned Income on Loans, Net of Costs �

(1,258

) �

--

�

--

� �

(1,443 ) �

--

--

� �

(2,111 ) �

--

--

�

Gross Loans, Net �

3,349,085 � �

45,085 �

5.46

% �

3,366,601 � �

51,305 6.06

% �

3,303,141 � �

60,598 7.38

% �

Investment Securities: Municipal

Bonds 58,886 643 4.37 % 59,718 646 4.33 % 71,879 759 4.22 % U.S.

Government Agency Securities 9,578 96 4.01 % 21,720 201 3.70 %

109,860 1,245 4.53 % Mortgage-Backed Securities 75,716 895 4.73 %

79,821 971 4.87 % 97,088 1,176 4.85 % Collateralized Mortgage

Obligations 33,631 348 4.14 % 37,853 403 4.26 % 49,932 534 4.28 %

Corporate Bonds 159 (22 ) -55.35 % 1,688 46 10.90 % 9,509 109 4.59

% Other Securities �

4,314 � �

33 �

3.06 % �

4,505 � �

23 2.04 % �

3,855 � �

52 5.40

% Total Investment Securities �

182,284 � �

1,993 �

4.37 % �

205,305 � �

2,290

4.46 % �

342,123 � �

3,875

4.53 % �

Other

Interest-Earning Assets: Equity Securities 41,727 153 1.49 %

42,551 437 4.09 % 33,490 414 4.97 % Federal Funds Sold 94,585 82

0.35 % 14,410 29 0.80 % 10,896 83 3.06 % Term Federal Funds Sold

138,344 700 2.05 % 7,609 43 2.25 %

--

--

--

Interest-Earning Deposits �

161 � �

2 �

5.04 % �

756 � �

5 2.63 % �

--

� �

--

--

�

Total Other Interest-Earning Assets �

274,817 � �

937 �

1.38 % �

65,326 � �

514

3.13 % �

44,386 � �

497

4.50 % �

TOTAL

INTEREST-EARNING ASSETS $

3,806,186 �

$

48,015 �

5.12

% $

3,637,232 �

$

54,109 5.92

% $

3,689,650 �

$

64,970 7.08

% �

INTEREST-BEARING LIABILITIES �

Interest-Bearing Deposits: Savings $ 82,029 $ 505 2.50 % $

83,777 $ 506 2.40 % $ 92,467 $ 527 2.29 % Money Market Checking and

NOW Accounts 343,354 1,854 2.19 % 506,062 3,963 3.12 % 557,493

4,660 3.36 % Time Deposits of $100,000 or More 1,078,650 10,322

3.88 % 754,081 8,162 4.31 % 1,354,466 15,687 4.66 % Other Time

Deposits �

1,171,246 � �

10,104 �

3.50 % �

966,965 � �

7,023 2.89 % �

339,645 � �

3,973 4.70

% Total Interest-Bearing Deposits �

2,675,279 � �

22,785 �

3.45 % �

2,310,885 � �

19,654

3.38 % �

2,344,071 � �

24,847

4.26 % �

Borrowings:

FHLB Advances and Other Borrowings 357,647 1,112 1.26 % 520,432

2,623 2.01 % 470,732 4,477 3.83 % Junior Subordinated Debentures �

82,406 � �

988 �

4.86

% �

82,406 � �

1,293

6.24 % �

82,406 � �

1,449 7.07 % Total

Borrowings �

440,053 � �

2,100 �

1.94

% �

602,838

� �

3,916 2.58

% �

553,138 � �

5,926 4.31

% �

TOTAL INTEREST-BEARING LIABILITIES

$ 3,115,332 �

$ 24,885 �

3.24 %

$ 2,913,723 �

$ 23,570

3.22 %

$ 2,897,209 �

$ 30,773

4.27 % �

NET INTEREST

INCOME $ 23,130 �

$ 30,539

$ 34,197 �

NET INTEREST

SPREAD 1.88 %

2.70 %

2.81 % �

NET INTEREST

MARGIN 2.46 %

3.34 %

3.73 %

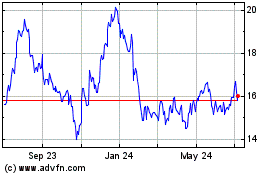

Hanmi Financial (NASDAQ:HAFC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Hanmi Financial (NASDAQ:HAFC)

Historical Stock Chart

From Jul 2023 to Jul 2024