Crocs, Inc. - Momentum

June 20 2011 - 8:00PM

Zacks

Crox, Inc. (CROX) has been bucking the weak market, recently

hitting a new multi-year high after reporting a solid 26% earnings

surprise in late April. With estimates on the upswing and a bullish

growth projection, this Zacks #1 rank stock is a comfortable take

on momentum.

Company Description

Crox, Inc. designs and sells footwear, apparel and

accessories for men, woman and children worldwide. The company was

founded in 1999 and has a market cap of $2.07 billion.

CROX has been a strong performer in 2011, handily

outperforming the market with a 35% gain. The bullish movement has

been predicated on impressive growth, last on display with strong

Q1 results from late April that came in ahead of expectations.

First-Quarter Results

Revenue for the period was up 36% from last year to

$227 million. Earnings also looked good, coming in at 24 cents, 26%

ahead of the Zacks Consensus Estimate, where the company has an

average earnings surprise of 60% over the last four quarters.

The company continued to see strong results across

its multiple distribution channels, with wholesale sales up 37% to

$165 million and Internet sales up 35% to $17 million.

Crox also boasts strong geographic diversity, with

Americas up 35% to $100 million and Europe up 42.5% to $54

million.

Financial Profile

CROX has seen its balance sheet strengthen over the

last year as well, with cash and short-term investments up $19

million to $115.5 million against total debt of just $7

million.

Estimates

We saw some decent movement in estimates off the

good quarter, with the current year adding 5 cents to $1.11. The

next-year estimate is pegged at $1.38, a bullish 24% growth

projection.

Valuation

But in spite of recent gains, CROX still has value,

trading with a PEG ratio of .88, safely below the benchmark for

value of 1.

12-Month Chart

On the chart, shares have been grinding higher for

most of the year, recently hitting a new multi-year high on the

good quarter and rising estimates. Look for support from the

long-term trend on any weakness, take a look below.

Michael Vodicka is the Momentum Stock Strategist

for Zacks.com. He is also the Editor in charge of the new Zacks

Momentum Trader Service.

CROCS INC (CROX): Free Stock Analysis Report

Zacks Investment Research

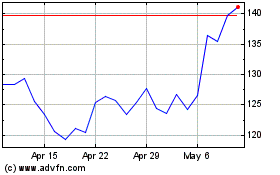

Crocs (NASDAQ:CROX)

Historical Stock Chart

From May 2024 to Jun 2024

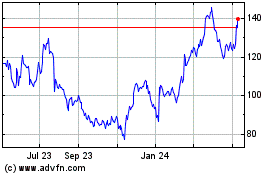

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Jun 2023 to Jun 2024