Duluth Holdings Inc. (dba, Duluth Trading Company) (“Duluth

Trading” or the “Company”) (NASDAQ: DLTH), a lifestyle brand of

men’s and women’s workwear, casual wear, outdoor apparel and

accessories, today announced its financial results for the fiscal

second quarter ended July 28, 2024.

Summary of the Second Quarter Ended July 28,

2024

- Net sales of 141.6 million increased 1.8% compared to the prior

year second quarter

- Net loss of $3.7 million and adjusted net loss1 of $0.6

million, compared to net loss of $2.0 million in the prior year

second quarter. Adjusted net loss of $0.6 million excludes $1.6

million of restructuring expense and a $2.4 million non-recurring

estimated sales tax expense accrual that is reflected in Selling,

general and administrative expenses

- EPS per diluted share of ($0.11); Adjusted EPS1 of ($0.02)

- Adjusted EBITDA2 increased $2.0 million from the prior year to

$10.6 million, representing 7.5% of net sales

1See Reconciliation of net loss to adjusted net loss and

adjusted net loss to adjusted EPS in the accompanying financial

tables.2See Reconciliation of net loss to EBITDA and EBITDA to

Adjusted EBITDA in the accompanying financial tables.

Management Commentary

President and CEO, Sam Sato commented, “We are pleased to have

returned to top-line growth in the second quarter, while also

expanding our gross margin as we begin to see the benefits of our

product development and sourcing initiatives. During the quarter we

saw a trend line improvement in both traffic and transactions with

healthy shopper conversion, fueling 1.8% year-over-year net sales

growth. The quarter strength was highlighted by product innovation

wins including Dry on the Fly, Armachillo and DuluthFlex Fire Hose

Sweat Management.

“We entered the third quarter with a strong lineup of newness

such as Duluth Reserve, Bullpen 3D and Souped up Sweats and we

expanded our Plus size assortment including our successful

Adjustabust, a bonded zip-front bra with a sleek silhouette and

criss-crossed back offering extra support and security. On August

10th we successfully hosted our second underwear trade-up event

engaging with existing and new customers throughout our local store

markets. The event generated a lot of buzz and resulted in a jump

in traffic, higher overall sales, and 40% of trade ups from our

female shoppers, which remains a key strategic growth opportunity

for Duluth.”

Sato concluded, “From a longer-term structural update, we have

successfully moved into phase two of our fulfillment center network

plan to maximize productivity and capacity. The tremendous success

we are seeing with our near fully automated fulfillment center in

Adairsville, Georgia, which processed 58% of total company volume

during the first of half of our fiscal year, allowed for the

planned exit of our Dubuque fulfillment center this October.

Importantly, we will begin to realize the SG&A benefits in

Q4.”

Operating Results for the Second Quarter Ended July 28,

2024

Net sales increased 1.8% to $141.6 million, compared to $139.1

million in the same period a year ago. Direct to-consumer net sales

increased by 5.6% to $91.7 million primarily driven by higher site

conversion compared to the prior year. Retail store net sales

decreased by 4.4% to $49.9 million due to slower store traffic,

partially offset by strong conversion rates.

Gross profit increased to $74.0 million, or 52.3% of net sales

up 90 basis points, compared to $71.5 million, or 51.4% of net

sales, in the corresponding prior year period driven by our

sourcing initiative.

Selling, general and administrative expenses increased 4.6% to

$76.3 million, compared to $72.9 million in the same period a year

ago. The increase included the $2.4 million non-recurring estimated

sales tax expense. Excluding this non-recurring expense, selling,

general and administrative expenses increased $1.0 million to $73.9

million, representing 52.2% of net sales and leveraging 20 basis

points compared to the prior year.

As part of the Company’s in-depth review of the retail portfolio

strategy, fulfillment center network, and benchmarking to identify

structural opportunities to improve operating margin, working

capital, and asset efficiency, in the second quarter of 2024, the

Company began phase two of the fulfillment center network plan to

maximize productivity and capacity. As a result, the Company

initiated a lease amendment for one of its legacy fulfillment

centers to accelerate the lease expiration date from September 2030

to October 2024.

