US Stocks Decline After ECB Disappoints, Summit Spurs Debt Jitters

December 08 2011 - 3:22PM

Dow Jones News

U.S. stocks fell in afternoon trading as investor focus shifted

from disappointment over the European Central Bank to the closely

watched summit on Europe's sovereign-debt crisis.

The Dow Jones Industrial Average lost 171 points, or 1.4%, to

12026 in recent action. The Standard & Poor's 500-stock index

shed 23 points, or 1.8%, to 1238 and the Nasdaq Composite lost 42

points, or 1.6%, to 2607. The losses sent the blue-chip Dow into

negative territory for December even though it has gained for six

of the last eight sessions.

Sentiment turned negative before the session's open, after ECB

President Mario Draghi quashed traders' hopes of more ECB bond

buying. In addition, the central bank gave no new plans to bail out

debt-laden governments. As expected, the ECB cut its key lending

rate to 1% from 1.25%, but the new efforts stopped well short of

committing to buy more government bonds.

The ECB news put traders on edge just ahead of the Brussels

summit, which kicked off with a working dinner and was set to

continue through Friday. The summit has been the focus of traders'

hopes for aggressive new plans to fight the sovereign-debt

crisis.

"We aren't expecting a masterstroke of an agreement," said John

Toohey, vice president at USAA Investment Management Co. "[But] if

they don't take any steps at all, it will be a big negative."

Financial stocks posted the steepest losses. J.P. Morgan Chase

lost 4.5% and Bank of America shed 4.4% to lead the Dow's

decliners. Morgan Stanley and Citigroup were two of the S&P

500's biggest decliners, each sliding more than 7%.

In U.S. economic data, the number of U.S. workers filing new

applications for unemployment benefits fell to the lowest level in

nine months, which helped limit the session's losses. Wholesale

inventories for October rose 1.6% as companies stocked up in

anticipation of strong holiday sales.

European markets also declined. The Stoxx Europe 600 finished

with a 1.5% loss and Germany's DAX shed 2%. Asian bourses fell,

with Japan's Nikkei Stock Average losing 0.7%.

"The expectations are ahead of the reality," said Jim Russell,

regional investment manager for U.S. Bank Wealth Management. "We

have seen the markets buy into optimistic statements on the

resolution of this crisis, only to be disappointed."

Gold futures settled down 1.8% at $1,709.80 a troy ounce. The

dollar gained versus the euro and the Japanese yen.

McDonald's was the strongest blue-chip stock and one of two Dow

advancers, gaining 0.8%. The fast-food company's global same-store

sales jumped a greater-than-expected 7.4% in November thanks to

expanding premium and mid-tier products in Europe and adding

Peppermint Mocha to the McCafe line-up in the U.S.

Costco Wholesale shed 1.6% after the wholesale club reported

fiscal first-quarter earnings grew just 2.6% despite a

double-digit-percentage increase in sales because of rising

costs.

Affymax soared 39% after its dialysis treatment received a

favorable vote from the Food and Drug Administration.

Ciena climbed 2.9% after the network gear maker's fourth-quarter

loss narrowed amid a big jump in revenue in high-margin

packet-optical switching.

MEMC Electronic Materials gained 2% after the company said it

would cut 20% of its work force and reduce manufacturing capacity

as part of a restructuring that will result in a fourth-quarter

charge of nearly $700 million.

Pacific Sunwear gained 14% after the company said it planned to

close up to 200 stores in the coming 14 months and hopes to seek

aid from a private-equity firm experienced with ailing

retailers.

Apparel maker G-III surged 18% after unveiling a deal with PVH's

Calvin Klein to open women's sports apparel stores in the U.S. and

China, overshadowing a lower-than-expected 2% gain in quarterly

profits and lower full-year earnings projection.

THQ slumped 34% after the videogame publisher cut its fiscal

third-quarter revenue outlook 25% and cut its full-year earnings

view.

-By Brendan Conway, Dow Jones Newswires; (212) 416-2670;

brendan.conway@dowjones.com

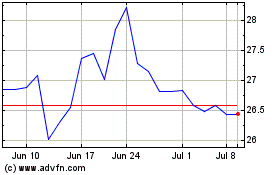

G III Apparel (NASDAQ:GIII)

Historical Stock Chart

From May 2024 to Jun 2024

G III Apparel (NASDAQ:GIII)

Historical Stock Chart

From Jun 2023 to Jun 2024