UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF

1934

For the month of

March 2019

Commission File No.

001-38612

ELECTRAMECCANICA VEHICLES CORP.

(Translation of registrant's name into English)

102 East 1st Avenue

Vancouver, British Columbia, V5T 1A4,

Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7)

¨

Item 8.01 Other Events.

|

|

a.

|

New Compensation Arrangements

|

The following information in this Item 8.01(a) was previously disclosed in our registration statement

on Form F-3 (333-229562) originally filed on February 8, 2019 and is being disclosed again so that it may be incorporated by reference

into our registration statement on Form F-3 (333-227883), originally filed on October 18, 2018, and the preliminary prospectus

supplement thereto filed on March 22, 2019.

On January 15, 2019, we revised or entered

into new compensation arrangements with four of our officers or their affiliated entities as set out below:

Jerry Kroll

On January 15, 2019, our Board approved

the entering into of a new executive employment agreement with Jerry Kroll (the “Kroll Agreement”), which is dated

for reference effective on January 1, 2019 (the “Effective Date”), and which supersedes our company’s prior agreement

with Mr. Kroll, dated July 1, 2016, which had been amended in August of 2018.

The Kroll Agreement commenced as of the

Effective Date and will continue indefinitely until terminated in accordance with its terms. Pursuant to the terms of the Kroll

Agreement, Mr. Kroll will continue to be employed as our CEO and will devote his full business time and best efforts, business

judgment, skill and knowledge exclusively to the advancement of the business and interests of the Company. Mr. Kroll will not engage

in any other business activity or serve in any industry, trade, professional, governmental or academic position during the term

of the Kroll Agreement, except as may be expressly approved in advance by the Board, in writing; provided that Mr. Kroll may make

passive personal investments, engage in outside non-competitive business activities, including being a director of non-competitive

businesses, or engage in other activities for any charitable or other non-profit institution; and provided, further, that such

activities do not conflict with the interests of any member of the Company or otherwise interfere, individually or in the aggregate,

with the performance of Mr. Kroll’s duties and responsibilities or the time required for the discharge of those duties and

responsibilities.

The Company will pay Mr. Kroll an annual

base salary from the Effective Date of $300,000 (the “Base Salary”). The Base Salary is subject to increase based on

periodic reviews at the discretion of the Board. Mr. Kroll will be entitled to participate in all other benefits, perquisites,

benefit plans or programs of the Company which are available generally to executives of the Company in accordance with the terms

of such plans, benefits or programs, including, but not limited to, the following: (a) no less than five weeks paid vacation during

each full fiscal year of Mr. Kroll’s employment (pro-rated for any partial year of employment); and (b) group insurance coverage

for medical, extended health, dental, life and long term disability as may be made available by the Company to its executive employees

from time to time. Mr. Kroll acknowledges that any of the benefits set out above are subject to the formal plan documents or policies

and may also be modified or amended at any time by the Board in its sole and absolute discretion.

The Company will use commercially reasonable

efforts to maintain an appropriate level of coverage for Mr. Kroll under its current directors’ and officers’ insurance

policy and will indemnify Mr. Kroll for all lawful acts (or omissions) undertaken by Mr. Kroll in the role of either director or

CEO of the Company to the extent allowed by law.

The Company may grant Mr. Kroll stock options

under its Stock Option Plan from time to time in its absolute discretion. Any stock options granted will be in accordance with

the following provisions: (a) the stock options will be subject to the terms and conditions of the Company’s Stock Option

Plan as may be amended from time to time by the Board in its absolute discretion; (b) the number of shares which may be purchased

pursuant to a stock option will be in accordance with the Company’s Stock Option Plan for allocating amounts of stock options

to employees as determined by the Board or any Board committee or party to whom that task has been delegated; (c) the terms and

conditions attaching to the Stock Option and including, without limitation, the number of shares which may be purchased pursuant

to the stock option, its exercise price, its term, its termination provisions and its vesting provisions, will be in the sole discretion

of the Board or any Board committee or party to whom that task has been delegated; and (d) stock options will otherwise be subject

to the requirements of any stock exchange, securities commission or other similar regulatory body having jurisdiction and rules

and policies adopted by the Company’s Compensation Committee.

