Energy Recovery Inc (NASDAQ: ERII), a leader in the design and

development of energy recovery devices for desalination and other

industrial processes, announced today the results of its third

quarter ended September 30, 2011. With no shipments for mega

projects and delayed OEM deliveries, the Company achieved net

revenue of $4.9 million for the quarter, reflecting a 29% decrease

as compared to the same period of last year. Low production volume

in manufacturing, coupled with a mix shift that favored smaller

devices, resulted in a gross margin of 15% in the current period as

compared to 34% in the third quarter of 2010. The progressive

qualification of ceramics production in California and the plant

disruption associated with the closure in Michigan, both scheduled

for completion by the end of this year, compounded the effects of

negative operating leverage and unfavorable product mix, all of

which combined to create a significant drag on margins in the

current period. The Company’s restructuring and integration

activities, however, are expected to generate significant cost

savings in 2012 and thereafter.

In the third quarter of 2011, the Company exhausted its

potential to carry-back net operating losses within the required

look-back period of three years. Accordingly, net operating losses

can no longer be applied on a look-back basis; rather, these losses

must be carried forward to offset taxable income in future periods.

Consequently, the Company recorded a valuation allowance against

deferred tax assets and other adjustments in the current period,

with a combined value of $4.5 million, in accordance with the

accounting guidance and related interpretations regarding

accounting for income taxes. Although management clearly believes

in the long-term strategic direction of the Company and its future

earnings potential, projected revenue and profit in subsequent

years do not outweigh prior cumulative losses when assessing the

need for a valuation allowance under accounting standards.

With tax adjustments of $4.5 million and restructuring costs of

$0.5 million, the Company reported a net loss of $11.3 million, or

($0.22) per share, for the three months ended September 30, 2011

compared to a net loss of $3.9 million, or ($0.07) per share, for

the same period of last year. For the nine-month period in 2011,

the Company reported a net loss of $16.4 million, or ($0.31) per

share, compared to a net loss of $4.1 million, or ($0.08) per share

for the same period of last year.

Tom Rooney, president and chief executive officer, commented,

“The quarterly results reflect continued sluggishness in the

desalination industry, manifested plainly through decreased revenue

levels and compressed margins caused by poor utilization in

manufacturing along with an unfavorable product mix. Moreover,

results were further undermined by tax adjustments and

restructuring costs, together totaling $5.0 million. While the

financial results, albeit anticipated, leave much room for

improvement, we are making meaningful progress with respect to our

strategic priorities. Restructuring and plant consolidation are on

target, vertical integration of production for all ceramic

components is nearing completion, and three product development

managers are in place to diversify our revenue mix. Moreover, we

are actively pursuing acquisition candidates that meet our

financial and strategic criteria, we successfully expanded the

product portfolio through the launch of the new PX-Q300 in

Australia, and the sales pipeline is shaping up to enable improved

performance in 2012. In summary, even in the context of challenging

results in the third quarter of 2011, we remain highly confident in

the future prospects of the Company as we conduct disciplined

execution of our strategic plan.”

Forward-Looking Statements

This press release includes "forward-looking statements" within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These forward-looking statements include our expectations

or goals relating to the completion of vertical integration for our

ceramic products in 2011, anticipated cost savings, penetration of

new markets, product diversification, future M&A efforts,

strategic direction, future earnings potential, and other future

prospects. Because such forward-looking statements involve risks

and uncertainties, the Company's actual results may differ

materially from the predictions in those forward-looking

statements. Factors that could cause actual results to differ

materially include, but are not limited to, delays in, or

cancellation of, the construction of desalination

plants; risks that our product diversification, M&A, and

other strategic efforts will not yield intended

benefits; political unrest; the inability of our customers to

obtain project financing; delays in governmental approvals; changes

in end users’ budgets for desalination plants or the timing of

their purchasing decisions; our ability to ship new products to

meet scheduled delivery times; the global economic crisis; our

ability to develop other energy recovery solutions for markets

outside of desalination; and other risks detailed in the Company's

filings with the Securities and Exchange Commission (“SEC”). All

forward-looking statements are made as of today, and the Company

assumes no obligation to update such statements. For more details

relating to the risks and uncertainties that could cause actual

results to differ materially from those anticipated in our

forward-looking statements, please refer to the Company's SEC

filings.

Conference Call to Discuss Third Quarter 2011 Results

The conference call scheduled today at 1:30 p.m. PST will be in

a "listen-only" mode for all participants other than the sell-side

investment professionals who regularly follow the Company. The

toll-free phone number for the call is 888-549-7880 or local

480-629-9644, and the access code is 4481254. Callers should dial

in approximately 15 minutes prior to the scheduled start time. A

telephonic replay will be available at 800-406-7325 or 303-590-3030

(access code: 4481254) until November 17, 2011. Investors may also

access the live call or the replay over the internet at

www.streetevents.com or tinyurl.com/earningscall-Nov2011. The

replay will be available approximately three hours after the live

call concludes.

