UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED

IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 2)1

Creative Media & Community Trust Corporation

(Name

of Issuer)

Common Stock, $0.001 par value

(Title of Class of Securities)

125525584

(CUSIP Number)

DANIEL M. NEGARI

2121 E. Tropicana Avenue, Suite 2

Las Vegas, Nevada 89119

(702) 900-2999

RYAN NEBEL

OLSHAN FROME WOLOSKY LLP

1325 Avenue of the Americas

New York, New York 10019

(212) 451-2300

(Name, Address and Telephone Number of Person

Authorized to Receive Notices

and Communications)

September 27, 2023

(Date of Event Which Requires

Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box ¨.

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§ 240.13d-7 for other parties to whom copies are to be sent.

1

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

The 1 8 999 Trust |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Nevada |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

624,045 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

624,045 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

624,045 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

2.7% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

XYZ LLC |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Nevada |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

750,000 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

750,000 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

750,000 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

3.3% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Daniel M. Negari |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

AF |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

USA |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

1,374,045 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

1,374,045 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

1,374,045 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

6.0% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

The Insight Trust |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Nevada |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

7,000 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

7,000 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

7,000 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

Less than 1% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Michael R. Ambrose |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

AF |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

USA |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

757,000 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

757,000 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

757,000 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

3.3% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

The following constitutes

Amendment No. 2 to the Schedule 13D filed by the undersigned (“Amendment No. 2”). This Amendment No. 2 amends the Schedule

13D as specifically set forth herein.

| Item 4. | Purpose of Transaction. |

Item 4 is hereby amended

to add the following:

On September 27, 2023,

Mr. Negari issued an open letter (the “Open Letter”) to the Board of Directors of the Issuer (the “Board”)

reiterating his proposal, initially made on April 17, 2023, to acquire all of the outstanding Shares of the Issuer for $8.88 per

Share in cash (the “Proposal”), representing a substantial premium of over 119% to the Issuer’s most recent

closing price of $4.05 and nearly 112% to the Issuer’s 30-day average closing price of $4.194. In addition to reiterating the

Proposal, Mr. Negari detailed alternative strategies for the Board to consider to enhance shareholder value should the Board

continue to refuse to commence a sales process, including (i) the immediate sale of non-core assets and repurchasing Shares or (ii)

disposing of all assets and returning capital to shareholders.

The foregoing description

of the Open Letter does not purport to be complete and is qualified in its entirety by reference to the Open Letter, which is attached

as Exhibit 99.1 hereto and is incorporated herein by reference.

| Item 7. | Material to be Filed as Exhibits. |

Item 7 is hereby amended

to add the following exhibit:

SIGNATURES

After reasonable inquiry

and to the best of his knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete

and correct.

Dated: September 27, 2023

| |

The 1 8 999 Trust |

| |

|

| |

By: |

/s/ Daniel M. Negari |

| |

|

Name: |

Daniel M. Negari |

| |

|

Title: |

Trustee |

| |

XYZ LLC |

| |

|

| |

By: |

/s/ Daniel M. Negari |

| |

|

Name: |

Daniel M. Negari |

| |

|

Title: |

Manager |

| |

/s/ Daniel M. Negari |

| |

Daniel M. Negari |

| |

The Insight Trust |

| |

|

| |

By: |

/s/ Michael R. Ambrose |

| |

|

Name: |

Michael R. Ambrose |

| |

|

Title: |

Trustee |

| |

/s/ Michael R. Ambrose |

| |

Michael R. Ambrose |

Exhibit 99.1

FROM THE DESK OF

DANIEL M. NEGARI

2121 E TROPICANA AVE #2 LAS VEGAS NV 89119

702-900-2999

September 27, 2023

Creative Media & Community Trust Corporation

17950 Preston Road, Suite 600

Dallas, Texas 75252

Attention: Board of Directors

Dear Members of the Board:

As you are aware, on April 17, 2023, I submitted

a proposal to the Board of Directors (the “Board”) of Creative Media & Community Trust Corporation (“CMCT”

or the “Company”) to acquire all of the outstanding shares for $8.88 per share in cash, which at the time represented a substantial

premium of nearly 110% to the Company’s previous closing price of $4.23 and over 103% to the Company’s preceding 30-day average

closing price of $4.386.

