Crocs, Inc. (NASDAQ: CROX) today reported financial results for

the third quarter ended September 30, 2009.

Third quarter 2009 revenues increased 1.7% to $177.1 million

compared to revenues of $174.2 million in the year ago period,

ahead of the Company’s guidance for revenues between $150 and $160

million. The Company’s third quarter 2009 revenue included $11.5

million in planned sales of previously impaired footwear.

The Company reported net income of $22.1 million in the third

quarter of 2009 with diluted earnings per share of $0.25, compared

to a third quarter 2008 net loss of $148.0 million, or ($1.79) per

diluted share. Third quarter 2009 net income includes the effects

of the following:

- $9.6 million gross margin impact

related to sales of product that had been previously impaired,

- $1.0 million gain from foreign

currency exchange rate fluctuations during the 2009 third quarter,

and

- $14.4 million one-time tax

benefit related to a change in the Company’s corporate tax

structure.

These positive effects on net income were partially offset by

the unfavorable impacts of $3.6 million in impairment and

restructuring charges and net charitable donations.

On a non-GAAP basis, the Company’s third quarter 2009 net income

after taxes and excluding certain other one-time items was $0.6

million, or $0.01 per diluted share.

Year-over-year third quarter changes in the Company’s channel

revenue streams were as follows:

- Retail sales increased 39.6% to

$53.9 million;

- Internet sales increased 61.0%

to $16.1 million; and

- Wholesale sales decreased 14.7%

to $107.1 million.

Changes in the Company’s regional revenue streams during the

same periods were as follows:

- Asia increased 7.4% to $68.0

million;

- Europe increased 1.7% to $29.9

million; and

- Americas decreased 2.8% to $79.3

million.

Balance Sheet

The Company’s cash and cash equivalents as of September 30, 2009

increased nearly 50% since December 31, 2008 to $76.0 million,

despite fully repaying previously-outstanding debt of $17.3 million

during the quarter. During the quarter, the Company also secured a

new asset-backed credit facility with up to $30.0 million in

borrowings available, which is intended to provide additional

liquidity and flexibility in the future.

Inventory of $113.7 million at September 30, 2009 was 20.6%

lower than at December 31, 2008 resulting in a trailing twelve

month inventory turnover of 3 times.

The Company ended the third quarter of 2009 with accounts

receivable of $65.8 million compared to $35.3 million at December

31, 2008 as a result of higher sales in the quarter. Days sales

outstanding decreased from 37.5 days for the three months ended

September 30, 2008 to 34.2 days for the three months ended

September 30, 2009.

Net capital expenditures in the third quarter of 2009 were $6.1

million compared to $18.3 million the third quarter of 2008.

“Our third quarter results were driven by the continuing

strength of our consumer-direct businesses and the favorable

effects of our cost reduction programs,” said John Duerden,

President and Chief Executive Officer. “While we are encouraged by

our top-line growth and return to profitability in the quarter, the

normal seasonality of our business will make it difficult to

maintain profitability in the fourth quarter. However, future

wholesale bookings for the spring 2010 line are strong in all

regions. When coupled with the launch of our new, targeted

marketing programs, this provides us with increased confidence that

we will return to profitability during 2010. In the meantime, we

will continue to invest in the products, systems, processes and

customer relationships necessary to deliver the best long-term

results.”

Guidance

The Company expects to generate between $110 million and $115

million in revenue during its fiscal fourth quarter, with a loss

per diluted share between ($0.20) and ($0.15). This guidance

excludes the effect of fluctuations in foreign currency, charitable

contributions and one-time and non-recurring charges. Guidance

includes the effect of impaired inventory sales and will on a

go-forward basis.

Conference Call Information

A conference call to discuss Crocs’ third quarter 2009 financial

results is scheduled for today (November 5, 2009) at 5:00 PM

Eastern Time. A webcast of the call will take place simultaneously

and can be accessed by clicking the ‘Investor Relations’ link under

the Company section on www.crocs.com or at www.earnings.com. To

listen to the broadcast, your computer must have Windows Media

Player installed. If you do not have Windows Media Player, go to

www.earnings.com prior to the call, where you can download the

software for free.

