Hanmi Financial Corporation (NASDAQ:HAFC), the holding company for

Hanmi Bank, reported that for the three months ended June 30, 2007,

it earned net income of $15.3 million, an increase of 17.4 percent

compared to net income of $13.1 million in the first quarter of

2007. Earnings per share were $0.31 (diluted), an increase of 19.2

percent compared to $0.26 per share (diluted) for the first quarter

of 2007. �The sequential increase of $2.2 million in net income �

to $15.3 million from $13.1 million in the prior quarter � points

to continuing solid performance in our core operations, including a

loan portfolio that grew by $191.0 million, or 6.7 percent, since

the beginning of the year,� said Sung Won Sohn, Ph.D., President

and Chief Executive Officer. �It points as well to the quality of

the loan portfolio and the fact that the second-quarter provision

for credit losses was only $3.0 million compared to $6.1 million in

the first quarter.� �We grew our net interest income before

provision for credit losses by $525,000, or 1.4 percent, compared

to the first quarter, despite a modest decline in the net interest

margin to 4.51 percent from 4.61 percent,� added Dr. Sohn. �This

illustrates the state of the markets we serve, particularly the

Southern California commercial real estate market: they present

numerous business opportunities, but at the same time remain

fiercely competitive.� �We anticipate that this competition � which

is coming from mainstream banks as well as other Korean-American

banks � will in the near term continue to put pressure on margins.

With that understood,� concluded Dr. Sohn, �the message I would

leave with investors is that while we will continue to focus on

growth in assets and net interest income, our foremost concern will

continue to be credit quality.� SECOND-QUARTER HIGHLIGHTS � Net

interest income before provision for credit losses was $38.6

million for the second quarter of 2007, compared to $38.1 million

for the first quarter of 2007 and $38.4 million for the second

quarter of 2006, reflecting a 2.4 percent and 7.8 percent,

respectively, sequential increase in average interest-earning

assets. Net interest margin for the second quarter of 2007 was 4.51

percent, compared to 4.61 percent for the first quarter of 2007 and

4.84 percent for the second quarter of 2006. � The loan portfolio

increased by $191.0 million, or 6.7 percent, to $3.06 billion at

June 30, 2007, compared to $2.86 billion at December 31, 2006,

reflecting continued growth in commercial and industrial loans. �

Non-performing loans increased by $3.1 million to $22.6 million, or

0.74 percent of the portfolio, at June 30, 2007, compared to $19.5

million, or 0.67 percent of the portfolio, at March 31, 2007. Loans

over 30 days delinquent decreased from $37.3 million at March 31,

2007 to $32.0 million at June 30, 2007. � The provision for credit

losses was $3.0 million for the second quarter of 2007, compared to

$6.1 million for the first quarter of 2007 and $900,000 for the

second quarter of 2006. � The allowance for loan losses was 1.05

percent, 1.08 percent and 0.98 percent of the gross loan portfolio

at June 30, 2007, March 31, 2007 and June 30, 2006, respectively. �

During the second quarter, the Company repurchased 923,800 of its

shares at a cost of $15.9 million, or $17.19 per share. NET

INTEREST INCOME BEFORE PROVISION FOR CREDIT LOSSES Net interest

income before provision for credit losses was $38.6 million for the

second quarter of 2007, an increase of $525,000, or 1.4 percent,

compared to $38.1 million for the first quarter of 2007, and an

increase of $193,000, or 0.5 percent, compared to $38.4 million for

the second quarter of 2006. The yield on the loan portfolio was

8.68 percent for the second quarter of 2007, a decrease of 12 basis

points compared to 8.80 percent for the first quarter of 2007, and

an increase of 3 basis points compared to 8.65 percent for the

second quarter of 2006. The yield on investment securities was 4.40

percent for the second quarter of 2007, a decrease of 4 basis

points compared to 4.44 percent for the first quarter of 2007, and

the same as the second quarter of 2006. The yield on average

interest-earning assets was 8.17 percent for the second quarter of

2007, a decrease of 6 basis points compared to 8.23 percent for the

first quarter of 2007, and an increase of 11 basis points compared

to 8.06 percent for the second quarter of 2006. The cost of

interest-bearing liabilities was 4.92 percent for the second

quarter of 2007, an increase of 5 basis points compared to 4.87

percent for the first quarter of 2007, and an increase of 55 basis

points compared to 4.37 percent for the second quarter of 2006, as

the competitive deposit rate environment continued to stabilize.