The Company expects to incur total restructuring expenses

related to the lease amendment of $7.4 million during the second

and third quarters of 2024, $1.6 million of which was recognized

during the second quarter. The Company expects a total cash outlay

of approximately $4.4 million related to this initiative, including

$1.7 million to be paid in the current fiscal year.

Exiting the legacy facility is projected to reduce overhead

expenses by approximately $1.2 million during the fourth quarter of

the current fiscal year. The Company expects an expense reduction

of approximately $5.0 million and cash savings of $4.0 million

annually.

As previously mentioned, during the third quarter last year, the

Company went live with a highly automated fulfillment center in

Adairsville, Georgia which now processes 58% of all online orders

and replenishment volume. The Adairsville facility has shortened

delivery times while driving lower cost per unit to fulfill an

order, which was 32% of the cost of the three legacy fulfillment

centers over the first half of the year. The success and

productivity from the critical Adairsville facility investment has

allowed the Company to accelerate phase two of its overall

fulfillment center network plan.

Balance Sheet and Liquidity

The Company ended the quarter with $9.8 million of cash and cash

equivalents, net working capital of $79.8 million, no outstanding

debt on the Duluth Trading $200 million revolving line of credit

and $209.8 million of liquidity.

Fiscal 2024 Outlook

The Company reaffirmed its fiscal 2024 outlook, excluding

restructuring expense and sales tax expense accrual:

- Net sales of approximately $640 million

- Adjusted EPS1 of approximately ($0.22) per diluted share

- Adjusted EBITDA2 of approximately $39 million

- Capital expenditures, inclusive of software hosting

implementation costs, of approximately $25 million

1See Reconciliation of forecasted net loss to forecasted

adjusted net loss and forecasted adjusted net loss to forecasted

adjusted EPS in the accompanying financial tables.2See

Reconciliation of forecasted net loss to forecasted EBITDA and

forecasted EBITDA to forecasted Adjusted EBITDA in the accompanying

financial tables.

Conference Call Information

A conference call and audio webcast with analysts and investors

will be held on Thursday, August 29, 2024 at 9:30 am Eastern Time,

to discuss the results and answer questions.

- Live conference

call: 844-875-6915 (domestic) or 412-317-6711 (international)

- Conference call

replay available through September 5, 2024: 877-344-7529 (domestic)

or 412-317-0088 (international)

- Replay access code:

5705373

- Live and archived

webcast: ir.duluthtrading.com

Investors can pre-register for the earnings conference call to

expedite their entry into the call and avoid waiting for a live

operator. To pre-register for the call, please visit

https://dpregister.com/sreg/10191086/fd20abea22 and enter your

contact information. You will then be issued a personalized phone

number and pin to dial into the live conference call. Investors can

pre-register any time prior to the start of the conference

call.

About Duluth Trading

Duluth Trading is a lifestyle brand for the Modern, Self-Reliant

American. Based in Mount Horeb, Wisconsin, we offer high quality,

solution-based casual wear, workwear and accessories for men and

women who lead a hands-on lifestyle and who value a job well-done.

We provide our customers an engaging and entertaining experience.

Our marketing incorporates humor and storytelling that conveys the

uniqueness of our products in a distinctive, fun way, and are

available through our content-rich website, catalogs, and “store

like no other” retail locations. We are committed to outstanding

customer service backed by our “No Bull Guarantee” - if it’s not

right, we’ll fix it. Visit our website at

http://www.duluthtrading.com.

Non-GAAP Measurements

Management believes that non-GAAP financial measures may be

useful in certain instances to provide additional meaningful

comparisons between current results and results in prior operating

periods. Within this release, including the tables attached hereto,

reference is made to adjusted earnings before interest, taxes,

depreciation and amortization (EBITDA), adjusted net loss and

adjusted earnings per share (EPS). See attached table

“Reconciliation of Net Loss to EBITDA and EBITDA to Adjusted

EBITDA,” for a reconciliation of net loss to EBITDA and EBITDA to

Adjusted EBITDA for the three and six months ended July 28, 2024,

versus the three and six months ended July 30, 2023 and attached

table “Reconciliation of Net Loss to Adjusted Net Loss and Adjusted

Net Loss to Adjusted EPS,” for a reconciliation of net loss to

adjusted net loss and adjusted net loss to adjusted EPS for the

three and six months ended July 28, 2024.

