Check Point® Software Technologies Ltd. (NASDAQ: CHKP)

- Revenue: $273.2 million, representing a 17 percent increase

year over year

- Product Revenues: $106.4 million, representing a 22 percent

increase year over year

- Non-GAAP Operating Income: $156.9 million, representing a 23

percent increase year over year or 57 percent of revenues versus 55

percent a year ago

- Non-GAAP EPS: $0.63, representing a 21 percent increase year

over year

Check Point® Software Technologies Ltd. (NASDAQ: CHKP), the

worldwide leader in securing the Internet, today announced record

financial results for the third quarter ended September 30,

2010.

"I am very pleased that we were able to deliver all-time record

quarterly results this quarter. We exceeded the high-end of our

projections in both revenues and earnings per share," said Gil

Shwed, chairman and chief executive officer at Check Point. "This

growth was a result of strong network security product sales across

all regions with particular strength coming from the America's and

Asia Pacific."

Financial Highlights for the Third Quarter of

2010

- Total Revenues: $273.2 million, an

increase of 17 percent, compared to $233.6 million in the third

quarter of 2009.

- GAAP Operating Income: $135.1 million, an

increase of 28 percent, compared to $105.5 million in the third

quarter of 2009. GAAP operating margin was 49 percent, compared to

45 percent in the third quarter of 2009.

- Non-GAAP Operating Income: $156.9

million, an increase of 23 percent, compared to $127.5 million in

the third quarter of 2009. Non-GAAP operating margin was 57

percent, compared to 55 percent in the third quarter of 2009.

- GAAP Net Income and Earnings per Diluted

Share: GAAP net income was $114.5 million, an increase of 25

percent, compared to $91.5 million in the third quarter of 2009.

GAAP earnings per diluted share were $0.54, an increase of 26

percent, compared to $0.43 in the third quarter of 2009.

- Non-GAAP Net Income and Earnings per Diluted

Share: Non-GAAP net income was $132.6 million, an increase of

21 percent, compared to $109.5 million in the third quarter of

2009. Non-GAAP earnings per diluted share were $0.63, an increase

of 21 percent, compared to $0.52 in the third quarter of 2009.

- Deferred Revenues: As of September 30,

2010, we had deferred revenues of $396.3 million, an increase of 10

percent, compared to $360.1 million as of September 30, 2009.

- Cash Flow: Cash flow from operations was

$144.6 million, an increase of 15 percent, compared to $126.1

million in the third quarter of 2009.

- Share Repurchase Program: During the

third quarter of 2010, we repurchased 1.44 million shares at a

total cost of $50 million.

- Cash Balances and Marketable Securities:

$2,256 million as of September 30, 2010, an increase of $520

million, compared to $1,736 million as of September 30, 2009.

Recent Business Highlights Include:

- Introduction of Check Point Application

Control Software Blade - Enables Web 2.0 security through a

unique combination of technology, user awareness and broad

application control from the world's largest application

classification database, the Check Point AppWiki, with over 50,000

Web 2.0 widgets and more than 4,500 Internet applications.

- Security Gateway Virtual Edition (VE) Software

Blade - Provides businesses with one-click security protection

for private and public clouds with VMsafe integration.

- Series 80 Appliance - Designed for remote

and branch offices, the new appliance delivers stronger security at

1.5 gigabit per second for under $2,500.

- Multi-Domain Management Software Blades -

Provides virtual security management to businesses of all sizes and

simplifies management by segmenting security into virtual domains

based on location, business unit or security functions.

- New Check Point R71 Training and Certification

Programs - Interactive programs to teach security

professionals how to deploy, maintain and optimize the latest

Software Blade Architecture™ protections.

In addition, Check Point validated its commitment to the

continual promotion of the open development, evolution and secure

use of the Web with the appointment of Check Point Fellow, Robert

Hinden, to the Board of Trustees for the Internet Society, the

organization that facilitates the creation of standards for the

future of Internet infrastructure.

Check Point products also continued to receive awards and

certifications from around the world, including:

- Information Security Magazine's Readers'

Choice Awards:

-

- Gold Medal - Check Point IPS Software Blade and IPS-1

Appliance

- Gold Medal - Check Point's Safe@Office and UTM-1 family of

appliances

- Silver Medal - Check Point Endpoint Security

- Virus Bulletin's VB100 Award - ZoneAlarm®

Internet Security Suite was recognized in the August comparative

review of antivirus solutions. Check Point's Endpoint Security was

also ranked highly in Virus Bulletin's RAP (Reactive and Proactive)

averages quadrant test based on its superior ability to proactively

detect new and unknown malware samples.