PROVISION FOR CREDIT LOSSES The provision for credit losses was

$3.0 million for the second quarter of 2007, compared to $6.1

million for the first quarter of 2007 and $900,000 for the same

quarter last year. In the second quarter of 2007, net charge-offs

were $2.5 million, compared to $2.4 million for the first quarter

of 2007 and $353,000 for the same quarter last year. The sequential

decrease in the provision for credit losses is attributable

primarily to decreased migration of loans into the Company�s more

adverse risk rating categories and the resolution of certain

non-performing loans in the second quarter. The sequential decrease

in the provision for credit losses also reflects a reduced rate of

increase in non-performing assets, which increased $4.2 million in

the second quarter to a balance of $23.7 million at June 30, 2007,

compared to an increase of $5.3 million to a balance of $19.5

million at March 31, 2007. Delinquent loans decreased to $32.0

million, or 1.05 percent of gross loans, at June 30, 2007 from

$37.3 million, or 1.28 percent of gross loans, at March 31, 2007.

While the level of non-performing assets and delinquent loans are

indicators of the credit quality of the portfolio, the provision

for credit losses is determined primarily on the basis of loan

classifications and the Company�s historical loss experience with

similarly situated credits. NON-INTEREST INCOME Non-interest income

increased by $705,000, or 7.1 percent, to $10.7 million for the

second quarter of 2007, compared to $10.0 million for the first

quarter of 2007, and increased by $2.0 million, or 23.4 percent,

compared to $8.7 million for the second quarter of 2006. The

increases in non-interest income are primarily attributable to

increases in the amount of gain on sales of loans and increased

insurance commissions as a result of the acquisition of two

insurance agencies in the first quarter of 2007. NON-INTEREST

EXPENSES Non-interest expenses increased by $521,000, or 2.5

percent, to $21.5 million for the second quarter of 2007, compared

to $21.0 million for the first quarter of 2007, and increased by

$1.7 million, or 8.6 percent, compared to $19.8 million for the

second quarter of 2006. Salaries and employee benefits decreased

$979,000, or 8.3 percent, sequentially from $11.8 million for the

quarter ended March 31, 2007 to $10.8 million for the quarter ended

June 30, 2007 because of decreased accruals for incentive

compensation. In addition, a larger percentage of payroll costs

were capitalized as direct loan origination costs, as a result of

higher loan volume, and the employer�s portion of payroll taxes

decreased. Other operating expenses increased $648,000, or 23.2

percent, sequentially from $2.8 million for the quarter ended March

31, 2007 to $3.4 million for the quarter ended June 30, 2007 as the

Company incurred increased deposit operations losses and increased

the amortization and write-downs of loan servicing assets. The

efficiency ratio (non-interest expenses divided by the sum of net

interest income before provision for credit losses and non-interest

income) for the second quarter of 2007 was 43.61 percent, compared

to 43.64 percent for the first quarter of 2007 and 42.06 percent

for the second quarter of 2006, reflecting the acquisitions of two

insurance agencies in the first quarter of 2007. PROVISION FOR

INCOME TAXES The provision for income taxes reflects a 38.1 percent

effective tax rate for the second quarter of 2007, compared to a

37.7 percent effective tax rate for the first quarter of 2007 and a

39.5 percent effective tax rate for the second quarter of 2006. The

periodic effective tax rates reflect a stable level of Enterprise

Zone and low-income housing tax credits in periods in which there

were fluctuations in taxable income. FINANCIAL POSITION Total

assets were $3.87 billion at June 30, 2007, an increase of $145.7

million, or 3.9 percent, compared to $3.73 billion at December 31,

2006, and an increase of $247.2 million, or 6.8 percent, from the

June 30, 2006 balance of $3.62 billion. At June 30, 2007, net loans

totaled $3.02 billion, an increase of $186.3 million, or 6.6

percent, from $2.84 billion at December 31, 2006. Real estate loans

increased by $21.1 million, or 2.0 percent, to $1.06 billion at

June 30, 2007, compared to $1.04 billion at December 31, 2006, and

commercial and industrial loans grew by $171.7 million, or 9.9

percent, to $1.90 billion at June 30, 2007, compared to $1.73

billion at December 31, 2006. The growth in total assets was funded

primarily by an increase in FHLB advances and other borrowings of

