Flexsteel Industries, Inc. (NASDAQ:FLXS) today reported results

of operations for its second quarter and fiscal year-to-date

December 31, 2009.

The Company reported net sales for the quarter ended December

31, 2009 of $83.5 million compared to $84.5 million in the prior

year quarter. The Company reported net income for the current

quarter of $3.0 million or $0.45 per share compared to net income

of $0.3 million or $0.04 per share in the prior year quarter. The

prior year quarter included approximately $0.5 million of pre-tax

facility consolidation costs.

For the six months ended December 31, 2009, the Company reported

net sales of $159.5 million compared to the prior year sales of

$176.0 million, a decrease of 9%. The Company reported net income

for the current six-month period of $4.3 million or $0.66 per share

compared to a net loss of $0.5 million or $0.07 per share in the

prior year period. The prior year six-month period included

approximately $1.8 million of pre-tax facility consolidation

costs.

For the quarter ended December 31, 2009, residential net sales

were $62.6 million, an increase of 8% from the prior year quarter

net sales of $58.1 million. Commercial net sales were $20.9 million

compared to $26.4 million in the prior year quarter, a decrease of

21%.

For the six months ended December 31, 2009, residential net

sales were $118.8 million, slightly less than residential net sales

of $120.1 million in the six months ended December 31, 2008.

Commercial net sales were $40.7 million for the six months ended

December 31, 2009, a decrease of 27% from the six months ended

December 31, 2008.

Gross margin for the quarter ended December 31, 2009 was 24.0%

compared to 19.1% in the prior year quarter. For the six months

ended December 31, 2009, the gross margin was 22.9% compared to

18.9% for the prior year six-month period. These gross margin

improvements are primarily due to better capacity utilization and

lower fixed manufacturing costs resulting from last year’s facility

consolidations, changes in product mix and lower ocean freight

costs.

Selling, general and administrative expenses for the quarter

ended December 31, 2009 were 18.3% compared to 18.2% in the prior

year quarter. For the six months ended December 31, 2009, selling,

general and administrative expenses were 18.4% compared to 18.2% in

the prior year six-month period.

Working capital (current assets less current liabilities) at

December 31, 2009 was $83.1 million. Net cash provided by operating

activities was $17.8 million during the six months ended December

31, 2009 due to improved profitability and lower inventory.

Subsequent to the end of the quarter the Company paid off the

remaining $5.0 million of bank borrowings with available cash.

Capital expenditures were $0.9 million during the first six

months of fiscal year 2010. Depreciation expense was $1.5 million

and $2.0 million in the six-month periods ended December 31, 2009

and 2008, respectively. The Company expects that capital

expenditures will be less than $1.0 million for the remainder of

the fiscal year.

All earnings per share amounts are on a diluted basis.

OutlookBased upon current

business conditions, we believe sales have stabilized at current

levels. The consolidation of manufacturing operations and workforce

reductions that the Company completed during the prior fiscal year

has brought production capacity and fixed overhead in line with

current and expected demand for our products. Company wide

employment, which was reduced approximately 30% in the prior fiscal

year through plant closures and workforce reductions, remains at

these reduced levels.

We believe that our residential product category has performed

reasonably well in relation to our competition. However,

residential furniture continues to be a highly deferrable purchase

item and is adversely impacted by low levels of consumer

confidence, a depressed market for new housing, limited consumer

credit and high unemployment. The commercial product category fell

considerably as the U. S. economy contracted and credit tightened

further during the fourth quarter of the prior fiscal year. We do

not foresee any immediate improvement in these conditions and

continue to operate on that basis.

While we expect that current business conditions will persist

for the remainder of fiscal year 2010, we remain optimistic that

our strategy, which includes a wide range of quality product

offerings and price points to the residential and commercial

markets, combined with our conservative approach to business, will

be rewarded when business conditions improve. We will maintain our

focus on a strong balance sheet during these challenging economic

times through emphasis on cash flow and improving

profitability.

Conference CallWe will

host a conference call on February 5, 2010, at 10:30 a.m. Central

Time. To access the call, please dial 1-866-830-5279 and provide

the operator with ID# 44642845. A replay will be available for two

weeks beginning approximately two hours after the conclusion of the

call by dialing 1-800-642-1687 and entering ID# 44642845.

Forward-Looking

StatementsStatements, including those in this release, which

are not historical or current facts, are “forward-looking

statements” made pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. There are certain

important factors that could cause our results to differ materially

from those anticipated by some of the statements made in this press

release. Investors are cautioned that all forward-looking

statements involve risk and uncertainty. Some of the factors that

could affect results are the cyclical nature of the furniture

industry, the effectiveness of new product introductions and

distribution channels, the product mix of sales, pricing pressures,

the cost of raw materials and fuel, foreign currency valuations,

actions by governments including taxes and tariffs, inflation, the

amount of sales generated and the profit margins thereon,

competition (both foreign and domestic), changes in interest rates,

credit exposure with customers and general economic conditions. Any

forward-looking statement speaks only as of the date of this press

release. We specifically decline to undertake any obligation to

publicly revise any forward-looking statements that have been made

to reflect events or circumstances after the date of such

statements or to reflect the occurrence of anticipated or

unanticipated events.

