0000019612false00000196122019-10-242019-10-240000019612us-gaap:CommonStockMember2019-10-242019-10-240000019612tcf:DepositarySharesMember2019-10-242019-10-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 24, 2019

TCF FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Michigan (State or other jurisdiction of incorporation) | 000-08185 (Commission File Number) | 38-2022454 (IRS Employer Identification No.) |

333 W. Fort Street, Suite 1800, Detroit, Michigan 48226

(Address of principal executive offices, including Zip Code)

(800) 867-9757

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| (Title of each class) | (Trading Symbol(s)) | (Name of exchange on which registered) |

| Common Stock (par value $.01 per share) | TCF | The NASDAQ Stock Market |

Depositary shares, each representing a 1/1000th interest in a share of the 5.70% Series C Non-Cumulative Perpetual Preferred Stock | TCFCP | The NASDAQ Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition.

The following information, including Exhibit 99.1, shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall such information and Exhibit be deemed incorporated by reference in any filing under the Securities Act of 1933, except as may be expressly set forth by specific reference in such a filing.

TCF Financial Corporation (the "Corporation") issued a press release dated October 28, 2019, attached to this Form 8-K as Exhibit 99.1, announcing its results of operations for the quarter ended September 30, 2019.

The earnings release is also available on the Investor Relations section of the Corporation’s website at http://ir.tcfbank.com. The Corporation’s Annual Report to Shareholders and its reports on Forms 10-K, 10-Q and 8-K and other publicly available information should be consulted for other important information about the Corporation.

Item 7.01 Regulation FD Disclosure.

Information is being furnished herein in Exhibit 99.2 with respect to the slide presentation prepared for use with the press release. This information includes selected financial and operational information through the third quarter of 2019 and does not represent a complete set of financial statements and related notes prepared in conformity with generally accepted accounting principles ("GAAP"). Most, but not all, of the selected financial information furnished herein is derived from the Corporation’s consolidated financial statements and related notes prepared in accordance with GAAP and management’s discussion and analysis of financial condition and results of operations included in the Corporation’s reports on Forms 10-K and 10-Q. The Corporation’s annual financial statements are subject to independent audit. These materials are dated October 28, 2019 and TCF does not undertake to update the materials after that date.

The presentation is also available on the Investor Relations section of the Corporation’s website at http://ir.tcfbank.com. The Corporation’s Annual Report to Shareholders and its reports on Forms 10-K, 10-Q and 8-K and other publicly available information should be consulted for other important information about the Corporation.

Information contained herein, including Exhibit 99.2, shall not be deemed filed for the purposes of the Securities Exchange Act of 1934, nor shall such information and Exhibit be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such a filing.

Item 8.01 Other Events.

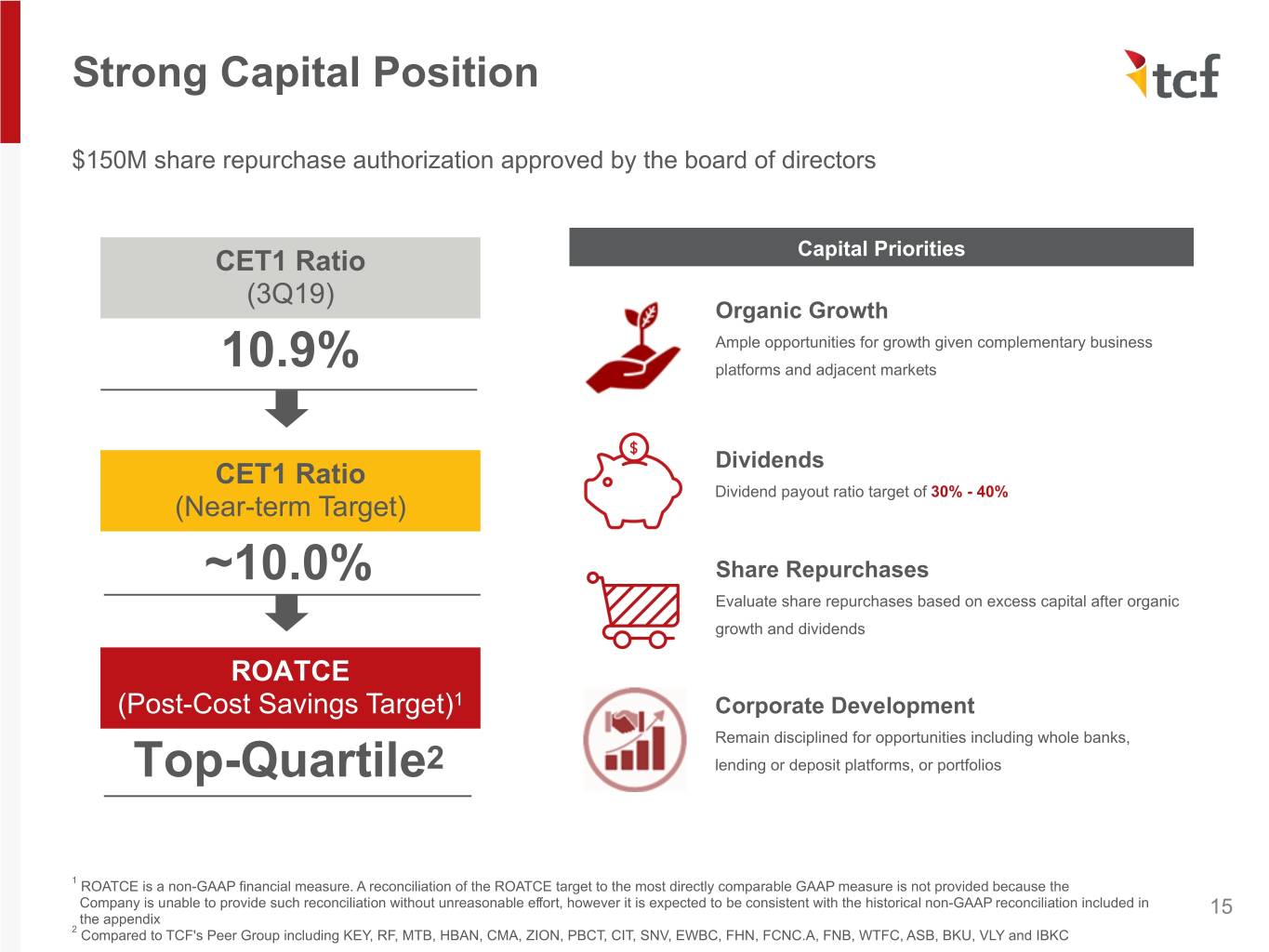

On October 24, 2019, the Corporation's board of directors approved an authorization to repurchase up to $150 million of TCF common stock. The repurchase program has no expiration, and permits shares to be repurchased in compliance with Rule 10b-18 of the Exchange Act, through one or more broker-dealers as part of “block purchases” made by the Corporation, and/or through privately negotiated purchases, accelerated stock repurchase agreements, or 10b5-1 plans at the discretion of the Corporation.

In addition, the board of directors declared a regular quarterly cash dividend of $0.35 per common share payable on December 2, 2019 to shareholders of record at the close of business on November 15, 2019, and declared a quarterly cash dividend of $0.35625 per depositary share payable on December 2, 2019 to shareholders of record of the depositary shares, each representing a 1/1,000th interest in a share of the 5.70% Series C Non-Cumulative Perpetual Preferred Stock, at the close of business on November 15, 2019.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit No. | Description |

| 99.1 | | |

| 99.2 | | |

| 101.1 | | Interactive Data File |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | |

| | TCF FINANCIAL CORPORATION |

| | |

| | |

| | /s/ Craig R. Dahl |

| | Craig R. Dahl,

President and Chief Executive Officer

(Principal Executive Officer) |

| | |

| | |

| | /s/ Dennis L. Klaeser |

| | Dennis L. Klaeser,

Executive Vice President and Chief Financial Officer

(Principal Financial Officer) |

| | |

| | |

| | /s/ Kathleen S. Wendt |

| | Kathleen S. Wendt,

Executive Vice President and Chief Accounting Officer

(Principal Accounting Officer) |

Dated: October 28, 2019

Exhibit 99.1

NEWS RELEASE

TCF Financial Corporation • 333 West Fort Street, Suite 1800 • Detroit, MI 48226

FOR IMMEDIATE RELEASE

| | | | | | | | | | | | | | |

| Contact: | | | | |

| Tom Wennerberg | (248) 498-2872 | news@tcfbank.com | (Media) | |

| Timothy Sedabres | (952) 745-2766 | investor@tcfbank.com | (Investors) | |

| | | | |

TCF REPORTS THIRD QUARTER 2019 RESULTS

AND ANNOUNCES $150 MILLION SHARE REPURCHASE AUTHORIZATION

TCF also announces quarterly cash dividends on common and preferred stock

Third Quarter Highlights

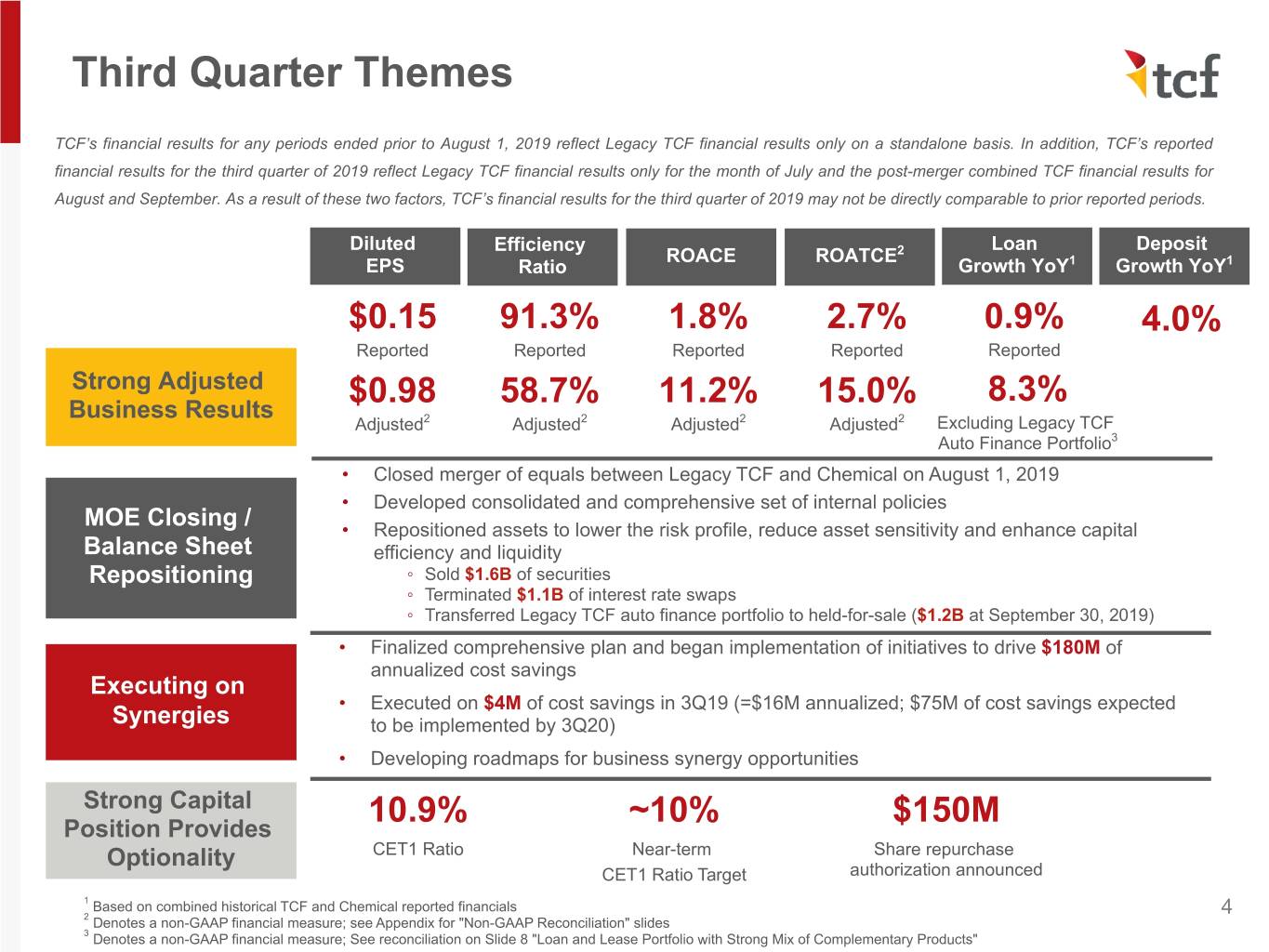

•Quarterly net income of $22.1 million, or $0.15 per diluted share

•Adjusted diluted earnings per common share of $0.98(1), excluding $106.2 million, or $0.83 per share, after-tax impact of merger-related expenses and non-core items

•Successfully closed merger of equals between Legacy TCF Financial Corporation (Legacy TCF) and Chemical Financial Corporation (Chemical) on August 1, 2019

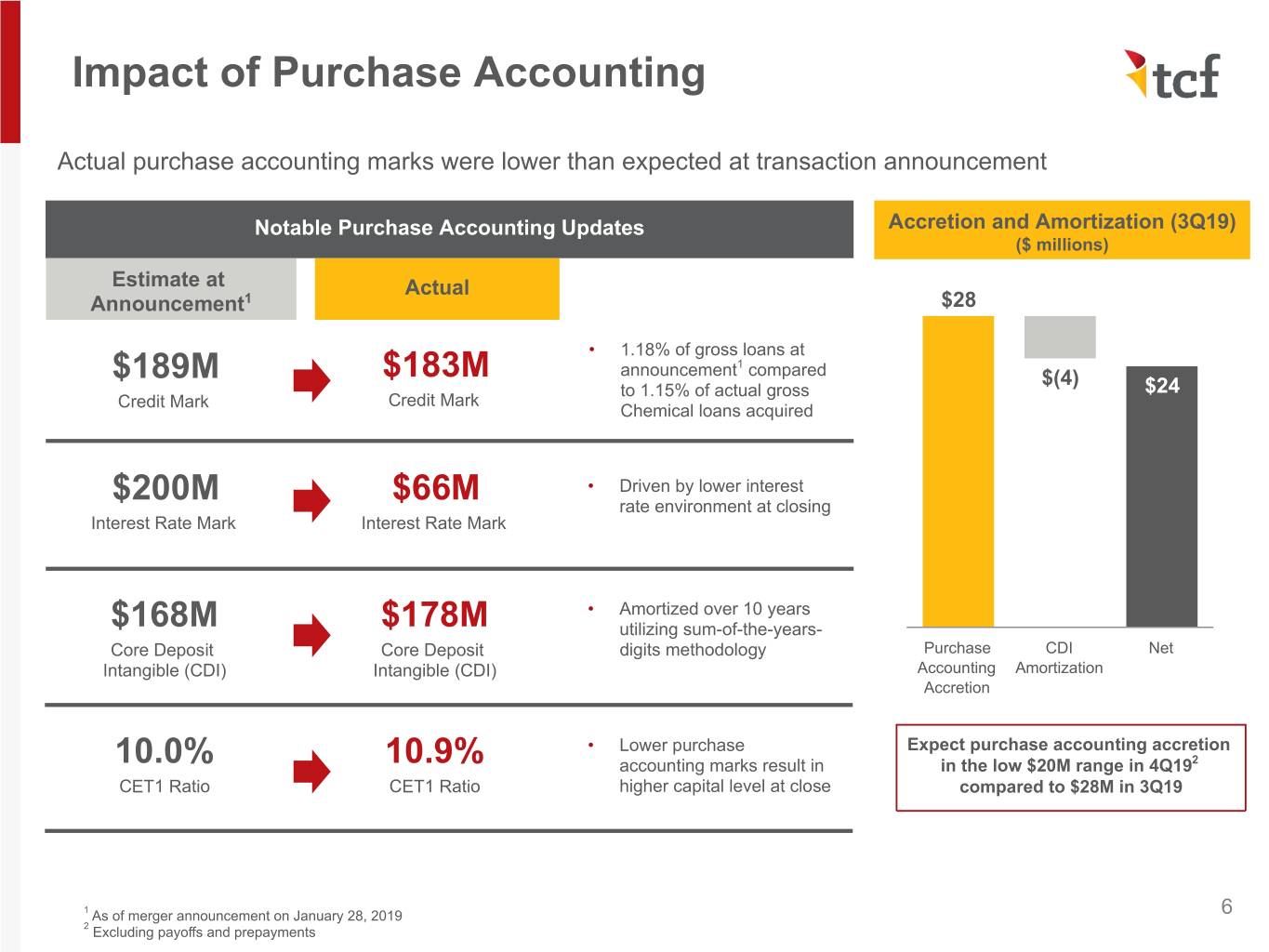

•Purchase accounting fair value credit mark of $183 million and interest rate mark of $66 million on the Chemical loans