About Crocs, Inc.

Crocs, Inc. is a designer, manufacturer and retailer of footwear

for men, women and children under the Crocs™ brand.

All Crocs™ brand shoes feature Crocs’ proprietary closed-cell

resin, Croslite™, which represents a substantial innovation in

footwear. The Croslite™ material enables Crocs to produce soft,

comfortable, lightweight, superior-gripping, non-marking and

odor-resistant shoes. These unique elements make Crocs™ footwear

ideal for casual wear, as well as for professional and recreational

uses such as boating, hiking, hospitality and gardening. The

versatile use of the material has enabled Crocs to successfully

market its products to a broad range of consumers.

Crocs™ shoes are sold in 125 countries and come in a wide array

of colors and styles. Please visit www.crocs.com for additional

information.

Forward-looking statements

The matters regarding the future discussed in this news release

include “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements

involve known and unknown risks, uncertainties and other factors

which may cause our actual results, performance or achievements to

be materially different from any future results, performances, or

achievements expressed or implied by the forward-looking

statements. These risks and uncertainties include, but are not

limited to, the following: macroeconomic issues, including, but not

limited to, the current global financial crisis; our ability to

obtain adequate financing; our significant expansion in recent

years; our ability to manage our future growth or decline

effectively; changing fashion trends; our defense and the ultimate

outcome of a pending class action lawsuit; our ability to

accurately anticipate and respond to seasonal or quarterly

fluctuations in our operating results; our management and

information systems infrastructure; our ability to obtain and

protect intellectual property rights; our reliance on third party

manufacturing and logistics providers for the production and

distribution of products; our limited manufacturing capacity and

distribution channels; our reliance on a single source supply for

certain raw materials; inherent risks associated with the

manufacture, distribution and sale of our products overseas; our

reliance on market acceptance of the small number of products we

sell; our ability to develop and sell new products; our limited

operating history; our ability to accurately forecast consumer

demand for our products; our ability to maintain effective internal

controls; our ability to attract, assimilate and retain management

talent; retail environment; our ability to effectively market and

maintain a positive brand image; the effect of competition in our

industry; the effect of potential adverse currency exchange rate

fluctuations; and other factors described in our annual report on

Form 10-K under the heading “Risk Factors” and our subsequent

filings with the Securities and Exchange Commission. Readers are

encouraged to review that section and all other disclosures

appearing in our filings with the Securities and Exchange

Commission. We do not undertake any obligation to update publicly

any forward-looking statements, including, without limitation, any

estimate regarding revenues or earnings, whether as a result of the

receipt of new information, future events, or otherwise.

CROCS,

INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (In thousands, except share and per share

data) (Unaudited) Three Months Ended

September 30,

Nine Months Ended

September 30,

2009 2008 2009 2008 Revenues $

177,141 $ 174,187 $ 509,756 $ 595,497 Cost of sales 87,291

171,788 269,115 417,575

Gross profit 89,850 2,399 240,641 177,922 Selling, general

and administrative expenses 76,963 104,391 239,407 270,959

Restructuring charges 17 2,450 5,916 6,769 Impairment charges 1,722

31,584 25,447 45,301 Charitable contributions expense 2,178

- 7,296 265

Income (loss) from operations 8,970 (136,026 ) (37,425 ) (145,372 )

Interest expense 155 413 1,412 1,385 Gain on charitable

contributions (810 ) - (2,833 ) - Other (income) expense

(125 ) (734 ) (833 ) (782 ) Income (loss)

before income taxes 9,750 (135,705 ) (35,171 ) (145,975 ) Income

tax (benefit) expense (12,318 ) 12,275

(4,541 ) 4,399 Net income (loss) $ 22,068 $

(147,980 ) $ (30,630 ) $ (150,374 ) Net income (loss) per common

share: Basic $ 0.26 ($1.79 ) ($0.36 )

($1.82 ) Diluted $ 0.25 ($1.79 ) ($0.36 )