About FlexsteelFlexsteel

Industries, Inc. is headquartered in Dubuque, Iowa, and was

incorporated in 1929. Flexsteel is a designer, manufacturer,

importer and marketer of quality upholstered and wood furniture for

residential, recreational vehicle, office, hospitality and

healthcare markets. All products are distributed nationally.

For more information, visit our web site at

http://www.flexsteel.com.

FLEXSTEEL INDUSTRIES, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED

BALANCE SHEETS (UNAUDITED) (in thousands)

December 31, June 30, 2009 2009

ASSETS

CURRENT ASSETS: Cash and cash equivalents $ 12,875 $ 1,714

Trade receivables, net 32,963 31,283 Inventories 66,834 73,844

Other 6,071 7,872 Total current assets

118,743 114,713 NONCURRENT ASSETS: Property, plant, and

equipment, net 22,742 23,298 Other assets 13,902

12,960 TOTAL $ 155,387 $ 150,971

LIABILITIES AND SHAREHOLDERS’

EQUITY

CURRENT LIABILITIES: Accounts payable – trade $ 9,665 $

9,745 Notes payable 5,000 10,000 Accrued liabilities 20,959

16,552 Total current liabilities 35,624 36,297

LONG-TERM LIABILITIES: Other long-term liabilities

8,194 7,676 Total liabilities 43,818 43,973

SHAREHOLDERS’ EQUITY 111,569 106,998

TOTAL $ 155,387 $ 150,971

FLEXSTEEL INDUSTRIES, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS

OF INCOME (UNAUDITED) (in thousands, except per share data)

Three Months Ended Six Months Ended December 31, December

31, 2009 2008 2009 2008 NET SALES $ 83,524 $ 84,550 $

159,465 $ 175,966 COST OF GOODS SOLD (63,483 )

(68,419 ) (122,868 ) (142,699 ) GROSS MARGIN 20,041

16,131 36,597 33,267 SELLING, GENERAL AND ADMINISTRATIVE (15,263 )

(15,393 ) (29,404 ) (32,163 ) FACILITY CONSOLIDATION AND OTHER

CHARGES -- (504 ) --

(1,852 ) OPERATING INCOME (LOSS) 4,778 234

7,193 (748 )

OTHER INCOME (EXPENSE):

Interest and other income 91 503 123 613 Interest expense

(95 ) (271 ) (233 ) (558 ) Total (4 )

232 (110 ) 55 INCOME (LOSS)

BEFORE INCOME TAXES

4,774

466

7,083

(693

)

(PROVISION FOR) BENEFIT FROM

INCOME TAXES (1,810 ) (170 ) (2,740 )

240 NET INCOME (LOSS) $ 2,964 $ 296 $ 4,343

$ (453 ) AVERAGE NUMBER OF COMMON SHARES OUTSTANDING: Basic

6,588 6,576 6,582

6,576 Diluted 6,627 6,652

6,621 6,576 EARNINGS (LOSS) PER SHARE OF

COMMON STOCK: Basic $ 0.45 $ 0.04 $ 0.66 $

(0.07 ) Diluted $ 0.45 $ 0.04 $ 0.66 $ (0.07 )

FLEXSTEEL INDUSTRIES, INC. AND SUBSIDIARIES CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) (in thousands)

Six Months Ended December 31,

2009 2008

OPERATING ACTIVITIES:

Net income (loss) $ 4,343 $ (453 ) Adjustments to

reconcile net income to net cash provided by (used in) operating

activities: Depreciation 1,545 1,986 Deferred income taxes (922 )

(241 ) Stock-based compensation expense 431 114 Gain on disposition

of capital assets (6 ) (186 ) Gain on sale of investments -- (462 )

Impairment of long-lived assets -- 137 Changes in operating assets

and liabilities 12,391

8,368 Net cash provided by operating activities

17,782 9,263

INVESTING ACTIVITIES:

Net sales of investments (292 ) 1,090 Proceeds from sale of capital

assets 11 554 Capital expenditures (923 )

(772 ) Net cash (used in) provided by

investing activities (1,204 )

872

FINANCING ACTIVITIES:

Repayment of borrowings, net (5,000 ) (10,464 ) Dividends paid (658

) (1,710 ) Proceeds from issuance of common stock 241

– Net cash used in

financing activities (5,417 )

(12,174 ) Increase (decrease) in cash and cash

equivalents 11,161 (2,039 ) Cash and cash equivalents at beginning

of period 1,714 2,841

Cash and cash equivalents at end of period $

12,875 $ 802

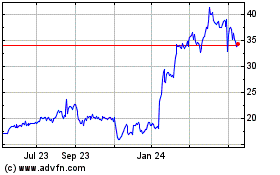

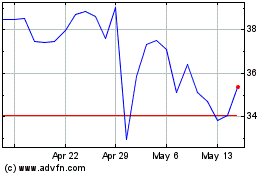

Flexsteel Industries (NASDAQ:FLXS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Flexsteel Industries (NASDAQ:FLXS)

Historical Stock Chart

From Nov 2023 to Nov 2024