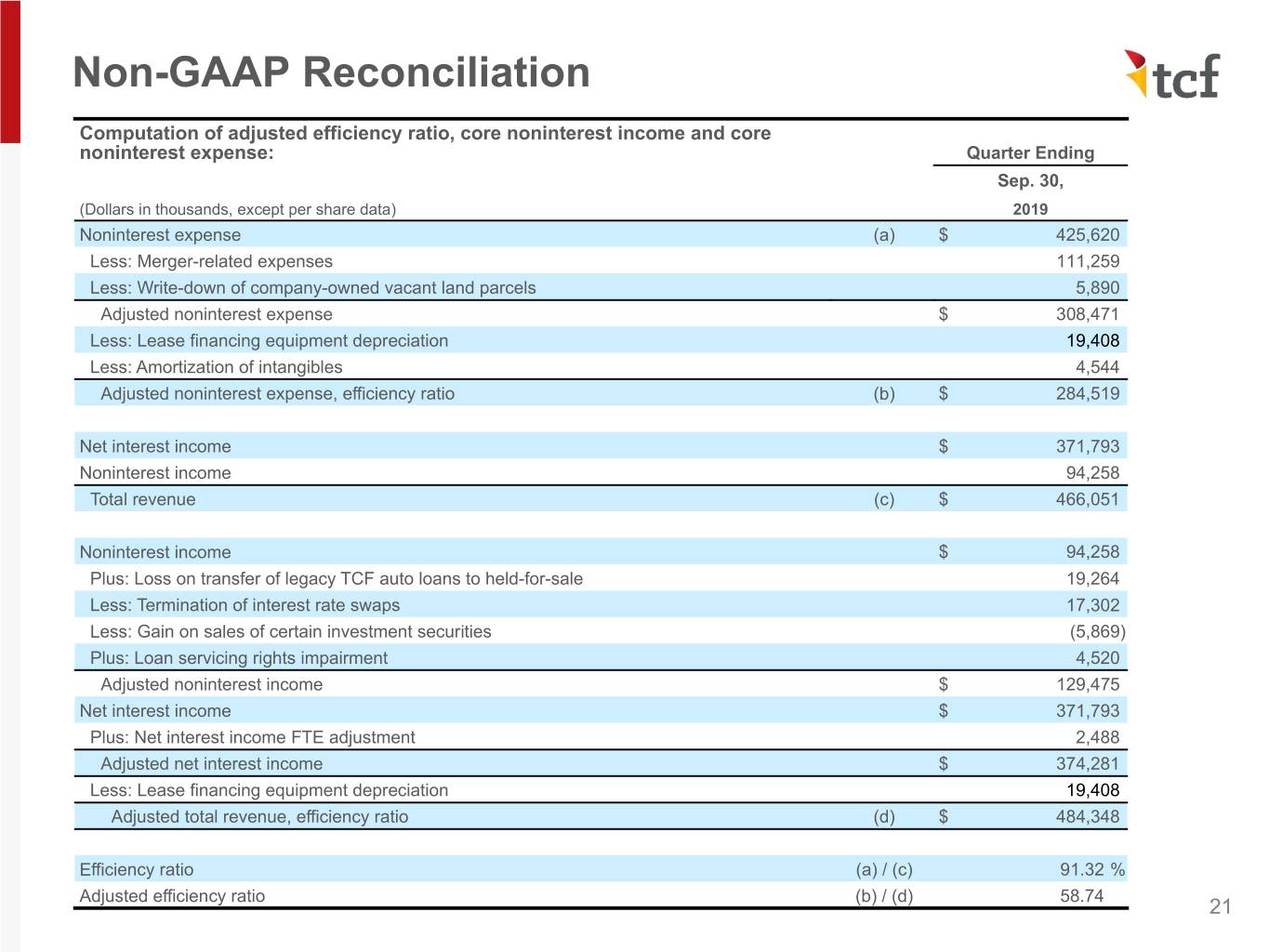

•Efficiency ratio of 91.32%; adjusted efficiency ratio of 58.74%(1)

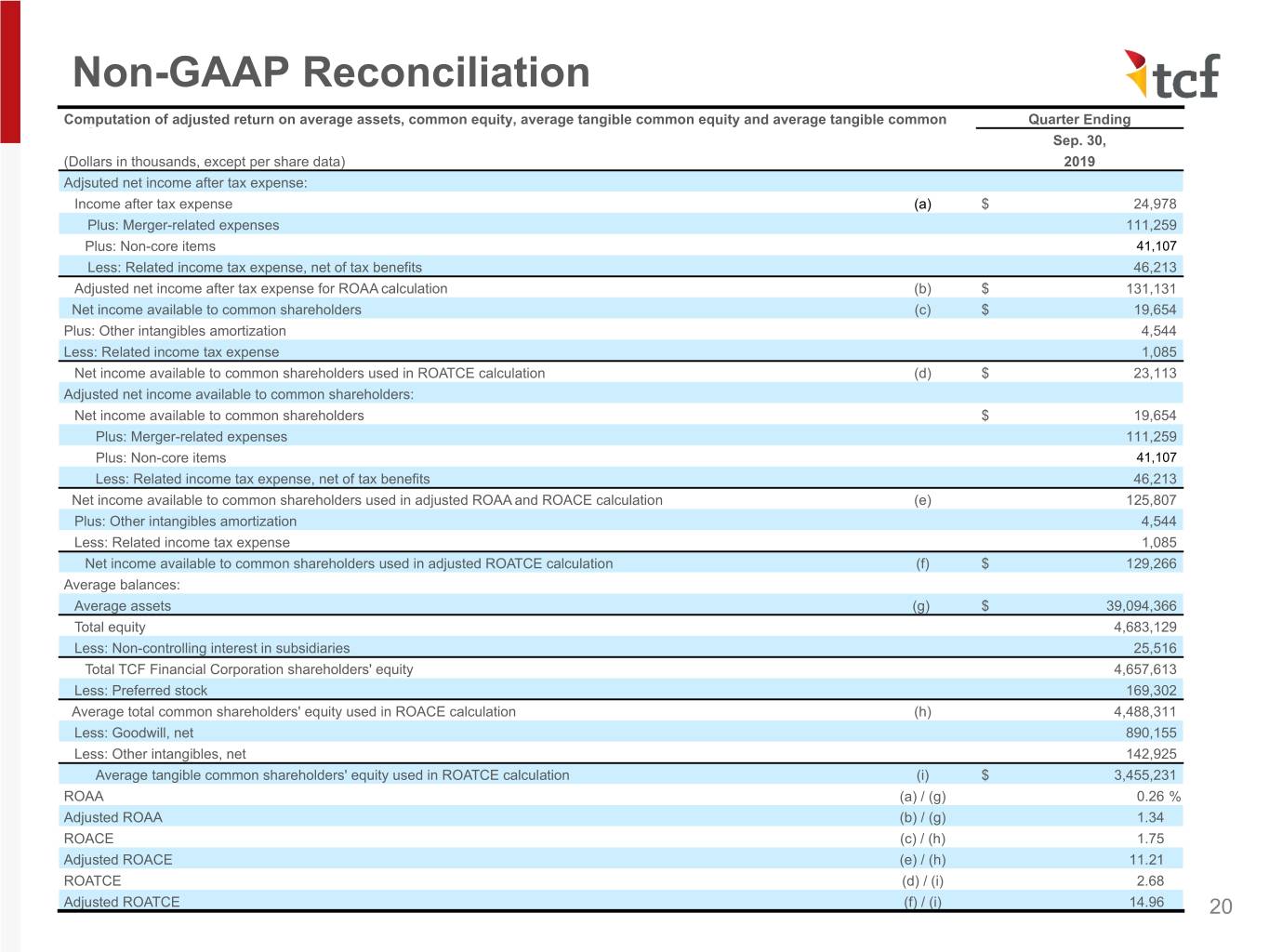

•Return on average common equity ("ROACE") of 1.75%; return on average tangible common equity ("ROATCE") of 2.68%(1); adjusted ROATCE of 14.96%(1)

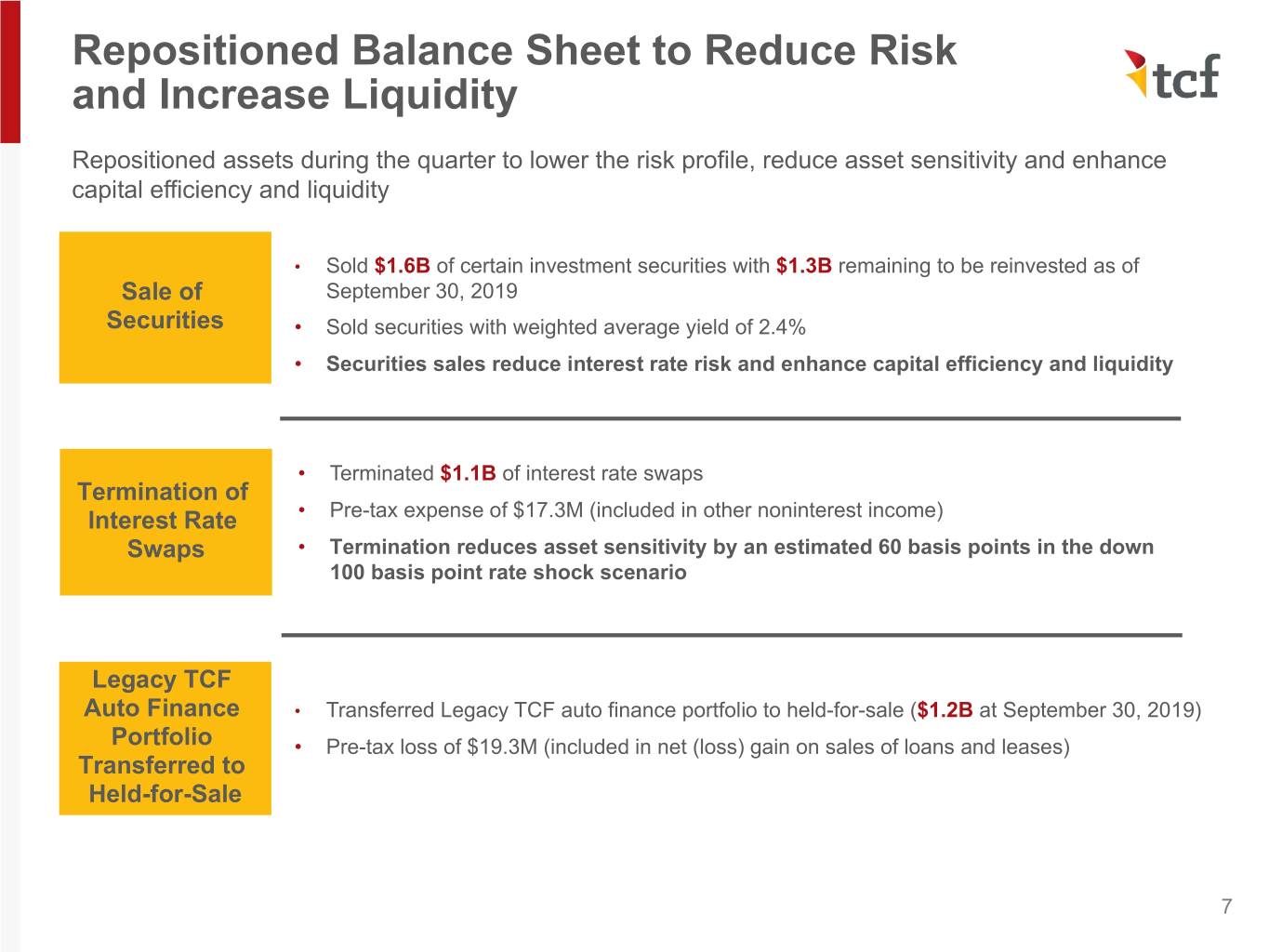

•Repositioned assets through investment securities sales and termination of interest rate swaps to lower the risk profile, reduce asset sensitivity and and enhance capital efficiency and liquidity

•Transferred Legacy TCF auto finance portfolio to held-for-sale ($1.2 billion at September 30, 2019), resulting in a $19.3 million pre-tax loss, or $14.7 million after tax

•Net charge-off rate as a percentage of average loans and leases of 0.39%, annualized

•Common equity Tier 1 capital ratio of 10.88%

•Announced $150 million share repurchase authorization on October 28, 2019

•Announced quarterly cash dividends on common stock of $0.35 per share on October 28, 2019

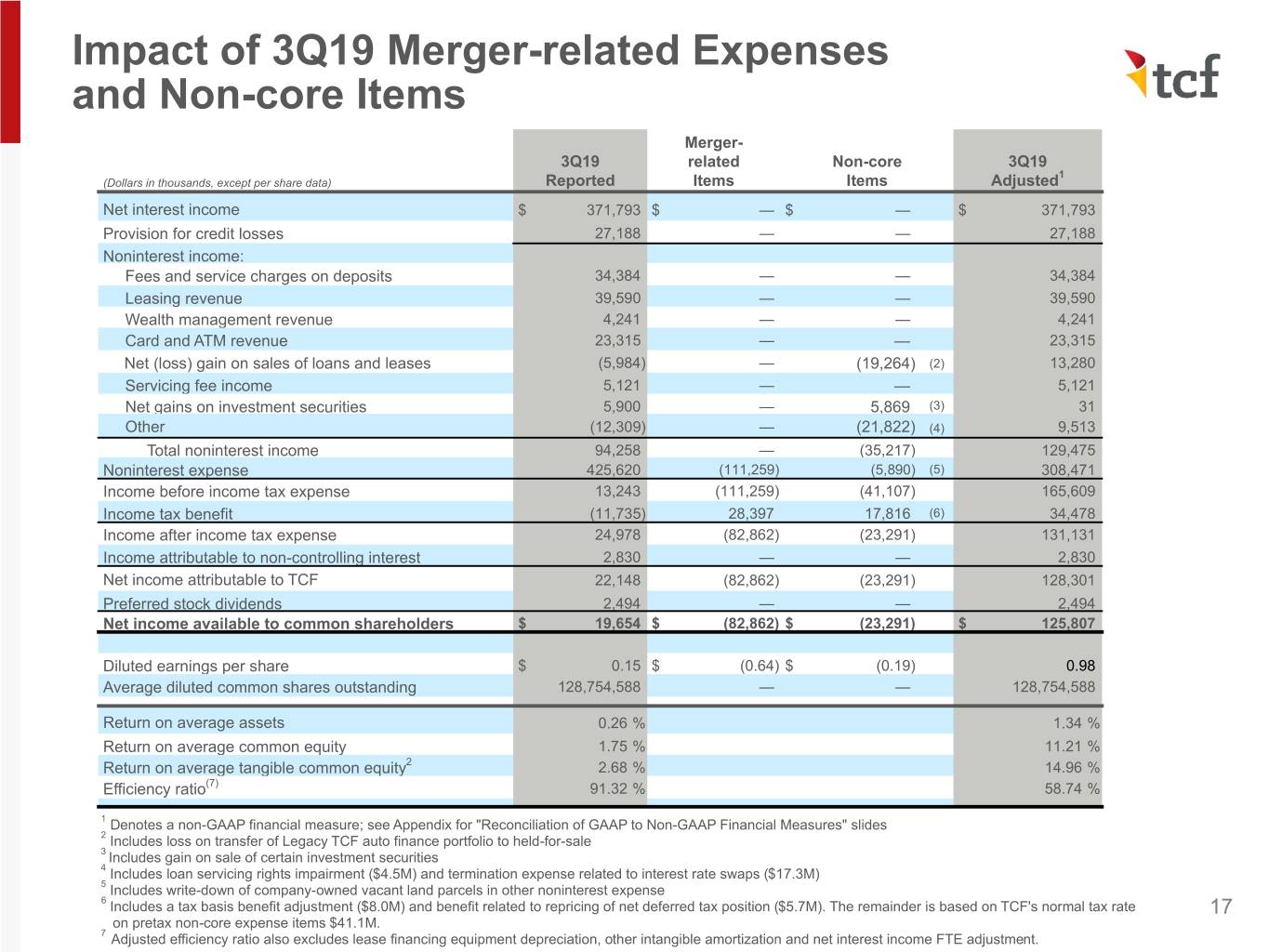

Merger-related Expenses and Non-core Items in the Third Quarter(1)

•Pre-tax merger-related expenses of $111.3 million, $82.9 million net of tax, or 64 cents per diluted common share

•Pre-tax loss of $41.1 million, $23.3 million net of tax, or 19 cents per diluted common share related to non-core items, see summary of non-core adjustments below

(1)Denotes a non-GAAP financial measure. See "Reconciliation of GAAP to Non-GAAP Financial Measures" tables.

