Conn’s, Inc. (NASDAQ/NM:CONN), a specialty retailer of consumer

electronics, home appliances, furniture, mattresses, computers and

lawn and garden products today announced its operating results for

the quarter ended October 31, 2011.

Significant items for the quarter include:

- The Company recorded a pretax charge of

$14.1 million, net of previously provided reserves, related to the

required adoption of recent accounting guidance related to troubled

debt restructuring, a pretax charge of $4.7 million for inventory

reserves related to aged product and a charge of $0.4 million

related to store closures, resulting in a reported net loss of

$12.7 million, or $0.40 per diluted share outstanding;

- Adjusted diluted earnings per share of

$0.02 for the third quarter of fiscal 2012, excluding the impact of

the adoption of the troubled debt restructuring accounting

guidance, inventory reserve adjustment and store closing costs, as

compared to an adjusted diluted loss per share of $0.12 for the

same period in the prior fiscal year, on a higher number of shares

outstanding in the current year period;

- Total revenues were $179.5 million, up

5.2% from the same period in the prior fiscal year, on a same store

sales increase of 18.9%;

- Retail segment adjusted retail gross

margin, excluding the inventory reserve adjustment, increased 240

basis points to 28.2%;

- Retail segment adjusted operating loss,

excluding the inventory reserve adjustment and store closing costs,

was reduced to $0.8 million for the quarter, as compared to $3.5

million for the same quarter in the prior fiscal year;

- Credit segment adjusted operating

income, excluding the required adoption of accounting guidance

related to troubled debt restructuring, decreased to $5.6 million

for the quarter, as compared to adjusted operating income of $6.8

million for the same quarter in the prior fiscal year;

- Credit segment 60+ day delinquency

percentage declined to 7.9%; and

- The Company initiated earnings guidance

for fiscal year 2013 of adjusted diluted earnings per share of

$1.05 to $1.15.

“I am encouraged by our sales performance, as we returned to

positive same store sales during the quarter,” commented Theodore

Wright, the Company’s CEO. “The improvements in our retail

operating performance carried over into the month of November, when

we experienced a same store sales increase of 10.5%.”

Retail Segment Results

The change in the retail segment’s total revenues was comprised

of a product sales increase of 11.6%, a repair service agreement

commission increase of 28.1% and a service revenue increase of

4.8%, as compared to the same quarter in the prior fiscal year. The

increase in sales during the quarter was driven by higher average

selling prices in all major categories and increased unit sales in

furniture and mattresses, home appliances and consumer

electronics.

The retail segment’s adjusted retail gross margin increased to

28.2% in the current-year quarter, from 25.8% in the same quarter

of the prior year. The increase in the retail gross margin was

driven by an increase in higher-margin furniture and mattress sales

as a percent of total product sales, improved gross margins in the

furniture and mattresses and home office categories, and increased

sales penetration of repair service agreements.

Credit Segment Results

The credit segment’s results, as compared to the same quarter in

the prior year, were impacted by:

- Reduced total portfolio balance and

delinquency levels, resulting in lower interest earnings and

reduced servicing costs;

- Changes in the Company’s charge-off

policy at July 31, 2011, and in its reaging policy during the third

quarter, that have resulted in:

- Accounts reaged more than twelve months

charging off more quickly, and thus an increase in the provision

for bad debts to account for the change in timing;

- A reduction in the number of accounts

reaged during the period, as compared to the prior year

period;

- A change in the approach to collections

of reaged accounts, allowing further reductions in servicing costs;

and

- The required adoption of accounting

guidance related to troubled debt restructuring, which, despite the

improving delinquency, reage and payment rate trends, resulted in

accelerating the recognition of expected losses on accounts that

qualify as restructured under the guidance, based on an estimate of

the present value of the account. As a result, the Company

increased its allowances for bad debts and cancellations of repair

service agreements and credit insurance by $14.1 million during the

quarter for accounts that qualified as restructured during the nine

months ended October 31, 2011.