$109.7 million, up 64.9 percent to $278.8 million at June 30, 2007,

compared to $169.0 million at December 31, 2006. In addition,

deposits increased $28.4 million, up 1.0 percent to $2.97 billion

at June 30, 2007 from $2.94 billion at December 31, 2006. The

increase in deposits included increases in time deposits of

$100,000 or more of $24.9 million, up 1.8 percent to $1.41 billion,

in other time deposits of $13.2 million, up 4.5 percent to $308.7

million, and in money market checking accounts of $706,000, up 0.2

percent to $439.0 million, partially offset by decreases in

noninterest-bearing demand deposits of $8.1 million, down 1.1

percent to $720.2 million, and in savings accounts of $2.2 million,

down 2.3 percent to $97.0 million. ASSET QUALITY Total

non-performing assets, including loans 90 days or more past due and

still accruing, non-accrual loans and other real estate owned

(�OREO�) assets, increased by $9.5 million to $23.7 million at June

30, 2007 from $14.2 million at December 31, 2006, and increased by

$11.6 million from $12.1 million at June 30, 2006. Non-performing

loans as a percentage of gross loans increased to 0.74 percent at

June 30, 2007 from 0.50 percent at December 31, 2006 and 0.43

percent at June 30, 2006. At June 30, 2007, delinquent loans were

$32.0 million, or 1.05 percent of gross loans, compared to $19.6

million, or 0.68 percent of gross loans, at December 31, 2006, and

$23.1 million, or 0.83 percent of gross loans, at June 30, 2006. At

June 30, 2007, the Company maintained an allowance for loan losses

of $32.2 million and a liability for off-balance sheet exposure,

primarily unfunded loan commitments, of $1.7 million. The allowance

for loan losses represented 1.05 percent of gross loans at June 30,

2007, compared to 0.96 percent and 0.98 percent at December 31,

2006 and June 30, 2006, respectively. As of June 30, 2007, the

allowance for loan losses was 142.3 percent of non-performing

loans, compared to 193.9 percent at December 31, 2006 and 224.5

percent at June 30, 2006. ABOUT HANMI FINANCIAL CORPORATION

Headquartered in Los Angeles, Hanmi Bank, a wholly owned subsidiary

of Hanmi Financial Corporation, provides services to the

multi-ethnic communities of California, with 23 full-service

offices in Los Angeles, Orange, San Francisco, Santa Clara and San

Diego counties, and nine loan production offices in California,

Colorado, Georgia, Illinois, Texas, Virginia and Washington. Hanmi

Bank specializes in commercial, SBA, trade finance and consumer

lending, and is a recognized community leader. Hanmi Bank�s mission

is to provide a full range of quality products and premier services

to its customers and to maximize shareholder value. Additional

information is available at www.hanmifinancial.com. FORWARD-LOOKING

STATEMENTS This release contains forward-looking statements, which

are included in accordance with the �safe harbor� provisions of the

Private Securities Litigation Reform Act of 1995. In some cases,

you can identify forward-looking statements by terminology such as

�may,� �will,� �should,� �could,� �expects,� �plans,� �intends,�

�anticipates,� �believes,� �estimates,� �predicts,� �potential,� or

�continue,� or the negative of such terms and other comparable

terminology. Although we believe that the expectations reflected in

the forward-looking statements are reasonable, we cannot guarantee

future results, levels of activity, performance or achievements.

These statements involve known and unknown risks, uncertainties and

other factors that may cause our actual results, levels of

activity, performance or achievements to differ from those

expressed or implied by the forward-looking statement. These

factors include the following: general economic and business

conditions in those areas in which we operate; demographic changes;

competition for loans and deposits; fluctuations in interest rates;

risks of natural disasters related to our real estate portfolio;

risks associated with SBA loans; changes in governmental

regulation; credit quality; our ability to successfully integrate

acquisitions we may make; the availability of capital to fund the

expansion of our business; and changes in securities markets. In

addition, we set forth certain risks in our reports filed with the

Securities and Exchange Commission, including our Annual Report on

Form 10-K for the fiscal year ended December 31, 2006, which could

cause actual results to differ from those projected. We undertake

no obligation to update such forward-looking statements except as

required by law. HANMI FINANCIAL CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) (Dollars in