Adjusted EBITDA is a metric used by management and frequently

used by the financial community, which provides insight into an

organization’s operating trends and facilitates comparisons between

peer companies, since interest, taxes, depreciation and

amortization can differ greatly between organizations as a result

of differing capital structures and tax strategies. Adjusted EBITDA

excludes certain items that are unusual in nature or not comparable

from period to period.

Adjusted Net Loss and Adjusted EPS is a metric used by

management and frequently used by the financial community, which

provides insight into the effectiveness of our business strategies

and to compare our performance against that of peer companies.

Adjusted Net Loss and Adjusted EPS excludes restructuring expenses

and a one-time estimated sales tax accrual that are not comparable

from period to period.

The Company provides this information to investors to assist in

comparisons of past, present and future operating results and to

assist in highlighting the results of on-going operations. While

the Company’s management believes that non-GAAP measurements are

useful supplemental information, such adjusted results are not

intended to replace the Company’s GAAP financial results and should

be read in conjunction with those GAAP results.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements, other than statements of historical facts

included in this press release, including statements concerning

Duluth Trading's plans, objectives, goals, beliefs, business

strategies, future events, business conditions, its results of

operations, financial position and its business outlook, business

trends and certain other information herein, including statements

under the heading “Fiscal 2024 Outlook” are forward-looking

statements. You can identify forward-looking statements by the use

of words such as “may,” ”might,” “will,” “should,” “expect,”

“plan,” “anticipate,” “could,” “believe,” “estimate,” “project,”

“target,” “predict,” “intend,” “future,” “budget,” “goals,”

“potential,” “continue,” “design,” “objective,” “forecasted,”

“would” and other similar expressions. The forward-looking

statements are not historical facts, and are based upon Duluth

Trading's current expectations, beliefs, estimates, and

projections, and various assumptions, many of which, by their

nature, are inherently uncertain and beyond Duluth Trading's

control. Duluth Trading's expectations, beliefs and projections are

expressed in good faith, and Duluth Trading believes there is a

reasonable basis for them. However, there can be no assurance that

management's expectations, beliefs, estimates, and projections will

be achieved and actual results may vary materially from what is

expressed in or indicated by the forward-looking statements.

Forward-looking statements are subject to risks and uncertainties

that could cause actual performance or results to differ materially

from those expressed in the forward-looking statements, including,

among others, the risks, uncertainties, and factors set forth under

Part 1, Item 1A “Risk Factors” in the Company’s Annual Report on

Form 10-K filed with the SEC on March 22, 2024 and other factors as

may be periodically described in Duluth Trading’s subsequent

filings with the SEC. These risks and uncertainties include, but

are not limited to, the following: the impact of inflation and

measures to control inflation on our results of operations; the

prolonged effects of economic uncertainties on store and website

traffic and disruptions to our distribution network, supply chains

and operations; our ability to maintain and enhance a strong brand

and sub-brand image; adapting to declines in consumer confidence,

inflation and decreases in consumer spending; disruptions in our

e-commerce platform; effectively adapting to new challenges

associated with our expansion into new geographic markets; our

ability to meet customer delivery time expectations; natural

disasters, unusually adverse weather conditions, boycotts,

prolonged public health crises, epidemics or pandemics and

unanticipated events; generating adequate cash from our existing

stores and direct sales to support our growth; the impact of

changes in corporate tax regulations and sales tax; identifying and

responding to new and changing customer preferences; the success of

the locations in which our stores are located; effectively relying

on sources for merchandise located in foreign markets;

transportation delays and interruptions, including port congestion;