($1.82 ) Weighted average common shares outstanding: Basic

85,514,385 82,854,419 84,933,858

82,687,861 Diluted 87,479,318

82,854,419 84,933,858 82,687,861

CROCS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (In thousands,

except share data) (Unaudited)

September 30, 2009 December 31, 2008 ASSETS

Current assets: Cash and cash equivalents $ 76,021 $ 51,665

Restricted cash 245 - Accounts receivable, net 65,794 35,305

Inventories 113,703 143,205 Deferred tax assets, net 12,088 11,364

Income tax receivable 8,248 24,417 Prepaid expenses and other

current assets 21,147 13,415

Total current assets

297,246 279,371 Property and equipment, net 70,738 95,892

Restricted cash 2,358 2,922 Intangible assets, net 34,501 40,892

Deferred tax assets, net 22,507 21,231 Other assets 15,623

15,691 Total assets $ 442,973 $ 455,999

LIABILITIES AND STOCKHOLDERS’ EQUITY Current

liabilities: Accounts payable $ 37,432 $ 35,137 Accrued expenses

and other current liabilities 55,345 50,076 Accrued restructuring

charges 3,149 1,439 Deferred tax liabilities, net 98 30 Income

taxes payable 16,308 24,420 Note payable, current portion of

long-term debt and capital lease obligations 628

22,431 Total current liabilities 112,960 133,533

Long-term debt and capital lease obligations 1,391 -

Deferred tax liabilities, net 5,355 2,917 Long-term restructuring

580 959 Other liabilities 30,043 31,427

Total liabilities 150,329 168,836

Commitments and contingencies (note 12) Stockholders’

equity:

Common shares, par value $0.001

per share; 250,000,000 sharesauthorized, 86,167,242 and 85,643,242

shares issued andoutstanding, respectively at September 30, 2009

and 83,543,501and 83,019,501 shares issued and outstanding,

respectively atDecember 31, 2008

85 84 Treasury Stock, 524,000 shares, at cost (25,022 ) (25,022 )

Additional paid-in capital 259,205 232,037 Deferred compensation -

(246 ) Retained earnings 33,603 64,233 Accumulated other

comprehensive income 24,773 16,077

Total stockholders’ equity 292,644 287,163

Total liabilities and stockholders’ equity $ 442,973

$ 455,999

Crocs, Inc. Reconciliation of

GAAP Measures to Non-GAAP Measures (In thousands, except

share and per share data) (Unaudited)

The Company prepares and reports its financial statements in

accordance with U.S. Generally Accepted Accounting Principles

(“GAAP”). Internally, management monitors the operating

performance of its business using non-GAAP metrics similar to those

below. These non-GAAP measures exclude the effects of foreign

exchange rate loss, restructuring activities, inventory write-down,

asset impairment charges and unusual gross profit on impaired

inventory sales. In management’s opinion, these non-GAAP

measures are important indicators of the continuing operations of

our business and provide better comparability between reporting

periods because they exclude items that may not be indicative of

current period results and provide a better baseline for analyzing

trends in our operations. The Company does not, nor does it suggest

that investors should, consider such non-GAAP financial measures in

isolation from, or as a substitute for, financial information

prepared in accordance with GAAP. The Company believes the

disclosure of the effects of these items increases the reader’s

understanding of the underlying performance of the business and

that such non-GAAP financial measures provide investors with an

additional tool to evaluate our financial results and assess our

prospects for future performance.

Non-GAAP Reconciliations

3 months ended 9 months ended

September 30, 2009 September 30, 2009 GAAP

gross profit 89,850 240,641 Net gross profit effect of sales of

previously impaired units (9,644 ) (1) (41,585 ) (1) Restructuring

charges reflected in cost of sales 459 (2) 5,779 (2)

Additional stock-based

compensation expense related to tender offerreflected in cost of

sales

- 3,056 (3) Non-GAAP gross profit

80,665 207,891

3 months

ended 9 months ended September 30, 2009

September 30, 2009 GAAP selling, general and

administrative expense 76,963 239,407

Additional stock-based

compensation expense related to tender offerreflected in selling,

general and administrative expense

- 13,261 (3 ) Foreign currency (gain)/loss (1,032 ) (4 )