Note: TCF’s financial results for any periods ended prior to August 1, 2019 reflect Legacy TCF financial results only on a standalone basis. In addition, TCF’s reported financial results for the third quarter of 2019 reflect Legacy TCF financial results only for the month of July and the post-merger combined TCF financial results for August and September. As a result of these two factors, TCF’s financial results for the third quarter of 2019 may not be directly comparable to prior reported periods. The number of shares issued and outstanding, earnings per share, additional paid-in-capital and all references to share quantities of TCF have been retrospectively restated to reflect the equivalent number of shares issued in the Merger as the Merger was treated as a reverse merger.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Summary of Financial Results(1) | | | | | | | | | | | | | | | | | | | | | |

| At or For the Quarter Ended | | | | | | | | | | Change From | | | | | | | | | | |

| Sep. 30, | | Jun. 30, | | Mar. 31, | | Dec. 31, | | Sep. 30, | | Jun. 30, | | Sep. 30, | | | | | | | | |

(Dollars in thousands, except per share data) | 2019 | | 2019 | | 2019 | | 2018 | | 2018 | | 2019 | | 2018 | | | | | | | | |

| Financial Results | | | | | | | | | | | | | | | | | | | | | |

Net income attributable to TCF | $ | 22,148 | | | $ | 90,427 | | | $ | 70,494 | | | $ | 85,652 | | | $ | 86,196 | | | (75.5) | | % | | (74.3) | | % | | | | | | | | |

| Net interest income | 371,793 | | | 254,057 | | | 254,429 | | | 253,153 | | | 253,502 | | | 46.3 | | | 46.7 | | | | | | | | | |

Basic earnings per common share | 0.15 | | | 1.07 | | | 0.83 | | | 1.00 | | | 1.00 | | | (86.0) | | | (85.0) | | | | | | | | | |

Diluted earnings per common share | 0.15 | | | 1.07 | | | 0.83 | | | 1.00 | | | 1.00 | | | (86.0) | | | (85.0) | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Return on average assets ("ROAA")(3) | 0.26 | % | | 1.54 | % | | 1.22 | % | | 1.52 | % | | 1.55 | % | | (128) | | bps | | (129) | | bps | | | | | | | | |

ROACE(3) | 1.75 | | | 14.27 | | | 11.40 | | | 14.30 | | | 14.44 | | | (1,252) | | | (1,269) | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

ROATCE(2)(3) | 2.68 | | | 15.46 | | | 12.42 | | | 15.58 | | | 15.76 | | | (1,278) | | | (1,308) | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Net interest margin (FTE)(3) | 4.14 | | | 4.49 | | | 4.61 | | | 4.67 | | | 4.73 | | | (35) | | | (59) | | | | | | | | | |

Net charge-offs as a percentage of average loans and leases(3) | 0.39 | | | 0.29 | | | 0.39 | | | 0.46 | | | 0.15 | | | 10 | | | 24 | | | | | | | | | |

Nonperforming assets as a percentage of total loans and leases and other real estate owned | 0.62 | | | 0.62 | | | 0.63 | | | 0.65 | | | 0.59 | | | — | | | 3 | | | | | | | | | |

| Efficiency ratio | 91.32 | | | 65.11 | | | 70.70 | | | 66.30 | | | 67.41 | | | 2,621 | | | 2,391 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Adjusted Financial Results (non-GAAP) | | | | | | | | | | | | | | | | | | | | | |

Adjusted net income attributable to TCF(2) | $ | 128,301 | | | | $ | 93,650 | | | | $ | 77,700 | | | | $ | 85,652 | | | | $ | 86,196 | | | 37.0 | | % | 48.8 | | % | | | | | | | |

Adjusted diluted earnings per common share(2) | 0.98 | | | 1.11 | | | | 0.91 | | | | 1.00 | | | | 1.00 | | | (11.7) | | | (2.0) | | | | | | | | | |

Adjusted ROAA(2)(3) | 1.34 | % | | 1.59 | % | | 1.34 | % | | 1.52 | % | | 1.55 | % | | (25) | | bps | | (21) | | bps | | | | | | | | |

Adjusted ROACE(2)(3) | 11.21 | | | 14.79 | | | 12.61 | | | 14.30 | | | 14.44 | | | (358) | | | (323) | | | | | | | | | |

Adjusted ROATCE(2)(3) | 14.96 | | | 16.02 | | | 13.72 | | | 15.58 | | | 15.76 | | | (106) | | | (80) | | | | | | | | | |

Adjusted efficiency ratio(2) | 58.74 | | | | 61.48 | | | | 65.67 | | | | 63.89 | | | | 64.91 | | | (274) | | | (617) | | | | | | | | | |

(1)Financial results for any periods ended prior to August 1, 2019 reflect Legacy TCF financials on a standalone basis. Certain reclassifications have been made to prior period financial statements to conform to the current period presentation.

(2)Denotes a non-GAAP financial measure. See "Reconciliation of GAAP to Non-GAAP Financial Measures" tables.

(3)Annualized.

The following table includes merger-related expenses and non-core items used to arrive at adjusted net income in the Adjusted Financial Results (non-GAAP) (see Reconciliation of Non-GAAP Financial Measures).

| | | | | | | | | | | | | | | | | |

| For the quarter ended September 30, 2019 | | | | |

| (Dollars in thousands, except per share data) | Pre-tax income (loss) | | After-tax benefit (loss)(1) | | Per Share |

| Merger-related expenses | $ | (111,259) | | | $ | (82,862) | | | $ | (0.64) | |

| Non-core items: | | | | | |

Transfer of Legacy TCF auto finance portfolio to held-for-sale(2) | (19,264) | | | (14,664) | | | (0.11) | |

Termination of interest rate swaps(3) | (17,302) | | | (13,170) | | | (0.10) | |

Write-down of company-owned vacant land parcels(4) | (5,890) | | | (4,483) | | | (0.04) | |

Sale of certain investment securities(5) | 5,869 | | | 4,467 | | | 0.03 | |

Loan servicing rights impairment(3) | (4,520) | | | (3,441) | | | (0.03) | |

Tax basis adjustment benefit(6) | — | | | 8,000 | | | 0.06 | |

| Total non-core items | $ | (41,107) | | | $ | (23,291) | | | $ | (0.19) | |

| Total merger-related and non-core items | $ | (152,366) | | | | $ | (106,153) | | | $ | (0.83) | |

(1)Net of tax benefit at TCF's normal tax rate and other tax benefits.

(2)Included within Net (loss) gain on sales of loans and leases.

(3)Included within Other noninterest income.

(4)Included within Other noninterest expense.

(5)Included within Net gains on investment securities.

(6)Included within Income tax (benefit) expense.

DETROIT (October 28, 2019) - TCF Financial Corporation ("TCF" or the "Corporation") (NASDAQ: TCF) today reported net income of $22.1 million and diluted earnings per common share of 15 cents for the third quarter of 2019. Adjusted net income was $128.3 million, or 98 cents per diluted earnings per common share, for the third quarter of 2019, excluding merger-related expenses and non-core items of 83 cents per common share (see "Reconciliation of GAAP to Non-GAAP Financial Measures" tables).

"Following the closing of the merger of equals on August 1, we continue to make progress on integration initiatives and I am optimistic about the growth outlook of the organization as we establish our roadmaps for execution on business synergy opportunities," said Craig R. Dahl, president and chief executive officer. "Our integration program and activities remain on track, and we continue to be focused on achieving targeted cost savings, planning for systems conversions and leveraging our full-scale product offering across our broader consumer and commercial customer base throughout the Midwest. Our teams are collaborating across the organization to ensure we continue to build on the momentum that each bank brings to the table, for both continued organic growth and taking care of our customers. As we go to market as One TCF, we are well positioned to deliver shareholder value through improved efficiency and return on capital, while maintaining an exceptional customer experience."

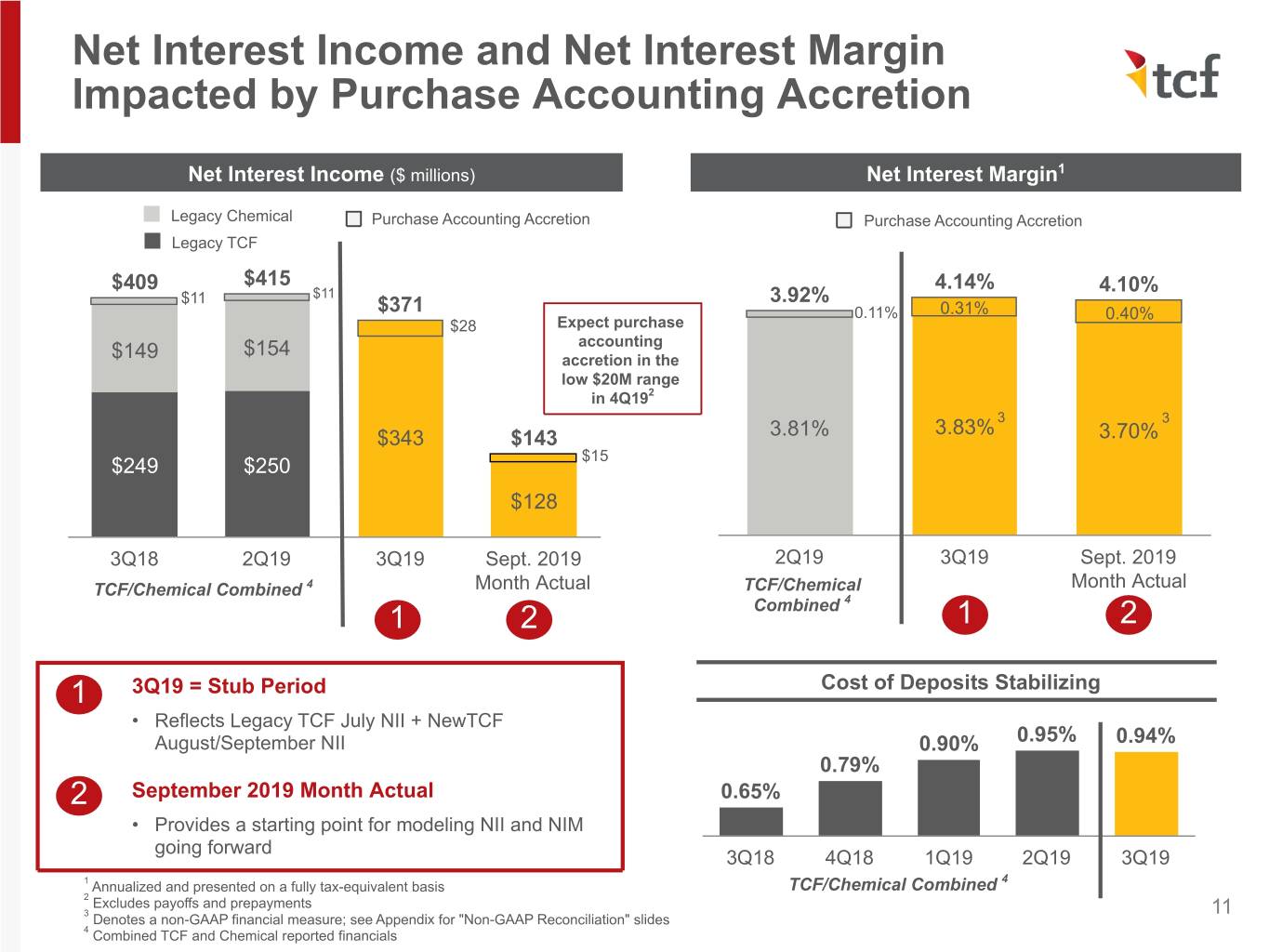

Net Interest Income and Net Interest Margin

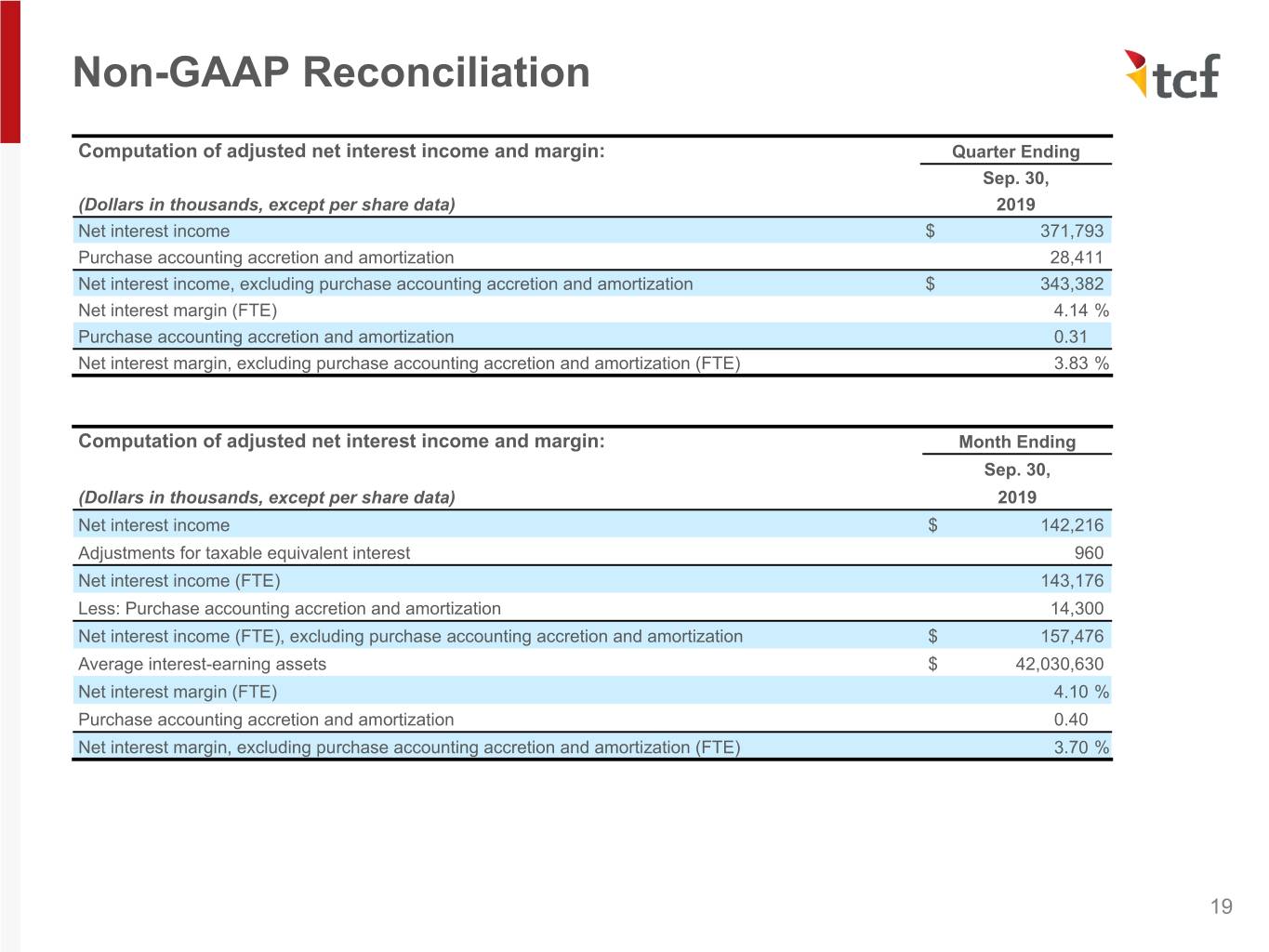

Net interest income was $371.8 million for the third quarter of 2019. Purchase accounting accretion and amortization included in net interest income was $28.4 million. Net interest income, excluding purchase accounting accretion and amortization, was $343.4 million. Net interest margin on a fully tax-equivalent basis (FTE) was 4.14% for the third quarter of 2019. Net interest margin FTE, excluding purchase accounting accretion and amortization, was 3.83% (see "Reconciliation of GAAP to Non-GAAP Financial Measures" tables).

Noninterest Income

Noninterest income was $94.3 million for the third quarter of 2019. Noninterest income included the following balance sheet repositioning actions considered to be non-core items: a $19.3 million loss related to the transfer of the Legacy TCF auto finance portfolio to held-for-sale, a $17.3 million loss related to the termination of interest rate swaps, and a gain of $5.9 million related to the sale of $1.6 billion of certain investment securities. Noninterest income additionally included $4.5 million of loan servicing rights impairment, also considered a non-core item. Adjusted noninterest income for the third quarter of 2019 was $129.5 million (see "Reconciliation of GAAP to Non-GAAP Financial Measures" tables). The third quarter of 2019 also included a $2.1 million unrealized loss related to interest rate swaps mark-to-market adjustments resulting from changes in the interest rate environment. Noninterest income, excluding the interest rate swap mark-to-market adjustment and non-core items discussed previously, was $131.6 million for the third quarter of 2019.

Noninterest Expense

Noninterest expense was $425.6 million for the third quarter of 2019 and included $111.3 million of merger-related expenses. Noninterest expense also included $5.9 million of expense, included within other noninterest expense, related to the write-down of company-owned vacant land parcels, considered a non-core item. Excluding merger-related expenses and the write-down of company-owned vacant land parcels, adjusted noninterest expense was $308.5 million (see "Reconciliation of GAAP to Non-GAAP Financial Measures" tables).