Despite CMCT’s stock price continuing

to decline, I am writing to reiterate my interest in acquiring the Company for $8.88 per share in cash. My offer now represents

an even greater premium of over 119% to yesterday’s closing price of $4.05 and nearly 112% to the Company’s 30-day average

closing price of $4.194.

Given the Company’s failure to engage

with me to date with respect to my acquisition proposal, I am also writing to share alternative strategies for the Board to consider to

enhance shareholder value should the Board continue to refuse to commence a sales process.

As shown below in Table 1, CIM Group,

L.P.’s (“CIM Group”) ownership of CMCT has risen from 19.2% to 45.7%, while the Company’s self-reported net asset

value (“NAV”) has been substantially eroded and a 6.25% ownership limitation was imposed on independent shareholders like

myself.

Table 1. Self-Reported NAV History and CIM

Group Ownership

| |

CMCT NAV |

CIM Group Ownership |

| Q4 2019 |

$28.49 |

19.2% (Nov 2019) |

| Q3 2022 |

$16.11 |

41.5% (August 2022) |

| Q4 2022 |

$14.30 |

42.7% (Nov 2022) |

| Q1 2023 |

$12.67 |

42.3% (May 2023) |

| Q2 2023 |

$11.03 |

45.7% (Aug 2023) |

In light of CIM Group’s near total control

of the Company at every level and the Board’s entrenchment tactics, which effectively prevents shareholders of the Company from

meaningfully exercising their rights to effect change, I can only present for the Board’s consideration the three proposals detailed

below in an effort to help you uphold your fiduciary duty to the Company and its shareholders. I firmly believe that each of these proposals

would benefit all shareholders (including CIM Group) and represent a significant improvement to the status quo.

Proposal X

Commence a Strategic Review Process to Sell

the Entire Company

As noted above, I remain interested in acquiring

the Company for $8.88 per share – in doing so I have effectively set the floor the Company can expect to receive in any sales process.

Based on the information currently in my possession, I would love to acquire the Company for $8.88 per share (and may be willing to pay

more after receiving access to a data room), but if someone else wants to pay more, that is great and will deliver further value to shareholders.

If the Board is not willing to sell the Company,

I strongly urge you to implement one of the other two proposals that follow, which I believe are your best paths forward to increase shareholder

value short of a sale.

Proposal Y

Dispose of Non-Strategic Assets; Recycle

Capital; Aggressively Repurchase Stock; Convert Preferred Stock to Common Stock

1. Sell Non-Core Assets Immediately

The Sheraton Grand Sacramento should be sold

immediately, which I believe would yield $175,000,000+ for the Company.1

The SBA lending business should be immediately sold as well. In addition, the Company should explore which other non-core

assets could be sold, sell them and maximize the use of the proceeds as described below.

1Annualized NOI is over $16,500,000 right now and, conservatively, a 9 Cap would yield over $183 million in proceeds.

2. Stock Buybacks

You should complete the existing buyback and

authorize a new buyback to repurchase up to 35% of the Company’s shares at significant discounts to NAV. As shown below in Table

2, this would be a highly accretive use of Company funds that would help close the gap between the Company’s share price and

NAV.

Table 2. Example of Proposed Buybacks

| Item |

Value/Amount |

| Assumptions |

| Total Shares |

23 Million |

| Funds From Operations (FFO) |

$11,500,000 |

| Shares to Buyback |

7 Million |

| Buyback Price Per Share |

$5 |

| Dividends Not Paid |

$0.34/share or $2,380,000 |

| FFO Before Buyback |

| FFO Per Share |

$0.50 |

| Total FFO |

$11,500,000 |

| FFO After Buyback |

| New Total Shares |

16 Million |

| FFO Per Share |

$0.8675

(Includes dividends not paid) |

| New Total FFO |

$13,880,000

(Includes dividends not paid) |

I've urged you to initiate a buyback, especially

given the current market dislocation and the Company’s existing authorization. If you choose not to sell the Company, you should

maximize this buyback opportunity. Purchasing shares below the true NAV offers an immediate 3X ROI, which I believe is the best you'll

achieve. The recent rights offering has created a hole in your shareholder base, and restrictions limiting shareholders like me to 6.25%

ownership further highlight this issue.

