2nd UPDATE: VF To Buy Timberland For $2 Billion Cash, A 43% Premium

June 13 2011 - 11:09AM

Dow Jones News

VF Corp. (VFC), whose brands include Wrangler denim and Nautica

apparel, agreed to buy footwear company Timberland Co. (TBL) for

about $2 billion, taking advantage of Timberland's beaten-down

stock price to boost its outdoor and action-sports businesses.

VF's offer of $43 a share represents a premium of 43% to

Friday's close. Shares of Timberland, which specializes in boots

and outdoor apparel, traded above the offer price as recently as

late April, but a disappointing first-quarter report last month

sent the stock tumbling.

Investors welcomed the deal, pushing Timberland shares up to

$42.76, just below the asking price, in recent trading. VF shares

gained 10.4% to $101.35.

Other footwear companies, including Crocs Inc. (CROX) and

Deckers Outdoor Corp. (DECK), edged up on hopes they might be also

acquisition candidates. Crocs increased 2.1% to $22.09, while

Deckers rose 1.2% to $78.62. Meanwhile, footwear retailer Finish

Line Inc. (FINL) gained 3% to $21.71 and Columbia Sportswear Co.

(COLM), whose products compete with VF-owned North Face as well as

Timberland, rose 2.9% to $60.14.

VF and Timberland said they expect to close the deal late in the

third quarter. The merger agreement allows for Timberland to accept

a superior proposal before July 26, though shareholders affiliated

with the founding Swartz family already have agreed to approve the

VF bid.

Timberland is expected to add about $700 million to VF's 2011

revenue and boost per-share earnings by 45 cents in the second half

of 2011 and by 90 cents in 2012, excluding acquisition-related

expenses.

VF Chairman and Chief Executive Eric Wiseman called the

acquisition "transformative." VF's outdoor and action-sports

businesses will now comprise 50% of total revenue, and are expected

to hit 60% by fiscal 2015, Wiseman said during a conference call to

discuss the deal.

The Greensboro, N.C., company's other brands are wide-ranging,

including 7 For All Mankind premium denim, John Varvatos men's

clothing and Reef surf gear. Its outdoor and active brands include

Vans, Lee and North Face, and the company said Timberland will be

complementary to, rather than competitive with, those names.

VF will fund the deal with $500 million in cash on hand, $700

million in commercial paper and $800 million in term debt.

In addition to expanding VF's active-gear and footwear lines,

the deal also will boost the company's overseas presence.

International sales now comprise 30% of VF's sales, while more than

half of Timberland's sales come from outside North America. The

combined company will derive 35% of revenue from international

markets.

Timberland will remain headquartered in Stratham, N.H.

In late April, VF Corp. posted a 23% rise in first-quarter

earnings. Sales grew across the board, but were particularly strong

in its outdoor and action-sports products division. Revenue jumped

12% to $1.96 billion.

Meanwhile, Timberland's first-quarter earnings fell 30% as the

company spent more on retail and advertising and saw higher product

costs. Revenue rose 10% to $349 million, a growth rate that VF

intends to maintain as it further expands womenswear offerings and

the Smartwool brand.

-By Melissa Korn, Dow Jones Newswires; 212-416-2271;

melissa.korn@dowjones.com

--Melodie Warner contributed to this article.

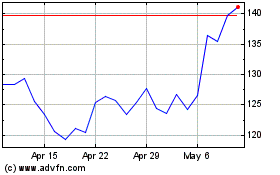

Crocs (NASDAQ:CROX)

Historical Stock Chart

From May 2024 to Jun 2024

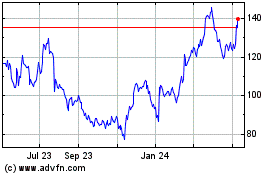

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Jun 2023 to Jun 2024