Thousands) � June 30, December 31, % June 30, % 2007 2006 Change

2006 Change ASSETS Cash and Due from Banks $ 98,020 $ 97,501 0.5 %

$ 110,271 (11.1)% Federal Funds Sold 23,800 41,000 (42.0)% 1,100

2,063.6 % Cash and Cash Equivalents 121,820 138,501 (12.0)% 111,371

9.4 % Term Federal Funds Sold � 5,000 (100.0)% � � Investment

Securities 364,732 391,579 (6.9)% 410,050 (11.1)% Loans: Loans, Net

of Deferred Loan Fees 3,055,921 2,864,947 6.7 % 2,787,970 9.6 %

Allowance for Loan Losses (32,190) (27,557) 16.8 % (27,250) 18.1 %

Net Loans 3,023,731 2,837,390 6.6 % 2,760,720 9.5 % Customers�

Liability on Acceptances 12,753 8,403 51.8 % 11,057 15.3 % Premises

and Equipment, Net 20,361 20,075 1.4 % 20,312 0.2 % Accrued

Interest Receivable 17,313 16,919 2.3 % 14,899 16.2 % Other Real

Estate Owned 1,080 � � � � Deferred Income Taxes 13,742 13,064 5.2

% 11,681 17.6 % Servicing Asset 4,417 4,579 (3.5)% 4,302 2.7 %

Goodwill 209,941 207,646 1.1 % 207,646 1.1 % Other Intangible

Assets 8,027 6,312 27.2 % 7,461 7.6 % Federal Reserve Bank and

Federal Home Loan Bank Stock 25,352 24,922 1.7 % 24,603 3.0 %

Bank-Owned Life Insurance 24,051 23,592 1.9 % 23,146 3.9 % Other

Assets 23,577 27,261 (13.5)% 16,401 43.8 % Total Assets $ 3,870,897

$ 3,725,243 3.9 % $ 3,623,649 6.8 % � LIABILITIES AND SHAREHOLDERS�

EQUITY Liabilities: Deposits: Noninterest-Bearing $ 720,214 $

728,348 (1.1)% $ 778,445 (7.5)% Interest-Bearing 2,252,932

2,216,367 1.6 % 2,116,567 6.4 % Total Deposits 2,973,146 2,944,715

1.0 % 2,895,012 2.7 % Accrued Interest Payable 23,343 22,582 3.4 %

15,319 52.4 % Acceptances Outstanding 12,753 8,403 51.8 % 11,057

15.3 % FHLB Advances and Other Borrowings 278,784 169,037 64.9 %

156,872 77.7 % Junior Subordinated Debentures 82,406 82,406 �

82,406 � Other Liabilities 14,431 10,983 31.4 % 12,253 17.8 % Total

Liabili-ties 3,384,863 3,238,126 4.5 % 3,172,919 6.7 %

Shareholders� Equity 486,034 487,117 (0.2)% 450,730 7.8 % Total

Liabilities and Shareholders� Equity $ 3,870,897 $ 3,725,243 3.9 %

$ 3,623,649 6.8 % HANMI FINANCIAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) (Dollars in

