UPDATE: H-P To Buy IT Security Company ArcSight For $1.5 Billion

September 13 2010 - 9:52AM

Dow Jones News

Hewlett-Packard Co. (HPQ) agreed to buy security-software maker

ArcSight Inc. (ARST) for about $1.5 billion, continuing the

company's spending spree that began after Chief Executive Mark Hurd

resigned last month.

The deal also represents the latest purchase of a smaller

security firm by a huge technology company, a trend some see

continuing as big tech considers the importance of adding security

to their product portfolio. ArSight makes software that monitors

corporate networks for unusual activity, such as a hacker's attempt

to break into a system.

ArcSight shares recently traded at $44.35 premarket, above H-P's

offer price of $43.50 a share, suggesting some traders may be

expecting or hoping for a higher bid, similar to what happened with

storage maker 3PAR Inc. (PAR). The agreed-upon deal already

provides a 24% premium to ArcSight's closing price Friday and a 70%

premium to where it was trading a month ago.

H-P expects the acquisition to close by the end of the calendar

year and doesn't see any material earnings dilution in its next

fiscal year. The company is in the fourth quarter of its fiscal

2010 year. H-P shares, down 26% so far this year, added 28 cents to

$38.48.

"The combination of H-P and ArcSight will provide clients with

the ability to fortify their applications, proactively monitor

events and respond to threats," said Bill Veghte, H-P's executive

vice president of software and solutions.

ArcSight, of Cupertino, Calif., had been quietly shopping itself

to a handful of big technology companies. ArcSight attracted

interest from a number of companies, and bidding quickly surpassed

$40 a share, people familiar with the matter said.

ArcSight, which went public in 2008, reported revenue of $181.4

million in the fiscal year ended April 30, up 33% from a year

earlier. Profit for the fiscal year grew to $28.4 million from $9.9

million a year before.

The ArcSight deal continues H-P's push into software and other

areas outside of its core computer-hardware businesses that began

under Hurd. Software, networking, storage and services--all areas

in which H-P has expanded recently--have higher margins than the

company's core personal-computer and server-system businesses. H-P

executives have said repeatedly that the company will continue the

expansion strategy.

The deal for ArcSight is the latest episode in a month-long

drama starring H-P. Last month, Hurd resigned following violations

of the Palo Alto, Calif., company's code of business conduct,

including failure to disclose a personal relationship with a

contractor and filing inaccurate expense reports.

Then H-P launched its public bidding war with Dell for 3PAR,

eventually winning it with a bid of $2.35 billion, or $33 a share,

almost double the $18 a share that Dell had initially agreed to

pay. Amid criticism from analysts that it was overspending on 3PAR,

H-P's board announced that it had authorized the company to buy

back $10 billion of its stock.

Before things had a chance to quiet down, Hurd joined H-P rival

Oracle Corp. (ORCL) as co-president, a move that triggered a

lawsuit from H-P arguing that the former CEO was breaking the

confidentiality agreement he signed as part of his exit

package.

"While such an acquisition would fit into the company's overall

enterprise strategy, we believe Street sentiment would likely

rather see the company get a new CEO announcement behind them and

look to digest some of the acquisitions it has recently or will be

completing (i.e., 3Com, Palm, 3PAR)," Stifel Nicolaus analyst Aaron

C. Rakers said in a research note Monday.

Others noted the deal continues a wave of consolidation in the

information technology sector.

"This purchase," Jefferies analyst Katherine Egbert said, "could

spur the large software, systems and hardware vendors to assess the

importance of IT security to their product portfolio, thereby

possibly sparking a wave of consolidation--like what happened

several years ago in the [business intelligence] and analytics

area."

Last month, chip maker Intel Corp. (INTC) agreed to buy security

specialist McAfee Inc. (MFE) for $7.7 billion.

Security companies have attracted interest from larger

information-technology providers lately as the industry's biggest

companies look to offer a wider variety of products. Software that

helps companies manage data securely is especially in demand.

Egbert noted seven other security companies that could attract

interest from larger tech companies. They were: Sourcefire Inc.

(FIRE), Fortinet Inc. (FTNT), Vasco Data Security International

Inc. (VDSI), Symantec Corp. (SYMC), Check Point Software

Technologies Ltd. (CHKP), Blue Coat Systems Inc. (BCSI) and

Websense Inc. (WBSN).

The analyst added, though, "we do not believe any of these

vendors are an active target right now."

-By Shara Tibken, Dow Jones Newswires; 212-416-2189;

shara.tibken@dowjones.com

(George Stahl, Ben Worthen and Anupreeta Das contributed to this

report.)

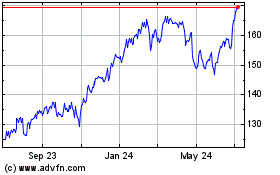

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From May 2024 to Jun 2024

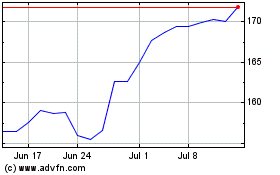

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From Jun 2023 to Jun 2024