- Common Criteria EAL4+ Certification -

Check Point Media Encryption

- Best International Innovation - Check

Point Abra at the 2010 Information Security Day (ITBN) Conference

in Hungary

- Readers' Choice Awards - Check Point

Firewall Software Blade from Computerworld Malaysia and

Singapore

Mr. Shwed concluded. "It is great to see the success of our

strategy reflected in our record all-time-high quarterly results.

The Software Blade Architecture combined, with a unique focus on

our customers' security needs, continues to drive Check Point's

industry leadership. "

Fourth Quarter Investor Conference

Participation Schedule:

- Wells Fargo Securities 2010 Technology, Media

and Telecom Conference November 9, 2010 - New York, NY

- Credit Suisse 2010 Global Technology

Conference December 1, 2010 - Scottsdale, AZ

- Barclay's 2010 Technology Conference

December 8, 2010 - San Francisco, CA

Members of Check Point's management team will present at these

conferences and will discuss the latest company strategies and

initiatives. Check Point's conference presentations are expected to

be available via webcast at the company's web site. To view these

presentations and access the most updated information on presenters

and the schedule, please visit the Investor Relations section of

the company's web site at http://www.checkpoint.com/ir. The

schedule is subject to change.

Conference Call and Webcast Information

Check Point will host a conference call with the investment

community on October 20, 2010 at 8:30 AM ET/5:30 AM PT. To listen

to the live webcast, please visit Check Point's website at

http://www.checkpoint.com/ir. A replay of the conference call will

be available through October 27, 2010 at the company's website

http://www.checkpoint.com/ir or by telephone at +1 201.612.7415,

passcode # 385515, account # 215.

About Check Point Software Technologies

Ltd. Check Point Software Technologies Ltd.

(www.checkpoint.com), the worldwide leader in securing the

Internet, is the only vendor to deliver Total Security for

networks, data and endpoints, unified under a single management

framework. Check Point provides customers with uncompromising

protection against all types of threats, reduces security

complexity and lowers total cost of ownership. Check Point first

pioneered the industry with FireWall-1 and its patented stateful

inspection technology. Today, Check Point continues to innovate

with the development of the Software Blade Architecture. The

dynamic Software Blade Architecture delivers secure, flexible and

simple solutions that can be fully customized to meet the exact

security needs of any organization or environment. Check Point

customers include tens of thousands of businesses and organizations

of all sizes including all Fortune 100 companies. Check Point's

award-winning ZoneAlarm solutions protect millions of consumers

from hackers, spyware and identity theft.

©2010 Check Point Software Technologies Ltd. All rights

reserved

Use of Non-GAAP Financial Information In

addition to reporting financial results in accordance with

generally accepted accounting principles, or GAAP, Check Point uses

non-GAAP measures of operating income, operating margin, net income

and earnings per share, which are adjusted from results based on

GAAP to exclude non-cash equity-based compensation charges,

amortization of acquired intangible assets, restructuring and other

acquisition related charges and the related tax affects. Management

uses both GAAP and non-GAAP information in evaluating and operating

the business internally and as such has determined that it is

important to provide this information to investors. Check Point's

management also believes the non-GAAP financial information

provided in this release is useful to investors' understanding and

assessment of Check Point's on-going core operations and prospects

for the future. The presentation of this non-GAAP financial

information is not intended to be considered in isolation or as a

substitute for results prepared in accordance with GAAP.

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

(In thousands, except per share amounts)

Three Months Ended Nine Months Ended

----------------------- -----------------------

September 30, September 30,

----------------------- -----------------------

2010 2009 2010 2009

----------- ----------- ----------- -----------

(unaudited) (unaudited) (unaudited) (unaudited)

Revenues:

Products and licenses $ 106,399 $ 86,883 $ 301,341 $ 241,428

Software updates,

maintenance and

services 166,795 146,759 478,021 410,867

----------- ----------- ----------- -----------

Total revenues 273,194 233,642 779,362 652,295

----------- ----------- ----------- -----------

Operating expenses:

Cost of products and

licenses 18,799 17,848 51,591 40,579

Cost of software updates,

maintenance and services 14,910 10,783 40,702 31,119

Amortization of

technology 8,311 7,471 24,527 20,501

----------- ----------- ----------- -----------

Total cost of revenues 42,020 36,102 116,820 92,199

Research and development 26,165 22,426 76,294 65,681

Selling and marketing 55,872 56,379 169,267 160,390

General and

administrative 14,075 13,190 43,357 40,487

Restructuring and

other acquisition

related costs - 67 588 9,101

----------- ----------- ----------- -----------

Total operating expenses 138,132 128,164 406,326 367,858

----------- ----------- ----------- -----------

Operating income 135,062 105,478 373,036 284,437

Financial income, net 7,243 7,825 21,569 24,368

----------- ----------- ----------- -----------

Income before income taxes 142,305 113,303 394,605 308,805

Taxes on income 27,790 21,839 79,188 60,817

----------- ----------- ----------- -----------

Net income $ 114,515 $ 91,464 $ 315,417 $ 247,988

=========== =========== =========== ===========

Earnings per share (basic) $ 0.55 $ 0.44 $ 1.52 $ 1.18

=========== =========== =========== ===========

Number of shares used in

computing earnings per

share (basic) 207,239 208,738 208,049 209,465

=========== =========== =========== ===========

Earnings per share

(diluted) $ 0.54 $ 0.43 $ 1.49 $ 1.17

=========== =========== =========== ===========

Number of shares used in

computing earnings per

share (diluted) 211,637 211,688 211,339 211,790

=========== =========== =========== ===========

CHECK POINT SOFTWARE TECHNOLOGIES LTD.

