East West Bancorp Increased Common Equity by $249 Million on Completion of Comprehensive Capital Plan

July 27 2009 - 6:50AM

Business Wire

East West Bancorp, Inc. (Nasdaq: EWBC), parent company of East

West Bank, today announced it has increased common equity by $249

million on completion of its comprehensive capital plan.

The company concluded its previously announced sale of common

stock, which raised $80.3 million through the issuance of

12,650,000 shares in a public offering last week. It has also

raised $27.5 million in private placements of common stock, and

increased common equity by $110.8 million from the exchanges of

convertible preferred stock to common stock and $30.6 million

from the desecuritization of private label MBS securitizations.

Combined, these initiatives have increased common equity by $249

million. The table below highlights the pro forma impact of these

actions on June 30, 2009 capital ratios, when combined with the

additional capital initiatives completed in the third quarter

2009:

(Dollars in millions)

2Q09

AsReported

2Q09

Pro Forma

Impact(1)

Well Capitalized

RegulatoryRequirement

Total Excess AboveWell

CapitalizedRequirement

Tier 1 leverage capital ratio 10.38% 11.22%

5.00% $768 Tier 1 risk-based capital ratio 12.25% 13.24% 6.00% $757

Total risk-based capital Ratio 14.28% 15.26% 10.00% $551 Tangible

common equity/risk weighted assets 6.16% 8.18% 4.00%(2)

$437(3)

(1)Includes impact of actions

taken in 3Q09 to complete comprehensive capital plan. (2)The

company has followed the tenets of the Supervisory Capital

Assessment Program (SCAP) and applied the “more adverse” stress

test guidelines to our loan and investment portfolios, under which

we can sustain the 4.00% tangible common equity/risk weight assets

ratio required under SCAP. East West Bank was not one of the banks

subject to the SCAP stress test, however, management believes it

was prudent risk management to conduct a similar test, with loss

assumptions similar to the indicative loss rates disclosed in the

SCAP white paper. (3)$437 million represents the amount of tangible

common equity in excess of the 4.00% SCAP requirement.

“The additional capital raised in the public offering, which was

over-subscribed fourfold, reflects the continued demand for our

common stock and, with the completion of our comprehensive capital

plan, we have achieved our capital objectives,” said Dominic Ng,

Chairman, President and Chief Executive Officer of East West. “The

$249 million increase in common equity will provide us with

flexibility to pursue new growth opportunities or aggressively

resolve problem assets, should economic conditions get worse,”

concluded Ng.

About East West

East West Bancorp is a publicly owned company with $12.7 billion

in assets and is traded on the NASDAQ Global Select Market under

the symbol “EWBC”. The Company’s wholly owned subsidiary, East West

Bank, is the second largest independent commercial bank

headquartered in Southern California with 71 branch locations. East

West Bank serves the community with 69 branch locations across

Southern and Northern California and a branch location in Houston,

Texas. East West Bank has three international locations in Greater

China, including a full-service branch in Hong Kong and

representative offices in Beijing and Shanghai.

Forward-Looking Statements

This press release contains statements that the company believes

are “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933, as amended, and

Rule 175 promulgated thereunder, and Section 21E of the

Securities Exchange Act of 1934, as amended, and Rule 3b-6

promulgated thereunder. These statements relate to our financial

condition, results of operations, plans, objectives, future

performance or business. They usually can be identified by the use

of forward-looking language such as “will likely result,” “may,”

“are expected to,” “is anticipated,” “estimate,” “forecast,”

“projected,” “intends to,” or may include other similar words or

phrases such as “believes,” “plans,” “trend,” “objective,”

“continue,” “remain,” or similar expressions, or future or

conditional verbs such as “will,” “would,” “should,” “could,”

“might,” “can,” or similar verbs. You should not place undue

reliance on these statements, as they are subject to risks and

uncertainties, including but not limited to those described in our

most recent Annual Report on Form 10-K, as updated by our

subsequently filed Quarterly Report on Form 10-Q and our Current

Reports on Form 8-K. When considering these forward-looking

statements, you should keep in mind these risks and uncertainties,

as well as any cautionary statements we may make. Moreover, you

should treat these statements as speaking only as of the date they

are made and based only on information then actually known to

us.

There are a number of important factors that could cause future

results to differ materially from historical performance and these

forward-looking statements. Factors that might cause such a

difference include, but are not limited to: (i) changes in our

borrowers’ performance on loans; (ii) changes in the

commercial and consumer real estate markets; (iii) changes in

our costs of operation, compliance and expansion; (iv) changes

in the economy, including inflation; (v) changes in government

interest rate policies; (vi) changes in laws or the regulatory

environment; (vii) changes in critical accounting policies and

judgments; (viii) changes in accounting policies or procedures

as may be required by the Financial Accounting Standards Board or

other regulatory agencies; (ix) changes in the equity and debt

securities markets; (x) changes in competitive pressures on

financial institutions; (xi) effect of additional provision

for loan losses; (xii) effect of any goodwill impairment;

(xiii) fluctuations of our stock price; (xiv) success and

timing of our business strategies; (xv) impact of reputational

risk created by these developments on such matters as business

generation and retention, funding and liquidity; (xvi) changes

in our ability to receive dividends from our subsidiaries; and

(xvii) political developments, wars or other hostilities that

may disrupt or increase volatility in securities or otherwise

affect economic conditions.

You should refer to our periodic and current reports filed with

the SEC for further information on other factors which could cause

actual results to be significantly different from those expressed

or implied by these forward-looking statements. Except as required

by law, East West does not undertake to update any such

forward-looking statements.

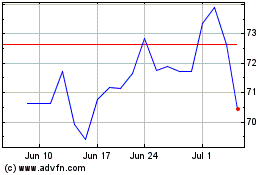

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From May 2024 to Jun 2024

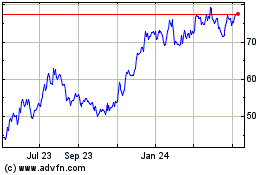

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From Jun 2023 to Jun 2024