inability to timely and effectively obtain shipments of products

from our suppliers and deliver merchandise to our customers; the

inability to maintain the performance of a maturing store

portfolio; our inability to deploy marketing tactics to strengthen

brand awareness and attract new customers in a cost effective

manner; our ability to successfully open new stores; competing

effectively in an environment of intense competition; our ability

to adapt to significant changes in sales due to the seasonality of

our business; price reductions or inventory shortages resulting

from failure to purchase the appropriate amount of inventory in

advance of the season in which it will be sold; the potential for

further increases in price and availability of raw materials; our

dependence on third-party vendors to provide us with sufficient

quantities of merchandise at acceptable prices; the susceptibility

of the price and availability of our merchandise to international

trade conditions; failure of our vendors and their manufacturing

sources to use acceptable labor or other practices; our dependence

upon key executive management or our inability to hire or retain

the talent required for our business; increases in costs of fuel or

other energy, transportation or utility costs and in the costs of

labor and employment; failure of our information technology systems

to support our current and growing business, before and after our

planned upgrades; disruptions in our supply chain and fulfillment

centers; our inability to protect our trademarks or other

intellectual property rights; infringement on the intellectual

property of third parties; acts of war, terrorism or civil unrest;

the impact of governmental laws and regulations and the outcomes of

legal proceedings; changes in U.S. and non-U.S. laws affecting the

importation and taxation of goods, including imposition of

unilateral tariffs on imported goods; our ability to secure the

personal and/or financial information of our customers and

employees; our ability to comply with the security standards for

the credit card industry; our failure to maintain adequate internal

controls over our financial and management systems; acquisition,

disposition, and development risks; and other factors that may be

disclosed in our SEC filings or otherwise. Forward-looking

statements speak only as of the date the statements are made.

Duluth Trading assumes no obligation to update forward-looking

statements to reflect actual results, subsequent events or

circumstances or other changes affecting forward-looking

information except to the extent required by applicable securities

laws.

(Tables Follow)***

|

DULUTH HOLDINGS INC.Condensed Consolidated

Balance Sheets(Unaudited)