(1,246 ) (4 ) Non-GAAP selling, general and administrative

expense 77,995 227,392

3

months ended 9 months ended September 30, 2009

September 30, 2009 GAAP Income/(loss) before income

taxes 9,750 (35,171 ) Net gross profit effect of sales of

previously impaired units (9,644 ) (1 ) (41,585 ) (1 ) Additional

stock-based compensation expense related to tender offer - 16,317

(3 ) Foreign currency (gain)/loss, net of tax (1,032 ) (4 ) (1,246

) (4 ) Restructuring charges 476 (2 ) 11,695 Asset impairment 1,722

(5 ) 25,447 (5 ) Charitable contributions expense 2,178 (5 ) 7,296

(5 ) Gain on charitable contributions (810 ) (5 )

(2,833 ) (5 ) Non-GAAP net income (loss) before income taxes

2,640 (20,080 ) Tax expense 2,082 (6 ) 9,859 (6 )

One-time tax benefit (14,400 ) (7 ) (14,400 ) (7 )

Non-GAAP net (loss) income 558 (29,939 )

Non-GAAP net (loss) income per diluted share $ 0.01 $ (0.36

) (1) This pro forma adjustment in the GAAP to Non-GAAP

reconciliations above represents the gross profit realized on sales

of impaired units at selling prices much higher than our previously

estimated net realizable value for those units. Because the amount

presented is accretive to our gross profit percentage during the

three and nine months ended September 30, 2009 and represents a

substantial change to our previous estimate of realizable value,

management believes that exclusion of the gross profit on these

sales in evaluating our results of operations provides important

information for the reader of our financial statements as such

changes in estimates are not anticipated to be recurring to the

extent or magnitude they occurred during the quarter. (2)

This proforma adjustment in the GAAP to Non-GAAP reconciliations

above represents non-recurring restructuring charges. Of the $0.5

million in total Q3 2009 restructuring charges, $459 thousand was

reflected in cost of sales and the remaining amount was reflected

in its own line item in the calculation of Q3 2009 operating loss.

For the nine months ended September 30, 2009, $5.8 million was

reflected in cost of sales with the remaining amount reflected in

its own line item in the calculation of operating loss for the nine

months ended September 30, 2009. (3) This proforma

adjustment in the GAAP to Non-GAAP reconciliations above represents

additional stock-based compensation expense incurred as a result of

the acceleration of tendered options from the Q2 2009 tender offer.

The total Q2 2009 additional expense incurred as a result of the

tender offer was $16.3 million, of which $3.0 million was reflected

in cost of sales and $13.3 million was reflected in selling,

general and administrative expense. These amounts are reflected in

our reconciliations for the nine month period ended September 30,

2009 only. (4) The proforma adjustments in this GAAP to

Non-GAAP reconciliation represent the add-back of GAAP charges

taken in connection with our quarter foreign currency exchange rate

loss reflected in selling, general and administrative expense.

(5) The proforma adjustments in this GAAP to Non-GAAP

reconciliation represent the add-back of GAAP charges taken in

connection with our quarter asset impairment charges as well as the

expense and related gain on charitable contributions during the

quarter. (6) Represents tax expense, net of the $14.4

million one-time tax benefit in the quarter (See Note 7). Because

total tax expense in the quarter related only to those

jurisdictions where the Company made money as well as taxes on

royalty payments, the assumed tax rate on the pro-forma adjustments

above is zero. (7) Represents a one-time tax benefit

resulting from the restructuring of our international operations

and cost sharing arrangements, resulting in a one-time benefit of

$11.8 million from a reduction in certain taxes previously accrued

with an associated accrual for uncertain tax benefits of $2.6

million.

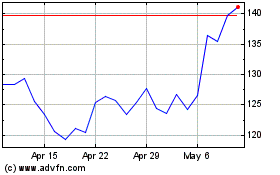

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Jun 2024 to Jul 2024

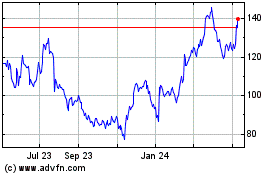

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Jul 2023 to Jul 2024