3. Stop Purchasing Properties and Limit

Development to New Co-Invest Structure.

Recent history has shown that purchasing or

developing new properties destroys NAV, even by the Company’s own metrics. In general, new acquisitions and development should

be avoided. On the other hand, the Company's new co-invest structure has proven to create significant value. The Company should utilize

this structure for existing properties and take on any future development projects using this structure.

4. Convert Preferred Stock to Common Stock

Instead of redeeming shares of preferred stock,

the Company should implement a stock buyback to align NAV with the common stock value. The Company would then be able to distribute shares

of common stock to shareholders of preferred stock as a substitute for direct payoffs. To protect NAV, an evergreen buyback program should

be implemented to repurchase shares on a continuous basis, but such a program should only be considered when the stock price is within

5% of NAV. Appropriately implementing an evergreen buyback program should eventually eliminate the need to have such an outsized preferred

stock program.

Final Points

This proposal will focus the Company on growth

and ensure its financial viability into the future. This is especially the case if the Company is successful in moving all properties

to a co-invest structure, which would potentially raise $200-300 million in cash, which could be put to work using the strategies described

above.

Proposal Z

Dispose of all Assets; Pay Off Debts; Return

Capital

The Company should dispose of all assets, starting

with the most liquid, pay off all debts and return capital to shareholders. I conservatively estimate that the Company could yield over

$12.00 per share using this strategy, which could be accomplished in 3-6 months.

Some analysts think your office assets are

dead, but the building next door to 1 Kaiser Plaza just sold to Pacific Gas and Electric Company for $892,000,000, or about $980 per sq.

ft. (https://therealdeal.com/sanfrancisco/2023/07/07/pge-buys-oakland-headquarters-for-up-to-900m/)

1 Kaiser Plaza is the headquarters of Kaiser

Permanente, and is about 530,000 sq. ft. Kaiser Permanente is active in buying office real estate and it completed a nine-figure office

purchase through a SMA recently. A sale price at $980 per sq. ft. would not be necessary to create significant shareholder value, as a

sales price at just $600 per sq. ft. would yield $318 million after paying off the $97 million CMBS loan. This sale alone could yield

investors more than $10 per share, as it would not require the Company to pay off its preferred stock and other debts in full.

Eleven Fifty Clay and Channel House can be

recapped through a co-invest and yield shareholders $6+ a share, while retaining 20% of the asset and generating management fees for the

benefit of all shareholders. A straightforward sale would yield even more.

Takeaways

Ultimately, the Board is well aware of the

value of the Company’s assets and fully capable of implementing a strategy to enhance shareholder value. While I remain interested

in acquiring the Company, it is crucial for the benefit of all shareholders that immediate action is taken to effect change – whether

by yourselves or through constructive engagement with me or other third parties. It is your fiduciary obligation to take decisive action

in the best interest of ALL shareholders (not just CIM Group). If needed, I’m prepared to be your stalking horse at $8.88 per share.

| |

Sincerely, |

| |

|

| |

/s/ Daniel M. Negari |

| |

|

| |

Daniel M. Negari |

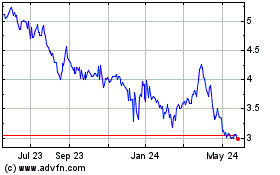

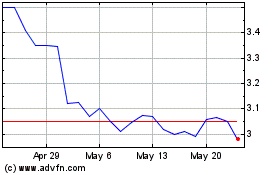

Creative Media and Commu... (NASDAQ:CMCT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Creative Media and Commu... (NASDAQ:CMCT)

Historical Stock Chart

From Jul 2023 to Jul 2024