About Energy Recovery Inc

Energy Recovery Inc (NASDAQ: ERII) designs and develops energy

recovery devices that significantly reduce energy consumption in

desalination and other industrial processes. Energy Recovery’s

portfolio includes notable technologies such as the PX Pressure

Exchanger™ (PX™) device, the ERI™ TurboCharger hydraulic turbine

energy recovery device, and the ERI™ AquaBold™ and ERI™ AquaSpire™

high-pressure pump. In total, Energy Recovery has more than 12,000

devices installed, helping to save an estimated 10 billion kilowatt

hours of energy per year. The company is headquartered in the San

Francisco Bay Area with offices in key centers worldwide, including

Madrid, Shanghai, and Dubai. For more information about Energy

Recovery, Inc., please visit www.energyrecovery.com.

Unaudited Consolidated Financial Results ENERGY

RECOVERY, INC. CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (in thousands, except per share data)

(unaudited) Three Months Ended Nine

Months Ended September 30, September 30,

2011 2010

2011 2010 Net

revenue $ 4,933 $ 6,921 $ 21,932 $ 32,840 Cost of revenue

4,214 4,537

14,221 16,470 Gross

profit

719 2,384

7,711 16,370

Operating expenses: General and administrative 3,571 3,335

11,953 10,724 Sales and marketing 2,291 1,860 6,370 5,962 Research

and development 726 1,252 2,626 2,943 Amortization of intangible

assets 346 683 1,037 2,049 Restructuring charges

470 —

470 — Total

operating expenses

7,404

7,130 22,456

21,678 Loss from operations (6,685 ) (4,746 )

(14,745 ) (5,308 ) Interest expense (5 ) (15 ) (30 ) (53 ) Other

non-operating income (expense), net

(127

) 78

128 (21 ) Loss

before income taxes (6,817 ) (4,683 ) (14,647 ) (5,382 ) Provision

for (benefit from) income taxes

4,509

(833 ) 1,775

(1,278 ) Net loss

$ (11,326 )

$

(3,850 ) $

(16,422 )

$ (4,104

) Basic and diluted net loss per share

$ (0.22 )

$

(0.07 ) $ (0.31

)

$ (0.08 ) Shares

used in computing basic and diluted net loss per share

52,636 52,447

52,602 51,923

ENERGY RECOVERY, INC. CONDENSED CONSOLIDATED BALANCE

SHEETS (in thousands, except share data and par value)

(unaudited) September 30, December

31, 2011 2010 ASSETS Current

assets:

Cash and cash equivalents

$ 45,430 $ 55,338 Restricted cash 6,674 4,636 Accounts receivable,

net of allowance for doubtful accounts of $48 and $44 at September

30, 2011 and December 31, 2010, respectively 3,795 9,649 Unbilled

receivables, current 2,173 2,278 Inventories 9,917 9,772 Deferred

income taxes 580 2,097 Prepaid expenses and other current assets

4,694 4,428

Total current assets 73,263 88,198 Restricted cash,

non-current 3,952 2,244 Property and equipment, net 20,787 22,314

Goodwill 12,790 12,790 Other intangible assets, net 7,314 8,352

Other assets, non-current

2

19 Total assets $

118,108 $ 133,917

LIABILITIES AND STOCKHOLDERS’ EQUITY Current

liabilities: Accounts payable $ 1,508 $ 1,429 Accrued expenses

and other current liabilities 4,642 5,248 Income taxes payable 21

13 Accrued warranty reserve 744 1,028 Deferred revenue, current 520

2,341 Current portion of long-term debt 117 128 Current portion of

capital lease obligations

98

160 Total current liabilities 7,650

10,347 Long-term debt — 85 Capital lease obligations, non-current

24 144 Deferred income taxes 1,647 317 Deferred revenue,

non-current 238 157 Other non-current liabilities

2,085 2,067 Total

liabilities 11,644

13,117 Commitments and Contingencies

Stockholders’ equity: Preferred stock, $0.001 par value;

10,000,000 shares authorized; no shares issued or outstanding — —

Common stock, $0.001 par value; 200,000,000 shares authorized;

52,643,129 and 52,596,170 shares issued and outstanding at

September 30, 2011 and December 31, 2010, respectively 53 53

Additional paid-in capital 114,103 112,025 Notes receivable from

stockholders (23 ) (38 ) Accumulated other comprehensive loss (87 )

(80 ) Retained earnings (accumulated deficit)

(7,582 ) 8,840

Total stockholders’ equity 106,464

120,800 Total liabilities and

stockholders’ equity $ 118,108

$ 133,917

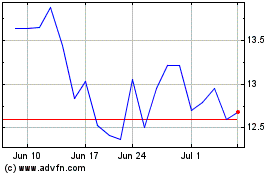

Energy Recovery (NASDAQ:ERII)

Historical Stock Chart

From Apr 2024 to May 2024

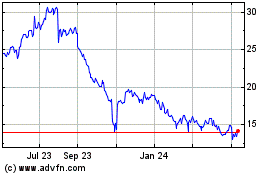

Energy Recovery (NASDAQ:ERII)

Historical Stock Chart

From May 2023 to May 2024