The Company has the right to and may terminate

the Kroll Agreement for Cause (as defined therein) immediately upon written notice to Mr. Kroll. Following any such termination,

the Company will have no further obligations to Mr. Kroll under the Kroll Agreement other than the Company’s obligations

to: (a) pay Mr. Kroll Base Salary accrued to the date of termination; (b) pay Mr. Kroll any accrued and unused vacation; and (c)

reimburse Mr. Kroll for expenses incurred through the termination date that are reimbursable under the Kroll Agreement.

The Company also has the right to and may

terminate the Kroll Agreement at any time, for any reason or for no reason, without Cause, immediately upon notice to Mr. Kroll.

Following any such termination the Company will have no further obligations to Mr. Kroll under Kroll Agreement other than the Company’s

obligations to: (a) pay Mr. Kroll Base Salary accrued to the date of termination; (b) pay Mr. Kroll Severance Pay (as defined therein);

(c) reimburse Mr. Kroll for expenses incurred by Mr. Kroll through the termination date that are reimbursable pursuant under the

Kroll Agreement; and (d) pay Mr. Kroll any accrued and unused vacation.

Within 12 months following a Change of

Control (as defined in the Kroll Agreement), Mr. Kroll may, in his sole discretion, elect to terminate the Kroll Agreement on written

notice to the Company. Following any such termination, the Company will have no further obligations to Mr. Kroll under the Kroll

Agreement other than the Company’s obligation to: (a) pay Mr. Kroll Base Salary accrued to the date of termination; (b) pay

Mr. Kroll Severance Pay; (c) reimburse Mr. Kroll for expenses incurred by Mr. Kroll through the termination date that are reimbursable

under the Kroll Agreement; and (d) pay Mr. Kroll any accrued and unused vacation.

In the event that the Kroll Agreement is

terminated by the Company without Cause, or by Mr. Kroll as a result of a Change of Control, Mr. Kroll will be entitled to a “Severance

Pay” in an amount equal to 12 months of Base Salary plus one additional month of Base Salary for each full year of employment

under the Kroll Agreement to a maximum of 18 months. In addition, all stock options then granted will accelerate and vest as at

the date of termination and be exercisable for the greater of 180 days or the greatest time permitted for exercise after any termination

of employment as set out in the Company’s then Stock Option Plan. The Company shall pay any such Severance Pay forthwith,

but in any event within two weeks of the termination date (subject to earlier payment of some of the Severance Pay in accordance

with the requirements of the British Columbia

Employment Standards Act

)

.

Upon satisfaction of its above

obligations, as applicable, the Company shall have no further liability or obligation to Mr. Kroll under the Kroll Agreement and

including, without limitation, any liability for any further severance pay for failure to give reasonable notice or for damages

in lieu of reasonable notice.

Mr. Kroll may resign at anytime by providing

the Company with not less than 90 days’ prior written notice, in which case the Kroll Agreement will terminate and all obligations

of each party to the other under the Kroll Agreement will terminate, on the date specified in the notice, other than the Company’s

obligations to: (a) pay Mr. Kroll Base Salary accrued to the date of termination; (b) reimburse Mr. Kroll for expenses incurred

by Mr. Kroll through the termination date that are reimbursable under the Kroll Agreement; and (c) pay Mr. Kroll any accrued and

unused vacation pay. In its discretion, the Company may elect to place Mr. Kroll on leave with pay and benefits during the notice

period of termination.

