US Stocks Tumble Into the Close As European Summit Opens; DJIA Loses 199

December 08 2011 - 5:26PM

Dow Jones News

U.S. stocks fell, tumbling into the close, after a summit that

could help stem Europe's economic turmoil got off to a rocky start

and the European Central Bank declined to enact aggressive new bond

purchases.

The Dow Jones Industrial Average lost 198.67 points, or 1.6%, to

11997.70, on Thursday, snapping a three-day winning streak and

turning negative for the month amid a raft of reports out of

Europe. The Standard & Poor's 500-stock index shed 26.66

points, or 2.1%, to 1234.35, while the Nasdaq Composite declined

52.83 points, or 2%, to 2596.38.

The European Central Bank cut its key lending rate to 1% from

1.25% but opted against increased government-bond purchases,

sending stock futures lower. ECB President Mario Draghi called the

bank's government-debt purchases "neither infinite nor

eternal."

Stocks tumbled further late in the session amid reports that

Germany may oppose key aspects of the summit's draft agreement,

such as issuing a banking license for a bailout fund. The trickle

of reports suggesting an acrimonious start to the summit was a

disappointment to investors, who have looked to the gathering in

hopes of more substantial efforts to combat the sovereign-debt

crisis.

"People are stressed out with all this news from Europe," said

Alan Valdes, director of floor trading at DME Securities.

"[They're] afraid that whatever comes out in the overnight is not

going to be good. It's going to add more fuel to the fire."

Financial stocks fell the hardest, with the S&P 500's

financial components losing 3.7%. J.P. Morgan Chase lost $1.78, or

5.2%, to 32.22, and Bank of America shed 30 cents, or 5.1%, to

5.59, leading the Dow's decliners. Morgan Stanley was the weakest

stock in the S&P 500, losing 1.46, or 8.4%, to 15.88. Citigroup

was another outsized decliner as it shed 2.08, or 7%, to 27.75.

"The expectations are ahead of the reality," said Jim Russell,

regional investment manager for U.S. Bank. "We have seen the

markets buy into optimistic statements on the resolution of this

crisis, only to be disappointed."

European markets also declined. The Stoxx Europe 600 finished

with a 1.5% loss, Germany's DAX shed 2% and France's CAC 40 slumped

2.5%. Asian bourses fell, with Japan's Nikkei Stock Average losing

0.7%.

The news from Europe overshadowed a favorable U.S. employment

report showing that the number of U.S. workers filing new

applications for unemployment benefits fell to the lowest level in

nine months.

Demand for U.S. Treasury bonds rose, driving yield on the

10-year note down to 1.972%. Bonds prices move inversely to their

yields. Oil prices slumped 2.1%, to $98.34 a barrel, the second

straight loss. Gold futures settled down 1.8%, at $1,709.80 a troy

ounce. The dollar gained versus the euro and the Japanese yen.

McDonald's was the only Dow stock to advance, gaining 47 cents,

or 0.5%, to 96.92. The fast-food company's global same-store sales

jumped a greater-than-expected 7.4% in November thanks to expanding

premium and midtier products in Europe and adding Peppermint Mocha

to the McCafe line-up in the U.S.

Costco Wholesale shed 1.71, or 2%, to 85.76, after the wholesale

club reported fiscal first-quarter earnings that rose just 2.6%

despite a double-digit-percentage increase in sales because of

rising costs.

Affymax soared 2.12, or 36%, to 7.98, after its dialysis

treatment received a favorable vote from the Food and Drug

Administration.

Ciena climbed 12 cents, or 1%, to 12.03, after the network gear

maker's fourth-quarter loss narrowed amid a jump in revenue in

high-margin packet-optical switching.

Pacific Sunwear gained 14 cents, or 10%, to 1.49, after the

company said it planned to close up to 200 stores in the coming 14

months and hoped to seek aid from a private-equity firm experienced

with ailing retailers.

Apparel maker G-III surged 3.66, or 18%, to 24.02, after

unveiling a deal with PVH's Calvin Klein to open women's sports

apparel stores in the U.S. and China, which overshadowed a

lower-than-expected gain in quarterly profits and lower full-year

earnings projection.

THQ slumped 56 cents, or 38%, to 90 cents, after the videogame

publisher cut its fiscal third-quarter revenue outlook 25% and its

full-year earnings view.

-By Brendan Conway, Dow Jones Newswires; (212) 416-2670;

brendan.conway@dowjones.com

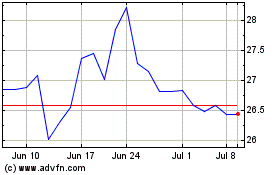

G III Apparel (NASDAQ:GIII)

Historical Stock Chart

From May 2024 to Jun 2024

G III Apparel (NASDAQ:GIII)

Historical Stock Chart

From Jun 2023 to Jun 2024