Income Tax (Benefit) Expense

Income tax benefit for the third quarter of 2019 was $11.7 million. The third quarter of 2019 included an $8.0 million tax basis adjustment benefit. The third quarter of 2019 also included a $5.7 million benefit provided by the repricing of TCF's net deferred tax position in conjunction with the completion of the merger and is reflected in the after-tax impact of merger-related expenses.

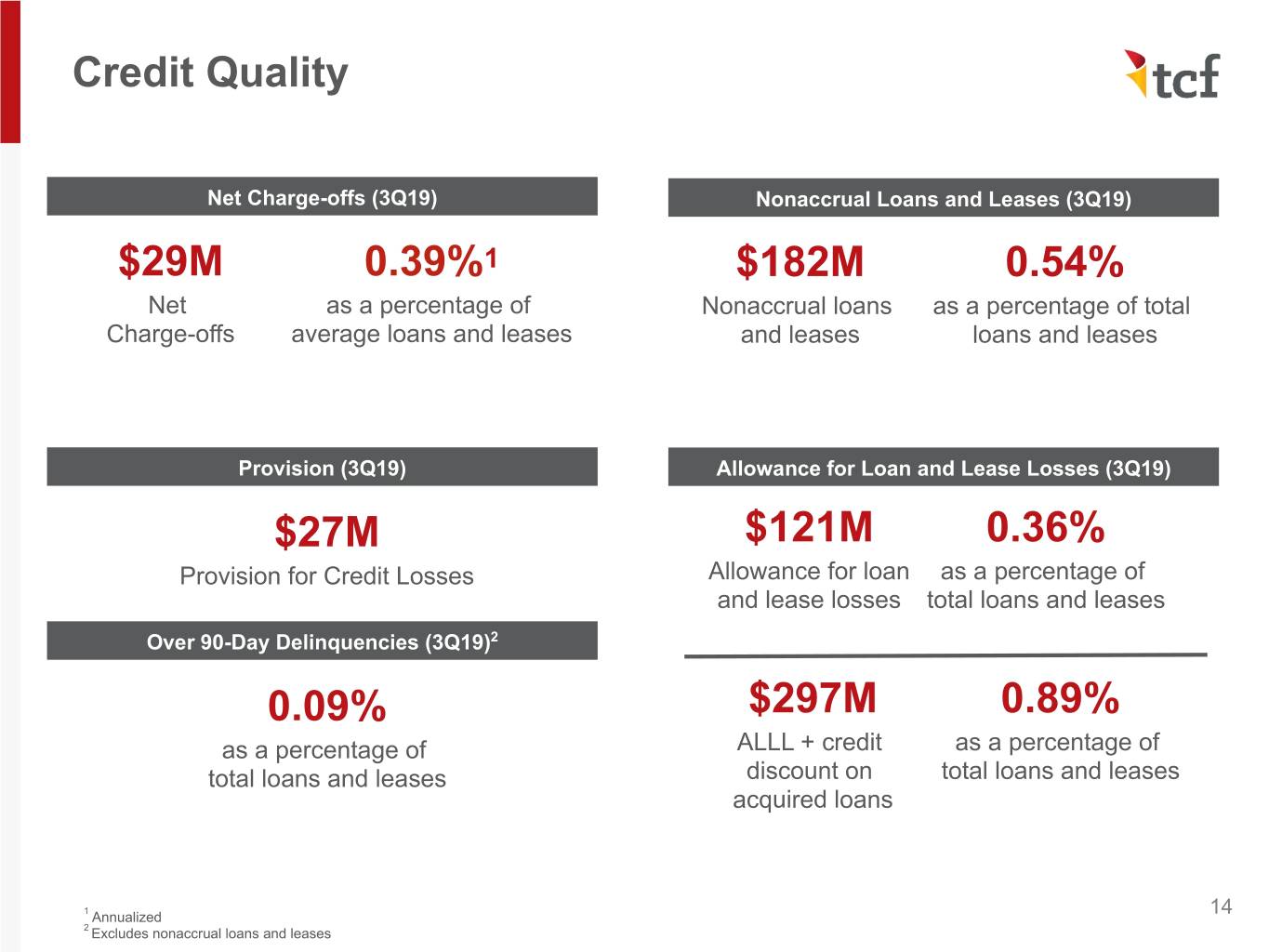

Credit Quality

Provision for credit losses Provision for credit losses was $27.2 million for the third quarter of 2019.

Net charge-off rate The annualized net charge-offs as a percentage of average loans and leases was 0.39% for the third quarter of 2019.

Allowance for Loan and Lease Losses Allowance for loan and lease losses was $121.2 million, or 0.36% of total loans and leases, at September 30, 2019. Loans acquired in the Merger were recorded at their fair value as of the merger date without a carryover of the related allowance, and as of September 30, 2019, the determination was made that no allowance was needed for this population of loans. Allowance for loan and lease losses and the credit discount on acquired loans was $297.0 million, or 0.89% of total loans and leases at September 30, 2019.

Nonaccrual loans and leases Nonaccrual loans and leases were $181.8 million at September 30, 2019 and represented 0.54% of total loans and leases.

Balance Sheet

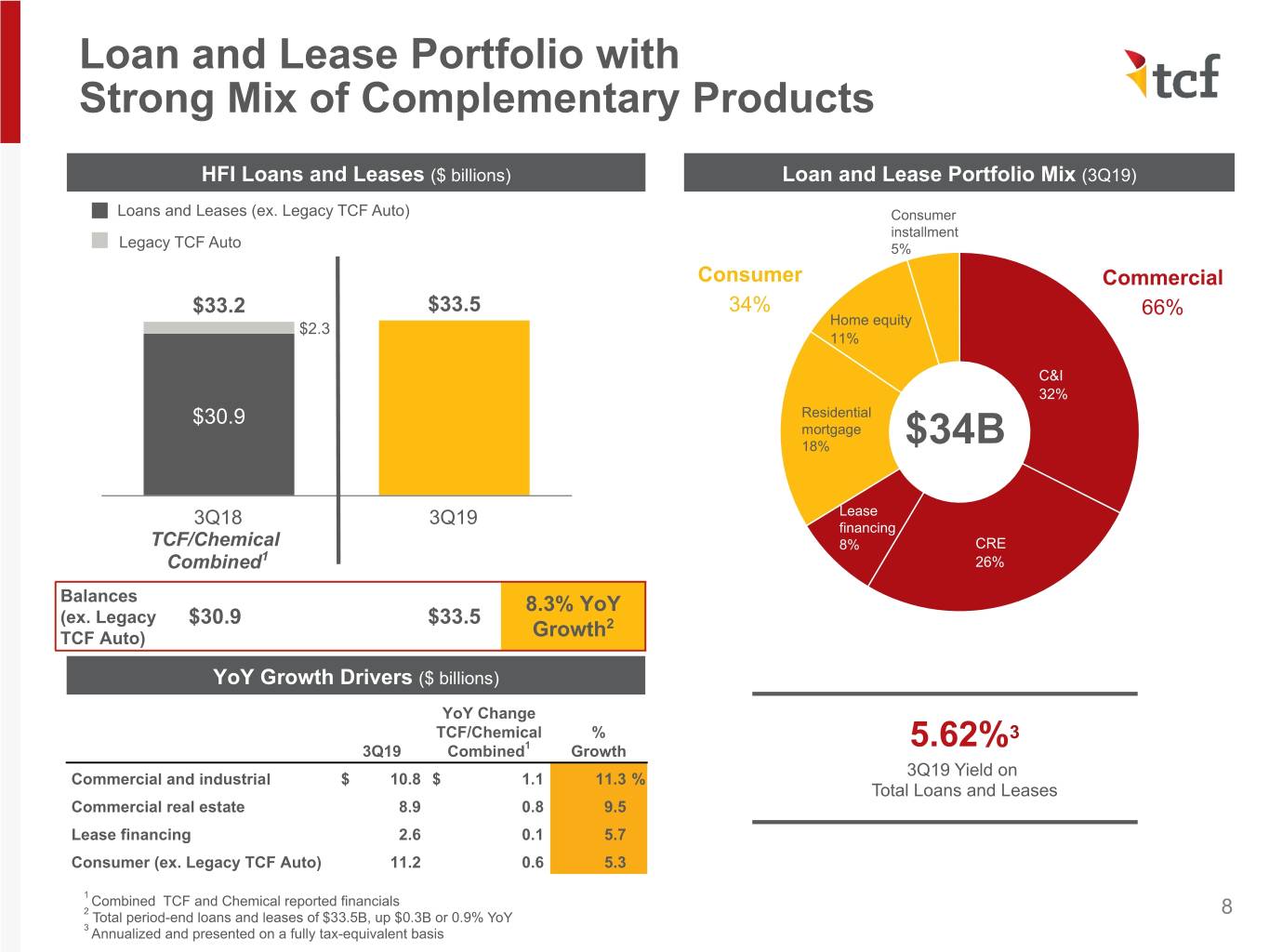

Loans and leases Loans and leases were $33.5 billion at September 30, 2019, compared to $19.2 billion at June 30, 2019. Loan and lease balances were impacted by the addition of Chemical's $15.7 billion loan and lease portfolio, partially offset by the transfer of the Legacy TCF auto finance portfolio to held-for-sale ($1.2 billion at September 30, 2019).

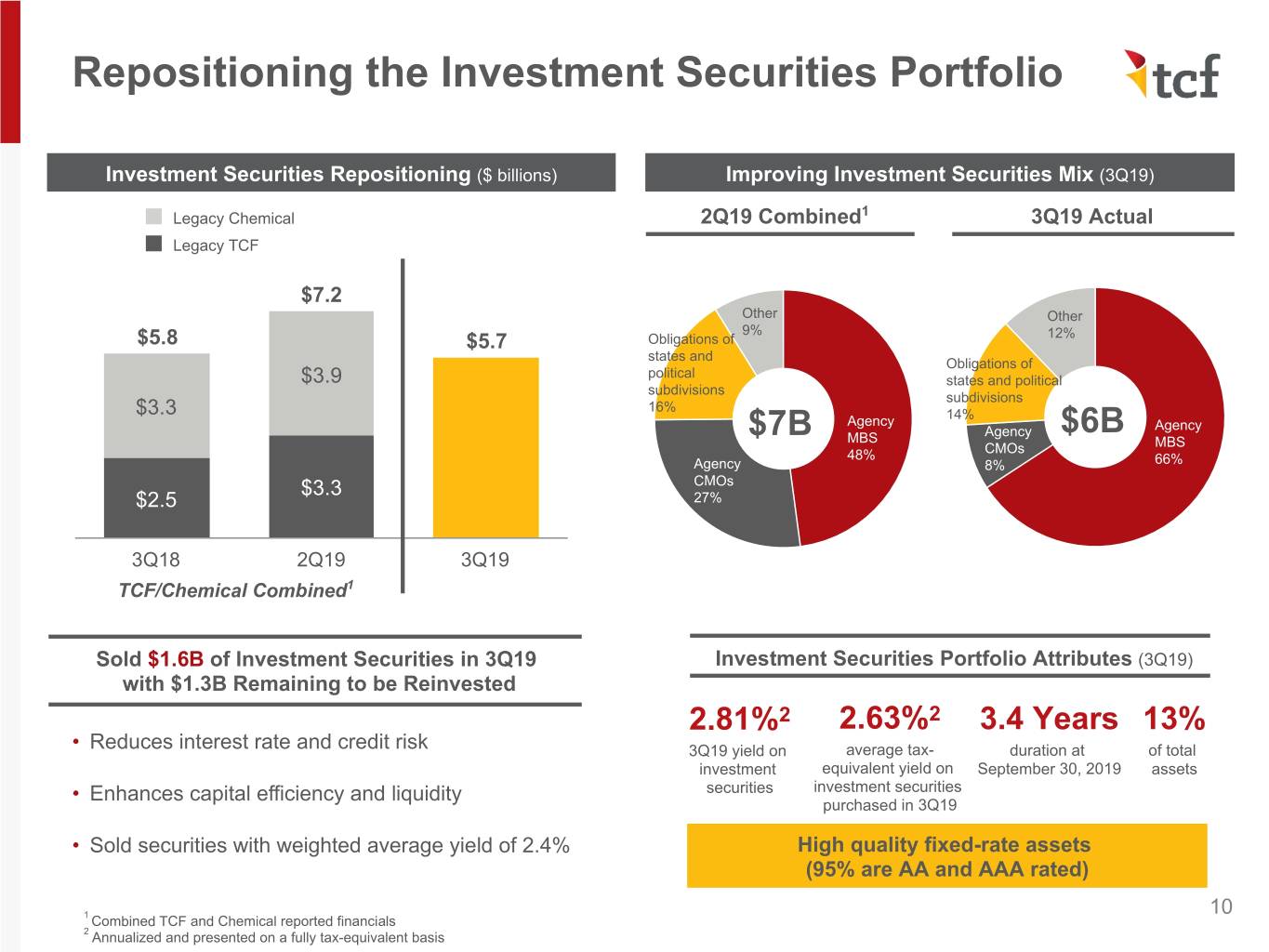

Investment securities The investment securities portfolio was $5.7 billion at September 30, 2019, compared to $3.3 billion at June 30, 2019. Portfolio balances were impacted by the addition of Chemical's $3.8 billion investment securities portfolio and the subsequent sale of $1.6 billion of these investment securities during the third quarter of 2019.

Deposits Deposits were $35.3 billion at September 30, 2019, compared to $19.1 billion at June 30, 2019. Deposit balances were impacted by the addition of $16.8 billion of Chemical deposits during the third quarter of 2019.

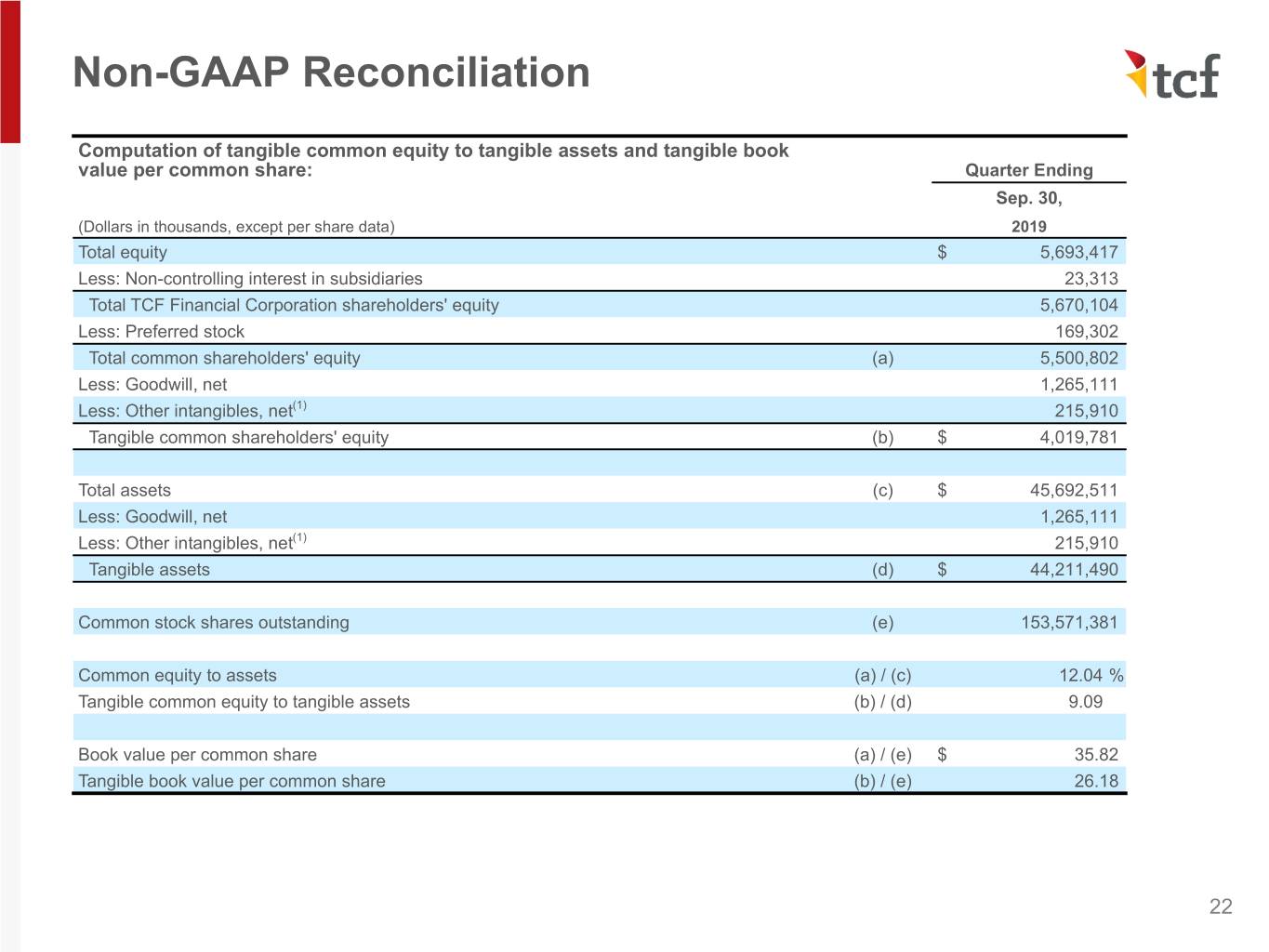

Capital The common equity Tier 1 capital ratio was 10.88% at September 30, 2019.