The Kroll Agreement will automatically

terminate upon the death or Permanent Disability (as defined therein) of Mr. Kroll and, upon such termination, the Company’s

obligations under the Kroll Agreement will immediately terminate other than the Company’s obligations to: (a) pay Mr. Kroll

Base Salary accrued to the date of termination; (b) pay Mr. Kroll any accrued and unused vacation pay; and (c) reimburse Mr. Kroll

for expenses incurred by Mr. Kroll through the termination date that are reimbursable under the Kroll Agreement. In the event that

Mr. Kroll dies or suffers a Permanent Disability, any payments due and owing to Mr. Kroll under the Kroll Agreement 0will enure

to the benefit of Mr. Kroll’s heirs and/or estate.

Bal Bhullar

On January 15, 2019, our Board approved

the entering into of a new consulting agreement with BKB Management Ltd., a company under the control and direction of Bal Bhullar,

our Chief Financial Officer (the “CFO”; and the “Bhullar Agreement”), which is dated for reference effective

on January 1, 2019 (the “Effective Date”), and which supersedes our company’s prior offer letter with Ms. Bhullar,

dated October 19, 2018.

In accordance with the Bhullar Agreement

the Consultant will provide the Company with management services as CFO (the “Services”). All Services will be performed

by the Consultant’s principal, Bal Bhullar. The Consultant shall report to and take direction from our CEO and the Board.

Under the Bhullar Agreement it is acknowledged that the Consultant may provide its services to other businesses and organizations

provided there is no conflict of interest and that the Consultant complies with its obligations under the Bhullar Agreement. The

Consultant shall devote as much time as required in the fulfillment of the role as CFO.

The Bhullar Agreement takes effect on the

Effective Date and is effective for a period of two years with an option to renew for an additional year by mutual agreement by

both parties thereafter.

In consideration of the Services provided

under the Bhullar Agreement, the Company will pay the Consultant a monthly fee of $15,000 and a $300 vehicle allowance plus any

applicable GST (collectively, the “Fees”) at the end of each month.

The Company may, at its option, terminate

the Bhullar Agreement at any time without notice or cause by advising the Consultant in writing. Following any such termination

without cause, the Company will have no further obligation to the Consultant under the Bhullar Agreement other than the Company’s

obligations to: (a) pay the Consultant all remaining unpaid Fees due at the time of termination; and (b) reimburse the Consultant

for any expenses incurred through to the termination date. The Company may also terminate the Bhullar Agreement at any time without

notice and for cause under the following circumstances: (i) the Consultant’s negligent performance of the Services; (ii)

the Consultant’s persistent failure to perform the Services; (iii) any breach by the Consultant of any of the obligations

set forth in the Bhullar Agreement; or (iv) a continued course of malfeasant or misfeasant actions or omissions by the Consultant,

an in each such instance.

The Company may terminate the Bhullar Agreement

at any time upon providing the Consultant with only the following: (a) Fees owed to the Consultant up to and including the date

of termination and any Bonus (as therein defined) earned prior to the date of termination; a lump sum payment equal to then term

of the Bhullar Agreement (the “Notice Period”) of Fees as in effect at the termination of the Consultant’s engagement;

(c) the Consultant’s participation in the Company’s benefits programs shall be continued for a period of eight weeks

and, thereafter, the Consultant’s benefits, including professional dues, but not including disability insurance coverage

or perquisites such as mobile phone, parking, etc., will be continued through the Notice Period to the maximum extent permitted

under applicable plan terms. To the extent the Company is unable to extend any such benefits coverage for any portion of such period

after reasonable efforts to obtain same, the Company shall pay the Consultant an amount sufficient to purchase comparable coverage

for such time; and (d) with a lump sum payment equal to the Bonus it would have earned through the Notice Period based on the Bonus

received by the Consultant in the year prior to the termination of the Bhullar Agreement (which, for greater certainty, will be

calculated by including the value of any Bonus paid in cash, RSUs or stock options)

The Consultant may terminate the Bhullar

Agreement by giving the Company written notice of Good Reason (as therein defined). In the event of a termination for Good Reason,

the Consultant shall be entitled to each of the Notice Period entitlements set forth above. The Consultant may voluntarily terminate

the Bhullar Agreement at any time by giving the Company two months’ prior notice. The Company may waive such notice in whole

or in part without any payment to the Consultant in lieu of the waived period of notice.

