Flexsteel Industries, Inc. (NASDAQ:FLXS) today reported sales and

earnings for its first fiscal quarter ended September 30, 2008. The

Company reported net sales for the quarter ended September 30, 2008

of $91.4 million compared to the prior year quarter of $100.9

million, a decrease of 9.4%. The Company reported a net loss for

the current quarter of $0.7 million or $0.11 per share compared to

net income of $1.2 million or $0.18 per share in the prior year

quarter. During the current quarter the Company recorded pre-tax

charges of approximately $1.4 million, or $0.13 per share after tax

related to facility consolidation. Excluding these charges, net

income1 for the current quarter was $0.1 million or $0.02 per

share. For the quarter ended September 30, 2008, residential net

sales were $62.0 million, slightly less than prior year quarter net

sales of $62.7 million. Recreational vehicle net sales were $5.9

million, a decrease of 62.1% from the prior year quarter net sales

of $15.7 million. Commercial net sales were $23.5 million compared

to $22.5 million in the prior year quarter, an increase of 4.3%.

Gross margin for the quarter ended September 30, 2008 was 18.7%

compared to 19.6% in the prior year quarter. The decrease in gross

margin percentage is primarily due to under-absorption of fixed

manufacturing costs on significantly lower sales volume and higher

material costs. Selling, general and administrative expenses for

the quarter ended September 30, 2008 were 18.3% compared to 17.4%

in the prior year quarter. This percentage increase is due to

under-absorption of fixed costs on the lower sales volume and an

increase in bad debt expense of approximately $0.2 million. Working

capital (current assets less current liabilities) at September 30,

2008 was $94.5 million. Net cash provided by operating activities

was $2.2 million during the first quarter ended September 30, 2008

due to lower accounts receivable and inventory. Net cash used in

operating activities was $0.9 million at September 30, 2007.

Capital expenditures were $0.2 million for the quarter ended

September 30, 2008. Depreciation and amortization expense was $1.1

million and $ 1.2 million for the fiscal quarters ended September

30, 2008 and 2007, respectively. The Company expects that capital

expenditures will be approximately $2.5 million for the remainder

of the 2009 fiscal year. All earnings per share amounts are on a

diluted basis. 1 Adjusted numbers are non-GAAP financial measures.

Further explanations of these non-GAAP measures and reconciliation

to the comparable GAAP measures are included in the attached

supplemental schedule. Outlook The impact of the slowdown of the U.

S. economy, where most of our products are sold, has magnified as

the news media reports job losses or layoffs related to cutbacks

and closings over a broad spectrum of industries, including the

furniture industry. With instability in the financial markets

despite government relief efforts, rising prices throughout our

supply chain and a changing political landscape, prospects for a

recovery appear to be moving further into the future. In response

to these conditions, we continue to adjust our operations and

workforce to bring production capacity in line with current and

expected demand for our products. Our workforce has been reduced

approximately 15% over the past year through layoffs and attrition.

As announced in September, we have proceeded with the closing of

two long-established manufacturing operations. Our Lancaster, PA

facility has produced and distributed high quality residential

furniture for over fifty years. As demand tightens and foreign

sourced products continue to gain acceptance as providing better

value at the retail level, we no longer require this manufacturing

capacity for residential products. Our New Paris, IN facility has

been an integral part of our success in supplying quality

recreational vehicle seating for over twenty-five years. With the

recreational vehicle seating industry experiencing such a drastic

decline in demand, as reflected by our 62% decrease in recreational

vehicle seating net sales from the prior year period, we can no

longer support our current capacity. While these are difficult

decisions to make, we expect annual pre-tax cost savings of $3.5

million to $4.0 million going forward, and will continue to pursue

cost savings in all aspects of our operations. While we expect that

current business conditions will persist for most, if not all, of

fiscal year 2009, we remain optimistic that our strategy of a wide

range of quality product offerings and price points to the

residential, recreational vehicle and commercial markets combined

with our conservative approach to business will be rewarded over

the longer-term. Analysts Conference Call We will host a conference

call for analysts on October 21, 2008, at 10:30 a.m. Central Time.

To access the call, please dial 1-888-275-4480 and provide the

operator with ID# 65674887. A replay will be available for two

weeks beginning approximately two hours after the conclusion of the

call by dialing 1-800-642-1687 and entering ID# 65674887.

Forward-Looking Statements Statements, including those in this

release, which are not historical or current facts, are

�forward-looking statements� made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

There are certain important factors that could cause our results to

differ materially from those anticipated by some of the statements

made in this press release. Investors are cautioned that all

forward-looking statements involve risk and uncertainty. Some of

the factors that could affect results are the cyclical nature of

the furniture industry, the effectiveness of new product

introductions and distribution channels, the product mix of sales,

pricing pressures, the cost of raw materials and fuel, foreign

currency valuations, actions by governments including taxes and

tariffs, the amount of sales generated and the profit margins

thereon, competition (both foreign and domestic), changes in

interest rates, credit exposure with customers and general economic

conditions. Any forward-looking statement speaks only as of the

date of this press release. We specifically decline to undertake

any obligation to publicly revise any forward-looking statements

that have been made to reflect events or circumstances after the

date of such statements or to reflect the occurrence of anticipated

or unanticipated events. About Flexsteel Flexsteel Industries, Inc.

is headquartered in Dubuque, Iowa, and was incorporated in 1929.

Flexsteel is a designer, manufacturer, importer and marketer of

quality upholstered and wood furniture for residential,

recreational vehicle, office, hospitality and healthcare markets.