TCF's board of directors approved an authorization to repurchase up to $150 million of TCF common stock.

TCF’s board of directors also declared a regular quarterly cash dividend of $0.35 per common share payable on December 2, 2019 to shareholders of record at the close of business on November 15, 2019. In addition, the board of directors declared a quarterly cash dividend of $0.35625 per depositary share payable on December 2, 2019 to shareholders of record of the depositary shares, representing a 1/1,000th interest in a share of the 5.70% Series C Non-Cumulative Perpetual Preferred Stock, at the close of business on November 15, 2019.

Conference Call Details TCF will host a conference call to discuss third quarter 2019 results on Tuesday, October 29, 2019 at 10:00 a.m. Eastern Daylight Time. The conference call will be available via a live webcast on the Investor Relations section of TCF's website, ir.tcfbank.com, and archived for replay. The conference call can also be accessed by dialing (844) 512-2926 and entering access code 3865677. To listen to the replay via phone, please dial (877) 344-7529 and enter access code 10135947. The replay begins approximately one hour after the call is completed on Tuesday, October 29, 2019 and will be available through Tuesday, November 5, 2019.

TCF Financial Corporation (NASDAQ: TCF) is a Detroit, Michigan-based financial holding company with $46 billion in total assets and a top 10 deposit market share in the Midwest at September 30, 2019. TCF’s primary banking subsidiary, TCF National Bank, is a premier Midwest bank offering consumer and commercial banking, trust and wealth management, and specialty leasing and lending products and services to consumers, small businesses and commercial clients. TCF has more than 500 branches primarily located in Michigan, Illinois and Minnesota with additional locations in Arizona, Colorado, Indiana, Ohio, South Dakota and Wisconsin. TCF also conducts business across all 50 states and Canada through its specialty lending and leasing businesses. To learn more about TCF, visit ir.tcfbank.com.

Cautionary Statements for Purposes of the Safe Harbor Provisions of the Securities Litigation Reform Act

Any statements contained in this earnings release regarding the outlook for the Corporation's businesses and their respective markets, such as projections of future performance, targets, guidance, statements of the Corporation's plans and objectives, forecasts of market trends and other matters are forward-looking statements based on the Corporation's assumptions and beliefs. Such statements may be identified by such words or phrases as "will likely result," "are expected to," "will continue," "outlook," "will benefit," "is anticipated," "estimate," "project," "management believes" or similar expressions. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those discussed in such statements and no assurance can be given that the results in any forward-looking statement will be achieved. For these statements, TCF claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Any forward-looking statement speaks only as of the date on which it is made and we disclaim any obligation to subsequently revise any forward-looking statement to reflect events or circumstances after such date or to reflect the occurrence of anticipated or unanticipated events.

Certain factors could cause the Corporation's future results to differ materially from those expressed or implied in any forward-looking statements contained herein. These factors include the factors discussed in Part I, Item 1A. of the Corporation's Annual Report on Form 10-K for the year ended December 31, 2018 under the heading "Risk Factors" and any other cautionary statements, written or oral, which may be made or referred to in connection with any such forward-looking statements. Since it is not possible to foresee all such factors, these factors should not be considered as complete or exhaustive.

Use of Non-GAAP Financial Measures

Management uses the adjusted diluted earnings per common share, adjusted ROAA, adjusted ROACE, ROATCE, adjusted ROATCE, adjusted efficiency ratio, tangible book value per common share and tangible common equity to tangible assets internally to measure performance and believes that these financial measures not recognized under generally accepted accounting principles in the United States ("GAAP") (i.e. non-GAAP) provide meaningful information to investors that will permit them to assess the Corporation's capital and ability to withstand unexpected market or economic conditions and to assess the performance of the Corporation in relation to other banking institutions on the same basis as that applied by management, analysts and banking regulators. TCF adjusts certain results to exclude merger-related expenses and non-core items management believes it is useful to investors in understanding TCF's business and operating results.

These non-GAAP financial measures are not defined by GAAP and other entities may calculate them differently than TCF does. Non-GAAP financial measures have inherent limitations and are not required to be uniformly applied. Although these non-GAAP financial measures are frequently used by stakeholders in the evaluation of a corporation, they have limitations as analytical tools and should not be considered in isolation or as a substitute for analyses of results as reported under GAAP. In particular, a measure of earnings that excludes selected items does not represent the amount that effectively accrues directly to shareholders.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| TCF FINANCIAL CORPORATION AND SUBSIDIARIES | | | | | | | | | | | | | | | | | |

| Consolidated Statements of Financial Condition (Unaudited) | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Change From | | | | | | |

(Dollars in thousands) | Sep. 30, | | Jun. 30, | | Mar. 31, | | Dec. 31, | | Sep. 30, | | Jun. 30, 2019 | | | | Sep. 30, 2018 | | |

| 2019 | | 2019 | | 2019 | | 2018 | | 2018 | | $ | | % | $ | | % |

| ASSETS: | | | | | | | | | | | | | | | | |

| Cash and cash equivalents: | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash and due from banks | $ | 586,060 | | | $ | 294,566 | | | $ | 283,659 | | | $ | 279,267 | | | $ | 306,834 | | | $ | 291,494 | | | 99.0 | % | $ | 279,226 | | | 91.0 | % |

| Interest-bearing deposits with other banks | 736,954 | | | 260,705 | | | 180,163 | | | 307,790 | | | 263,134 | | | 476,249 | | | 182.7 | | 473,820 | | | 180.1 | |

| | | | | | | | | | | | | | | | |

| Total cash and cash equivalents | 1,323,014 | | | 555,271 | | | 463,822 | | | 587,057 | | | 569,968 | | | 767,743 | | | 138.3 | | 753,046 | | | 132.1 | |

| Federal Home Loan Bank and Federal Reserve Bank stocks, at cost | 290,238 | | | 105,659 | | | 103,644 | | | 91,654 | | | 80,672 | | | 184,579 | | | 174.7 | | 209,566 | | | N.M. | |

| Investment securities: | | | | | | | | | | | | | | | | |

| Carried at fair value | 5,579,835 | | | 3,109,803 | | | 2,945,342 | | | 2,470,065 | | | 2,379,546 | | | 2,470,032 | | | 79.4 | | 3,200,289 | | | 134.5 | |

| Held-to-maturity, at amortized cost | 144,000 | | | 144,919 | | | 148,024 | | | 148,852 | | | 152,881 | | | (919) | | | (0.6) | | (8,881) | | | (5.8) | |

| Total investment securities | 5,723,835 | | | 3,254,722 | | | 3,093,366 | | | 2,618,917 | | | 2,532,427 | | | 2,469,113 | | | 75.9 | | 3,191,408 | | | 126.0 | |

| Loans and leases held-for-sale | 1,436,069 | | | 74,410 | | | 64,468 | | | 90,664 | | | 114,198 | | | 1,361,659 | | | N.M. | | 1,321,871 | | | N.M. | |

| Loans and leases | 33,510,752 | | | 19,185,137 | | | 19,384,210 | | | 19,073,020 | | | 18,422,088 | | | 14,325,615 | | | 74.7 | | 15,088,664 | | | 81.9 | |

| Allowance for loan and lease losses | (121,218) | | | (146,503) | | | (147,972) | | | (157,446) | | | (160,621) | | | 25,285 | | | 17.3 | | 39,403 | | | 24.5 | |

| Loans and leases, net | 33,389,534 | | | 19,038,634 | | | 19,236,238 | | | 18,915,574 | | | 18,261,467 | | | 14,350,900 | | | 75.4 | | 15,128,067 | | | 82.8 | |

| Premises and equipment, net | 554,194 | | | 432,751 | | | 429,711 | | | 427,534 | | | 429,648 | | | 121,443 | | | 28.1 | | 124,546 | | | 29.0 | |

| Goodwill | 1,265,111 | | | 154,757 | | | 154,757 | | | 154,757 | | | 154,757 | | | 1,110,354 | | | N.M. | | 1,110,354 | | | N.M. | |

| Other intangible assets, net | 215,910 | | | 18,885 | | | 19,684 | | | 20,496 | | | 21,339 | | | 197,025 | | | N.M. | | 194,571 | | | N.M. | |

| Loan servicing rights | 55,301 | | | 19 | | | 20 | | | 23 | | | 25 | | | 55,282 | | | N.M. | | 55,276 | | | N.M. | |

| Other assets | 1,439,305 | | | 991,722 | | | 853,005 | | | 792,936 | | | 740,284 | | | 447,583 | | | 45.1 | | 699,021 | | | 94.4 | |

| Total assets | $ | 45,692,511 | | | $ | 24,626,830 | | | $ | 24,418,715 | | | $ | 23,699,612 | | | $ | 22,904,785 | | | $ | 21,065,681 | | | 85.5 | | $ | 22,787,726 | | | 99.5 | |

| LIABILITIES AND EQUITY: | | | | | | | | | | | | | | | | |

| Deposits: | | | | | | | | | | | | | | | | |

| Noninterest-bearing | $ | 7,979,900 | | | $ | 4,062,912 | | | $ | 4,104,652 | | | $ | 3,936,155 | | | $ | 3,974,333 | | | $ | 3,916,988 | | | 96.4 | % | $ | 4,005,567 | | | 100.8 | % |

| Interest-bearing | 27,306,174 | | | 15,049,475 | | | 14,919,459 | | | 14,967,531 | | | 14,522,178 | | | 12,256,699 | | | 81.4 | | 12,783,996 | | | 88.0 | |

| Total deposits | 35,286,074 | | | 19,112,387 | | | 19,024,111 | | | 18,903,686 | | | 18,496,511 | | | 16,173,687 | | | 84.6 | | 16,789,563 | | | 90.8 | |

| Short-term borrowings | 2,607,300 | | | 350,764 | | | 355,992 | | | — | | | 2,324 | | | 2,256,536 | | | N.M. | | 2,604,976 | | | N.M. | |

| Long-term borrowings | 860,482 | | | 1,617,531 | | | 1,411,426 | | | 1,449,472 | | | 1,171,541 | | | (757,049) | | | (46.8) | | (311,059) | | | (26.6) | |

Other liabilities | 1,245,238 | | | 835,630 | | | 981,341 | | | 790,194 | | | 706,397 | | | 409,608 | | | 49.0 | | 538,841 | | | 76.3 | |

| Total liabilities | 39,999,094 | | | 21,916,312 | | | 21,772,870 | | | 21,143,352 | | | 20,376,773 | | | 18,082,782 | | | 82.5 | | 19,622,321 | | | 96.3 | |

| Equity: | | | | | | | | | | | | | | | | |

Preferred stock | 169,302 | | | 169,302 | | | 169,302 | | | 169,302 | | | 169,302 | | | — | | | — | | — | | | — | |

Common stock | 153,571 | | | 87,944 | | | 88,063 | | | 88,198 | | | 88,201 | | | 65,627 | | | 74.6 | | 65,370 | | | 74.1 | |

| Additional paid-in capital | 3,478,159 | | | 781,788 | | | 789,467 | | | 798,627 | | | 795,856 | | | 2,696,371 | | | N.M. | | 2,682,303 | | | N.M. | |

Retained earnings | 1,840,214 | | | 1,874,308 | | | 1,810,701 | | | 1,766,994 | | | 1,708,410 | | | (34,094) | | | (1.8) | | 131,804 | | | 7.7 | |

Accumulated other comprehensive income (loss) | 56,228 | | | 37,334 | | | 5,481 | | | (33,138) | | | (65,259) | | | 18,894 | | | 50.6 | | 121,487 | | | N.M. | |

Treasury stock at cost and other | (27,370) | | | (265,016) | | | (246,621) | | | (252,182) | | | (189,652) | | | 237,646 | | | 89.7 | | 162,282 | | | 85.6 | |

Total TCF Financial Corporation shareholders' equity | 5,670,104 | | | 2,685,660 | | | 2,616,393 | | | 2,537,801 | | | 2,506,858 | | | 2,984,444 | | | 111.1 | | 3,163,246 | | | 126.2 | |

Non-controlling interest | 23,313 | | | 24,858 | | | 29,452 | | | 18,459 | | | 21,154 | | | (1,545) | | | (6.2) | | 2,159 | | | 10.2 | |

| Total equity | 5,693,417 | | | 2,710,518 | | | 2,645,845 | | | 2,556,260 | | | 2,528,012 | | | 2,982,899 | | | 110.0 | | 3,165,405 | | | 125.2 | |

Total liabilities and equity | $ | 45,692,511 | | | $ | 24,626,830 | | | $ | 24,418,715 | | | $ | 23,699,612 | | | $ | 22,904,785 | | | $ | 21,065,681 | | | 85.5 | | $ | 22,787,726 | | | 99.5 | |

N.M. Not Meaningful

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| TCF FINANCIAL CORPORATION AND SUBSIDIARIES | | | | | | | | | | | | | | | | | |

| Consolidated Statements of Income (Unaudited) | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Quarter Ended | | | | | | | | | | Change From | | | | | | |

(Dollars in thousands) | Sep. 30, | | Jun. 30, | | Mar. 31, | | Dec. 31, | | Sep. 30, | | Jun. 30, 2019 | | | | Sep. 30, 2018 | | |

| 2019 | | 2019 | | 2019 | | 2018 | | 2018 | | $ | | % | | $ | | % |

| Interest income: | | | | | | | | | | | | | | | | | |

| Interest and fees on loans and leases | $ | 417,370 | | | $ | 283,282 | | | $ | 283,238 | | | $ | 275,200 | | | $ | 269,167 | | | $ | 134,088 | | | 47.3 | % | | $ | 148,203 | | | 55.1 | % |

| Interest on investment securities: | | | | | | | | | | | | | | | | — | | | — | | | — | | | — | |

| Taxable | 31,038 | | | 22,041 | | | 16,666 | | | 13,915 | | | 11,498 | | | 8,997 | | | 40.8 | | | 19,540 | | | 169.9 | |

| Tax-exempt | 3,385 | | | 1,208 | | | 2,684 | | | 4,147 | | | 4,328 | | | 2,177 | | | 180.2 | | | (943) | | | (21.8) | |

| Interest on loans held-for-sale | 1,408 | | | 599 | | | 825 | | | 1,405 | | | 3,625 | | | 809 | | | 135.1 | | | (2,217) | | | (61.2) | |

| Interest on other earning assets | 6,607 | | | 3,651 | | | 3,481 | | | 3,242 | | | 3,089 | | | 2,956 | | | 81.0 | | | 3,518 | | | 113.9 | |

| Total interest income | 459,808 | | | 310,781 | | | 306,894 | | | 297,909 | | | 291,707 | | | 149,027 | | | 48.0 | | | 168,101 | | | 57.6 | |

| Interest expense: | | | | | | | | | | | | | | | | | |

| Interest on deposits | 70,900 | | | 40,646 | | | 37,608 | | | 33,462 | | | 27,479 | | | 30,254 | | | 74.4 | | | 43,421 | | | 158.0 | |

| Interest on borrowings | 17,115 | | | 16,078 | | | 14,857 | | | 11,294 | | | 10,726 | | | 1,037 | | | 6.4 | | | 6,389 | | | 59.6 | |

| Total interest expense | 88,015 | | | 56,724 | | | 52,465 | | | 44,756 | | | 38,205 | | | 31,291 | | | 55.2 | | | 49,810 | | | 130.4 | |

| Net interest income | 371,793 | | | 254,057 | | | 254,429 | | | 253,153 | | | 253,502 | | | 117,736 | | | 46.3 | | | 118,291 | | | 46.7 | |

| Provision for credit losses | 27,188 | | | 13,569 | | | 10,122 | | | 18,894 | | | 2,270 | | | 13,619 | | | 100.4 | | | 24,918 | | | N.M. | |

