East West Bancorp to Present at Keefe, Bruyette & Woods 5th Annual Community Bank Investor Conference

July 26 2004 - 7:55AM

PR Newswire (US)

East West Bancorp to Present at Keefe, Bruyette & Woods 5th

Annual Community Bank Investor Conference SAN MARINO, Calif., July

26 /PRNewswire-FirstCall/ -- East West Bancorp, Inc. (NASDAQ:EWBC),

parent company of East West Bank, one of the nation's premier

community banks and a leading institution focused on the Chinese-

American and other niche markets, today announced that management

is scheduled to present at the invitation-only Keefe Bruyette &

Woods 5th Annual Community Bank Investor Conference. East West is

scheduled to present on Wednesday, July 28, 2004 at 10:30 a.m.

Eastern time. The Bank's presentation will include an overview of

the Company followed by a question and answer session. A live audio

webcast can be accessed at the KBW website at http://www.kbw.com/.

East West Bancorp is a publicly owned company, with $4.9 billion in

assets, whose stock is traded on the Nasdaq National Market under

the symbol "EWBC." The company's wholly owned subsidiary, East West

Bank, is the fourth largest independent commercial bank

headquartered in Los Angeles. East West Bank serves the community

with 40 locations throughout Los Angeles, Orange, San Francisco,

Alameda, Santa Clara, and San Mateo counties and a Beijing

Representative Office in China. It is also one of the largest

financial institutions in the nation focusing on the

Chinese-American community. For more information on East West

Bancorp, visit the company's website at

http://www.eastwestbank.com/. Forward-Looking Statements This

release may contain forward-looking statements, which are included

in accordance with the "safe harbor" provisions of the Private

Securities Litigation Reform Act of 1995 and accordingly, the

cautionary statements contained in East West Bancorp's Annual

Report on Form 10-K for the year ended Dec. 31, 2003 (See Item I --

Business, and Item 7 -- Management's Discussion and Analysis of

Consolidated Financial Condition and Results of Operations), and

other filings with the Securities and Exchange Commission are

incorporated herein by reference. These factors include, but are

not limited to: the effect of interest rate and currency exchange

fluctuations; competition in the financial services market for both

deposits and loans; EWBC's ability to efficiently incorporate

acquisitions into its operations; the ability of EWBC and its

subsidiaries to increase its customer base; the effect of

regulatory and legislative action, including recently enacted

California tax legislation and an announcement by the state's

Franchise Tax Board regarding the taxation of Registered Investment

Companies; and regional and general economic conditions. Actual

results and performance in future periods may be materially

different from any future results or performance suggested by the

forward-looking statements in this release. Such forward-looking

statements speak only as of the date of this release. East West

expressly disclaims any obligation to update or revise any

forward-looking statements found herein to reflect any changes in

the Bank's expectations of results or any change in events. For

further information please contact Julia Gouw, Chief Financial

Officer, +1-626-583-3512, or Steven Canup, Investor Relations,

+1-626-583-3775, both of East West Bancorp, Inc. DATASOURCE: East

West Bancorp, Inc. CONTACT: Julia Gouw, Chief Financial Officer,

+1-626-583-3512, or Steven Canup, Investor Relations,

+1-626-583-3775, both of East West Bancorp, Inc. Web site:

http://www.kbw.com/ Web site: http://www.eastwestbank.com/

Copyright

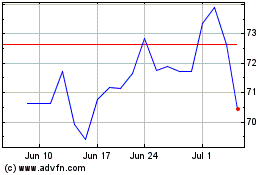

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From Oct 2024 to Nov 2024

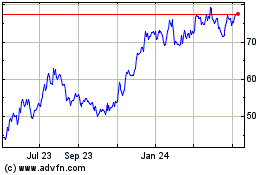

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From Nov 2023 to Nov 2024