Thousands, Except Per Share Data) � For the Three Months Ended For

the Six Months Ended June 30, March 31, % June 30, % June 30, June

30, % � � 2007 � 2007 Change � 2006 Change � 2007 � 2006 Change

INTEREST INCOME: Interest and Fees on Loans $ 65,212 $ 62,561 4.2 %

$ 58,870 10.8 % $ 127,773 $ 112,017 14.1 % Intereston Invest-ments

4,472 4,664 (4.1 )% 5,013 (10.8 )% 9,136 10,112 (9.7 )% Interest on

Federal Funds Sold 176 726 (75.8 )% 23 665.2 % 902 312 189.1 %

Interest on Term Federal Funds Sold � � � 5 (100.0 )% � � � � � 5 �

� � � Total Interest Income � 69,860 � 67,956 2.8 % � 63,906 9.3 %

� 137,816 � 122,441 12.6 % � INTEREST EXPENSE: Interest on Deposits

26,691 26,081 2.3 % 21,921 21.8 % 52,772 41,512 27.1 % Interest on

FHLB Advances and Other Borrowings 2,919 2,171 34.5 % 2,001 45.9 %

5,090 2,615 94.6 % Interest on Junior Subordi-nated Debentures �

1,660 � 1,639 1.3 % � 1,587 4.6 % � 3,299 � 3,062 7.7 % Total

Interest Expense � 31,270 � 29,891 4.6 % � 25,509 22.6 % � 61,161 �

47,189 29.6 % � NET INTEREST INCOME BEFORE PROVISION FOR CREDIT

LOSSES 38,590 38,065 1.4 % 38,397 0.5 % 76,655 75,252 1.9 % � � �

Provision for Credit Losses � 3,023 � 6,132 (50.7 )% � 900 235.9 %

� 9,155 � 3,860 137.2 % � NET INTEREST INCOME AFTER PROVISION FOR

CREDIT LOSSES � 35,567 � 31,933 11.4 % � 37,497 (5.1 )% � 67,500 �

71,392 (5.5 )% � NON-INTEREST INCOME: Service Charges on Deposit

Accounts 4,438 4,488 (1.1 )% 4,183 6.1 % 8,926 8,414 6.1 %

Insurance Commissions 1,279 1,125 13.7 % 243 426.3 % 2,404 396

507.1 % Trade Finance Fees 1,177 1,290 (8.8 )% 1,116 5.5 % 2,467

2,187 12.8 % Remittance Fees 520 471 10.4 % 532 (2.3 )% 991 1,020

(2.8 )% Other Service Charges and Fees 574 616 (6.8 )% 614 (6.5 )%

1,190 1,148 3.7 % Bank-Owned Life Insurance Income 229 230 (0.4 )%

215 6.5 % 459 433 6.0 % Increase in Fair Value of Derivatives 222

92 141.3 % 109 103.7 % 314 334 (6.0 )% Other Income 491 275 78.5 %

345 42.3 % 766 626 22.4 % Gain on Sales of Loans 1,762 1,400 25.9 %

1,311 34.4 % 3,162 2,150 47.1 % Gain on Sales of Securities

Available for Sale � � � � � � � � � � � � � 5 (100.0 )% Total

Non-Interest Income � 10,692 � 9,987 7.1 % � 8,668 23.4 % � 20,679

� 16,713 23.7 % � NON-INTEREST EXPENSES: Salaries and Employee

Benefits 10,782 11,761 (8.3 )% 10,691 0.9 % 22,543 19,852 13.6 %

Occupancy and Equipment 2,571 2,512 2.3 % 2,670 (3.7 )% 5,083 4,876

4.2 % Data Processing 1,665 1,563 6.5 % 1,218 36.7 % 3,228 2,647

21.9 % Advertising and Promotion 889 661 34.5 % 811 9.6 % 1,550

1,457 6.4 % Suppliesand Communi-cations 704 588 19.7 % 576 22.2 %

1,292 1,212 6.6 % Professional Fees 647 474 36.5 % 492 31.5 % 1,121

1,160 (3.4 )% Amortization of Other Intangible Assets 592 614 (3.6

)% 605 (2.1 )% 1,206 1,230 (2.0 )% Decrease in Fair Value of

Embedded Option 196 � � 112 75.0 % 196 214 (8.4 )% Other Operating

Expenses � 3,444 � 2,796 23.2 % � 2,622 31.4 % � 6,240 � 4,889 27.6

% Total Non-Interest Expenses � 21,490 � 20,969 2.5 % � 19,797 8.6

% � 42,459 � 37,537 13.1 % � INCOME BEFORE PROVISION FOR INCOME

TAXES 24,769 20,951 18.2 % 26,368 (6.1 )% 45,720 50,568 (9.6 )%

Provision for Income Taxes � 9,446 � 7,896 19.6 % � 10,428 (9.4 )%

� 17,342 � 19,826 (12.5 )% � NET INCOME $ 15,323 $ 13,055 17.4 % $

15,940 (3.9 )% $ 28,378 $ 30,742 (7.7 )% � EARNINGS PER SHARE:

Basic $ 0.32 $ 0.27 18.5 % $ 0.33 (3.0 )% $ 0.58 $ 0.63 (7.9 )%

Diluted $ 0.31 $ 0.26 19.2 % $ 0.32 (3.1 )% $ 0.58 $ 0.62 (6.5 )% �

WEIGHTED-AVERAGE SHARES OUTSTANDING: Basic 48,397,824 48,962,089

48,822,729 48,678,399 48,768,881 Diluted 48,737,574 49,500,312

49,404,204 49,110,835 49,366,709 � SHARES OUTSTANDING AT PERIOD-END

47,950,929 48,825,537 48,908,580 47,950,929 48,908,580 HANMI

FINANCIAL CORPORATION AND SUBSIDIARIES SELECTED FINANCIAL DATA

(UNAUDITED) (Dollars in Thousands) For the Three Months Ended For

the Six Months Ended June 30, March 31, % June 30, % June 30, June

30, % � 2007 � � 2007 � Change � 2006 � Change � 2007 � � 2006 �

Change � AVERAGE BALANCES: Average Gross Loans, Net of Deferred

Loan Fees $ 3,014,895 $ 2,882,632 4.6 % $ 2,729,218 10.5 % $

2,949,129 $ 2,638,822 11.8 % Average Investment Securities 375,598

386,688 (2.9 )% 425,371 (11.7 )% 381,113 431,440 (11.7 )% Average

Interest-Earning Assets 3,429,123 3,350,245 2.4 % 3,180,999 7.8 %

3,414,585 3,109,051 9.8 % Average Total Assets 3,818,170 3,740,936

2.1 % 3,570,389 6.9 % 3,780,147 3,497,310 8.1 % Average Deposits

2,967,748 2,945,386 0.8 % 2,832,218 4.8 % 2,956,629 2,821,648 4.8 %

Average Borrow-ings 304,744 251,594 21.1 % 248,480 22.6 % 278,316

193,691 43.7 % Average Interest-Bearing Liabilities 2,551,665

2,487,429 2.6 % 2,341,481 9.0 % 2,519,725 2,278,944 10.6 % Average

Share-holders� Equity 495,719 495,832 � 449,664 10.2 % 497,444

443,507 12.2 % Average Tangible Equity 277,414 276,918 0.2 %

232,802 19.2 % 277,778 226,645 22.6 % � � PERFORMANCE RATIOS:

