MetLife Maintained at Neutral - Analyst Blog

June 07 2012 - 2:10PM

Zacks

We reiterate our Neutral recommendation on MetLife

Inc. (MET) based on robust growth in the U.S. and

international businesses, improved underwriting results, higher

premiums, strong book value growth and stable ratings. However,

escalated expenses, stiff competition and higher-than-expected

derivative losses are the downsides.

MetLife reported first quarter operating earnings per share of

$1.37, ahead of both the Zacks Consensus Estimate of $1.30 and the

year-ago quarter earnings of $1.23. Operating earnings escalated

11% year over year to $1.46 billion.

MetLife maintains a diversified business mix and is one of the

strongest brands in the U.S., Mexico, Japan, Chile, Poland and

Korea based on its customer-centric business model. Moreover, the

company consistently realigns its business portfolio to cater to

market demands.

MetLife is also regaining its competitive and operating

strengths by aggressively divesting its banking operations.Over the

past six months, MetLife agreed to sell MetLife Bank's deposit

business to General Electric Co.’s (GE) financial

services unit – GE Capital, warehouse finance business to

EverBank Financial Corp. (EVER) and its reverse

mortgage servicing portfolio to Nationstar Mortgage.

Moreover, MetLife has a strong risk-based capital position,

ample liquidity and leading market position in its core group and

individual insurance businesses. Going ahead, management projected

return on equity growth of 12–14% by 2016, while excess capital is

expected to augment to $6–7 billion by the end of 2012.

However, the current interest rate environment is affecting the

spreads and MetLife’s risk-adjusted capitalization. Consequently,

the annuity operations, sales in corporate benefit funding and

investment income have moderated in the last few quarters and are

expected to weaken in the upcoming quarters.

The adverse impacts of interest rate, currency fluctuation and

credit spreads also resulted in pre-tax derivative losses of

approximately $2.0 billion in the first quarter of 2012.

Furthermore, an earnings reduction of about 20 cents per share is

estimated this year, should the ten-year Treasury bond interest

rate continue at 2.5% through 2012.

Although losses in net investment portfolio have moderated from

the peak levels during 2008 and early part of 2009, these are

expected to persistently trim profits over the near term until the

markets gain buoyancy.

MetLife continues to be pressured by a rising trend in benefits

and claims that puts additional strain on the expenses and bottom

line. Consequently, total expenses increased 6.6% year over year in

the first quarter of 2012. Meanwhile, MetLife expects to incur

costs of $90–100 million in 2013 due to the shutdown of its forward

residential mortgage business.

MetLife currently carries a Zacks #3 Rank (short-term Hold

rating).

EVERBANK FIN CP (EVER): Free Stock Analysis Report

GENL ELECTRIC (GE): Free Stock Analysis Report

METLIFE INC (MET): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

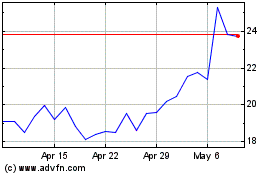

EverQuote (NASDAQ:EVER)

Historical Stock Chart

From Jun 2024 to Jul 2024

EverQuote (NASDAQ:EVER)

Historical Stock Chart

From Jul 2023 to Jul 2024