If at any time during the term of the Bhullar

Agreement there is a Change of Control (as therein defined) and, within 12 months of such Change of Control: (i) there is a material

reduction in the CFO’s title or a material reduction in hers duties or responsibilities such that the Consultant gives notice

of the Consultant’s intention to terminate the Bhullar Agreement as a result thereof; (ii) there is a material adverse change

in the Consultant’s Fees or benefits such that the Consultant gives notice of the Consultant’s intention to terminate

the Bhullar Agreement as a result thereof; or (iii) the Consultant’s engagement is terminated by the Company unless such

termination is as a result of the Consultant’s material breach of the Bhullar Agreement; the Consultant shall then be entitled

to receive from the Company: (a) a cash amount equal to two years of the Consultant’s Fees as in effect at the termination

of the Consultant’s engagement; and (b) an additional amount equal to two times the previous year’s annual Bonus (as

defined therein, and which, for greater certainty, will be calculated by including the value of any Bonus paid in cash, Restricted

Stock Units (“RSU”) or stock options). Notwithstanding the terms of any other plan or agreement, and subject to the

Company’s then Stock Option Plan and any RSU Plan, all stock options and RSUs previously granted by the Company to the Consultant

which have not vested shall be deemed to vest and all stock options held by the Consultant shall remain exercisable until the earlier

of their expiration date or 90 days from the termination date. The Company shall maintain the Consultant’s benefits under

the Bhullar Agreement for a period of 12 months.

Henry Reisner

On January 15, 2019, our Board approved

the entering into of a new executive employment agreement with Henry Reisner (the “Reisner Agreement”), which is dated

for reference effective on January 1, 2019 (the “Effective Date”), and which supersedes our company’s prior agreement

with Mr. Reisner, dated July 1, 2016, which had been amended in August of 2018.

The Reisner Agreement commenced as of the

Effective Date and will continue indefinitely until terminated in accordance with its terms. Pursuant to the terms of the Reisner

Agreement, Mr. Reisner will continue to be employed as our Chief Operating Officer (the “COO”) and President and will

devote his full business time and best efforts, business judgment, skill and knowledge exclusively to the advancement of the business

and interests of the Company. Mr. Reisner will not engage in any other business activity or serve in any industry, trade, professional,

governmental or academic position during the term of the Reisner Agreement, except as may be expressly approved in advance by the

Board, in writing; provided that Mr. Reisner may make passive personal investments, engage in outside non-competitive business

activities, including being a director of non-competitive businesses, or engage in other activities for any charitable or other

non-profit institution; and provided, further, that such activities do not conflict with the interests of any member of the Company

or otherwise interfere, individually or in the aggregate, with the performance of Mr. Reisner’s duties and responsibilities

or the time required for the discharge of those duties and responsibilities.

The Company will pay Mr. Reisner an annual

base salary from the Effective Date of $180,000 (the “Base Salary”). The Base Salary is subject to increase based on

periodic reviews at the discretion of the Board. Mr. Reisner will be entitled to participate in all other benefits, perquisites,

benefit plans or programs of the Company which are available generally to executives of the Company in accordance with the terms

of such plans, benefits or programs, including, but not limited to, the following: (a) no less than five weeks paid vacation during

each full fiscal year of Mr. Reisner’s employment (pro-rated for any partial year of employment); and (b) group insurance

coverage for medical, extended health, dental, life and long term disability as may be made available by the Company to its executive

employees from time to time. Mr. Reisner acknowledges that any of the benefits set out above are subject to the formal plan documents

or policies and may also be modified or amended at any time by the Board in its sole and absolute discretion.

The Company will use commercially reasonable

efforts to maintain an appropriate level of coverage for Mr. Reisner under its current directors’ and officers’ insurance

policy and will indemnify Mr. Reisner for all lawful acts (or omissions) undertaken by Mr. Reisner in the role of either director,

COO or President of the Company to the extent allowed by law.