Return on Average Assets 1.61 % 1.42 % 1.79 % 1.51 % 1.77 % Return

on Average Shareholders� Equity 12.40 % 10.68 % 14.22 % 11.50 %

13.98 % Return on Average Tangible Equity 22.15 % 19.12 % 27.46 %

20.60 % 27.35 % Effi-ciency Ratio 43.61 % 43.64 % 42.06 % 43.62 %

40.82 % Net Interest Margin 4.51 % 4.61 % 4.84 % 4.53 % 4.88 % � �

ALLOWANCE FOR LOAN LOSSES: Balance at the Beginning of Period $

31,527 $ 27,557 14.4 % $ 26,703 18.1 % $ 27,557 $ 24,963 10.4 %

Provision Charged to Operating Expense 3,181 6,374 (50.1 )% 900

253.4 % 9,555 3,860 147.5 % Charge-Offs, Net of Recoveries � (2,518

) � (2,404 ) 4.7 % � (353 ) 613.3 % � (4,922 ) � (1,573 ) 212.9 %

Balance at the End of Period $ 32,190 � $ 31,527 � 2.1 % $ 27,250 �

18.1 % $ 32,190 � $ 27,250 � 18.1 % � Allowance for Loan Losses to

Total Gross Loans 1.05 % 1.08 % 0.98 % 1.05 % 0.98 % Allowance for

Loan Losses to Total Non-Performing Loans 142.30 % 161.55 % 224.54

% 142.30 % 224.54 % � � ALLOWANCE FOR OFF-BALANCE SHEET ITEMS:

Balance at the Beginning of Period $ 1,888 $ 2,130 (11.4 )% $ 2,130

(11.4 )% $ 2,130 $ 2,130 � Provision Charged to Operating Expense �

(158 ) � (242 ) (34.7 )% � � � � � � (400 ) � � � � � Balance at

the End of Period $ 1,730 � $ 1,888 � (8.4 )% $ 2,130 � (18.8 )% $

1,730 � $ 2,130 � (18.8 )% HANMI FINANCIAL CORPORATION AND

SUBSIDIARIES SELECTED FINANCIAL DATA (UNAUDITED) (Continued)

(Dollars in Thousands) � June 30, December 31, % June 30, % � 2007

� � 2006 � Change � 2006 � Change NON-PERFORMING ASSETS:

Non-Accrual Loans $ 22,442 $ 14,213 57.9 % $ 12,001 87.0 % Loans 90

Days or More Past Due and Still Accruing � 179 � � 2 � 8,850.0 % �

135 � 32.6 % Total Non-Performing Loans 22,621 14,215 59.1 % 12,136

86.4 % Other Real Estate Owned � 1,080 � � � � � � � � � � � Total

Non-Performing Assets $ 23,701 � $ 14,215 � 66.7 % $ 12,136 � 95.3

% � Total Non-Performing Loans/Total Gross Loans 0.74 % 0.50 % 0.43

% Total Non-Performing Assets/Total Assets 0.61 % 0.38 % 0.33 %

Total Non-Performing Assets/Allowance for Loan Losses 73.6 % 51.6 %

44.5 % � DELINQUENT LOANS $ 31,979 � $ 19,616 � 63.0 % $ 23,084 �

38.5 % � Delinquent Loans/Total Gross Loans 1.05 % 0.68 % 0.83 % �

LOAN PORTFOLIO: Real Estate Loans $ 1,062,460 $ 1,041,393 2.0 % $

1,029,462 3.2 % Commercial and Industrial Loans 1,898,097 1,726,434

9.9 % 1,663,449 14.1 % Consumer Loans � 97,496 � � 100,121 � (2.6

)% � 98,974 � (1.5 )% Total Gross Loans 3,058,053 2,867,948 6.6 %

2,791,885 9.5 % Deferred Loan Fees (2,132 ) (3,001 ) (29.0 )%

(3,915 ) (45.5 )% Allowance for Loan Losses � (32,190 ) � (27,557 )