(Amounts in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

July 28, 2024 |

|

January 28, 2024 |

|

July 30, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

9,787 |

|

|

$ |

32,157 |

|

|

$ |

11,148 |

|

|

Receivables |

|

|

8,318 |

|

|

|

5,955 |

|

|

|

5,758 |

|

|

Income tax receivable |

|

|

313 |

|

|

|

617 |

|

|

|

140 |

|

|

Inventory, net |

|

|

168,718 |

|

|

|

125,757 |

|

|

|

157,126 |

|

|

Prepaid expenses & other current assets |

|

|

19,722 |

|

|

|

16,488 |

|

|

|

17,665 |

|

|

Total current assets |

|

|

206,858 |

|

|

|

180,974 |

|

|

|

191,837 |

|

|

Property and equipment, net |

|

|

121,148 |

|

|

|

132,718 |

|

|

|

125,970 |

|

|

Operating lease right-of-use assets |

|

|

107,799 |

|

|

|

121,430 |

|

|

|

126,132 |

|

|

Finance lease right-of-use assets, net |

|

|

34,646 |

|

|

|

40,315 |

|

|

|

45,742 |

|

|

Available-for-sale security |

|

|

4,877 |

|

|

|

4,986 |

|

|

|

5,254 |

|

|

Other assets, net |

|

|

8,961 |

|

|

|

9,020 |

|

|

|

7,853 |

|

|

Deferred tax assets |

|

|

4,306 |

|

|

|

1,010 |

|

|

|

353 |

|

|

Total assets |

|

$ |

488,595 |

|

|

$ |

490,453 |

|

|

$ |

503,141 |

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

|

Trade accounts payable |

|

$ |

77,600 |

|

|

$ |

51,122 |

|

|

$ |

59,259 |

|

|

Accrued expenses and other current liabilities |

|

|

30,069 |

|

|

|

30,930 |

|

|

|

28,215 |

|

|

Current portion of operating lease liabilities |

|

|

16,027 |

|

|

|

16,401 |

|

|

|

15,993 |

|

|

Current portion of finance lease liabilities |

|

|

2,450 |

|

|

|

3,149 |

|

|

|

2,964 |

|

|

Current maturities of TRI long-term debt1 |

|

|

888 |

|

|

|

847 |

|

|

|

807 |

|

|

Total current liabilities |

|

|

127,034 |

|

|

|

102,449 |

|

|

|

107,238 |

|

|

Operating lease liabilities, less current maturities |

|

|

92,275 |

|

|

|

106,413 |

|

|

|

110,999 |

|

|

Finance lease liabilities, less current maturities |

|

|

31,911 |

|

|

|

34,276 |

|

|

|

35,906 |

|

| TRI

long-term debt, less current maturities1 |

|

|

24,723 |

|

|

|

25,141 |

|

|

|

25,538 |

|

|

Total liabilities |

|

|

275,943 |

|

|

|

268,279 |

|

|

|

279,681 |

|

|

Shareholders' equity: |

|

|

|

|

|

|

|

|

|

|

Treasury stock |

|

|

(2,243 |

) |

|

|

(1,738 |

) |

|

|

(1,733 |

) |

|

Capital stock |

|

|

106,169 |

|

|

|

103,579 |

|

|

|

101,415 |

|

|

Retained earnings |

|

|

112,199 |

|

|

|

123,816 |

|

|

|

127,299 |

|

|

Accumulated other comprehensive loss, net |

|

|

(436 |

) |

|

|

(427 |

) |

|

|

(295 |

) |

|

Total shareholders' equity of Duluth Holdings Inc. |

|

|

215,689 |

|

|

|

225,230 |

|

|

|

226,686 |

|

|

Noncontrolling interest |

|

|

(3,037 |

) |

|

|

(3,056 |

) |

|

|

(3,226 |

) |

|

Total shareholders' equity |

|

|

212,652 |

|

|

|

222,174 |

|

|

|

223,460 |

|

|

Total liabilities and shareholders' equity |

|

$ |

488,595 |

|

|

$ |

490,453 |

|

|

$ |

503,141 |

|

1Represents debt of the variable interest entity, TRI Holdings,

LLC, that is consolidated in accordance with ASC 810,

Consolidation. Duluth Holdings Inc. is not the guarantor nor the

obligor of this debt.

|

DULUTH HOLDING INC.Consolidated Statements

of Operations(Unaudited)(Amounts

in thousands, except per share figures) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