RECONCILIATION OF SELECTED GAAP MEASURES TO NON GAAP MEASURES

(In thousands, except per share amounts)

Three Months Ended Nine Months Ended

------------------------ ------------------------

September 30, September 30,

------------------------ ------------------------

2010 2009 2010 2009

----------- ----------- ----------- -----------

(unaudited) (unaudited) (unaudited) (unaudited)

GAAP operating income $ 135,062 $ 105,478 $ 373,036 $ 284,437

Stock-based

compensation (1) 8,701 7,695 26,714 22,769

Amortization of

intangible assets (2) 13,114 14,301 38,770 36,647

Restructuring and other

acquisition related

costs (3) - 67 588 9,101

----------- ----------- ----------- -----------

Non-GAAP operating

income 156,877 $ 127,541 439,108 $ 352,954

=========== =========== =========== ===========

GAAP net income $ 114,515 $ 91,464 $ 315,417 $ 247,988

Stock-based

compensation (1) 8,701 7,695 26,714 22,769

Amortization of

intangible assets (2) 13,114 14,301 38,770 36,647

Restructuring and other

acquisition related

costs (3) - 67 588 9,101

Taxes on the above

items (4) (3,703) (4,040) (9,676) (10,662)

----------- ----------- ----------- -----------

Non-GAAP net income $ 132,627 $ 109,487 $ 371,813 $ 305,843

=========== =========== =========== ===========

GAAP Earnings per share

(diluted) $ 0.54 $ 0.43 $ 1.49 $ 1.17

Stock-based

compensation (1) 0.04 0.04 0.13 0.11

Amortization of

intangible assets (2) 0.06 0.07 0.18 0.17

Restructuring and other

acquisition related

costs (3) - - - 0.04

Taxes on the above

items (4) (0.01) (0.02) (0.04) (0.05)

----------- ----------- ----------- -----------

Non-GAAP Earnings per

share (diluted) 0.63 $ 0.52 $ 1.76 $ 1.44

=========== =========== =========== ===========

Number of shares used

in computing Non-GAAP

earnings per share

(diluted) 211,637 211,688 211,339 211,790

=========== =========== =========== ===========

(1) Stock-based

compensation:

Cost of products and

licenses $ 10 $ 14 $ 38 $ 35

Cost of software

updates, maintenance

and services 322 236 780 536

Research and

development 2,403 1,998 5,744 4,771

Selling and

marketing 1,776 1,769 5,572 4,485

General and

administrative 4,190 3,678 14,580 12,942

----------- ----------- ----------- -----------

8,701 7,695 26,714 22,769

----------- ----------- ----------- -----------

(2) Amortization of

intangible assets:

Amortization of

technology 8,311 7,471 24,527 20,501

Research and

development 685 - 2,055 -

Selling and

marketing 4,118 6,830 12,188 16,146

----------- ----------- ----------- -----------

13,114 14,301 38,770 36,647

----------- ----------- ----------- -----------

(3) Restructuring and

other acquisition

related costs - 67 588 9,101

----------- ----------- ----------- -----------

(4) Taxes on the above

items (3,703) (4,040) (9,676) (10,662)

----------- ----------- ----------- -----------

Total, net $ 18,112 $ 18,023 $ 56,396 $ 57,855

=========== =========== =========== ===========

CHECK POINT SOFTWARE TECHNOLOGIES LTD.

CONDENSED CONSOLIDATED BALANCE SHEET DATA

(In thousands)

ASSETS

September 30, December 31,

2010 2009

------------- -------------

(unaudited) (audited)

Current assets:

Cash and cash equivalents $ 438,785 $ 414,085

Marketable securities 515,448 469,913

Trade receivables, net 165,712 283,668

Prepaid expenses and other current assets 38,265 34,544

------------- -------------

Total current assets 1,158,210 1,202,210

------------- -------------

Long-term assets:

