Flexsteel Industries, Inc. (NASDAQ:FLXS) today reported sales and

earnings for its fourth quarter and fiscal year ended June 30,

2006. The Company reported net sales for the quarter ended June 30,

2006 of $112.3 million compared to the prior year quarter of $105.8

million, an increase of 6.2%. Net income for the quarter ended June

30, 2006 and the prior year quarter was $1.5 million or $0.23 per

share. Net sales for the fiscal year ended June 30, 2006 were

$426.4 million compared to $410.0 million in the prior fiscal year,

an increase of 4.0%. Net income for the fiscal year ended June 30,

2006 was $4.7 million or $0.72 per share compared to $6.0 million

or $0.92 per share for the fiscal year ended June 30, 2005, a

decrease of 21.9%. The current year net income was adversely

impacted by the recording of stock-based compensation expense, as

required by Statement of Financial Accounting Standard No. 123

(Revised), of $0.4 million (after tax) or $0.06 per share. During

the fiscal year ended June 30, 2005, the Company recorded a pre-tax

gain on the sale of facilities of $0.8 million and a one-time

favorable income tax adjustment of $0.7 million. For the quarter

ended June 30, 2006, residential net sales were $70.4 million, an

increase of 4.0% from the prior year quarter net sales of $67.7

million. For the fiscal year ended June 30, 2006, residential net

sales of $267.7 million were up 2.2% from net sales of $261.9

million in the prior year. These increases in residential net sales

in the current quarter and the fiscal year ended June 30, 2006 are

primarily due to introductions to newly developed markets, selected

sell price increases and improved demand for products in existing

markets. Recreational vehicle net sales for the quarter ended June

30, 2006 were $20.1 million, up 9.6% from the prior year quarter

net sales of $18.4 million. For the fiscal year ended June 30,

2006, recreational vehicle net sales decreased 6.9% to $73.4

million, compared to $78.8 million in the fiscal year ended June

30, 2005. While the quarter ended June 30, 2006 showed an increase

over the prior year quarter, the fiscal year decline in

recreational vehicle net sales reflects a generally soft wholesale

market environment for recreational vehicles. Net sales of

commercial products increased from $19.7 million to $21.8 million

and from $69.3 million to $85.3 million, for the quarter and fiscal

year ended June 30, 2006, respectively. This approximate 10.6%

increase in commercial net sales for the quarter and 23.1% for the

fiscal year ended June 30, 2006 is primarily due to expanded

commercial office product offerings and improved industry

performance of hospitality products. Gross margin for the quarter

ended June 30, 2006 was 18.8% compared to 19.3% in the prior year

quarter. During the quarter ended June 30, 2005, LIFO inventory

quantities (steel and lumber) were reduced; resulting in a

favorable impact on gross margin of 0.6% when compared to the

quarter ended June 30, 2006. For the fiscal year ended June 30,

2006, the gross margin was 19.1% compared to 18.7% for the prior

fiscal year. Gross margin improvement for the year is a result of a

greater percentage of shipments being commercial office,

hospitality and foreign sourced products whose margins were not as

significantly impacted by raw material increases. Selling, general

and administrative expenses were 16.4% and 17.0% of net sales for

the quarters ended June 30, 2006 and 2005, respectively. The

decrease in quarterly SG&A expenses is due primarily to lower

advertising and selling expenses when compared to the prior year

quarter. For the fiscal years ended June 30, 2006 and 2005,

selling, general and administrative expenses were 17.1% and 16.7%

of net sales, respectively. The year-to-date increase in SG&A

expenses reflects increased marketing related costs and the

recording of stock-based compensation. The income tax rate was

39.6% and 39.3% for the quarter and fiscal year ended June 30,

2006, respectively. During the fiscal year ended June 30, 2005, an

examination by the Internal Revenue Service of the Company's

federal income tax returns for the fiscal years ended June 30, 2003

and 2004 was completed. Due to the favorable results, the Company

reduced its estimate of accrued tax liabilities by $0.7 million.