All products are distributed nationally. For more information,

visit our web site at http://www.flexsteel.com. FLEXSTEEL

INDUSTRIES, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE

SHEETS (UNAUDITED) � � September 30, June 30, 2008 2008 ASSETS �

CURRENT ASSETS: Cash and cash equivalents $ 1,308,967 $ 2,841,323

Investments 915,522 1,160,066 Trade receivables, net 41,047,495

43,783,224 Inventories 83,934,451 85,791,400 Other � 7,211,215 �

7,063,634 Total current assets 134,417,650 140,639,647 � NONCURRENT

ASSETS: Property, plant, and equipment, net 25,173,412 26,372,392

Other assets � 12,163,909 � 12,894,179 � TOTAL $ 171,754,971 $

179,906,218 � LIABILITIES AND�SHAREHOLDERS' EQUITY � CURRENT

LIABILITIES: Accounts payable � trade $ 12,041,229 $ 14,580,275

Notes payable and current maturities of long-term debt 7,815,996

5,142,945 Accrued liabilities � 20,053,287 � 19,996,315 Total

current liabilities 39,910,512 39,719,535 � LONG-TERM LIABILITIES:

Long-term debt 14,675,016 20,810,597 Other long-term liabilities �

6,403,324 � 6,623,699 Total liabilities 60,988,852 67,153,831 �

SHAREHOLDERS� EQUITY � 110,766,119 � 112,752,387 � TOTAL $

171,754,971 $ 179,906,218 FLEXSTEEL INDUSTRIES, INC. AND

SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) � Three

Months Ended September 30, 2008 � 2007 NET SALES $ 91,416,883 $

100,900,363 COST OF GOODS SOLD � (74,280,397 ) � (81,136,820 )

GROSS MARGIN 17,136,486 19,763,543 SELLING, GENERAL AND

ADMINISTRATIVE (16,770,037 ) (17,563,085 ) FACILITY CONSOLIDATION

COSTS � (1,348,099 ) � -- � OPERATING (LOSS) INCOME � (981,650 ) �

2,200,458 � OTHER�INCOME (EXPENSE): Interest and other income

109,057 99,582 Interest expense � (286,661 ) � (427,390 ) Total �

(177,604 ) � (327,808 ) (LOSS) INCOME BEFORE INCOME TAXES

(1,159,254 ) 1,872,650 INCOME TAX BENEFIT (PROVISION) � 410,000 � �

(690,000 ) NET (LOSS) INCOME $ (749,254 ) $ 1,182,650 �

AVERAGE�NUMBER�OF�COMMON�SHARES�OUTSTANDING: Basic � 6,575,633 � �

6,571,171 � Diluted � 6,575,633 � � 6,604,220 �

EARNINGS�PER�SHARE�OF�COMMON�STOCK: Basic $ (0.11 ) $ 0.18 �

Diluted $ (0.11 ) $ 0.18 � FLEXSTEEL INDUSTRIES, INC. AND

SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED) � Three Months Ended September 30, 2008 � 2007

OPERATING ACTIVITIES: Net (loss) income $ (749,254 ) $ 1,182,650

Adjustments to reconcile net income to net cash provided by (used

in) operating activities: � Depreciation and amortization 1,055,743

1,233,551 Gain on disposition of capital assets (142,742 ) (26,497

) Changes in operating assets and liabilities � 2,068,512 � �

(3,307,269 ) Net cash provided by (used in) operating activities �

2,232,259 � � (917,565 ) � INVESTING�ACTIVITIES: Net sales of

investments 262,386 314,086 Proceeds from sale of capital assets

440,619 39,097 Capital expenditures � (150,259 ) � (410,304 ) Net

cash provided by (used in) investing activities � 552,746 � �

(57,121 ) � FINANCING ACTIVITIES: Net (repayments of) proceeds from

borrowings (3,462,529 ) 2,241,906 Dividends paid (854,832 )

(854,161 ) Proceeds from issuance of common stock � - � � 10,208 �

Net cash provided by (used in) financing activities � (4,317,361 )

� 1,397,953 � � (Decrease) increase in cash and cash equivalents

(1,532,356 ) 423,267 Cash and cash equivalents at beginning of

period � 2,841,323 � � 900,326 � Cash and cash equivalents at end

of period $ 1,308,967 � $ 1,323,593 � SUPPLEMENTAL INFORMATION

NON-GAAP DISCLOSURE (UNAUDITED) Investors should consider the

foregoing non-GAAP net income financial measure in addition to, and

not as a substitute for, the GAAP net loss financial measure. See

the following table for a reconciliation of the non-GAAP net income

financial measure to the GAAP net loss financial measure. � Three

Months Ended September 30, 2008 $ in millions � $ per share GAAP

net loss $ (0.7 ) $ (0.11 ) Adjustments to reconcile net income:

Facility consolidation, net of tax G � (0.8 ) � (0.13 ) NON-GAAP

net income $ 0.1 � $ 0.02 �

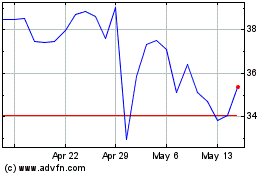

Flexsteel Industries (NASDAQ:FLXS)

Historical Stock Chart

From Oct 2024 to Nov 2024

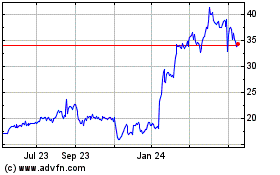

Flexsteel Industries (NASDAQ:FLXS)

Historical Stock Chart

From Nov 2023 to Nov 2024