Marketable securities 1,302,266 963,001

Property and equipment, net 37,329 38,936

Severance pay fund 6,237 6,314

Deferred tax asset, net 19,956 16,307

Other intangible assets, net 79,972 114,192

Goodwill 714,803 708,458

Other assets 18,076 20,176

------------- -------------

Total long-term assets 2,178,639 1,867,384

------------- -------------

Total assets $ 3,336,849 $ 3,069,594

============= =============

LIABILITIES AND

SHAREHOLDERS' EQUITY

Current liabilities:

Deferred revenues $ 362,918 $ 384,255

Trade payables and other accrued liabilities 195,582 169,011

------------ ------------

Total current liabilities 558,500 553,266

------------ ------------

Long-term deferred revenues 33,430 41,005

Income tax accrual 155,137 132,908

Deferred tax liability, net 5,687 11,636

Accrued severance pay 10,967 11,061

------------ ------------

205,221 196,610

------------ ------------

Total liabilities 763,721 749,876

------------ ------------

Shareholders' equity:

Share capital 774 774

Additional paid-in capital 563,494 527,874

Treasury shares at cost (1,306,030) (1,199,752)

Accumulated other comprehensive income 23,220 12,555

Retained earnings 3,291,670 2,978,267

------------ ------------

Total shareholders' equity 2,573,128 2,319,718

------------ ------------

Total liabilities and shareholders' equity $ 3,336,849 $ 3,069,594

============ ============

Total cash and cash equivalents and marketable

securities $ 2,256,499 $ 1,846,999

============ ============

CHECK POINT SOFTWARE TECHNOLOGIES LTD.

SELECTED CONSOLIDATED CASH FLOW DATA

(In thousands)

Three Months Ended Nine Months Ended

------------------------ ------------------------

September 30, September 30,

------------------------ ------------------------

2010 2009 2010 2009

----------- ----------- ----------- -----------

(unaudited) (unaudited) (unaudited) (unaudited)

Cash flow from

operating activities:

Net income $ 114,515 $ 91,464 $ 315,417 $ 247,988

Adjustments to

reconcile net income

to net cash provided

by operating

activities:

Depreciation and

amortization of

property, plant and

equipment 1,730 2,189 5,305 7,225

Decrease (increase) in

trade and other

receivables, net (7,939) (50) 115,714 85,050

Increase in deferred

revenues, trade

payables and other

accrued liabilities 19,876 15,494 22,025 24,769

Realized loss (gain) on

marketable securities (781) - (781) 1,896

Stock-based

compensation 8,701 7,695 26,714 22,768

Amortization of

intangible assets 13,114 14,301 38,770 36,647

Excess tax benefit from

stock-based

compensation (1,082) (2,474) (4,042) (6,988)

Deferred income taxes,

net (3,558) (2,487) (7,807) (8,729)

----------- ----------- ----------- -----------

Net cash provided by

operating activities 144,576 126,132 511,315 410,626

----------- ----------- ----------- -----------

Cash flow from

investing activities:

Cash paid in

conjunction with

acquisitions, net of

acquired cash (333) - (13,957) (57,540)

Investment in property

and equipment (1,441) (1,043) (3,585) (3,644)

----------- ----------- ----------- -----------

Net cash used in

investing activities (1,774) (1,043) (17,542) (61,184)

----------- ----------- ----------- -----------

Cash flow from

financing activities:

Proceeds from issuance

of shares upon

exercise of options 12,568 20,166 46,566 62,469

Purchase of treasury

shares (50,000) (50,000) (150,000) (152,286)

Excess tax benefit from

stock-based

compensation 1,082 2,474 4,042 6,988

----------- ----------- ----------- -----------

Net cash used in

financing activities (36,350) (27,360) (99,392) (82,829)

----------- ----------- ----------- -----------

Unrealized gain on

marketable securities,

net 9,131 8,255 15,119 25,719

----------- ----------- ----------- -----------

Increase in cash and

cash equivalents and

marketable securities 115,583 105,984 409,500 292,332

Cash and cash

equivalents and

marketable securities

at the beginning of

the period 2,140,916 1,630,180 1,846,999 1,443,832

----------- ----------- ----------- -----------

Cash and cash

equivalents, and

marketable securities

at the end of the

period $ 2,256,499 $ 1,736,164 $ 2,256,499 $ 1,736,164

=========== =========== =========== ===========

Investor Contact Kip E. Meintzer Check Point Software

Technologies +1.650.628.2040 ir@checkpoint.com Media Contact

Amber Rensen Check Point Software Technologies +1.650.628.2070

press@checkpoint.com

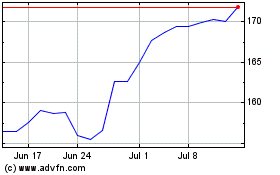

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From May 2024 to Jun 2024

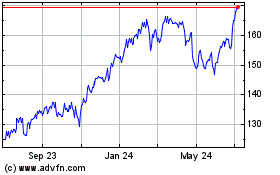

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From Jun 2023 to Jun 2024