4 Stocks from the Most Profitable Sector - Investment Ideas

April 10 2011 - 8:00PM

Zacks

Margin expansion has been a huge source of earnings growth as

companies emerged from the recession lean and mean.

Revenue growth in the S&P 500 rose a solid 9.7%

in 2010 (excluding financials). However, the real driver of income

growth came from expanding profit margins.

Lean & Mean

Net profit margins increased from 7.1% in 2009 to

8.2% in 2010 as companies that slashed costs during the recession

squeezed the most they could out of their resources.

This led to a whopping 27.4% increase in net

income for the S&P - and a soaring stock market.

Net profit margins, calculated as net income

divided by revenues, are expected to continue expanding, leading to

more double-digit earnings growth in 2011. The net profit margin is

expected to increase to 8.8% for the S&P 500. Combine that with

projected revenue growth of 6.6%, and you get net income growth of

14.4%.

Not too shabby.

The Most Profitable Sector

So what sector is expected to see the widest net

profit margins in 2011?

Computer and Technology.

The computer and technology sector is expected to

see an incredible 16.3% net profit margin in 2011, up from 15.3% in

2010. That means for every $1 in revenue, companies keep an average

of 16.3 cents after-tax. That's nearly twice the average of the

S&P 500.

Moreover, revenues are expected to grow 10.7% in

the sector, leading to net income growth of 18.3% in 2011.

Valuation is very reasonable too, with the sector

sporting an average P/E of 15.0x 2011 earnings. That's a slight

premium to the S&P multiple of 13.9x, but still well below its

historical average.

Here are 4 computer and technology stocks

looking attractive right now:

Check Point Software Technologies Ltd.

(CHKP) provides IT security solutions around the globe. It is best

known for its firewall and virtual private network (VPN)

products.

The company is wildly profitable, posting a

remarkable 41.2% net profit margin in 2010. Earnings are expected

to grow a solid 12% in 2011 based on the Zacks Consensus

Estimate.

Check Point also has a pristine balance sheet with

over $1 billion in cash and no debt. Shares trade at 19.8x forward

earnings, a discount to the industry average of 25.9x.

It is a Zacks #2 Rank (Buy) stock.

Oracle Corp (ORCL) continues to outperform

expectations. The tech giant recently posted its fourth consecutive

positive earnings surprise on 35% growth in revenues.

Estimates have been rising off the strong quarter,

sending the stock to a Zacks #2 Rank (Buy). The company is expected

to grow EPS a whopping 32% in 2011. Despite this, shares are

trading at just 15.9x forward earnings.

Oracle has a 22.4% net profit margin over the last

12 months. It has also generated an average of $8.6 billion in free

cash flow per quarter since the beginning of 2010. It

currently pays a dividend that yields 0.6%.

Waters Corporation (WAT) operates as an

analytical instrument manufacturer for pharmaceutical, biochemical,

and industrial companies. It designs and manufactures high

performance liquid chromatography, ultra performance liquid

chromatography, and mass spectrometry instrument systems and

support products.

The company's net profit margin was an impressive

23.2% in 2010. Furthermore, EPS is expected to grow 14% in 2011

based on the Zacks Consensus Estimate.

Valuation is reasonable with shares trading at

18.9x forward earnings and a PEG ratio of 1.3.

WAT is a Zacks #2 Rank (Buy) stock.

Netease.com Inc. (NTES) is one of the

leading Internet and online gaming companies in China.

Estimates have been surging since NTES posted a 19%

positive earnings surprise on February 23. The company also

reported a fat net profit margin of 40.4% for 2010.

Analysts are calling for 23.9% EPS growth in 2011

based on the Zacks Consensus Estimate. It is a Zacks #1 Rank

(Strong Buy) stock.

Valuation is reasonable with shares sporting a PEG

ratio of 1.0. The stock is trading at 16.4x forward earnings, a

discount to the industry average of 25.9x.

NTES is also financially sound with nearly $9.5

billion in cash and short term investments and no long-term

debt.

Conclusion

As the U.S. emerged out of recession, companies

were able to turn decent sales growth into huge earnings growth

through expanding profit margins. These gains are expected to

continue in 2011, particularly in the wide-margin computer and

technology sector. With strong earnings growth expected and

reasonable valuations, tech stocks are looking like an attractive

investment.

Todd Bunton is the Growth & Income Stock

Strategist for Zacks.com.

CHECK PT SOFTW (CHKP): Free Stock Analysis Report

NETEASE.COM-ADR (NTES): Free Stock Analysis Report

ORACLE CORP (ORCL): Free Stock Analysis Report

WATERS CORP (WAT): Free Stock Analysis Report

Zacks Investment Research

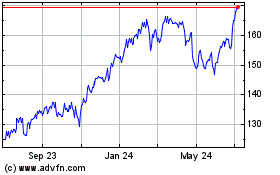

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From May 2024 to Jun 2024

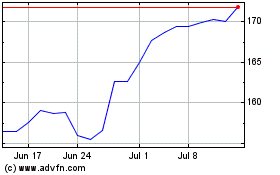

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From Jun 2023 to Jun 2024