Perry Ellis Beats, Ups Outlook - Analyst Blog

May 26 2011 - 10:00AM

Zacks

Perry Ellis International

Inc. (PERY) posted adjusted earnings per share of $1.08 in

the first quarter of fiscal 2012, treading ahead of the Zacks

Consensus Estimate of 98 cents and the year-ago performance of 81

cents. GAAP net earnings came in at 99 cents per share, up from 81

cents in the year-earlier period.

Perry Ellis' total revenue surged

31% year over year in the quarter to $288.3 million, which also

surpassed the Zacks Consensus Estimate of $272.0 million. Sales

growth was aided by improved performances at the Golf and Hispanic

lifestyle brands, as well as Perry Ellis Collection. Organic

revenue grew 13% to $249 million, excluding the recently acquired

Rafaella business. In the first quarter, Rafaella injected $38.9

million to the total revenue.

During the quarter, Perry Ellis'

gross profit leaped 23% year over year to $97.0 million. However,

gross margin was 33.6% of total revenue compared to 35.7% in the

comparable prior-year quarter. The decline was due to the

Rafaella business (acquired in late January), which had a lower

gross margin and dampened first quarter gross margin of Perry Ellis

by 110 basis points. Incremental program business and the effect of

converting licenses for small leather goods and dress shirts into

wholesale businesses also hurt first quarter gross margin by

approximately 100 basis points.

Financials

At quarter end, Perry Ellis had

cash and cash equivalents of $21.7 million. Long-term debt was

$219.5 million.

Outlook

Perry Ellis expects earnings per

share in the range of $2.40–$2.50 for fiscal 2012, compared to

$2.30–$2.40 guided earlier. The expectation for revenue was

reiterated at $1 billion.

Our Take

Perry Ellis, the designer,

distributor and licensor of a broad line of men's and women's

apparel, accessories, and fragrances, remains optimistic about the

performance of Rafaella as well as current business trends.

Management remains committed to integrate its niche businesses such

as Golf and Hispanic as well as the Perry Ellis Collection with

Rafaella’s women’s sportswear. We believe this is a positive step

toward the strength of Perry Ellis’ market share gain.

Perry Ellis is currently a Zacks #2

Rank (short-term 'Buy' rating). For the long term, we reiterate our

“Neutral” recommendation on the stock. Perry Ellis' peers include

Polo Ralph Lauren Corp. (RL) and CROCS

Inc. (CROX)

CROCS INC (CROX): Free Stock Analysis Report

PERRY ELLIS INT (PERY): Free Stock Analysis Report

POLO RALPH LAUR (RL): Free Stock Analysis Report

Zacks Investment Research

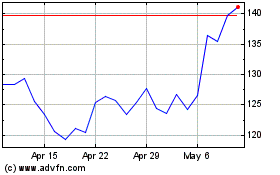

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Jul 2024 to Aug 2024

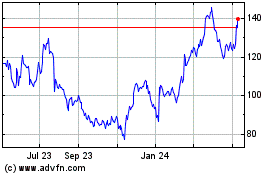

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Aug 2023 to Aug 2024