Net interest income after provision for credit losses | 344,605 | | | 240,488 | | | 244,307 | | | 234,259 | | | 251,232 | | | 104,117 | | | 43.3 | | | 93,373 | | | 37.2 | |

| Noninterest income: | | | | | | | | | | | | | | | | | |

| Fees and service charges on deposit accounts | 34,384 | | | 27,842 | | | 26,278 | | | 29,539 | | | 29,175 | | | 6,542 | | | 23.5 | | | 5,209 | | | 17.9 | |

| Leasing revenue | 39,590 | | | 39,277 | | | 38,165 | | | 51,602 | | | 41,944 | | | 313 | | | 0.8 | | | (2,354) | | | (5.6) | |

| Wealth management revenue | 4,241 | | | — | | | — | | | — | | | — | | | 4,241 | | | N.M. | | | 4,241 | | | N.M. | |

| Card and ATM revenue | 23,315 | | | 20,496 | | | 18,659 | | | 20,093 | | | 20,074 | | | 2,819 | | | 13.8 | | | 3,241 | | | 16.1 | |

| Net (loss) gain on sales of loans and leases | (5,984) | | | 11,141 | | | 8,217 | | | 8,795 | | | 8,502 | | | (17,125) | | | N.M. | | | (14,486) | | | N.M. | |

| Servicing fee revenue | 5,121 | | | 4,523 | | | 5,110 | | | 5,523 | | | 6,032 | | | 598 | | | 13.2 | | | (911) | | | (15.1) | |

| Net gains on investment securities | 5,900 | | | 1,066 | | | 451 | | | 167 | | | 94 | | | 4,834 | | | N.M. | | | 5,806 | | | N.M. | |

| Other | (12,309) | | | 5,373 | | | 6,624 | | | 8,149 | | | 6,243 | | | (17,682) | | | N.M. | | | (18,552) | | | N.M. | |

| Total noninterest income | 94,258 | | | 109,718 | | | 103,504 | | | 123,868 | | | 112,064 | | | (15,460) | | | (14.1) | | | (17,806) | | | (15.9) | |

| Noninterest expense: | | | | | | | | | | | | | | | | | |

| Compensation and employee benefits | 155,745 | | | 116,266 | | | 123,942 | | | 130,022 | | | 124,996 | | | 39,479 | | | 34.0 | | | 30,749 | | | 24.6 | |

| Occupancy and equipment | 49,229 | | | 41,850 | | | 41,710 | | | 42,277 | | | 42,337 | | | 7,379 | | | 17.6 | | | 6,892 | | | 16.3 | |

| Lease financing equipment depreciation | 19,408 | | | 19,133 | | | 19,256 | | | 19,085 | | | 19,525 | | | 275 | | | 1.4 | | | (117) | | | (0.6) | |

| Net foreclosed real estate and repossessed assets | 2,203 | | | 2,448 | | | 4,630 | | | 4,396 | | | 3,880 | | | (245) | | | (10.0) | | | (1,677) | | | (43.2) | |

| Merger-related expenses | 111,259 | | | 4,226 | | | 9,458 | | | — | | | — | | | 107,033 | | | N.M. | | | 111,259 | | | N.M. | |

| Other | 87,776 | | | 52,926 | | | 54,079 | | | 54,178 | | | 55,685 | | | 34,850 | | | 65.8 | | | 32,091 | | | 57.6 | |

| Total noninterest expense | 425,620 | | | 236,849 | | | 253,075 | | | 249,958 | | | 246,423 | | | 188,771 | | | 79.7 | | | 179,197 | | | 72.7 | |

Income before income tax expense | 13,243 | | | 113,357 | | | 94,736 | | | 108,169 | | | 116,873 | | | (100,114) | | | (88.3) | | | (103,630) | | | (88.7) | |

| Income tax (benefit) expense | (11,735) | | | 19,314 | | | 21,287 | | | 20,013 | | | 28,034 | | | (31,049) | | | N.M. | | | (39,769) | | | N.M. | |

Income after income tax expense | 24,978 | | | 94,043 | | | 73,449 | | | 88,156 | | | 88,839 | | | (69,065) | | | (73.4) | | | (63,861) | | | (71.9) | |

Income attributable to non-controlling interest | 2,830 | | | 3,616 | | | 2,955 | | | 2,504 | | | 2,643 | | | (786) | | | (21.7) | | | 187 | | | 7.1 | |

Net income attributable to TCF Financial Corporation | 22,148 | | | 90,427 | | | 70,494 | | | 85,652 | | | 86,196 | | | (68,279) | | | (75.5) | | | (64,048) | | | (74.3) | |

| Preferred stock dividends | 2,494 | | | 2,494 | | | 2,493 | | | 2,494 | | | 2,494 | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | |

Net income available to common shareholders | $ | 19,654 | | | $ | 87,933 | | | $ | 68,001 | | | $ | 83,158 | | | $ | 83,702 | | | $ | (68,279) | | | (77.6) | | | $ | (64,048) | | | (76.5) | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

N.M. Not Meaningful

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| TCF FINANCIAL CORPORATION AND SUBSIDIARIES | | | | | | | | |

| Consolidated Statements of Income (Unaudited) | | | | | | | | |

| | | | | | | | |

| Nine Months Ended September 30, | | | | Change | | | |

| (Dollars in thousands, except per share data) | 2019 | | 2018 | | $ | | % | |

| Interest income: | | | | | | | | |

| Interest and fees on loans and leases | $ | 983,890 | | | $ | 806,935 | | | $ | 176,955 | | | 21.9 | | % | |

| Interest on investment securities: | | | | | | | | | | |

| Taxable | 69,745 | | | 27,491 | | | 42,254 | | | | 153.7 | | |

| Tax-exempt | 7,277 | | | 12,991 | | | (5,714) | | | (44.0) | | |

| Interest on loans held-for-sale | 2,832 | | | 5,281 | | | (2,449) | | | (46.4) | | |

| Interest on other earning assets | 13,739 | | | 8,722 | | | 5,017 | | | 57.5 | | |

| Total interest income | 1,077,483 | | | 861,420 | | | 216,063 | | | 25.1 | | |

| Interest expense: | | | | | | | | |

| Interest on deposits | 149,154 | | | 74,228 | | | 74,926 | | | 100.9 | | |

| Interest on borrowings | 48,050 | | | 31,850 | | | 16,200 | | | 50.9 | | |

| Total interest expense | 197,204 | | | 106,078 | | | 91,126 | | | 85.9 | | |

| Net interest income | 880,279 | | | 755,342 | | | 124,937 | | | 16.5 | | |

| Provision for credit losses | 50,879 | | | 27,874 | | | 23,005 | | | 82.5 | | |

| Net interest income after provision for credit losses | 829,400 | | | 727,468 | | | 101,932 | | | 14.0 | | |

| Noninterest income: | | | | | | | | |

| Fees and service charges on deposit accounts | 88,504 | | | 83,703 | | | 4,801 | | | 5.7 | | |

| Leasing revenue | 117,032 | | | 121,001 | | | (3,969) | | | (3.3) | | |

| Wealth management revenue | 4,241 | | | — | | | 4,241 | | | N.M. | | |

| Card and ATM revenue | 62,470 | | | 58,313 | | | 4,157 | | | 7.1 | | |

| Net gains on sales of loans and leases | 13,374 | | | 24,900 | | | (11,526) | | | (46.3) | | |

| Servicing fee revenue | 14,754 | | | 21,811 | | | (7,057) | | | (32.4) | | |

| Net gains (losses) on investment securities | 7,417 | | | 181 | | | 7,236 | | | N.M. | | |

| Other | (312) | | | 20,620 | | | (20,932) | | | N.M. | | |

| Total noninterest income | 307,480 | | | 330,529 | | | (23,049) | | | (7.0) | | |

| Noninterest expense: | | | | | | | | |

| Compensation and employee benefits | 395,953 | | | 372,174 | | | 23,779 | | | 6.4 | | |

| Occupancy and equipment | 132,789 | | | 123,562 | | | 9,227 | | | 7.5 | | |

| Lease financing equipment depreciation | 57,797 | | | 54,744 | | | 3,053 | | | 5.6 | | |

| Net foreclosed real estate and repossessed assets | 9,281 | | | 12,654 | | | (3,373) | | | (26.7) | | |

| Merger-related expenses | 124,943 | | | — | | | 124,943 | | | N.M. | | |

| Other | 194,781 | | | 201,308 | | | (6,527) | | | (3.2) | | |

| Total noninterest expense | 915,544 | | | 764,442 | | | 151,102 | | | 19.8 | | |

| Income before income tax expense | 221,336 | | | 293,555 | | | (72,219) | | | (24.6) | | |

| Income tax expense | 28,866 | | | 66,083 | | | (37,217) | | | (56.3) | | |

| Income after income tax expense | 192,470 | | | 227,472 | | | (35,002) | | | (15.4) | | |

| Income attributable to non-controlling interest | 9,401 | | | 8,766 | | | 635 | | | 7.2 | | |

| Net income attributable to TCF Financial Corporation | 183,069 | | | 218,706 | | | (35,637) | | | (16.3) | | |

| Preferred stock dividends | 7,481 | | | 9,094 | | | (1,613) | | | (17.7) | | |

| Impact of preferred stock redemption | — | | | 3,481 | | | (3,481) | | | (100.0) | | |

| Net income available to common shareholders | $ | 175,588 | | | $ | 206,131 | | | $ | (30,543) | | | (14.8) | | |

| | | | | | | | |

| Earnings per common share: | | | | | | | | |

| Basic | $ | 1.79 | | | $ | 2.44 | | | $ | (0.65) | | | (26.6) | | % | |

| Diluted | 1.79 | | | 2.43 | | | (0.64) | | | (26.3) | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

N.M. Not Meaningful

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| TCF FINANCIAL CORPORATION AND SUBSIDIARIES | | | | | | | | | | | | | | | | | |

| Consolidated Average Balance Sheets, Yields and Rates (Unaudited) | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | | | | | | | | | | | | | |

| September 30, 2019 | | | | | | June 30, 2019 | | | | | | September 30, 2018 | | | | |

| Average | | | | Yields & | | Average | | | | Yields & | | Average | | | | Yields & |

| (Dollars in thousands) | Balance | | Interest(1) | | Rates(1)(2) | | Balance | | Interest(1) | | Rates(1)(2) | | Balance | | Interest(1) | | Rates(1)(2) |

| ASSETS: | | | | | | | | | | | | | | | | | |

| Federal Home Loan Bank and Federal Reserve Bank stocks | $ | 230,767 | | | $ | 806 | | | 1.39 | % | | $ | 112,118 | | | $ | 1,093 | | | 3.91 | % | | $ | 87,485 | | | $ | 1,057 | | | 4.81 | % |

| Investment securities held-to-maturity | 143,078 | | | 602 | | | 1.68 | | | 146,296 | | | 924 | | | 2.53 | | | 153,652 | | | 988 | | | 2.57 | |

| Investment securities available-for-sale: | | | | | | | | | | | | | | | | | |

| Taxable | 4,232,878 | | | 30,436 | | 2.88 | | | 2,711,984 | | | 21,117 | | | 3.11 | | | 1,525,665 | | | 10,511 | | | 2.76 | |

Tax-exempt(3) | 643,576 | | | 4,283 | | 2.66 | | | 222,534 | | | 1,530 | | | 2.75 | | | 823,854 | | | 5,478 | | | 2.66 | |

| Loans and leases held-for-sale | 118,482 | | | 1,408 | | 4.74 | | | 40,835 | | | 599 | | | 5.88 | | | 216,669 | | | 3,625 | | | 6.64 | |

Loans and leases(1)(3)(4) | | | | | | | | | | | | | | | | | | | | |

| Commercial and industrial | 9,290,978 | | | 146,865 | | 6.25 | | | 6,683,060 | | | 109,679 | | | 6.56 | | | 5,956,211 | | | 94,971 | | | 6.33 | |

| Commercial real estate | 6,964,643 | | | 97,042 | | 5.45 | | | 3,069,969 | | | 39,204 | | | 5.05 | | | 2,840,005 | | | 35,214 | | | 4.85 | |

| Lease financing | 2,570,567 | | | 32,833 | | 5.11 | | | 2,565,175 | | | 32,899 | | | 5.13 | | | 2,473,793 | | | 32,110 | | | 5.19 | |

| Residential mortgage | 4,853,627 | | | 51,511 | | 4.23 | | | 2,337,818 | | | 28,665 | | | 5.91 | | | 1,691,691 | | | 22,642 | | | 5.32 | |

| Consumer installment | 2,389,830 | | | 34,543 | | 5.73 | | | 1,586,633 | | | 22,262 | | | 3.64 | | | 2,449,414 | | | 34,439 | | | 5.58 | |

| Home equity | 3,433,830 | | | 56,166 | | 6.49 | | | 2,997,050 | | | 51,588 | | | 5.48 | | | 3,005,196 | | | 50,753 | | | 6.70 | |

Total loans and leases(1)(3)(4) | 29,503,475 | | | 418,960 | | | 5.62 | | | | 19,239,705 | | | 284,297 | | | 5.91 | | | 18,416,310 | | | 270,129 | | | 5.82 | |

| Interest-bearing deposits with banks and other | 933,014 | | | 5,800 | | 2.44 | | | 280,075 | | | 2,557 | | | 3.64 | | | 218,771 | | | 2,031 | | | 3.69 | |

| Total interest-earning assets | 35,805,270 | | | 462,295 | | | 5.11 | | | 22,753,547 | | | | 312,117 | | | 5.48 | | | 21,442,406 | | | | 293,819 | | | 5.44 | |

| Other assets | 3,289,096 | | | | | | | 1,730,275 | | | | | | | 1,461,998 | | | | | |

| Total assets | $ | 39,094,366 | | | | | | | $ | 24,483,822 | | | | | | | $ | 22,904,404 | | | | | |

| LIABILITIES AND EQUITY: | | | | | | | | | | | | | | | | | |

| Noninterest bearing deposits | $ | 6,564,195 | | | | | | | $ | 3,980,811 | | | | | | | $ | 3,874,421 | | | | | |

| Interest-bearing deposits: | | | | | | | | | | | | | | | | | |

| Checking | 4,805,843 | | | 5,520 | | | 0.46 | % | | 2,479,814 | | | 440 | | | 0.07 | % | | 2,427,288 | | | 234 | | | 0.04 | % |

| Savings | 7,676,165 | | | 14,110 | | | 0.73 | | | 6,452,510 | | | 12,314 | | | 0.77 | | | 5,620,161 | | | 4,994 | | | 0.35 | |

| Money market | 3,490,922 | | | 13,037 | | | 1.48 | | | 1,430,556 | | | 4,588 | | | 1.29 | | | 1,496,223 | | | 2,941 | | | 0.78 | |

| Certificates of deposit | 7,320,720 | | | 38,233 | | | 2.07 | | | 4,527,822 | | | 23,304 | | | 2.06 | | | 4,868,286 | | | 19,310 | | | 1.57 | |

| Total interest-bearing deposits | 23,293,650 | | | 70,900 | | | 1.21 | | | 14,890,702 | | | 40,646 | | | 1.09 | | | 14,411,958 | | | 27,479 | | | 0.76 | |

| Total deposits | 29,857,845 | | | 70,900 | | | 0.94 | | | 18,871,513 | | | 40,646 | | | 0.86 | | | 18,286,379 | | | 27,479 | | | 0.60 | |

| Borrowings: | | | | | | | | | | | | | | | | | |

| Short-term borrowings | 1,884,228 | | | 5,345 | | | 1.11 | | | 321,043 | | | 2,131 | | | 2.63 | | | 3,357 | | | 21 | | | 2.44 | |

| Long-term borrowings | 1,472,150 | | | 11,769 | | | 3.17 | | | 1,657,527 | | | 13,946 | | | 3.34 | | | 1,351,585 | | | 10,705 | | | 3.13 | |

| Total borrowings | 3,356,378 | | | 17,114 | | | 2.01 | | | 1,978,570 | | | 16,077 | | | 3.23 | | | 1,354,942 | | | 10,726 | | | 3.13 | |

| Total interest-bearing liabilities | 26,650,028 | | | 88,014 | | | 1.31 | | | 16,869,272 | | | 56,723 | | | 1.34 | | | 15,766,900 | | | 38,205 | | | 0.96 | |

| Total deposits and borrowings | 33,214,223 | | | 88,014 | | | 1.05 | | | 20,850,083 | | | 56,723 | | | 1.09 | | | 19,641,321 | | | 38,205 | | | 0.77 | |

| Accrued expenses and other liabilities | 1,197,014 | | | | | | | 969,723 | | | | | | | 751,100 | | | | | |

| Total liabilities | 34,411,237 | | | | | | | 21,819,806 | | | | | | | 20,392,421 | | | | | |

Total TCF Financial Corporation shareholders' equity | 4,657,613 | | | | | | | 2,634,386 | | | | | | | 2,488,435 | | | | | |

| Non-controlling interest in subsidiaries | 25,516 | | | | | | | 29,630 | | | | | | | 23,548 | | | | | |

| Total equity | 4,683,129 | | | | | | | 2,664,016 | | | | | | | 2,511,983 | | | | | |

| Total liabilities and equity | $ | 39,094,366 | | | | | | | $ | 24,483,822 | | | | | | | $ | 22,904,404 | | | | | |

| Net interest spread (FTE) | | | | | | 4.06 | % | | | | | | | 4.39 | % | | | | | | | 4.67 | % |

| Net interest income(FTE) and net interest margin(FTE) | | | $ | 374,281 | | | 4.14 | % | | | | $ | 255,394 | | | 4.49 | % | | | | $ | 255,614 | | | 4.73 | % |

| Reconciliation to Reported Net Interest Income | | | | | | | | | | | | | | | | | | | |

| Net interest income (FTE) | | | $ | 374,281 | | | | | | | | | | | $ | 255,394 | | | | | | | | | | | $ | 255,614 | | | | |

Adjustments for taxable equivalent interest(1)(3) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loans and leases | | | (1,590) | | | | | | | | | | | (1,015) | | | | | | | | | | | (962) | | | | |

| Tax-exempt investment securities | | | (898) | | | | | | | | | | | (322) | | | | | | | | | | | (1,150) | | | | |

| Total FTE adjustments | | | (2,488) | | | | | | | | | | | (1,337) | | | | | | | | | | | (2,112) | | | | |

| Net interest income (GAAP) | | | $ | 371,793 | | | | | | | | | | | $ | 254,057 | | | | | | | | | | | $ | 253,502 | | | |

| Net interest margin (GAAP) | | | 4.12 | % | | | | | | 4.48 | % | | | | | | | 4.69 | % | | |

(1)Interest and yields are presented on a fully tax-equivalent basis.

