Current Report Filing (8-k)

October 06 2022 - 4:10PM

Edgar (US Regulatory)

0000785557false00007855572022-10-062022-10-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 3, 2022

DLH Holdings Corp.

(Exact name of Registrant as Specified in its Charter) | | | | | | | | | | | | | | |

| New Jersey | | 0-18492 | | 22-1899798 |

| (State or Other Jurisdiction of Incorporation | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

3565 Piedmont Road, NE, Building 3, Suite 700

Atlanta, GA 30305

(Address of Principal Executive Offices, and Zip Code)

(866) 952-1647

Registrant's telephone number, Including Area Code (Former Name or Former Address, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | DLHC | Nasdaq | Capital Market |

| | | |

| | |

CHECK THE APPROPRIATE BOX BELOW IF THE FORM 8-K FILING IS INTENDED TO SIMULTANEOUSLY SATISFY THE FILING OBLIGATION OF THE REGISTRANT UNDER ANY OF THE FOLLOWING PROVISIONS: |

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | | | | |

| Item 5.02 | Departure of Directors of Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

| | |

On October 3, 2022, DLH Holdings Corp. (“DLH” or the “Company”) entered into a new employment agreement with Zachary C. Parker, its Chief Executive Officer and President. The new employment agreement with Mr. Parker is dated September 30, 2022, is effective as of October 1, 2022 and will expire September 30, 2025. The following is a summary of the terms of the new employment agreement with Mr. Parker, which summary is qualified in its entirety by reference to the full text of such agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K.

Mr. Parker will continue to serve as the Chief Executive Officer and President of DLH and as a member of its board of directors. Under the employment agreement, Mr. Parker will initially receive a base salary of $675,000 per annum and provided, that he achieves the annual performance targets determined by the Management Resources and Compensation Committee of the board of directors (the “Committee”), his base salary during the second and third years of the agreement will be paid at the rate of at least $725,000 per annum and $750,000 per annum, respectively. In addition, Mr. Parker is eligible to receive an annual bonus targeted at 100% of base salary for each fiscal year of employment based on performance targets and other key objectives established by the Committee.

During the term of the agreement, Mr. Parker shall also be eligible to receive equity or performance awards pursuant to long-term incentive compensation plans as may be approved by the Committee. The actual grant date value of any such awards shall be determined in the discretion of the Committee or Board and any such awards shall include such vesting conditions and other terms and conditions as determined by the Committee or the Board; provided, that the target values of such award opportunities will be (i) two hundred percent (200%) of his base salary for the first incentive award which may be granted during the first year of the agreement; (ii) two hundred and twenty-five percent (225%) of his base salary for the second incentive award which may be granted during the second year of the agreement, and (iii) two hundred and fifty percent (250%) of his annual base salary for the third incentive award which may be granted during the third year of this agreement.

In the event of the termination of Mr. Parker’s employment by us without “cause” or by him for “good reason”, as such terms are defined in the employment agreement, he would be entitled to: (a) a severance payment of 24 months of base salary; (b) continued participation in our health and welfare plans for up to 18 months; (c) all accrued but unpaid compensation; and (d) the accelerated vesting of equity compensation awards to the extent they are subject to time-based vesting conditions. If his employment is terminated because of death or disability, he or his beneficiary, as the case may be, will be paid his accrued compensation, a pro rata bonus for the year of termination, the accelerated vesting of outstanding equity compensation awards and in the case of disability, a severance payment of one year of base salary. Further, under the new employment agreement, if within 180 days of a “change in control” (as defined in the new employment agreement) either Mr. Parker’s employment is terminated without cause or he terminates his employment for good reason, he would be entitled to: (a) a severance payment of 250% of base salary; (b) continued participation in our health and welfare plans for up to 18 months; (c) all accrued but unpaid compensation; and (d) the accelerated vesting of equity compensation awards held by him. Such benefits remain subject to limitation to avoid the imposition of the excise tax imposed by Section 4999 of the Internal Revenue Code of 1986, as amended (the “Code”) if such payments would constitute an “excess parachute payment” as defined in Section 280G of the Code.

Pursuant to the employment agreement, Mr. Parker is subject to customary confidentiality, non-solicitation of employees and non-competition obligations that survive the termination of such agreement.

|

| | |

| Item 9.01 | Financial Statements and Exhibits |

| | |

(d) Exhibits | |

| | |

| The following exhibit is attached to this Current Report on Form 8-K: |

Exhibit Number | Exhibit Title or Description |

| 10.1 | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized. | | | | | | | | |

| | | DLH Holdings Corp. |

| | | |

| | | By: /s/ Kathryn M. JohnBull |

| | | |

| | | Name: Kathryn M. JohnBull |

| | | Title: Chief Financial Officer |

| Date: October 6, 2022 | | |

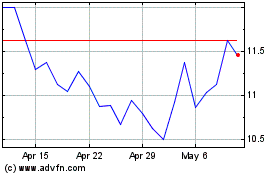

DLH (NASDAQ:DLHC)

Historical Stock Chart

From Jun 2024 to Jul 2024

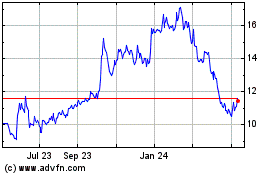

DLH (NASDAQ:DLHC)

Historical Stock Chart

From Jul 2023 to Jul 2024