The Company may grant Mr. Reisner stock

options under its Stock Option Plan from time to time in its absolute discretion. Any stock options granted will be in accordance

with the following provisions: (a) the stock options will be subject to the terms and conditions of the Company’s Stock Option

Plan as may be amended from time to time by the Board in its absolute discretion; (b) the number of shares which may be purchased

pursuant to a stock option will be in accordance with the Company’s Stock Option Plan for allocating amounts of stock options

to employees as determined by the Board or any Board committee or party to whom that task has been delegated; (c) the terms and

conditions attaching to the Stock Option and including, without limitation, the number of shares which may be purchased pursuant

to the stock option, its exercise price, its term, its termination provisions and its vesting provisions, will be in the sole discretion

of the Board or any Board committee or party to whom that task has been delegated; and (d) stock options will otherwise be subject

to the requirements of any stock exchange, securities commission or other similar regulatory body having jurisdiction and rules

and policies adopted by the Company’s Compensation Committee.

The Company has the right to and may terminate

the Reisner Agreement for Cause (as defined therein) immediately upon written notice to Mr. Reisner. Following any such termination,

the Company will have no further obligations to Mr. Reisner under the Reisner Agreement other than the Company’s obligations

to: (a) pay Mr. Reisner Base Salary accrued to the date of termination; (b) pay Mr. Reisner any accrued and unused vacation; and

(c) reimburse Mr. Reisner for expenses incurred through the termination date that are reimbursable under the Reisner Agreement.

The Company also has the right to and may

terminate the Reisner Agreement at any time, for any reason or for no reason, without Cause, immediately upon notice to Mr. Reisner.

Following any such termination the Company will have no further obligations to Mr. Reisner under Reisner Agreement other than the

Company’s obligations to: (a) pay Mr. Reisner Base Salary accrued to the date of termination; (b) pay Mr. Reisner Severance

Pay (as defined therein); (c) reimburse Mr. Reisner for expenses incurred by Mr. Reisner through the termination date that are

reimbursable pursuant under the Reisner Agreement; and (d) pay Mr. Reisner any accrued and unused vacation.

Within 12 months following a Change of

Control (as defined in the Reisner Agreement), Mr. Reisner may, in his sole discretion, elect to terminate the Reisner Agreement

on written notice to the Company. Following any such termination, the Company will have no further obligations to Mr. Reisner under

the Reisner Agreement other than the Company’s obligation to: (a) pay Mr. Reisner Base Salary accrued to the date of termination;

(b) pay Mr. Reisner Severance Pay; (c) reimburse Mr. Reisner for expenses incurred by Mr. Reisner through the termination date

that are reimbursable under the Reisner Agreement; and (d) pay Mr. Reisner any accrued and unused vacation.

In the event that the Reisner Agreement

is terminated by the Company without Cause, or by Mr. Reisner as a result of a Change of Control, Mr. Reisner will be entitled

to a “Severance Pay” in an amount equal to 12 months of Base Salary plus one additional month of Base Salary for each

full year of employment under the Reisner Agreement to a maximum of 18 months. In addition, all stock options then granted will

accelerate and vest as at the date of termination and be exercisable for the greater of 180 days or the greatest time permitted

for exercise after any termination of employment as set out in the Company’s then Stock Option Plan. The Company shall pay

any such Severance Pay forthwith, but in any event within two weeks of the termination date (subject to earlier payment of some

of the Severance Pay in accordance with the requirements of the British Columbia

Employment Standards Act

)

.

Upon

satisfaction of its above obligations, as applicable, the Company shall have no further liability or obligation to Mr. Reisner

under the Reisner Agreement and including, without limitation, any liability for any further severance pay for failure to give

reasonable notice or for damages in lieu of reasonable notice.