(2)Annualized

(3)The yield on tax-exempt loans, leases and investment securities available-for-sale is computed on a tax-equivalent basis using a statutory federal income tax rate of 21%.

(4)Average balances of loans and leases include non-accrual loans and leases and are presented net of unearned income.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| TCF FINANCIAL CORPORATION AND SUBSIDIARIES | | | | | | | | | | | |

| Consolidated Average Balance Sheets, Yields and Rates (Unaudited) | | | | | | | | | | | |

| | | | | | | | | | | |

| Nine Months Ended September 30, | | | | | | | | | | |

| 2019 | | | | | | 2018 | | | | |

| Average | | | | Yields and | | Average | | | | Yields and |

| (Dollars in thousands) | Balance | | Interest(1) | | Rates(1)(2) | | Balance | | Interest(1) | | Rates(1)(2) |

| ASSETS: | | | | | | | | | | | |

| Federal Home Loan Bank and Federal Reserve Bank stocks | $ | 149,801 | | | $ | 2,860 | | | 2.55 | % | | $ | 90,600 | | | $ | 2,698 | | | 3.98 | % |

| Investment securities held-to-maturity | 145,627 | | | 2,061 | | | 1.89 | | | 156,170 | | | 3,005 | | | 2.57 | |

| Investment securities available-for-sale: | | | | | | | | | | | |

| Taxable | 3,029,754 | | | 67,684 | | | 2.98 | | | 1,258,708 | | | 24,487 | | | 2.59 | |

Tax-exempt(3) | 461,499 | | | 9,210 | | | 2.66 | | | 824,551 | | | 16,444 | | | 2.66 | |

| Loans and leases held-for-sale | 71,739 | | | 2,832 | | | 5.27 | | | 108,992 | | | 5,281 | | | 6.48 | |

Loans and leases(1)(3)(4) | | | | | | | | | | | |

| Commercial and industrial | 7,499,975 | | | 363,260 | | | 6.45 | | | 6,189,854 | | | 288,522 | | | 6.21 | |

| Commercial real estate | 4,332,238 | | | 173,983 | | | 5.30 | | | 2,800,912 | | | 99,940 | | | 4.71 | |

| Lease financing | 2,554,521 | | | 98,116 | | | 5.12 | | | 2,453,344 | | | 92,201 | | | 5.01 | |

| Residential mortgage | 3,188,294 | | | 109,634 | | | 4.59 | | | 1,731,913 | | | 69,424 | | | 5.36 | |

| Consumer installment | 1,945,059 | | | 82,305 | | | 5.66 | | | 2,729,135 | | | 112,454 | | | 5.51 | |

| Home equity | 3,161,083 | | | 160,206 | | | 6.78 | | | 3,013,433 | | | 147,210 | | | 6.53 | |

Total loans and leases(1)(3)(4) | 22,681,170 | | | 987,504 | | | 5.80 | | | 18,918,591 | | | 809,751 | | | 5.71 | |

| Interest-bearing deposits with banks and other | 494,007 | | | 10,878 | | | 2.92 | | | 225,203 | | | 6,023 | | | 3.58 | |

| Total interest-earning assets | 27,033,597 | | | 1,083,029 | | | 5.33 | | | 21,582,815 | | | 867,689 | | | 5.36 | |

| Other assets | 2,249,678 | | | | | | | 1,448,293 | | | | | |

| Total assets | $ | 29,283,275 | | | | | | | $ | 23,031,108 | | | | | |

| LIABILITIES AND EQUITY: | | | | | | | | | | | |

| Noninterest bearing deposits | $ | 4,831,271 | | | | | | | $ | 3,833,543 | | | | | |

| Interest-bearing deposits: | | | | | | | | | | | | | |

| Checking | 3,256,409 | | | 6,347 | | | 0.26 | % | | 2,449,723 | | | 466 | | | 0.03 | % |

| Savings | 6,799,432 | | | 37,094 | | | 0.73 | | | 5,520,287 | | | 11,895 | | | 0.29 | |

| Money market | 2,144,697 | | | 22,078 | | | 1.38 | | | 1,588,210 | | | 7,970 | | | 0.67 | |

| Certificates of deposit | 5,500,105 | | | 83,635 | | | 2.03 | | | 4,924,804 | | | 53,897 | | | 1.46 | |

| Total interest-bearing deposits | 17,700,643 | | | 149,154 | | | 1.13 | | | 14,483,024 | | | 74,228 | | | 0.69 | |

| Total deposits | 22,531,914 | | | 149,154 | | | 0.88 | | | 18,316,567 | | | 74,228 | | | 0.54 | |

| Borrowings: | | | | | | | | | | | |

| Short-term borrowings | 838,750 | | | 9,433 | | | 1.48 | | | 3,473 | | | 58 | | | 2.23 | |

| Long-term borrowings | 1,543,398 | | | 38,616 | | | 3.32 | | | 1,435,088 | | | 31,792 | | | 2.94 | |

| Total borrowings | 2,382,148 | | | 48,049 | | | 2.67 | | | 1,438,561 | | | 31,850 | | | 2.93 | |

| Total interest-bearing liabilities | 20,082,791 | | | 197,203 | | | 1.31 | | | 15,921,585 | | | 106,078 | | | 0.89 | |

| Total deposits and borrowings | 24,914,062 | | | 197,203 | | | 1.06 | | | 19,755,128 | | | 106,078 | | | 0.72 | |

| Accrued expenses and other liabilities | 1,052,709 | | | | | | | 741,222 | | | | | |

| Total liabilities | 25,966,771 | | | | | | | 20,496,350 | | | | | |

Total TCF Financial Corporation shareholders' equity | 3,289,946 | | | | | | | 2,509,625 | | | | | |

| Non-controlling interest in subsidiaries | 26,558 | | | | | | | 25,133 | | | | | |

| Total equity | 3,316,504 | | | | | | | 2,534,758 | | | | | |

| Total liabilities and equity | $ | 29,283,275 | | | | | | | $ | 23,031,108 | | | | | |

| Net interest spread (FTE) | | | | | 4.27 | | | | | | | 4.64 | |

| Net interest income (FTE) and net interest margin (FTE) | | | $ | 885,826 | | | 4.36 | | | | | $ | 761,611 | | | 4.70 | |

| Reconciliation to Reported Net Interest Income | | | | | | | | | | | |

| Net interest income (FTE) | | | $ | 885,826 | | | | | | | | | | | | $ | 761,611 | | | |

Adjustments for taxable equivalent interest(1)(3) | | | | | | | | | | | | | | | | | | |

| Loans | | | (3,614) | | | | | | | | | | | | (2,816) | | | |

| Tax-exempt investment securities | | | (1,933) | | | | | | | | | | | | (3,453) | | | |

| Total FTE adjustments | | | (5,547) | | | | | | | | | | | | (6,269) | | | |

| Net interest income (GAAP) | | | $ | 880,279 | | | | | | | | | | | | $ | 755,342 | | | |

| Net interest margin (GAAP) | | | 4.35 | % | | | | | | 4.68 | % | | |

(1)Interest and yields are presented on a fully tax-equivalent basis.

(2)Annualized

(3)The yield on tax-exempt debt securities available for sale is computed on a tax-equivalent basis using a statutory federal income tax rate of 21%.

(4)Average balances of loans and leases include non-accrual loans and leases and are presented net of unearned income.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| TCF FINANCIAL CORPORATION AND SUBSIDIARIES | | | | | | | | | | | | | | | | | |

| Consolidated Quarterly Average Balance Sheets (Unaudited) | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Quarter Ended | | | | | | | | | | Change From | | | | | | |

| Sep. 30, | | Jun. 30, | | Mar. 31, | | Dec. 31, | | Sep. 30, | | Jun. 30, 2019 | | | | Sep. 30, 2018 | | |

| (Dollars in thousands) | 2019 | | 2019 | | 2019 | | 2018 | | 2018 | | $ | | % | | $ | | % |

| ASSETS: | | | | | | | | | | | | | | | | | |

| Federal Home Loan Bank and Federal Reserve Bank stocks | $ | 230,767 | | | $ | 112,118 | | | $ | 105,135 | | | $ | 87,321 | | | $ | 87,485 | | | $ | 118,649 | | | 105.8 | % | | $ | 143,282 | | | 163.8 | % |

| Investment securities held-to-maturity | 143,078 | | | 146,296 | | | 147,556 | | | 150,016 | | | 153,652 | | | (3,218) | | | (2.2) | | | (10,574) | | | (6.9) | |

| Investment securities available-for-sale: | | | | | | | | | | | | | | | | | |

| Taxable | 4,232,878 | | | 2,711,984 | | | 2,121,196 | | | 1,779,654 | | | 1,525,665 | | | 1,520,894 | | | 56.1 | | | 2,707,213 | | | 177.4 | |

| Tax-exempt | 643,576 | | | 222,534 | | | 516,995 | | | 788,806 | | | 823,854 | | | 421,042 | | | 189.2 | | | (180,278) | | | (21.9) | |

| Loans and leases held-for-sale | 118,482 | | | 40,835 | | | 55,204 | | | 86,169 | | | 216,669 | | | 77,647 | | | 190.1 | | | (98,187) | | | (45.3) | |

Loans and leases(1) : | | | | | | | | | | | | | | | | | |

| Commercial and industrial | 9,290,978 | | | 6,683,060 | | | 6,495,163 | | | 6,116,369 | | | 5,956,211 | | | 2,607,918 | | | 39.0 | | | 3,334,767 | | | 56.0 | |

| Commercial real estate | 6,964,643 | | | 3,069,969 | | | 2,917,631 | | | 2,795,403 | | | 2,840,005 | | | 3,894,674 | | | 126.9 | | | 4,124,638 | | | 145.2 | |

| Lease financing | 2,570,567 | | | 2,565,175 | | | 2,527,346 | | | 2,479,045 | | | 2,473,793 | | | 5,392 | | | 0.2 | | | 96,774 | | | 3.9 | |

| Residential mortgage | 4,853,627 | | | 2,337,818 | | | 2,345,881 | | | 1,957,323 | | | 1,691,691 | | | 2,515,809 | | | 107.6 | | | 3,161,936 | | | 186.9 | |

| Consumer installment | 2,389,830 | | | 1,586,633 | | | 1,852,813 | | | 2,134,568 | | | 2,449,414 | | | 803,197 | | | 50.6 | | | (59,584) | | | (2.4) | |

| Home equity | 3,433,830 | | | 2,997,050 | | | 3,048,128 | | | 3,072,697 | | | 3,005,196 | | | 436,780 | | | 14.6 | | | 428,634 | | | 14.3 | |

Total loans and leases(1) | 29,503,475 | | | 19,239,705 | | | 19,186,962 | | | 18,555,405 | | | 18,416,310 | | | 10,263,770 | | | 53.3 | | | 11,087,165 | | | 60.2 | |

| Interest-bearing deposits with banks and other | 933,014 | | | 280,075 | | | 261,556 | | | 243,038 | | | 218,771 | | | 652,939 | | | N.M. | | | 714,243 | | | N.M. | |

Total interest-earning assets | 35,805,270 | | | 22,753,547 | | | 22,394,604 | | | 21,690,409 | | | 21,442,406 | | | 13,051,723 | | | 57.4 | | | 14,362,864 | | | 67.0 | |

| Other assets | 3,289,096 | | | 1,730,275 | | | 1,712,337 | | | 1,463,844 | | | 1,461,998 | | | 1,558,821 | | | 90.1 | | | 1,827,098 | | | 125.0 | |

| Total assets | $ | 39,094,366 | | | $ | 24,483,822 | | | $ | 24,106,941 | | | $ | 23,154,253 | | | $ | 22,904,404 | | | $ | 14,610,544 | | | 59.7 | | | $ | 16,189,962 | | | 70.7 | |

| LIABILITIES AND EQUITY: | | | | | | | | | | | | | | | | | |

Noninterest bearing deposits | $ | 6,564,195 | | | $ | 3,980,811 | | | $ | 3,919,746 | | | $ | 3,873,023 | | | $ | 3,874,421 | | | $ | 2,583,384 | | | 64.9 | % | | $ | 2,689,774 | | | 69.4 | % |

| Interest-bearing deposits: | | | | | | | | | | | | | | | | | |

| Checking | 4,805,843 | | | 2,479,814 | | | 2,457,767 | | | 2,403,370 | | | 2,427,288 | | | 2,326,029 | | | 93.8 | | | 2,378,555 | | | 98.0 | |

| Savings | 7,676,165 | | | 6,452,510 | | | 6,253,992 | | | 5,922,724 | | | 5,620,161 | | | 1,223,655 | | | 19.0 | | | 2,056,004 | | | 36.6 | |

| Money market | 3,490,922 | | | 1,430,556 | | | 1,490,631 | | | 1,449,531 | | | 1,496,223 | | | 2,060,366 | | | 144.0 | | | 1,994,699 | | | 133.3 | |

| Certificates of deposit | 7,320,720 | | | 4,527,822 | | | 4,622,120 | | | 4,818,211 | | | 4,868,286 | | | 2,792,898 | | | 61.7 | | | 2,452,434 | | | 50.4 | |

Total interest-bearing deposits | 23,293,650 | | | 14,890,702 | | | 14,824,510 | | | 14,593,836 | | | 14,411,958 | | | 8,402,948 | | | 56.4 | | | 8,881,692 | | | 61.6 | |

| Total deposits | 29,857,845 | | | 18,871,513 | | | 18,744,256 | | | 18,466,859 | | | 18,286,379 | | | 10,986,332 | | | 58.2 | | | 11,571,466 | | | 63.3 | |

| Borrowings: | | | | | | | | | | | | | | | | | |

| Short-term borrowings | 1,884,228 | | | 321,043 | | | 293,499 | | | 2,738 | | | 3,357 | | | 1,563,185 | | | N.M. | | | 1,880,871 | | | N.M. | |

| Long-term borrowings | 1,472,150 | | | 1,657,527 | | | 1,500,832 | | | 1,344,228 | | | 1,351,585 | | | (185,377) | | | (11.2) | | | 120,565 | | | 8.9 | |

| Total borrowings | 3,356,378 | | | 1,978,570 | | | 1,794,331 | | | 1,346,966 | | | 1,354,942 | | | 1,377,808 | | | 69.6 | | | 2,001,436 | | | 147.7 | |

Total interest-bearing liabilities | 26,650,028 | | | 16,869,272 | | | 16,618,841 | | | 15,940,802 | | | 15,766,900 | | | 9,780,756 | | | 58.0 | | | 10,883,128 | | | 69.0 | |

Total deposits and borrowings | 33,214,223 | | | 20,850,083 | | | 20,538,587 | | | 19,813,825 | | | 19,641,321 | | | 12,364,140 | | | 59.3 | | | 13,572,902 | | | 69.1 | |

Accrued expenses and other liabilities | 1,197,014 | | | 969,723 | | | 989,104 | | | 822,558 | | | 751,100 | | | 227,291 | | | 23.4 | | | 445,914 | | | 59.4 | |

| Total liabilities | 34,411,237 | | | 21,819,806 | | | 21,527,691 | | | 20,636,383 | | | 20,392,421 | | | 12,591,431 | | | 57.7 | | | 14,018,816 | | | 68.7 | |

Total TCF Financial Corporation shareholders' equity | 4,657,613 | | | 2,634,386 | | | 2,554,729 | | | 2,495,952 | | | 2,488,435 | | | 2,023,227 | | | 76.8 | | | 2,169,178 | | | 87.2 | |

Non-controlling interest in subsidiaries | 25,516 | | | 29,630 | | | 24,521 | | | 21,918 | | | 23,548 | | | (4,114) | | | (13.9) | | | 1,968 | | | 8.4 | |

| Total equity | 4,683,129 | | | 2,664,016 | | | 2,579,250 | | | 2,517,870 | | | 2,511,983 | | | 2,019,113 | | | 75.8 | | | 2,171,146 | | | 86.4 | |