The key credit portfolio performance metrics of the credit

segment for the quarter included:

- Net charge-offs for the third fiscal

quarter of 2012 totaled $5.4 million, as compared to $10.7 million

for the same period in the prior fiscal year, and benefited from

the impact of the charge-off policy change during the second

quarter, which accelerated charge-offs of delinquent accounts

during the second quarter of the current fiscal year;

- A 20 basis point improvement in the

60-209 day delinquency rate to 7.9% at October 31, 2011, from 8.1%

at October 31, 2010. The 60-209 day delinquency rate was 7.0% at

January 31, 2011;

- A 370 basis point improvement in the

percentage of the portfolio reaged to 16.0% at October 31, 2011,

from 19.7% at October 31, 2010. The percentage of the portfolio

reaged at January 31, 2011, was 19.8%; and

- The average monthly payment rate

(amount collected from customers as a percentage of the portfolio

balance) increased for the seventh consecutive quarter, versus the

same quarter in the prior year, to 5.39% for the quarter ended

October 31, 2011, from 5.10% for the quarter ended October 31,

2010.

More information on the credit portfolio and its performance may

be found in the table included with this press release and in the

Company’s Form 10-Q to be filed with the Securities and Exchange

Commission.

The Company reported a net loss of $12.7 million, or a diluted

loss per share of $0.40 for the third quarter of fiscal 2012,

compared to a net loss of $4.8 million, or a diluted loss per share

of $0.19, for the third quarter of fiscal 2011. The net loss for

the third quarter of fiscal 2012 was impacted by the Company’s

investments in advertising and sales staffing, in support of its

growth initiatives, to drive sales growth during the third and

fourth quarters of the current fiscal year and on an ongoing basis.

Adjusted net income, adjusted for the impact of the adoption of the

troubled debt restructuring accounting guidance, inventory reserve

adjustment and store closing costs, was $0.5 million, or adjusted

diluted earnings per share of $0.02, for the third quarter of

fiscal 2012.

Capital and Liquidity

As of October 31, 2011, there was $302.0 million, excluding $1.8

million of letters of credit, outstanding under the asset-based

loan facility. As of October 31, 2011, the Company had $80.1

million of immediately available borrowing capacity, and an

additional $46.1 million that could become available upon increases

in eligible inventory and customer receivable balances under the

borrowing base. Subsequent to the completion of the quarter, during

November 2011, the Company completed a $20 million expansion of its

asset-based loan facility, increasing the total commitment to $450

million to provide additional borrowing capacity to support future

growth.

Outlook and Guidance

The Company reduced its guidance for the fiscal year ending

January 31, 2012, to an adjusted diluted earnings per share range

of $0.55 to $0.65, excluding charges related to the Company’s

refinancing completed during the second quarter, costs related to

completed and future store closings, the impact of the required

adoption of accounting guidance related to troubled debt

restructuring and the additional inventory reserves recorded. The

following factors were considered in developing the guidance:

- Same stores sales are expected to be

positive during the fourth quarter;

- Retail segment retail gross margin is

expected to be between 28.0% and 29.0% during the fourth

quarter;

- The credit portfolio balance is

expected to grow during the fourth quarter;

- The provision for bad debts, including

adjustments related to the new troubled debt restructuring

accounting, is expected to be between 4.0% and 5.0%, on an

annualized basis, of the average portfolio balance outstanding

during the fourth quarter; and

- Selling, general and administrative

expense, as a percent of revenues, is expected to be consistent

with or slightly lower than prior year levels.

The Company initiated earnings guidance, for the fiscal year

ending January 31, 2013, of diluted earnings per share of $1.05 to

$1.15. The following factors were considered in developing the

guidance:

- Same stores sales are expected to be up

low to mid-single digits;

- Opening of between five and seven new

locations in new markets;

- Retail segment retail gross margin is

expected to be between 28.0% and 30.0%;

- The credit portfolio balance is

expected to increase;

- The provision for bad debts is expected

to be between 3.0% and 4.0% of the average portfolio balance

outstanding; and

- Selling, general and administrative

expense, as a percent of revenues, is expected to be between 28.5%

and 29.5% of total revenues.

Conference Call Information

Conn’s, Inc. will host a conference call and audio webcast

today, December 8, 2011, at 10:00 AM, CT, to discuss its financial

results for the quarter ended October 31, 2011. A link to the live

webcast, which will be archived for one year, and slides to be

referred to during the call will be available at IR.Conns.com.

Participants can join the call by dialing 877-754-5302 or

678-894-3020.

About Conn’s, Inc.