Mr. Reisner may resign at anytime by providing

the Company with not less than 90 days’ prior written notice, in which case the Reisner Agreement will terminate and all

obligations of each party to the other under the Reisner Agreement will terminate, on the date specified in the notice, other than

the Company’s obligations to: (a) pay Mr. Reisner Base Salary accrued to the date of termination; (b) reimburse Mr. Reisner

for expenses incurred by Mr. Reisner through the termination date that are reimbursable under the Reisner Agreement; and (c) pay

Mr. Reisner any accrued and unused vacation pay. In its discretion, the Company may elect to place Mr. Reisner on leave with pay

and benefits during the notice period of termination.

The Reisner Agreement will automatically

terminate upon the death or Permanent Disability (as defined therein) of Mr. Reisner and, upon such termination, the Company’s

obligations under the Reisner Agreement will immediately terminate other than the Company’s obligations to: (a) pay Mr. Reisner

Base Salary accrued to the date of termination; (b) pay Mr. Reisner any accrued and unused vacation pay; and (c) reimburse Mr.

Reisner for expenses incurred by Mr. Reisner through the termination date that are reimbursable under the Reisner Agreement. In

the event that Mr. Reisner dies or suffers a Permanent Disability, any payments due and owing to Mr. Reisner under the Reisner

Agreement 0will enure to the benefit of Mr. Reisner’s heirs and/or estate.

Isaac Moss

On January 15, 2019, our Board approved

the entering into of a new independent contractor agreement with Isaac Moss (the “Moss Agreement”), which is dated

for reference effective on January 1, 2019 (the “Effective Date”), and which supersedes our company’s prior agreement

with Mr. Moss, dated December 1, 2017, which had been amended in August of 2018.

The term of the Moss Agreement commenced

on the Effective Date and continues for a period of two years unless terminated as therein provided. The Moss Agreement automatically

renews for a further term of one year unless either party provides written notice of intent not to renew 30 days prior to expiration

of the Moss Agreement.

Under the Moss Agreement the Company has

agreed to pay Mr. Moss an annual fee of $200,000 (the “Fee”), and the Fee is payable in equal monthly instalments by

no later than the 30

th

day of each month.

The Company has the right to and may terminate

the Moss Agreement for Cause (as defined therein) immediately upon written notice to Mr. Moss. Following any such termination for

Cause, the Company will have no further obligations to Mr. Moss under the Moss Agreement other than to: (a) pay Mr. Moss all unpaid

Fees and applicable taxes thereon due to Mr. Moss at time of termination; and (b) reimburse Mr. Moss for any expenses incurred

through the termination date.

The Company will have the right to and

may terminate the Moss Agreement at any time, for any reason or for no reason without Cause, immediately upon notice to Mr. Moss.

Following any such termination of the Moss Agreement without Cause, the Company will have no further obligation to Mr. Moss under

the Moss Agreement other than the Company’s obligations to: (a) pay Mr. Moss all remaining unpaid Fees and applicable taxes

thereon due to the termination date of the Moss Agreement; and (b) to reimburse Mr. Moss for any expenses incurred through the

termination date. In addition, any stock options granted to Mr. Moss will accelerate and vest at the date of termination.

If at any time during the term of the Moss

Agreement there is a Change of Control (as defined therein) and, within 12 months of such Change of Control: (i) there is a material

reduction in Mr. Moss’s title or a material reduction in his duties or responsibilities such that Mr. Moss gives notice of

his intention to terminate the Moss Agreement as a result thereof; (ii) there is a material adverse change in Mr. Moss’s

Fees such that Mr. Moss gives notice of his intention to terminate the Moss Agreement as a result thereof; or (iii) Mr. Moss’s

engagement is terminated by the Company unless such termination is as a result of Mr. Moss’s material breach of the Moss

Agreement; then Mr. Moss will be entitled to receive from the Company: (a) a cash amount equal to two years of the Fees as in effect

at the termination of the Moss Agreement; and (b) all stock options previously granted by the Company to Mr. Moss which have not

vested shall be deemed to vest and all stock options held by Mr. Moss shall remain exercisable until the earlier of their expiration

date or 90 days from the termination date.

