Miller Industries (MLR) and Crocs (CROX) - Zacks #1 Rank Top Performers

June 19 2011 - 8:00PM

Zacks

Miller Industries, Inc. (MLR) ended Monday's session as one

of the top-performing Zacks #1 Rank companies, while the market put

together a third straight day of gains.

Shares increased 6.18% today with volume at a little more than

86,000, compared to the daily average of about 53,000.

The 3 analysts covering MLR have been sitting still over the

past 30 days, but the Zacks Consensus Estimates for 2011 and 2012

show that its quarterly report from early May was well

received.

The Zacks Consensus Estimate for this year is currently $1.52

per share, or 25.6% better than 2 months ago. As for 2012, the

expectation of $1.44 per share has advanced 14.3% in the same time

frame.

Miller Industries is the world's largest manufacturer of towing

and recovery equipment, and markets its towing and recovery

equipment under a number of well-recognized brands, including

Century, Vulcan, Chevron, Holmes, Challenger, Champion, Jige,

Boniface and Eagle.

The company is part of the auto-truck – orig industry. There are

4 other names from this space on today's Zacks #1 Rank List:

Dana Holding Corporation (DAN), Federal-Mogul

Corporation (FDML), Titan International, Inc. (TWI) and

WABCO Holdings Inc. (WBC).

Government-related revenues led to a solid first quarter report

for MLR. Earnings per share of 61 cents blew past the year-ago

performance. It also handily beat the Zacks Consensus Estimate by

more than 110%, marking the fifth straight quarter with a positive

earnings surprise.

Net sales of $108.9 million soared nearly 51% from last year's

$72.3 million.

Looking forward, the company expects second-quarter revenue to

decline from the first quarter, but is "cautiously optimistic" for

the rest of 2011 and believes that it is prepared to take advantage

of any future opportunities.

Right behind MLR was Crocs, Inc. (CROX), which gained

6.16% Monday. Volume moved past 2.9 million shares, versus the

daily average of around 1.5 million.

CROX announced a very solid first-quarter report in late April,

which included earnings per share of 24 cents on revenue of $226.7

million. The earnings result surpassed the previous year's 7 cents

many times over, and also topped the Zacks Consensus Estimate by

more than 26%. It was the company's seventh straight quarter with a

positive surprise.

Meanwhile, revenue increased by nearly 36% year over year from

$166.9 million.

CROX expects second quarter revenue to improve 23% to $280

million, while earnings per share should be around 43 cents.

The Zacks Consensus Estimate for 2011 is $1.11 per share, which

has been stagnant for the past 30 days but is up 4.7% from 2 months

ago. Analysts expect 2012 profit to advance more than 24% over the

current year to $1.38 per share. That Zacks Consensus Estimate is

up 1.5% in the past 30 days and 4.5% in 60 days.

Crocs is a world leader in innovative casual footwear for men,

women and children. We have the company as part of the

Textile-Apparel industry. There are 2 other names from this space

on today's Zacks #1 Rank List: Delta Apparel, Inc. (DLA) and

Oxford Industries, Inc. (OXM).

By the way, neither MLR nor CROX were THE top performers on

Monday. That distinction goes to Universal Stainless & Alloy

Products, Inc. (USAP), which trounced every other name on the

list by gaining north of 13%.

USAP is a company that has been mentioned a lot in this article

in recent days, so for more background make sure to take a look at

our offerings from Thursday, Wednesday and Tuesday of last

week.

CROCS INC (CROX): Free Stock Analysis Report

DANA HOLDING CP (DAN): Free Stock Analysis Report

DELTA APPAREL (DLA): Free Stock Analysis Report

FEDERAL MOGUL-A (FDML): Free Stock Analysis Report

MILLER INDS INC (MLR): Free Stock Analysis Report

OXFORD INDS INC (OXM): Free Stock Analysis Report

TITAN INTL INC (TWI): Free Stock Analysis Report

UNVL STAINLESS (USAP): Free Stock Analysis Report

WABCO HOLDINGS (WBC): Free Stock Analysis Report

Zacks Investment Research

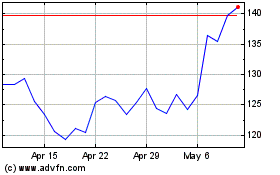

Crocs (NASDAQ:CROX)

Historical Stock Chart

From May 2024 to Jun 2024

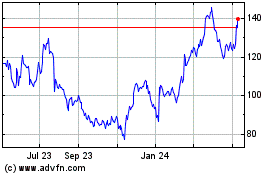

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Jun 2023 to Jun 2024