16.8 % � (27,250 ) 18.1 % Loans Receivable, Net $ 3,023,731 � $

2,837,390 � 6.6 % $ 2,760,720 � 9.5 % � LOAN MIX: Real Estate Loans

34.7 % 36.3 % 36.9 % Commercial and Industrial Loans 62.1 % 60.2 %

59.6 % Consumer Loans � 3.2 % � 3.5 % � 3.5 % Total Gross Loans �

100.0 % � 100.0 % � 100.0 % � DEPOSIT PORTFOLIO: Demand -

Noninterest-Bearing $ 720,214 $ 728,348 (1.1 )% $ 778,445 (7.5 )%

Savings 97,019 99,254 (2.3 )% 110,492 (12.2 )% Money Market

Checking and NOW Accounts 438,973 438,267 0.2 % 440,970 (0.5 )%

Time Deposits of $100,000 or More 1,408,237 1,383,358 1.8 %

1,287,257 9.4 % Other Time Deposits � 308,703 � � 295,488 � 4.5 % �

277,848 � 11.1 % Total Deposits $ 2,973,146 � $ 2,944,715 � 1.0 % $

2,895,012 � 2.7 % � DEPOSIT MIX: Demand - Noninterest-Bearing 24.2

% 24.7 % 26.9 % Savings 3.3 % 3.4 % 3.8 % Money Market Checking and

NOW Accounts 14.8 % 14.9 % 15.2 % Time Deposits of $100,000 or More

47.4 % 47.0 % 44.5 % Other Time Deposits � 10.3 % � 10.0 % � 9.6 %

Total Deposits � 100.0 % � 100.0 % � 100.0 % HANMI FINANCIAL

CORPORATION AND SUBSIDIARIES AVERAGE BALANCES, AVERAGE YIELDS

EARNED AND AVERAGE RATES PAID (UNAUDITED) (Dollars in Thousands)

For the Three Months Ended For the Three Months Ended For the Six

Months Ended June 30, 2007 March 31, 2007 June 30, 2006 June 30,

2007 June 30, 2006 Average Balance Inter-est Income/ Expense

Aver-age Yield/ Rate Average Balance Inter-est Income/ Expense

Aver-age Yield/ Rate � Average Balance Interest Income/ Expense

Average Yield/ Rate Average Balance Interest Income/ Expense

Aver-age Yield/ Rate Average Balance Interest Income/ Expense

Aver-age Yield/ Rate � INTEREST-EARNING ASSETS � LOANS: Real Estate

Loans: Commercial Property $ 769,112 $ 15,534 8.10 % $ 752,673 $

15,168 8.17 % $ 761,626 $ 15,425 8.12 % $ 760,938 $ 30,702 8.14 % $

747,442 $ 29,931 8.08 % Construc-tion 215,760 5,137 9.55 % 212,370

4,937 9.43 % 179,588 4,286 9.57 % 214,074 10,075 9.49 % 170,293

8,052 9.54 % Residen-tial Property � 86,596 � � 1,157 5.36 % �

85,022 � � 1,097 5.23 % � 86,091 � � 1,107 5.16 % � 85,813 � �

2,254 5.30 % � 86,352 � � 2,189 5.11 % Total Real Estate Loans

1,071,468 21,828 8.17 % 1,050,065 21,202 8.19 % 1,027,305 20,818

8.13 % 1,060,825 43,031 8.18 % 1,004,087 40,172 8.07 % Commercial

and Industrial Loans 1,848,369 41,206 8.94 % 1,736,530 38,769 9.05

% 1,608,638 35,905 8.95 % 1,792,760 79,973 9.00 % 1,543,507 67,737

8.85 % Consumer Loans � 97,175 � � 2,016 8.32 % � 98,634 � � 2,173

8.93 % � 97,169 � � 2,081 8.59 % � 97,900 � � 4,189 8.63 % � 95,079

� � 3,964 8.41 % Total Loans - Gross 3,017,012 65,050 8.65 %

2,885,229 62,144 8.74 % 2,733,112 58,804 8.63 % 2,951,485 127,193

8.69 % 2,642,673 111,873 8.54 % Prepayment Penalty Income � 162 �

417 66 � 580 � 144 Unearned Income on Loans, Net of Costs � (2,117

) � � � (2,597 ) � � � (3,894 ) � � � (2,356 ) � � � (3,851 ) � �

Gross Loans, Net $ 3,014,895 � $ 65,212 8.68 % $ 2,882,632 � $

62,561 8.80 % $ 2,729,218 � $ 58,870 8.65 % $ 2,949,129 � $ 127,773

8.74 % $ 2,638,822 � $ 112,017 8.56 % � INVESTMENT SECURI-TIES:

