Ebix, Inc. (NASDAQ: EBIX), a leading international supplier of

On-Demand software and E-commerce services to the insurance,

financial, healthcare and e-learning industries, today announced

that its joint venture with Bombay Stock Exchange (BSE), Asia’s

oldest exchange, has received formal approval for Certificate of

Registration to act as a direct insurance broker (Life and General)

under the IRDAI (Insurers Brokers) Regulations, 2018. The venture,

branded as BSE-Ebix Insurance Broking Pvt. Ltd., will enable

distribution outlets, wealth management advisors, Point of Sale

Persons (PoSPs) to sell life and non-life insurance products.

BSE-Ebix confirmed that it will soon announce a

formal date for the go-live date of its distribution franchise.

BSE-Ebix aims to offer numerous choices to customers, besides

reaching to remote villages across India to access these products.

The venture will make use of the reach of both BSE and EbixCash

that spans over 3 lakh outlets across the country, and shall cover

the entire insurance lifecycle from customer relationship

management, agency management, multi-quoting, underwriting, policy

creation, claims filing and settlement to back-end insurance policy

administration.

BSE is India’s leading exchange group and has

played a prominent role in developing the Indian capital market.

BSE is a corporatized and demutualized entity, with a broad

shareholder base that includes the leading global exchange-

Deutsche Bourse, as a strategic partner.

EbixCash is the Indian subsidiary of Ebix, Inc.

that today transacts $18 Billion in Gross merchandise value (GMV)

on its platforms, besides being an end-to-end services market

leader in the financial exchange industry.

About BSE

BSE (formerly Bombay Stock Exchange) established

in 1875, is Asia’s first & now the world’s fastest Stock

Exchange with a speed of 6 microseconds. BSE is India’s

leading exchange group and has played a prominent role in

developing the Indian capital market. BSE is a corporatized and

demutualized entity, with a broad shareholder base that includes

the leading global exchange- Deutsche Bourse, as a strategic

partner. BSE provides an efficient and transparent market for

trading in equity, debt instruments, equity derivatives, currency

derivatives, commodity derivatives, interest rate derivatives,

mutual funds and stock lending and borrowing.

BSE also has a dedicated platform for trading in

equities of small and medium enterprises (SMEs) that has been

highly successful. BSE also has a dedicated MF distribution

platform BSE StAR MF which is India Largest Mutual Funds

Distribution Infrastructure. On October 1, 2018, BSE launched

commodity derivatives trading in Gold, Silver, Copper , Oman Crude

Oil Guar Gum , Guar Seeds & Turmeric .

BSE provides a host of other services to capital

market participants including risk management, clearing,

settlement, market data services and education. It has a global

reach with customers around the world and a nation-wide presence.

BSE’s systems and processes are designed to safeguard market

integrity, drive the growth of the Indian capital market and

stimulate innovation and competition across all market

segments.

Indian Clearing Corporation Limited, a wholly

owned subsidiary of BSE, acts as the central counterparty to all

trades executed on the BSE trading platform and provides full

novation, guaranteeing the settlement of all bonafide trades

executed. BSE Institute Ltd, another fully owned subsidiary of BSE

runs one of the most respected capital market educational

institutes in the country. Central Depository Services Ltd. (CDSL),

associate company of BSE, is one of the two Depositories in

India.

BSE has set up an Investor Protection Fund (IPF)

on July 10, 1986 to meet the claims of investors against defaulter

Members, in accordance with the Guidelines issued by the Ministry

of Finance, Government of India. BSE Investor Protection Fund is

responsible for creating Capital markets related awareness among

the investor community in India.

About Ebix

With 50+ offices across 6 continents, Ebix,

Inc., (NASDAQ: EBIX) endeavors to provide On-Demand software and

E-commerce services to the insurance, financial, healthcare and

e-learning industries. In the Insurance sector, Ebix’s main focus

is to develop and deploy a wide variety of insurance and

reinsurance exchanges on an on-demand basis, while also, providing

Software-as-a-Service ("SaaS") enterprise solutions in the area of

CRM, front-end & back-end systems, outsourced administration

and risk compliance services, around the world.

With a "Phygital” strategy that combines 320,000

physical distribution outlets in many Southeast Asian Nations

(“ASEAN”) countries, to an Omni-channel online digital platform,

the EbixCash Financial exchange portfolio encompasses leadership in

areas of domestic & international money remittance, foreign

exchange (Forex), travel, pre-paid & gift cards, utility

payments, lending, wealth management etc. in India and other

markets. EbixCash’s Forex operations have emerged as a leader in

India’s airport Foreign Exchange business with operations in 32

international airports including Delhi, Mumbai, Bangalore,

Hyderabad, Chennai and Kolkata, conducting over $4.8 billion in

gross transaction value per year. EbixCash’s inward remittance

business in India conducts approx. $6.5 billion gross annual

remittance business, confirming its undisputed leadership position

in India. EbixCash, through its travel portfolio of Via and

Mercury, is also one of Southeast Asia’s leading travel exchanges

with over 2,200+ employees, 212,450+ agent network, 25 branches and

over 9,800 corporate clients; processing an estimated $2.5 billion

in gross merchandise value per year. For more information, visit

the Company’s website at www.ebix.com

Contact:

Darren Joseph

IR@ebix.com or +1 678 281 2027

David Collins or Chris Eddy

Catalyst Global + 1 212-924-9800 or

ebix@catalyst-ir.com

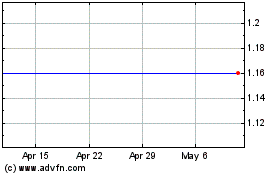

Ebix (NASDAQ:EBIX)

Historical Stock Chart

From Oct 2024 to Nov 2024

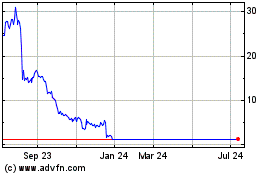

Ebix (NASDAQ:EBIX)

Historical Stock Chart

From Nov 2023 to Nov 2024