|

July 28, 2024 |

|

July 30, 2023 |

|

July 28, 2024 |

|

July 30, 2023 |

|

Net sales |

|

$ |

141,619 |

|

|

$ |

139,099 |

|

|

$ |

258,303 |

|

|

$ |

262,858 |

|

|

Cost of goods sold (excluding depreciation and amortization) |

|

|

67,623 |

|

|

|

67,616 |

|

|

|

122,683 |

|

|

|

125,724 |

|

|

Gross profit |

|

|

73,996 |

|

|

|

71,483 |

|

|

|

135,620 |

|

|

|

137,134 |

|

|

Selling, general and administrative expenses1 |

|

|

76,286 |

|

|

|

72,926 |

|

|

|

146,881 |

|

|

|

143,126 |

|

|

Restructuring expense |

|

|

1,596 |

|

|

|

— |

|

|

|

1,596 |

|

|

|

— |

|

|

Operating loss |

|

|

(3,886 |

) |

|

|

(1,443 |

) |

|

|

(12,857 |

) |

|

|

(5,992 |

) |

|

Interest expense |

|

|

988 |

|

|

|

880 |

|

|

|

1,981 |

|

|

|

1,814 |

|

|

Other income, net |

|

|

145 |

|

|

|

109 |

|

|

|

161 |

|

|

|

257 |

|

|

Loss before income taxes |

|

|

(4,729 |

) |

|

|

(2,214 |

) |

|

|

(14,677 |

) |

|

|

(7,549 |

) |

|

Income tax benefit |

|

|

(996 |

) |

|

|

(202 |

) |

|

|

(3,079 |

) |

|

|

(1,660 |

) |

| Net

loss |

|

|

(3,733 |

) |

|

|

(2,012 |

) |

|

|

(11,598 |

) |

|

|

(5,889 |

) |

|

Less: Net income (loss) attributable to noncontrolling

interest |

|

|

11 |

|

|

|

(8 |

) |

|

|

19 |

|

|

|

(16 |

) |

| Net

loss attributable to controlling interest |

|

$ |

(3,744 |

) |

|

$ |

(2,004 |

) |

|

$ |

(11,617 |

) |

|

$ |

(5,873 |

) |

|

Basic earnings per share (Class A and Class

B): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares of common stock outstanding |

|

|

33,367 |

|

|

|

32,952 |

|

|

|

33,247 |

|

|

|

32,912 |

|

| Net

loss per share attributable to controlling interest |

|

$ |

(0.11 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.35 |

) |

|

$ |

(0.18 |

) |

|

Diluted earnings per share (Class A and Class

B): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares and equivalents outstanding |

|

|

33,367 |

|

|

|

32,952 |

|

|

|

33,247 |

|

|

|

32,912 |

|

| Net

loss per share attributable to controlling interest |

|

$ |

(0.11 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.35 |

) |

|

$ |

(0.18 |

) |

1In conjunction with ongoing state sales tax audits the Company

began a review of its sales tax positions. As a result of the

review, the Company recorded an estimated sales tax expense accrual

of $2.4M that is reflected in Selling, general and administrative

expenses.

|

DULUTH HOLDINGS INC.Consolidated

Statements of Cash

Flows(Unaudited)(Amounts in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended |

|

|

|

July 28, 2024 |

|

July 30, 2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

Net loss |

|

$ |

(11,598 |

) |

|

$ |

(5,889 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

16,297 |

|

|

|

14,868 |

|

|

Stock based compensation |

|

|

2,383 |

|

|

|

2,284 |

|

|

Deferred income taxes |

|

|

(3,293 |

) |

|

|

(1,553 |

) |

|

Loss on disposal of property and equipment |

|

|

77 |

|

|

|

16 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

Receivables |

|

|

(2,363 |

) |

|

|

283 |

|

|

Income taxes receivable |

|

|

304 |

|

|

|

(140 |

) |

|

Inventory |

|

|

(42,961 |

) |

|

|

(2,204 |

) |

|

Prepaid expense & other current assets |

|

|

130 |

|

|

|

(1,351 |

) |

|

Software hosting implementation costs, net |

|

|

(3,406 |

) |

|

|

(370 |

) |

|

Trade accounts payable |

|

|

26,623 |

|

|

|

2,716 |

|

|

Income taxes payable |

|

|

— |

|

|

|

(1,761 |

) |

|

Accrued expenses and deferred rent obligations |

|

|

(591 |

) |

|

|

(7,343 |

) |

|

Other assets |

|

|

(2 |

) |

|

|

(20 |

) |

|

Noncash lease impacts |

|

|

1,348 |

|

|

|

(785 |

) |

| Net

cash used in operating activities |

|

|

(17,052 |

) |

|

|

(1,249 |

) |

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(3,183 |

) |

|

|

(31,483 |

) |

|

Principal receipts from available-for-sale security |

|

|

97 |

|

|

|

88 |

|

| Net

cash used in investing activities |

|

|

(3,086 |

) |

|

|

(31,395 |

) |

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

Proceeds from line of credit |

|

|

40,500 |

|

|

|

10,000 |

|

|

Payments on line of credit |

|

|

(40,500 |

) |

|

|

(10,000 |

) |

|

Payments on TRI long term debt |

|

|

(412 |

) |

|

|

(373 |

) |

|

Payments on finance lease obligations |

|

|

(1,521 |

) |

|

|

(1,397 |

) |

|

Payments of tax withholding on vested restricted shares |

|

|

(505 |

) |

|

|

(274 |

) |

|

Other |

|

|

206 |

|

|

|

288 |

|

| Net

cash used in financing activities |

|

|

(2,232 |

) |

|

|

(1,756 |

) |

|

Decrease in cash and cash equivalents |

|

|

(22,370 |

) |

|

|

(34,400 |

) |

|

Cash and cash equivalents at beginning of period |

|

|

32,157 |

|

|

|

45,548 |

|

|

Cash and cash equivalents at end of period |

|

$ |

9,787 |

|

|

$ |

11,148 |

|

|

Supplemental disclosure of cash flow

information: |

|

|

|

|

|

|

|

Interest paid |

|

$ |

1,981 |

|

|

$ |

1,814 |

|

|

Income taxes paid |

|

$ |

125 |

|

|

$ |

1,795 |

|

|

Supplemental disclosure of non-cash

information: |

|

|

|

|

|

|

|

Unpaid liability to acquire property and equipment |

|

$ |

1,459 |

|

|

$ |

1,336 |

|

|

DULUTH HOLDINGS INC.Reconciliation of Net

Loss to EBITDA and EBITDA to Adjusted EBITDAFor

the Fiscal Quarter and Six Months Ended July 28, 2024 and July 30,

2023(Unaudited)(Amounts in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

|

July 28, 2024 |

|

July 30, 2023 |

|

July 28, 2024 |

|

July 30, 2023 |

| (in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(3,733 |

) |

|

$ |

(2,012 |

) |

|

$ |

(11,598 |

) |

|

$ |

(5,889 |

) |

|

Depreciation and amortization |

|

|

8,046 |

|

|

|

7,455 |

|

|

|

16,297 |

|

|

|

14,868 |

|

|

Amortization of internal-use software hosting |

|

|

|

|

|

|

|

|

|

|

|

|

|

subscription implementation costs |

|

|

1,292 |

|

|

|

1,150 |

|

|

|

2,462 |

|

|

|

2,420 |

|

|

Interest expense |

|

|

988 |

|

|

|

880 |

|

|

|

1,981 |

|

|

|

1,814 |

|

|

Income tax benefit |

|

|

(996 |

) |

|

|

(202 |

) |

|

|

(3,079 |

) |

|

|

(1,660 |

) |

|

EBITDA |

|

$ |

5,597 |

|

|

$ |

7,271 |

|

|

$ |

6,063 |

|

|

$ |

11,553 |

|

|

Stock based compensation |

|

|

1,011 |

|

|