The information in Item 8.01(a) of this current report on Form 6-K (and the applicable exhibits) is incorporated

by reference into our registration statement on Form F-3 (333-227883), originally filed on October 18, 2018, and the preliminary

prospectus supplement thereto filed on March 22, 2019.

|

|

b.

|

Certain Current Reports

|

On November 9, 2018, the Company filed

a current report on Form 6-K, which among other things, described the entry into a placement agency agreement and related securities

purchase agreement (such current report, together with exhibits 10.1, 10.2 and 4.1 thereto, the “November 9, 2018 Current

Report”).

On November 16, 2018, the Company filed a current report on Form 6-K, which among other things, described

the completion of an offering of an aggregate of 4,250,000 common shares, with no par value, and a concurrent private placement

of 4,250,000 (such current report, together with exhibit 99.1 thereto (“Interim financial statements for the three and nine

months ended September 30, 2018 and 2017”) and exhibit 99.2 thereto (“

Management’s

Discussion & Analysis for the nine months ended September 30, 2018 and 2017”), the “November 16, 2018 Current Report”).

On November 26, 2018, the Company filed

a current report on Form 6-K, which among other things, described the appointment of a new officer and a new director (such current

report, together with the exhibits 99.2 and 99.3 thereto, the “November 26, 2018 Current Report”).

The information in Item 8.01(b) of this current report on Form 6-K and the applicable exhibits (including

the November 9, 2018 Current Report, the November 16, 2018 Current Report, the November 26, 2018 Current Report and the respective

applicable exhibits) is incorporated by reference into (i) our registration statement on Form F-3 (333-227883), originally filed

on October 18, 2018, and the preliminary prospectus supplement thereto filed on March 22, 2019 and (ii) our registration statement

on Form F-3 (333-229562) originally filed on February 8, 2019.

Exhibits

|

Exhibit

No.

|

|

Exhibit

|

|

|

|

|

|

99.1

|

|

Executive Employment Agreement between the Company and Jerry Kroll, dated January 1, 2019 (incorporated by reference to Exhibit 10.1 to the registration statement on Form F-3 filed on February 8, 2019)

|

|

99.2

|

|

Executive Employment Agreement between the Company and BKB Management Ltd., dated January 1, 2019 (incorporated by reference to Exhibit 10.2 to the registration statement on Form F-3 filed on February 8, 2019)

|

|

99.3

|

|

Executive Employment Agreement between the Company and Henry Reisner, dated January 1, 2019 (incorporated by reference to Exhibit 10.3 to the registration statement on Form F-3 filed on February 8, 2019)

|

|

99.4

|

|

Executive Employment Agreement between the Company and Isaac Moss, dated January 1, 2019 (incorporated by reference to Exhibit 10.4 to the registration statement on Form F-3 filed on February 8, 2019)

|

|

99.5

|

|

The November 9, 2018 Current Report (incorporated by reference to the Form 6-K filed on November 9, 2018)

|

|

99.6

|

|

The November 16, 2018 Current Report (incorporated by reference to the Form 6-K filed on November 16, 2018)

|

|

99.7

|

|

The November 26, 2018 Current Report (incorporated by reference to the Form 6-K filed on November 26, 2018)

|

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ELECTRAMECCANICA VEHICLES CORP.

|

|

|

|

|

|

Date: March 25, 2019

|

By:

|

/s/ Bal Bhullar

|

|

|

Name:

|

Bal Bhullar

|

|

|

Title:

|

Chief Financial Officer

|

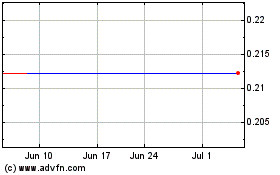

Electrameccanica Vehicles (NASDAQ:SOLO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Electrameccanica Vehicles (NASDAQ:SOLO)

Historical Stock Chart

From Jul 2023 to Jul 2024