Total liabilities and equity | $ | 39,094,366 | | | $ | 24,483,822 | | | $ | 24,106,941 | | | $ | 23,154,253 | | | $ | 22,904,404 | | | $ | 14,610,544 | | | 59.7 | | | $ | 16,189,962 | | | 70.7 | |

N.M. Not Meaningful

(1)Average balances of loans and leases include non-accrual loans and leases and are presented net of unearned income.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| TCF FINANCIAL CORPORATION AND SUBSIDIARIES | | | | | | | | | | | | | | |

Consolidated Quarterly Yields and Rates(1)(2) (Unaudited) | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Quarter Ended | | | | | | | | | | Change From | | | |

| Sep. 30, | | Jun. 30, | | Mar. 31, | | Dec. 31, | | Sep. 30, | | Jun. 30, | | Sep. 30, | |

| 2019 | | 2019 | | 2019 | | 2018 | | 2018 | | 2019 | | 2018 | |

| ASSETS: | | | | | | | | | | | | | | |

| Federal Home Loan Bank and Federal Reserve Bank stocks | 1.39 | % | | 3.91 | % | | 3.70 | % | | 4.19 | % | | 4.81 | % | | (252) | | bps | | (342) | | bps | |

| Investment securities held-to-maturity | 1.68 | | | 2.53 | | | 1.45 | | | 2.58 | | | 2.57 | | | (85) | | | (89) | | |

| Investment securities available-for-sale: | | | | | | | | | | | | | | |

| Taxable | 2.88 | | | 3.11 | | | 3.04 | | | 2.91 | | | 2.76 | | | (23) | | | 12 | | |

Tax-exempt(3) | 2.66 | | | 2.75 | | | 2.63 | | | 2.66 | | | 2.66 | | | (9) | | | — | | |

| Loans and leases held-for-sale | 4.74 | | | 5.88 | | | 6.05 | | | 6.48 | | | 6.64 | | | (114) | | | (190) | | |

Loans and leases(1)(3): | | | | | | | | | | | | | | | | | | | | | |

| Commercial and industrial | 6.25 | | | 6.56 | | | 6.63 | | | 6.36 | | | 6.33 | | | (31) | | | (8) | | |

| Commercial real estate | 5.45 | | | 5.05 | | | 5.17 | | | 5.02 | | | 4.85 | | | 40 | | | 60 | | |

| Lease financing | 5.11 | | | 5.13 | | | 5.13 | | | 5.32 | | | 5.19 | | | (2) | | | (8) | | |

| Residential mortgage | 4.23 | | | 5.91 | | | 5.97 | | | 5.27 | | | 5.32 | | | (168) | | | (109) | | |

| Consumer installment | 5.73 | | | 3.64 | | | 3.87 | | | 5.62 | | | 5.58 | | | 209 | | | 15 | | |

| Home equity | 6.49 | | | 5.48 | | | 5.55 | | | 6.86 | | | 6.70 | | | 101 | | | (21) | | |

Total loans and leases(1) | 5.62 | | | 5.91 | | | 5.97 | | | 5.90 | | | 5.82 | | | (29) | | | (20) | | |

| Interest-bearing deposits with banks and other | 2.44 | | | 3.64 | | | 3.87 | | | 3.79 | | | 3.69 | | | (120) | | | (125) | | |

| | | | | | | | | | | | | | |

| Total interest-earning assets | 5.11 | | | 5.48 | | | 5.55 | | | 5.49 | | | 5.44 | | | (37) | | | (33) | | |

| | | | | | | | | | | | | | |

| LIABILITIES: | | | | | | | | | | | | | | |

| Interest-bearing deposits: | | | | | | | | | | | | | | |

| Checking | 0.46 | | | 0.07 | | | 0.06 | | | 0.04 | | | 0.04 | | | 39 | | | 42 | | |

| Savings | 0.73 | | | 0.77 | | | 0.69 | | | 0.54 | | | 0.35 | | | (4) | | | 38 | | |

| Money market | 1.48 | | | 1.29 | | | 1.21 | | | 0.99 | | | 0.78 | | | 19 | | | 70 | | |

| Certificates of deposit | 2.07 | | | 2.06 | | | 1.94 | | | 1.77 | | | 1.57 | | | 1 | | | 50 | | |

Total interest-bearing deposits | 1.21 | | | 1.09 | | | 1.03 | | | 0.91 | | | 0.76 | | | 12 | | | 45 | | |

| Total deposits | 0.94 | | | 0.86 | | | 0.81 | | | 0.72 | | | 0.60 | | | 8 | | | 34 | | |

| Borrowings: | | | | | | | | | | | | | | |

| Short-term borrowings | 1.11 | | | 2.63 | | | 2.67 | | | 2.74 | | | 2.44 | | | (152) | | | (133) | | |

| Long-term borrowings | 3.17 | | | 3.34 | | | 3.44 | | | 3.31 | | | 3.13 | | | (17) | | | 4 | | |

| Total borrowings | 2.01 | | | 3.23 | | | 3.31 | | | 3.31 | | | 3.13 | | | (122) | | | (112) | | |

| | | | | | | | | | | | | | |

| Total interest-bearing liabilities | 1.31 | | | 1.34 | | | 1.28 | | | 1.11 | | | 0.96 | | | (3) | | | 35 | | |

| | | | | | | | | | | | | | |

| Net interest margin (FTE) | 4.14 | | | 4.49 | | | 4.61 | | | 4.67 | | | 4.73 | | | (35) | | | (59) | | |

(1)Annualized

(2)Yields are presented on a fully tax-equivalent basis.

(3)The yield on tax-exempt debt securities available-for-sale is computed on a tax-equivalent basis using a statutory federal income tax rate of 21%.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| TCF FINANCIAL CORPORATION AND SUBSIDIARIES | | | | | | | | | | | | | |

| Summary of Loans (Unaudited) | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Composition of Loans | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Quarter Ended | | | | | | | | | | Change From | | |

| Sep. 30, | | Jun. 30, | | Mar. 31, | | Dec. 31, | | Sep. 30, | | Jun. 30, | | Sep. 30, |

| (Dollars in thousands) | 2019 | | 2019 | | 2019 | | 2018 | | 2018 | | 2019 | | 2018 |

| Commercial and industrial | $ | 10,810,534 | | | $ | 6,572,393 | | | $ | 6,790,956 | | | $ | 6,220,632 | | | $ | 5,995,118 | | | $ | 4,238,141 | | | $ | 4,815,416 | |

| Commercial real estate | 8,876,779 | | | 3,262,487 | | | 2,965,796 | | | 2,908,313 | | | 2,773,761 | | | 5,614,292 | | | 6,103,018 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Lease financing | 2,594,373 | | | 2,582,613 | | | 2,551,344 | | | 2,530,163 | | | 2,455,511 | | | 11,760 | | | 138,862 | |

| Residential mortgage | 6,057,404 | | | 2,368,411 | | | 2,376,878 | | | 2,335,835 | | | 1,847,130 | | | 3,688,993 | | | 4,210,274 | |

| Consumer installment | 1,562,252 | | | 1,474,480 | | | 1,722,557 | | | 2,003,572 | | | 2,296,241 | | | 87,772 | | | (733,989) | |

| Home equity | 3,609,410 | | | 2,924,753 | | | 2,976,679 | | | 3,074,505 | | | 3,054,327 | | | 684,657 | | | 555,083 | |

| Total | $ | 33,510,752 | | | $ | 19,185,137 | | | $ | 19,384,210 | | | $ | 19,073,020 | | | $ | 18,422,088 | | | $ | 14,325,615 | | | | $ | 15,088,664 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Composition of Deposits | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Quarter Ended | | | | | | | | | | Change From | | |

| Sep. 30, | | Jun. 30, | | Mar. 31, | | Dec. 31, | | Sep. 30, | | Jun. 30, | | Sep. 30, |

| (Dollars in thousands) | 2019 | | 2019 | | 2019 | | 2018 | | 2018 | | 2019 | | 2018 |

| Noninterest-bearing deposits | $ | 7,979,900 | | | $ | 4,062,912 | | | $ | 4,104,652 | | | $ | 3,936,155 | | | $ | 3,974,333 | | | $ | 3,916,988 | | | $ | 4,005,567 | |

| Interest-bearing deposits: | | | | | | | | | | | | | | | |

| Checking | 6,266,740 | | | 2,498,042 | | | 2,532,688 | | | 2,459,617 | | | 2,420,896 | | | 3,768,698 | | | 3,845,844 | |

| Savings | 8,347,541 | | | 6,503,102 | | | 6,426,465 | | | 6,107,812 | | | 5,724,582 | | | 1,844,439 | | | 2,622,959 | |

| Money market | 4,305,921 | | | 1,443,004 | | | 1,468,308 | | | 1,609,422 | | | 1,504,952 | | | 2,862,917 | | | 2,800,969 | |

| Certificates of deposit | 8,385,972 | | | 4,605,327 | | | 4,491,998 | | | 4,790,680 | | | 4,871,748 | | | 3,780,645 | | | 3,514,224 | |

| Total interest-bearing deposits | 27,306,174 | | | 15,049,475 | | | 14,919,459 | | | 14,967,531 | | | 14,522,178 | | | 12,256,699 | | | 12,783,996 | |

| Total deposits | $ | 35,286,074 | | | $ | 19,112,387 | | | $ | 19,024,111 | | | $ | 18,903,686 | | | $ | 18,496,511 | | | $ | 16,173,687 | | | $ | 16,789,563 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| TCF FINANCIAL CORPORATION AND SUBSIDIARIES | | | | | | | | | | | | | | | | | | | |

| Summary of Credit Quality Data (Unaudited) | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Allowance for Loan and Lease Losses | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Sep. 30, | | | | Jun. 30, | | | | Mar. 31, | | | | Dec. 31, | | | | Sep. 30, | | |

| 2019 | | | | 2019 | | | | 2019 | | | | 2018 | | | | 2018 | | |

| | | % of | | | | % of | | | | % of | | | | % of | | | | % of |

| (Dollars in thousands) | Balance | Portfolio | | | Balance | Portfolio | | | Balance | Portfolio | | | Balance | Portfolio | | | Balance | | Portfolio |

| Commercial and industrial | $ | 39,974 | | | 0.37 | % | | $ | 38,605 | | | 0.59 | % | | $ | 38,639 | | | 0.57 | % | | $ | 41,103 | | | 0.66 | % | | $ | 40,211 | | | 0.67 | % |

| Commercial real estate | 24,090 | | | 0.27 | | | 22,747 | | | 0.70 | | | 20,659 | | | 0.70 | | | 22,877 | | | 0.79 | | | 22,119 | | | 0.80 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Lease financing | 14,367 | | | 0.55 | | | 14,440 | | | 0.56 | | | 14,377 | | | 0.56 | | | 13,449 | | | 0.53 | | | 12,427 | | | 0.51 | |

| Residential mortgage | 19,816 | | | 0.33 | | | 21,102 | | | 0.89 | | | 20,281 | | | 0.85 | | | 21,436 | | | 0.92 | | | 22,312 | | | 1.21 | |

| Consumer installment | 1,859 | | | 0.12 | | | 26,731 | | | 1.81 | | | 30,477 | | | 1.77 | | | 35,151 | | | 1.75 | | | 40,606 | | | 1.77 | |

| Home equity | 21,112 | | | 0.58 | | | 22,878 | | | 0.78 | | | 23,539 | | | 0.79 | | | 23,430 | | | 0.76 | | | 22,946 | | | 0.75 | |

| Total | $ | 121,218 | | | 0.36 | % | | $ | 146,503 | | | 0.76 | % | | $ | 147,972 | | | 0.76 | % | | $ | 157,446 | | | 0.83 | % | | $ | 160,621 | | | 0.87 | % |

| Credit discount on acquired loans | 175,759 | | | | | | | | | | | | | | | | | | | | | | | | |

| Total allowance and discount on acquired loans | $ | 296,977 | | | 0.89 | % | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Changes in Allowance for Loan and Lease Losses | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Quarter Ended | | | | | | | | | | Change From | | |

| Sep. 30, | | Jun. 30, | | Mar. 31, | | Dec. 31, | | Sep. 30, | | Jun. 30, | | Sep. 30, |

| (In thousands) | 2019 | | 2019 | | 2019 | | 2018 | | 2018 | | 2019 | | 2018 |

| Balance, beginning of period | $ | 146,503 | | | $ | 147,972 | | | $ | 157,446 | | | $ | 160,621 | | | $ | 165,619 | | | $ | (1,469) | | | $ | (19,116) | |

| Charge-offs | (35,547) | | | (21,066) | | | (24,431) | | | (27,227) | | | (19,448) | | | (14,481) | | | (16,099) | |

| Recoveries | 6,969 | | | 6,984 | | | 5,777 | | | 5,913 | | | 12,658 | | | (15) | | | (5,689) | |

| Net (charge-offs) recoveries | (28,578) | | | (14,082) | | | (18,654) | | | (21,314) | | | (6,790) | | | (14,496) | | | (21,788) | |

| Provision for credit losses | 27,188 | | | 13,569 | | | 10,122 | | | 18,894 | | | 2,270 | | | 13,619 | | | 24,918 | |

Other(1) | (23,895) | | | (956) | | | (942) | | | (755) | | | (478) | | | (22,939) | | | (23,417) | |

| Balance, end of period | $ | 121,218 | | | $ | 146,503 | | | $ | 147,972 | | | $ | 157,446 | | | $ | 160,621 | | | $ | (25,285) | | | $ | (39,403) | |

(1)Primarily includes the transfer of the allowance for loan and lease losses to loans and leases held for sale.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Charge-offs | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | | | | | | | | | | | | | | | | | |

| Sep. 30, | | | | Jun. 30, | | | | Mar. 31, | | | | Dec. 31, | | | | Sep. 30, | | |

| 2019 | | | | 2019 | | | | 2019 | | | | 2018 | | | | 2018 | | |

| (Dollars in thousands) | Balance | | Rate(1) | | Balance | | Rate(1) | | Balance | | Rate(1) | | Balance | | Rate(1) | | Balance | | Rate(1) |

| Commercial and industrial | $ | (17,631) | | | 0.76 | % | | $ | (5,820) | | | 0.35 | % | | $ | (5,259) | | | 0.32 | % | | $ | (9,678) | | | 0.63 | % | | $ | (2,081) | | | 0.14 | % |

| Commercial real estate | 13 | | | — | | | 9 | | | — | | | 5 | | | — | | | 150 | | | (0.02) | | | 19 | | | — | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Lease financing | (2,192) | | | 0.34 | | | (966) | | | 0.15 | | | (1,391) | | | 0.22 | | | (574) | | | 0.09 | | | (497) | | | 0.08 | |

| Residential mortgage | (189) | | | 0.02 | | | (80) | | | 0.01 | | | (468) | | | 0.08 | | | (109) | | | 0.02 | | | 3390 | | | (0.80) | |

| Consumer installment | (8,984) | | | 1.50 | | | (6,990) | | | 1.76 | | | (11,561) | | | 2.50 | | | (11,299) | | | 2.12 | | | (10,662) | | | 1.74 | |

| Home equity | 405 | | | (0.05) | | | (235) | | | 0.03 | | | 20 | | | — | | | 196 | | | (0.03) | | | 3041 | | | (0.40) | |

| Total | $ | (28,578) | | | 0.39 | % | | $ | (14,082) | | | 0.29 | % | | $ | (18,654) | | | 0.39 | % | | $ | (21,314) | | | 0.46 | % | | $ | (6,790) | | | 0.15 | % |

(1) Annualized net charge-off rate based on average loans and leases

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| TCF FINANCIAL CORPORATION AND SUBSIDIARIES | | | | | | | | | | | | | | |

| Summary of Credit Quality Data (Unaudited), Continued | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Over 90-Day Delinquencies as a Percentage of Portfolio(1) | | | | | | | | | | | | | | |

| | | | | | | | | | | Change From | | | |

| Sep. 30, | | Jun. 30, | | Mar. 31, | | Dec. 31, | | Sep. 30, | | Jun. 30, | | Sep. 30, | |

| 2019 | | 2019 | | 2019 | | 2018 | | 2018 | | 2019 | | 2018 | |

| Commercial and industrial | 0.02 | % | | | — | % | | | — | % | | | 0.01 | % | | | — | % | | 2 | | bps | 2 | | bps |

| Commercial real estate | 0.09 | | | — | | | — | | | — | | | — | | | 9 | | | 9 | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Lease financing | 0.09 | | | 0.12 | | | 0.10 | | | 0.07 | | | 0.07 | | | (3) | | | 2 | | |

| Residential mortgage | 0.01 | | | 0.05 | | | 0.07 | | | 0.06 | | | 0.04 | | | (4) | | | (3) | | |