|

1,294 |

|

|

|

2,383 |

|

|

|

2,284 |

|

|

Restructuring expense |

|

|

1,596 |

|

|

|

— |

|

|

|

1,596 |

|

|

|

— |

|

|

Sales tax expense accrual |

|

|

2,406 |

|

|

|

— |

|

|

|

2,406 |

|

|

|

— |

|

|

Adjusted EBITDA |

|

$ |

10,610 |

|

|

$ |

8,565 |

|

|

$ |

12,448 |

|

|

$ |

13,837 |

|

|

DULUTH HOLDINGS INC.Reconciliation of

Forecasted Net Loss to Forecasted EBITDA and Forecasted EBITDA to

Forecasted Adjusted EBITDAFor the Fiscal Year

Ending February 2,

2025(Unaudited)(Amounts in

thousands) |

|

|

|

|

|

|

Forecasted |

|

|

|

|

Net loss |

|

$ |

(14,800 |

) |

|

Depreciation and amortization |

|

|

33,200 |

|

|

Amortization of internal-use software hosting subscription

implementation costs |

|

|

5,000 |

|

|

Interest expense |

|

|

5,450 |

|

|

Income tax benefit |

|

|

(4,350 |

) |

|

EBITDA |

|

$ |

24,500 |

|

|

Stock based compensation |

|

|

4,694 |

|

|

Restructuring expense |

|

|

7,400 |

|

|

Sales tax expense accrual |

|

|

2,406 |

|

|

Adjusted EBITDA |

|

$ |

39,000 |

|

|

DULUTH HOLDINGS INC.Reconciliation of

Forecasted Net Loss to Forecasted Adjusted Net Loss and Forecasted

Adjusted Net Loss to Forecasted Adjusted EPSFor

the Fiscal Year Ending February 2,

2025(Unaudited)(Amounts in

thousands) |

|

|

|

|

|

|

|

|

|

Forecasted |

|

|

|

|

|

|

| (in

thousands, except per share amounts) |

|

|

Amount |

|

|

Per share |

|

Forecasted Net Loss |

|

$ |

(14,800 |

) |

|

$ |

(0.45 |

) |

|

Plus: Forecasted income tax benefit |

|

|

(4,350 |

) |

|

|

(0.13 |

) |

|

Forecasted Net loss before income taxes |

|

$ |

(19,150 |

) |

|

$ |

(0.58 |

) |

|

Plus: Forecasted restructuring expenses |

|

|

7,400 |

|

|

|

0.22 |

|

|

Plus: Sales tax expense accrual |

|

|

2,406 |

|

|

|

0.07 |

|

|

Forecasted Adjusted loss before income taxes |

|

$ |

(9,344 |

) |

|

$ |

(0.28 |

) |

|

Forecasted Adjusted estimated income tax benefit |

|

|

(1,944 |

) |

|

|

(0.06 |

) |

|

Forecasted Adjusted net loss |

|

$ |

(7,400 |

) |

|

$ |

(0.22 |

) |

|

DULUTH HOLDINGS INC.Reconciliation of Net

Loss to Adjusted Net Loss and Adjusted Net Loss to Adjusted

EPSFor the Fiscal Quarter and Six Months Ended

July 28, 2024(Unaudited)(Amounts

in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

July 28, 2024 |

|

|

July 28, 2024 |

| (in

thousands, except per share amounts) |

|

Amount |

|

|

Per share |

|

|

|

Amount |

|

|

Per share |

|

Net Loss |

$ |

(3,733 |

) |

|

$ |

(0.11 |

) |

|

|

$ |

(11,598 |

) |

|

$ |

(0.35 |

) |

|

Plus: Income tax benefit |

|

(996 |

) |

|

|

(0.03 |

) |

|

|

|

(3,079 |

) |

|

|

(0.09 |

) |

| Net

loss before income taxes |

$ |

(4,729 |

) |

|

$ |

(0.14 |

) |

|

|

$ |

(14,677 |

) |

|

$ |

(0.44 |

) |

|

Plus: Restructuring expenses |

|

1,596 |

|

|

|

0.05 |

|

|

|

|

1,596 |

|

|

|

0.05 |

|

|

Plus: Sales tax expense accrual |

|

2,406 |

|

|

|

0.07 |

|

|

|

|

2,406 |

|

|

|

0.07 |

|

|

Adjusted loss before income taxes |

$ |

(727 |

) |

|

$ |

(0.02 |

) |

|

|

$ |

(10,675 |

) |

|

$ |

(0.32 |

) |

|

Adjusted estimated income tax benefit |

|

(159 |

) |

|

|

(0.00 |

) |

|

|

|

(2,242 |

) |

|

|

(0.07 |

) |

|

Adjusted net loss |

$ |

(568 |

) |

|

$ |

(0.02 |

) |

|

|

$ |

(8,433 |

) |

|

$ |

(0.25 |

) |

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/258f8294-62c0-412d-b897-efc33dd32268

Investor Contacts:

Tom Filandro

ICR, Inc.

(646) 277-1200

DuluthIR@icrinc.com

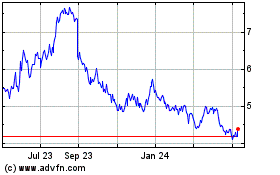

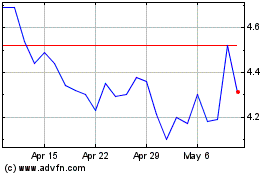

Duluth (NASDAQ:DLTH)

Historical Stock Chart

From Oct 2024 to Nov 2024

Duluth (NASDAQ:DLTH)

Historical Stock Chart

From Nov 2023 to Nov 2024