The Company is a specialty retailer currently operating 70

retail locations in Texas, Louisiana and Oklahoma: with 23 stores

in the Houston area, 17 in the Dallas/Fort Worth Metroplex, eight

in San Antonio, three in Austin, five in Southeast Texas, one in

Corpus Christi, four in South Texas, six in Louisiana and three in

Oklahoma. The Company’s primary product categories include:

- Home appliances, including

refrigerators, freezers, washers, dryers, dishwashers and

ranges;

- Consumer electronics, including LCD,

LED, 3-D, plasma and DLP televisions, camcorders, digital cameras,

Blu-ray and DVD players, video game equipment, portable audio, MP3

players and home theater products;

- Furniture and mattresses, including

furniture for the living room, dining room, bedroom and related

accessories and mattresses; and

- Home office, including desktop,

notebook, netbook and tablet computers, printers and computer

accessories.

Additionally, the Company offers a variety of products on a

seasonal basis, including lawn and garden equipment, and continues

to introduce additional product categories for the home to help

respond to its customers' product needs and to increase same store

sales. Unlike many of its competitors, the Company provides

flexible in-house credit options for its customers, in addition to

third-party financing programs and third-party rent-to-own payment

plans. In the last three years, the Company financed, on average,

approximately 60% of its retail sales under its in-house financing

plan.

This press release contains forward-looking statements that

involve risks and uncertainties. Such forward-looking statements

generally can be identified by the use of forward-looking

terminology such as "may," "will," "expect," "intend," "could,"

"estimate," "should," "anticipate," or "believe," or the negative

thereof or variations thereon or similar terminology. Although the

Company believes that the expectations reflected in such

forward-looking statements will prove to be correct, the Company

can give no assurance that such expectations will prove to be

correct. The actual future performance of the Company could differ

materially from such statements. Factors that could cause or

contribute to such differences include, but are not limited to:

- the Company's growth strategy and plans

regarding opening new stores and entering new markets;

- the Company's intention to update,

relocate or expand existing stores;

- the effect of closing or reducing the

hours of operation of existing stores;

- the Company's estimated capital

expenditures and costs related to the opening of new stores or the

update, relocation or expansion of existing stores;

- the Company's ability to introduce

additional product categories;

- sales trends in the home appliances,

consumer electronics and furniture and mattress industries and the

Company's ability to respond to those trends;

- the pricing actions and promotional

activities of competitors;

- relationships with the Company's key

suppliers;

- delinquency and loss trends in the

receivables portfolio;

- the Company’s ability to offer flexible

financing programs;

- changes in the Company’s collection

practices and policies;

- the Company’s ability to amend, renew

or replace its existing credit facilities before the maturity dates

of the facilities;

- the Company's ability to fund

operations, debt repayment and expansion from cash flow from

operations, borrowings on its revolving lines of credit and

proceeds from securitizations and from accessing debt or equity

markets;

- the ability of the Company to obtain

additional funding for the purpose of funding the receivables

generated by the Company;

- the ability of the Company to maintain

compliance with the covenants in its financing facilities or obtain

amendments or waivers of the covenants to avoid violations or

potential violations of the covenants;

- reduced availability under the

Company’s credit facilities as a result of borrowing base

requirements and the impact on the borrowing base calculation of

changes in the performance or eligibility of the customer

receivables financed by that facility;

- the ability of the financial

institutions providing lending facilities to the Company to fund

their commitments;

- the effect on borrowing costs of

downgrades by rating agencies or changes in laws or regulations on

the Company’s financing providers;

- the cost of any amended, renewed or

replacement credit facilities;

- interest rates;

- general economic and financial market

conditions;

- weather conditions in the Company's

markets;

- the outcome of litigation or government

investigations;

- changes in the Company's stock price;

and

- the actual number of shares of common

stock outstanding.

Further information on these risk factors is included in the

Company's filings with the Securities and Exchange Commission,

including the Company's annual report on Form 10-K filed on April

1, 2011. You are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of this

press release. Except as required by law, the Company is not

obligated to publicly release any revisions to these

forward-looking statements to reflect the events or circumstances

after the date of this press release or to reflect the occurrence

of unanticipated events.

Conn's, Inc.