The decrease resulted in an income tax rate of 30.6% for the fiscal

year ending June 30, 2005. All earnings per share amounts are on a

diluted basis. Working capital (current assets less current

liabilities) at June 30, 2006 was $97.0 million compared to $85.4

million at June 30, 2005. Net cash used in operating activities was

$7.3 million in fiscal year 2006. Cash was used in operating

activities to increase inventory for the expansion of import

programs, including commercial office product offerings and to

support an increase in accounts receivable due to the higher sales

volume. The Company does not expect significant future increases in

inventory related to our import programs. The available credit

facilities provided the additional cash required. Capital

expenditures were $3.4 million and $3.3 million during fiscal 2006

and 2005, respectively. Depreciation and amortization expense was

$5.5 million and $5.8 million during fiscal 2006 and 2005,

respectively. The Company expects that capital expenditures will be

approximately $4.0 million in fiscal year 2007. Outlook Flexsteel

Industries, Inc. and the other U.S. furniture manufacturers

continue to be impacted by increases in interest rates and

geopolitical issues leading to increased energy costs and consumer

uncertainty. At the same time, the U.S. furniture industry

continues to evolve and globalize at a staggering rate. U.S.

manufacturers are faced with increases in the cost of raw

materials, labor and overhead costs, including fuel, accompanied by

an increased flow of competing product from all over the world

generally produced with lower manufacturing costs all of which

added to product pricing pressures. Additionally, the distribution

channels are changing and increasingly include non-traditional

customers such as mass merchandisers, wholesale clubs and specialty

retail chains in addition to e-commerce opportunities. For the

fiscal year ended June 30, 2006, residential net sales were weaker

than anticipated and we expect that this softness will continue

through the first half of fiscal year 2007 due to the uncertainties

described above. Net sales of vehicle seating products have fallen

off due to a weak wholesale market environment. While vehicle

seating product net sales during the fourth quarter of fiscal 2006

showed an increase over the prior year quarter, a sustained

improvement in demand has not yet been confirmed. Additionally, the

volatility and high cost of fuel may temper the favorable

longer-term demographics that exist in the recreational vehicle

industry. Our commercial marketing channels provide an opportunity

to expand distribution and increase net sales for fiscal 2007.

Commercial office furniture net sales are expected to benefit from

a continued general increase in demand for these products and we

have expanded our product offerings to capitalize on this market

area. Hospitality occupancy rates continue strong which has led to

an increase in construction and renovation activity. These

activities have increased the demand for the hospitality products

we offer. The increased cost of raw materials, component parts and

fuel created continued pressures on margins through all of fiscal

year 2006 and we expect these pressures to continue into fiscal

year 2007. During fiscal year 2006, we were able to maintain our

margins through cost controls, the implementation of a fuel

surcharge on product delivery and selected product sale price

increases. We expect that fuel costs will continue to rise and to

negatively impact the cost of bringing raw materials, component

parts and sourced finished products into our facilities as well as

the cost of delivering products to our customers. We anticipate

that petroleum prices will remain volatile and at record or near

record levels for the foreseeable future. The result will be

continuing cost increases and we believe a factor in keeping

consumers on the sideline for furniture purchases, negatively

affecting demand for residential and vehicle seating products.

