Earnings Preview: Check Point - Analyst Blog

January 16 2012 - 8:15AM

Zacks

Check Point Software

Technologies (CHKP) is scheduled to announce its fourth

quarter 2011 results on January 17, 2012 before market opens and we

see limited estimate revisions at this point.

Third Quarter

Overview

Check Point delivered a decent

third quarter, with earnings per share of 67 cents beating the

Zacks Consensus Estimates by a penny. The quarter’s results

increased 13.6% from a year ago. Revenue saw a 12.8% year-over-year

increase, aided by strong performances by the Product &

Licenses as well as Software Updates, Maintenance and Services

segments. However, the overall improvement was mainly aided by the

growing demand for its security products.

Check Point has earned a reputation

among customers and analysts for providing simple, all-in-one

security solutions that provide the highest level of protection to

small and mid-sized businesses and remote/branch offices. Hence, we

believe new product ramp up will better serve the growing demand

for Check Point’s security products.

Management

Guidance

Management raised its full-year

2011 outlook and provided fourth quarter 2011 guidance. Top-line

growth of 11.1% is expected for the fourth quarter and 13.3% for

the full year (up from 12.7% previously). Regarding non-GAAP

earnings per share, management expects 79–82 cents in the fourth

quarter, representing a 10.5% growth at the midpoint, and

$2.83–$2.86 for the full year, implying 14.7% growth (up from 13.1%

previously).

(Detailed earnings results can be

viewed in the blog titled: Steady Performance by Check Point)

Agreement of

Analysts

Given the company’s broader suite

of offerings and its steadily growing annuity blade content,

growing network security spending and continuous share gains, some

analysts believe its projected growth rate should exceed the

guidance. Also, the analysts are encouraged by the company’s

ongoing appliance upgrade adoption cycle and momentum on the

software blade architecture front.

The analysts are also confident

about Check Point’s market share gain versus tech giant

Cisco Systems Inc. (CSCO) based on strong demand

for its high-end (Power-1) and mid-range (UTM-1) appliances. The

analysts are also optimistic about the improved enterprise

information technology spending environment.

Out of the 11 and 12 analysts

providing estimates for the fourth quarter and fiscal 2011,

respectively, none revised their estimates upward in the past 30

days. But there was only one downward revision for the fiscal 2011

and 2012 in the past 30 days. Despite the positive momentum, we

think that the downward revision could be due to strained

macroeconomic condition and ongoing debt problems in Europe, which

could put a lid over IT spending budgets.

Magnitude of Estimate

Revisions

There was no change to the Zacks

Consensus Estimates for the fourth quarter and fiscal 2011 over the

past 30 days. However, the Zacks Consensus Estimate for fiscal 2011

increased 2 cents to $2.69 over the past 90 days. The reason for

the uptick could be the growing demand for Check Point’s security

products. The Zacks Consensus Estimate for fiscal 2012 grew a penny

to $2.99 in the past 90 days.

Recommendation

We remain encouraged by the steady

traction of Software Blade architecture (security solution) that

will likely lead to a solid fourth quarter. We believe this would

result in considerable upside to the shares.

In order to address the growing

security needs of customers, attain operational excellence and

expand market share, Check Point continues to invest in R&D.

Apart from security, Check Point is also focusing on the mobile

Internet and cloud computing space. According to the analysts,

these strategic initiatives to expand its operational footprint

from its core network firewall market to adjacent network security

will not only enhance its market position, but will also provide

the company with a competitive advantage over its peers Cisco

Systems and Juniper Networks Inc. (JNPR). But

these investments could rationalize its margin performance in the

near term.

However, competitive pressures and

Check Point’s significant European exposure are concerns.

Currently, Check Point has a Zacks

#4 Rank, implying a short-term Sell recommendation.

CHECK PT SOFTW (CHKP): Free Stock Analysis Report

CISCO SYSTEMS (CSCO): Free Stock Analysis Report

JUNIPER NETWRKS (JNPR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

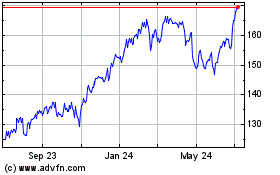

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From Jun 2024 to Jul 2024

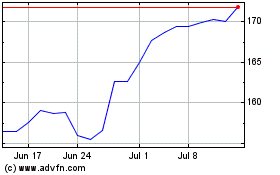

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From Jul 2023 to Jul 2024