CONDENSED, CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited)

(in thousands, except earnings per share)

Three Months EndedOctober

31,

Nine Months EndedOctober

31,

2010 2011 2010 2011 Revenues

Total net sales $ 135,650 $ 149,967 $ 474,694 $ 456,287 Finance

charges and other 34,914 29,578

106,719 98,081

Total revenues 170,564

179,545 581,413 554,368 Cost and

expenses

Cost of goods and parts sold, including

warehousing and occupancy costs

101,188 114,669 350,113 333,106 Selling, general and administrative

expense 55,288 59,623 174,589 172,062

Costs and impairment charges related to

store closings

- 375 - 4,033 Provision for bad debts 10,813

19,322 28,786 31,852

Total cost and

expenses 167,289 193,989

553,488 541,053

Operating income (loss) 3,275 (14,444 )

27,925 13,315 Interest expense, net 7,722 3,919

20,234 18,479

Costs related to financing transactions

not completed

2,896 - 2,896 - Loss from early extinguishment of debt - - - 11,056

Other income (expense), net (17 ) (5 ) 167

81

Income (loss) before income taxes

(7,326 ) (18,358 ) 4,628

(16,301 ) Provision (benefit) for income taxes

(2,546 ) (5,635 )

2,123 (4,877 ) Net income (loss)

$ (4,780 ) $ (12,723 )

$ 2,505 $ (11,424 )

Earnings (loss) per share Basic $ (0.19 ) $ (0.40 ) $ 0.10 $

(0.36 ) Diluted $ (0.19 ) $ (0.40 ) $ 0.10 $ (0.36 )

Average

common shares outstanding Basic 24,951

31,881

24,941 31,819 Diluted 24,951

31,881

24,944 31,819

Notes:

- Previously reported Earnings per share

and Average common shares outstanding amounts have been corrected

to retroactively adjust for the impact of the Company’s November

2010 common stock rights offering.

- Previously reported Finance charges and

other amounts have been revised to correct the Company’s prior

estimates related to its change from recording interest income

based on the Rule of 78’s to the interest method.

Conn's, Inc. - Retail Segment CONDENSED FINANCIAL

INFORMATION (unaudited) (in thousands, except store counts)

Three Months EndedOctober

31,

Nine Months EndedOctober

31,

2010 2011 2010 2011 Revenues

Product sales $ 125,817 $ 140,404 $ 439,492 $ 422,914 Repair

service agreement commissions, net 8,275 10,602 28,616 29,449

Service revenues 3,769 3,950

12,709 11,650 Total net sales 137,861

154,956 480,817 464,013

Finance charges and other 215 60

681 678

Total revenues

138,076 155,016

481,498 464,691 Cost and

expenses

Cost of goods sold, including warehousing

and occupancy costs

99,546 113,022 343,979 328,133

Cost of parts sold, including warehousing

and occupancy costs

1,642 1,647 6,134 4,973 Selling, general and administrative expense

40,148 45,721 126,689 128,653

Costs and impairment charges related to

store closings

- 375 - 4,033 Provision for bad debts 271 135

668 469

Total cost and

expenses 141,607 160,900

477,470 466,261

Operating income (loss) (3,531 ) (5,884

) 4,028 (1,570 ) Other (income)

expense, net (17 ) (5 ) 167 81

Segment income (loss) before income taxes $

(3,514 ) $ (5,879 ) $

3,861 $ (1,651 ) Retail

gross margin 25.8 % 25.2 % 26.5 % 27.5 %

Selling, general and administrative

expense as percent of revenues

29.1 % 29.5 % 26.3 % 27.7 % Operating margin (2.6 %) (3.8 %) 0.8 %

(0.3 %) Number of stores, end of period 76 70 76 70

Conn's, Inc. - Credit Segment

CONDENSED FINANCIAL INFORMATION (unaudited) (in thousands)

Three Months EndedOctober

31,

Nine Months EndedOctober

31,

2010 2011 2010 2011

Revenues Product sales $ - $ - $ - $ - Repair service

agreement commissions, net (2,211 ) (4,989 ) (6,123 ) (7,726 )

Service revenues - - -

- Total net sales (2,211 ) (4,989 )