Municipal Bonds $ 72,284 $ 762 4.22 % $ 72,396 $ 764 4.22 % $

73,061 $ 773 4.23 % $ 72,340 $ 1,526 4.22 % $ 73,414 $ 1,551 4.23 %

U.S. Government Agency Securities 118,696 1,233 4.16 % 118,267

1,256 4.25 % 127,184 1,316 4.14 % 118,483 2,489 4.20 % 126,843

2,619 4.13 % Mortgage-Backed Securities 111,568 1,317 4.72 %

118,899 1,404 4.72 % 136,514 1,612 4.72 % 115,213 2,721 4.72 %

140,511 3,282 4.67 % Collatera-lized Mortgage Obligations 60,199

651 4.33 % 64,208 697 4.34 % 75,728 810 4.28 % 62,193 1,348 4.33 %

77,703 1,657 4.26 % Corporate Bonds 7,907 89 4.50 % 7,869 90 4.57 %

7,903 89 4.50 % 7,888 179 4.54 % 7,968 179 4.49 % Other Securi-ties

� 4,944 � � 84 6.80 % � 5,049 � � 84 6.65 % � 4,981 � � 83 6.67 % �

4,996 � � 168 6.73 % � 5,001 � � 168 6.72 % Total Invest-ment

Securi-ties $ 375,598 � $ 4,136 4.40 % $ 386,688 � $ 4,295 4.44 % $

425,371 � $ 4,683 4.40 % $ 381,113 � $ 8,431 4.42 % $ 431,440 � $

9,456 4.38 % � OTHER INTEREST-EARNING ASSETS: Equity Securities

(FHLB and FRB Stock) $ 25,290 $ 336 5.31 % $ 25,008 $ 369 5.90 % $

24,524 $ 330 5.38 % $ 49,833 $ 705 2.83 % $ 24,567 $ 655 5.33 %

Federal Funds Sold 13,340 176 5.28 % 55,528 726 5.23 % 1,859 23

4.95 % 34,317 902 5.26 % 14,158 312 4.41 % Term Federal Funds Sold

� � � 389 5 5.14 % � � � 193 5 5.18 % � � � Interest-Earning

Deposits � � � � � � � � � � � � � � � 27 � � � 3.64 % � � � � � �

� � 64 � � 1 4.01 % Total Other Interest-Earning Assets $ 38,630 �

$ 512 5.30 % $ 80,925 � $ 1,100 5.44 % $ 26,410 � $ 353 5.35 % $

84,343 � $ 1,612 3.82 % $ 38,789 � $ 968 4.99 % � TOTAL

INTEREST-EARNING ASSETS $ 3,429,123 � $ 69,860 8.17 % $ 3,350,245 �

$ 67,956 8.23 % $ 3,180,999 � $ 63,906 8.06 % $ 3,414,585 � $

137,816 8.14 % $ 3,109,051 � $ 122,441 7.94 % � INTEREST-BEARING

LIABILITIES � INTEREST-BEARING DEPOSITS: Savings $ 99,457 $ 502

2.02 % $ 100,777 $ 461 1.86 % $ 112,341 $ 480 1.71 % $ 100,114 $

963 1.94 % $ 115,036 $ 962 1.69 % Money Market Checking and NOW

Accounts 432,408 3,666 3.40 % 427,871 3,472 3.29 % 484,039 3,638

3.01 % 430,152 7,138 3.35 % 501,735 7,352 2.95 % Time Deposits of

$100,000 or More 1,411,099 18,778 5.34 % 1,406,311 18,498 5.33 %

1,223,118 14,869 4.88 % 1,408,718 37,276 5.34 % 1,195,348 27,653

4.67 % Other Time Deposits � 303,957 � � 3,745 4.94 % � 300,876 � �

3,650 4.92 % � 273,503 � � 2,934 4.30 % � 302,425 � � 7,395 4.93 %

� 273,134 � � 5,545 4.09 % Total Interest-Bearing Deposits $

2,246,921 � $ 26,691 4.76 % $ 2,235,835 � $ 26,081 4.73 % $

2,093,001 � $ 21,921 4.20 % $ 2,241,409 � $ 52,772 4.75 % $

2,085,253 � $ 41,512 4.01 % � BORROWINGS: FHLB Advances and Other

Borrowings $ 222,338 $ 2,919 5.27 % $ 169,188 $ 2,171 5.20 % $

166,074 $ 2,001 4.83 % $ 195,910 $ 5,090 5.24 % $ 111,285 $ 2,615

4.74 % Junior Subordinated Debentures � 82,406 � � 1,660 8.08 % �

82,406 � � 1,639 8.07 % � 82,406 � � 1,587 7.72 % � 82,406 � �

3,299 8.07 % � 82,406 � � 3,062 7.49 % Total Borrow-ings $ 304,744

� $ 4,579 6.03 % $ 251,594 � $ 3,810 6.14 % $ 248,480 � $ 3,588

5.79 % $ 278,316 � $ 8,389 6.08 % $ 193,691 � $ 5,677 5.91 % �

TOTAL INTEREST-BEARING LIABILITIES $ 2,551,665 � $ 31,270 4.92 % $

2,487,429 � $ 29,891 4.87 % $ 2,341,481 � $ 25,509 4.37 % $

2,519,725 � $ 61,161 4.89 % $ 2,278,944 � $ 47,189 4.18 % � NET

INTEREST SPREAD 3.25 % 3.36 % 3.69 % 3.25 % 3.76 % � NET INTEREST

MARGIN 4.51 % 4.61 % 4.84 % 4.53 % 4.88 %

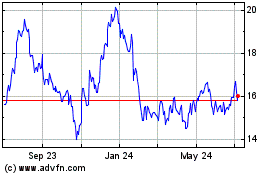

Hanmi Financial (NASDAQ:HAFC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Hanmi Financial (NASDAQ:HAFC)

Historical Stock Chart

From Jul 2023 to Jul 2024