Flexsteel continues to take actions to address the above concerns

including: new product introductions, refining existing product

offerings, adjusting selling and delivery prices, adjusting

production levels and implementing cost control measures for

inventory and capital expenditures. These actions occur regularly

regardless of operating performance, but will continue to receive

additional attention under current business conditions. Management

believes that Flexsteel is also in a unique position to take

advantage of the rapid change that is affecting most of the markets

we serve. We have had a successful introduction of our complete new

line of Wrangler Home (R) Collection. We continue to develop

products for the marine industry to augment our vehicle seating

products. We believe that our commercial office product lineup is

strong and expanded to continue to take full advantage as demand

for this product increases. Our hospitality team is poised to

deliver the needed products as this market expansion continues. We

continue to believe that our strategy of providing furniture from a

wide selection of domestically manufactured and imported products

is sound business practice. This blended strategy gives Flexsteel

the opportunity to successfully participate in all the important

avenues of furniture distribution in the United States. Analysts

Conference Call The Company will host a conference call for

analysts on Friday, August 18, 2006, at 10:30 a.m. Central Time. To

access the call, please dial 1-888-275-4480 and provide the

operator with ID # 9559102. A replay will be available for two

weeks beginning approximately two hours after the conclusion of the

call by dialing 1-800-642-1687 and entering ID # 9559102.

Forward-Looking Statements Statements, including those in this

release, which are not historical or current facts, are

"forward-looking statements" made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

There are certain important factors that could cause results to

differ materially from those anticipated by some of the statements

made herein. Investors are cautioned that all forward-looking

statements involve risk and uncertainty. Some of the factors that

could affect results are the cyclical nature of the furniture

industry, the effectiveness of new product introductions and

distribution channels, the product mix of sales, pricing pressures,

the cost of raw materials and fuel, foreign currency valuations,

actions by governments including taxes and tariffs, the amount of

sales generated and the profit margins thereon, competition (both

foreign and domestic), changes in interest rates, credit exposure

with customers and general economic conditions. Any forward-looking

statement speaks only as of the date of this press release. The

Company specifically declines to undertake any obligation to

publicly revise any forward-looking statements that have been made

to reflect events or circumstances after the date of such

statements or to reflect the occurrence of anticipated or

unanticipated events. About Flexsteel Flexsteel Industries, Inc. is

headquartered in Dubuque, Iowa, and was incorporated in 1929.

Flexsteel is a designer, manufacturer, importer and marketer of

quality upholstered and wood furniture for residential,

recreational vehicle, office, hospitality and healthcare markets.

All products are distributed nationally. For more information,

visit our web site at http://www.flexsteel.com. -0- *T FLEXSTEEL

INDUSTRIES, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE

SHEETS (UNAUDITED) June 30, June 30, 2006 2005 -------------

------------- ASSETS CURRENT ASSETS: Cash and cash

equivalents.............. $1,985,768 $1,706,584

Investments............................ 817,618 1,508,751 Trade

receivables, net................. 51,179,791 48,355,070

Inventories............................ 84,769,972 69,945,400

Other.................................. 6,634,121 6,281,869

------------- ------------- Total current

assets...................... 145,387,270 127,797,674 NONCURRENT

ASSETS: Property, plant, and equipment, net 24,158,041 26,140,914

Other assets........................... 13,780,393 12,719,090

------------- -------------

TOTAL..................................... $183,325,704

$166,657,678 ============= ============= LIABILITIES AND

SHAREHOLDERS' EQUITY CURRENT LIABILITIES: Accounts payable -

trade................. $15,768,435 $16,259,905 Notes payable and

current maturities of long-term debt..........................

9,466,643 5,000,000 Accrued liabilities......................

23,164,927 21,149,428 ------------- ------------- Total current

liabilities................. 48,400,005 42,409,333 LONG-TERM

LIABILITIES: Long-term debt........................... 21,846,386

12,800,000 Other long-term liabilities.............. 5,576,988

6,650,625 ------------- ------------- Total

liabilities......................... 75,823,379 61,859,958

SHAREHOLDERS' EQUITY...................... 107,502,325 104,797,720

------------- -------------

TOTAL..................................... $183,325,704

$166,657,678 ============= ============= FLEXSTEEL INDUSTRIES, INC.

AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

Three Months Ended Fiscal Year Ended June 30, June 30,

--------------------------- --------------------------- 2006 2005

2006 2005 ------------- ------------- ------------- -------------

NET SALES..... $112,325,883 $105,768,368 $426,407,585 $410,022,809

COST OF GOODS SOLD......... (91,198,852) (85,343,905) (345,068,305)

(333,170,329) ------------- ------------- -------------

------------- GROSS MARGIN.. 21,127,031 20,424,463 81,339,280

76,852,480 SELLING, GENERAL AND ADMINISTRATIVE (18,457,644)

(17,958,185) (72,778,576) (68,595,788) GAIN ON SALE OF FACILITIES

--- --- --- 809,022 ------------- ------------- -------------

------------- OPERATING INCOME....... 2,669,387 2,466,278 8,560,704

9,065,714 ------------- ------------- ------------- -------------

OTHER INCOME (EXPENSE): Interest and other income.... 220,728

191,623 774,783 627,996 Interest expense... (438,370) (198,313)

(1,557,304) (989,754) ------------- ------------- -------------

------------- Total.. (217,642) (6,690) (782,521) (361,758)

------------- ------------- ------------- ------------- INCOME

BEFORE INCOME TAXES. 2,451,745 2,459,588 7,778,183 8,703,956

BENEFIT FROM (PROVISION FOR) INCOME TAXES........ (970,000)

(920,000) (3,060,000) (2,660,000) ------------- -------------

------------- ------------- NET INCOME.... $1,481,745 $1,539,588

$4,718,183 $6,043,956 ============= ============= =============

============= AVERAGE NUMBER OF COMMON SHARES OUTSTANDING: Basic...

6,563,750 6,540,636 6,558,440 6,531,293 ============= =============

============= ============= Diluted. 6,579,647 6,595,170 6,577,278

6,600,905 ============= ============= ============= =============

EARNINGS PER SHARE OF COMMON STOCK: Basic... $0.23 $0.24 $0.72

$0.93 ============== ============ ============= =============

Diluted. $0.23 $0.23 $0.72 $0.92 ============== ============

============= ============= FLEXSTEEL INDUSTRIES, INC. AND

SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED) Fiscal Year Ended June 30, -------------------------

2006 2005 ------------ ------------ OPERATING ACTIVITIES: Net

income.................................. $4,718,183 $6,043,956

Adjustments to reconcile net income to net cash provided by (used

in) operating activities: Depreciation and amortization............

5,485,884 5,785,354 Gain on disposition of capital assets....

(55,504) (879,462) Stock-based compensation expense.........

427,000 --- Changes in operating assets and

liabilities............................. (17,830,434) 1,773,774

------------ ------------ Net cash (used in) provided by operating

activities................................. (7,254,871) 12,723,622

------------ ------------ INVESTING ACTIVITIES: Net sales

(purchases) of investments..... 655,252 (275,331) Proceeds from

sale of capital assets..... 89,787 2,121,083 Capital

expenditures..................... (3,410,914) (3,346,984)

------------ ------------ Net cash used in investing

activities....... (2,665,875) (1,501,232) ------------ ------------

FINANCING ACTIVITIES: Net proceeds (payment) of borrowings....

13,513,030 (8,805,426) Dividends paid..........................

(3,408,994) (3,393,842) Proceeds from issuance of common stock..

95,894 206,941 ------------ ------------ Net cash provided by (used

in) financing activities.................................

10,199,930 (11,992,327) ------------ ------------ Increase

(decrease) in cash and cash

equivalents................................ 279,184 (769,937) Cash

and cash equivalents at beginning of

period..................................... 1,706,584 2,476,521

------------ ------------ Cash and cash equivalents at end of

period.. $1,985,768 $1,706,584 ============ ============ *T

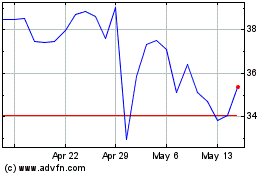

Flexsteel Industries (NASDAQ:FLXS)

Historical Stock Chart

From Oct 2024 to Nov 2024

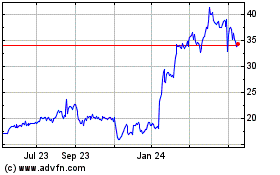

Flexsteel Industries (NASDAQ:FLXS)

Historical Stock Chart

From Nov 2023 to Nov 2024