(6,123 ) (7,726 ) Finance charges and other

34,699 29,518 106,038

97,403

Total revenues 32,488

24,529 99,915

89,677 Cost and expenses Selling, general and

administrative expense 15,140 13,902 47,900 43,409 Provision for

bad debts 10,542 19,187 28,118

31,383

Total cost and expenses

25,682 33,089

76,018 74,792 Operating

income (loss) 6,806 (8,560 ) 23,897

14,885 Interest expense, net 7,722 3,919 20,234 18,479

Costs related to financing transactions

not completed

2,896 - 2,896 - Loss from early extinguishment of debt -

- - 11,056

Segment income (loss) before income taxes $

(3,812 ) $ (12,479 ) $

767 $ (14,650 )

Selling, general and administrative

expense as percent of revenues

46.6 % 56.7 % 47.9 % 48.4 % Operating margin 20.9 % -34.9 % 23.9 %

16.6 %

MANAGED

PORTFOLIO STATISTICS (dollars in thousands, except average

outstanding balance per account)

Year ended January

31, Nine Months ended October 31, 2009

2010 2011 2010 2011 Total

accounts 537,957 551,312 525,950 521,316 472,791 Total outstanding

balance $ 753,513 $ 736,041 $ 675,766 $ 676,994 $ 605,650 Average

outstanding balance per account $ 1,401 $ 1,335 $ 1,285 $ 1,299 $

1,281

Weighted average origination credit score

of sales financed

612 620 624 627 623

Weighted average credit score of

outstanding balances

585 586 591 590 602 Balance 60+ days delinquent $ 55,141 $ 73,391 $

58,042 $ 64,934 $ 47,653 Percent 60+ days delinquent 7.3 % 10.0 %

8.6 % 9.6 % 7.9 % Percent 60-209 days delinquent 6.0 % 8.3 % 7.0 %

8.1 % 7.9 % Percent of portfolio reaged 18.8 % 20.2 % 19.8 % 19.7 %

16.0 % Weighted average monthly payment rate (YTD) 5.5 % 5.2 % 5.3

% 5.4 % 5.7 % Net charge-off ratio (YTD annualized) 3.3 % 4.1 % 5.6

% 5.5 % 5.5 %

Notes: The net charge-off ratio for the nine months ended

October 31, 2011, is impacted by the additional $4.4 million

charged-off as a result of the charge-off policy change earlier in

the fiscal year, which impacted the net charge-off ratio by

approximately 90 basis points.

Conn's, Inc. CONDENSED, CONSOLIDATED BALANCE

SHEETS (in thousands)

January 31,

October 31, 2011 2011 Assets

Current assets Cash and cash equivalents $ 10,977 $ 6,510

Other accounts receivable, net 30,476 30,515 Customer accounts

receivable, net 342,754 305,623 Inventories 82,354 96,703 Deferred

income taxes 19,477 21,388 Prepaid expenses and other assets

10,418 10,623

Total current assets 496,456

471,362 Non-current deferred income tax asset

8,009 9,721 Long-term customer accounts

receivable, net 289,965 255,346 Total property

and equipment, net 46,890 40,619 Other assets,

net 10,118 10,004 Total

assets $ 851,438 $ 787,052

Liabilities and Stockholders' Equity Current

Liabilities Current portion of long-term debt $ 167 $ 679

Accounts payable 57,740 59,480 Accrued compensation and related

expenses 5,477 7,425 Accrued expenses 25,423 29,579 Other current

liabilities 30,917 29,109

Total current

liabilities 119,724 126,272 Long-term debt

373,569 309,997 Other long-term liabilities

5,248 6,856 Total stockholders' equity

352,897 343,927 Total liabilities and

stockholders' equity $ 851,438 $

787,052

NON-GAAP RECONCILIATION OF NET INCOME (LOSS), AS ADJUSTED

AND DILUTED EARNINGS (LOSS) PER SHARE, AS ADJUSTED

(unaudited) (in thousands, except earnings per share)

Three Months EndedOctober

31,

Nine Months EndedOctober

31,

2010 2011 2010 2011 Net income

(loss), as reported $ (4,780 ) $

(12,723 ) $ 2,505 $

(11,424 ) Adjustments: Costs related to financing

transactions not completed 2,896 - 2,896 - Loss from early

extinguishment of debt - - - 11,056 Costs and impairment charges

related to store closings - 375 - 4,033 Severance costs - - - 813

Inventory reserve adjustment - 4,669 - 4,669

Charge to record reserves required by the

adoption of troubled debt restructuring accounting guidance

- 27,487 - 27,487

Reserves previously provided related to

accounts considered restructured under the troubled debt

restructuring accounting guidance

- (13,350 ) - (13,350 ) Tax impact of adjustments (1,019 )

(5,961 ) (1,019 ) (12,166 )

Net income

(loss), as adjusted $ (2,903 ) $

497 $ 4,382 $

11,118 Average common shares outstanding -

Diluted 24,951 31,881 24,944 31,819

Earnings (loss) per

share - Diluted As reported $ (0.19 ) $ (0.40 ) $ 0.10 $ (0.36

) As adjusted $ (0.12 ) $ 0.02 $ 0.18 $ 0.35

NON-GAAP RECONCILIATION OF RETAIL

SEGMENT OPERATING INCOME (LOSS), AS ADJUSTED (unaudited)

(in thousands)

Three Months EndedOctober

31,

Nine Months EndedOctober

31,

2010 2011 2010 2011 Operating income

(loss), as reported $ (3,531 ) $

(5,884 ) $ 4,028 $ (1,570

) Adjustments:

Inventory reserve adjustment

- 4,669 - 4,669

Costs and impairment charges related to

store closings

- 375 - 4,033

Operating income (loss), as adjusted $ (3,531

) $ (840 ) $ 4,028

$ 7,132

NON-GAAP RECONCILIATION OF RETAIL SEGMENT GROSS

MARGIN, AS ADJUSTED (unaudited) (in thousands)

Three Months EndedOctober

31,

Nine Months EndedOctober

31,

2010 2011 2010 2011 Product sales, as

reported $ 125,817 $ 140,404 $ 439,492 $ 422,914

Repair service agreement commissions, net,

as reported

8,275 10,602 28,616

29,449 134,092 151,006 468,108 452,363

Cost of goods sold, including warehousing

and occupancy costs, as reported

99,546 113,022 343,979

328,133

Gross Profit, as reported $

34,546 $ 37,984 $

124,129 $ 124,230 Gross

Margin, as reported 25.8 % 25.2 %

26.5 % 27.5 % Adjustments: Inventory

reserve adjustment - 4,669 -

4,669

Gross Profit, as adjusted

$ 34,546 $ 42,653

$ 124,129 $ 128,899

Gross Margin, as adjusted 25.8 % 28.2

% 26.5 % 28.5 %

NON-GAAP RECONCILIATION OF CREDIT SEGMENT OPERATING

INCOME (LOSS), AS ADJUSTED (unaudited) (in thousands)

Three Months EndedOctober

31,

Nine Months EndedOctober

31,

2010 2011 2010 2011 Operating income

(loss), as reported $ 6,806 $

(8,560 ) $ 23,897 $

14,885 Adjustments:

Charge to record reserves required by the

adoption of troubled debt restructuring accounting guidance

- 27,487 27,487

Reserves previously recorded related to

accounts considered restructured under the troubled debt

restructuring accounting guidance

- (13,350 ) - (13,350 )

Operating

income, as adjusted $ 6,806 $ 5,577

$ 23,897 $ 29,022

Basis for presentation of non-GAAP

disclosures:

To supplement the Company’s consolidated financial statements,

which are prepared and presented in accordance with generally

accepted accounting principles ("GAAP"), the Company also provides

adjusted net income and adjusted earnings per diluted share

information. These non-GAAP financial measures are not meant to be

considered as a substitute for comparable GAAP measures but should

be considered in addition to results presented in accordance with

GAAP, and are intended to provide additional insight into the

Company’s operations and the factors and trends affecting the

Company’s business. The Company’s management believes these

non-GAAP financial measures are useful to financial statement

readers because (1) they allow for greater transparency with

respect to key metrics the Company uses in its financial and

operational decision making and (2) they are used by some of its

institutional investors and the analyst community to help them

analyze the Company’s operating results.

CONN-F

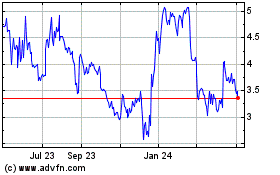

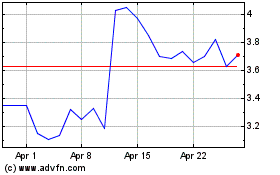

Conns (NASDAQ:CONN)

Historical Stock Chart

From May 2024 to Jun 2024

Conns (NASDAQ:CONN)

Historical Stock Chart

From Jun 2023 to Jun 2024