Check Point® Software Technologies Ltd. (NASDAQ: CHKP)

- Revenue: $245.1 million, representing a 26 percent increase

year over year

- Non-GAAP Operating Income: $137.6 million, representing a 26

percent increase year over year and reflecting 56 percent of

revenues

- Non-GAAP EPS: $0.55, representing a 22 percent increase year

over year

- Deferred Revenues: $419.8 million, representing a 29 percent

increase year over year

- Cash Flow from Operations: $217.8 million, representing a 27

percent increase year over year

Check Point® Software Technologies Ltd. (NASDAQ: CHKP), the

worldwide leader in securing the Internet, today announced record

financial results for the first quarter ended March 31, 2010.

"We delivered record first quarter results, attaining the top

end of our projections for both revenues and earnings per share,

while experiencing healthy growth across all regions," said Gil

Shwed, chairman and chief executive officer of Check Point

Software. "Our software blade architecture continues to make

inroads with our annuity based software blades helping to drive

services revenues. In addition to these great results, we delivered

a record $218 million of operating cash flow for the quarter and

now have cash balances exceeding $2 billion."

- Total Revenues: $245.1 million, an

increase of 26 percent, compared to $195.0 million in the first

quarter of 2009.

- GAAP Operating Income: $115.9 million, an

increase of 26 percent, compared to $92.3 million in the first

quarter of 2009. The GAAP operating income in the first quarter of

2010 included additional amortization of intangible assets net of

taxes in the amount of $3.3 million related to the acquisition of

the Nokia security appliance business, which was completed during

the second quarter of 2009.

- Non-GAAP Operating Income: $137.6

million, an increase of 26 percent, compared to $109.0 million in

the first quarter of 2009. Non-GAAP operating margin was 56

percent, same as in the first quarter of 2009.

- GAAP Net Income and Earnings per Diluted

Share: GAAP net income was $98.0 million, an increase of 21

percent, compared to $80.9 million in the first quarter of 2009.

GAAP earnings per diluted share were $0.46, an increase of 21

percent, compared to $0.38 in the first quarter of 2009. GAAP net

income in the first quarter of 2010 included additional

amortization of intangible assets net of taxes in the amount of

$3.3 million (which represented $0.02 in GAAP earnings per diluted

share) related to the acquisition of the Nokia security appliance

business, which was completed during the second quarter of

2009.

- Non-GAAP Net Income and Earnings per Diluted

Share: Non-GAAP net income was $116.8 million, an increase of

22 percent, compared to $95.5 million in the first quarter of 2009,

and non-GAAP EPS was $0.55, an increase of 22 percent compared to

$0.45 in the first quarter of 2009.

- Deferred Revenues: As of March 31, 2010,

we had deferred revenue of $419.8 million, an increase of 29

percent, compared to $325.0 million as of March 31, 2009.

- Cash Flow: Cash flow from operations was

$217.8 million, an increase of 27 percent compared to $171.8

million in the first quarter of 2009.

- Share Repurchase Program: During the

first quarter of 2010, we repurchased 1.5 million shares at a total

cost of $50 million.

Recent Business Highlights Include:

Since the beginning of the year, Check Point has introduced

several new products and technologies.

- Check Point Data Loss Prevention (DLP)

solution -- a network-based solution that helps businesses

move data loss protection from detection to prevention by

preemptively protecting sensitive information such as regulatory,

confidential and proprietary information from unintentional

loss.

- The new SmartEvent Software Blade -- a

unified security management solution for real-time event visibility

across multiple security systems, including Firewall, Intrusion

Prevention (IPS), Data Loss Prevention (DLP) and endpoints.

- Significant antivirus and URL performance

improvements -- streaming technology dramatically increases

software blades performance, benefiting Check Point security

gateways through a software upgrade at no additional cost. In

addition, Check Point extended its patented SecureXL acceleration

technology to UTM-1 appliances, significantly boosting firewall

throughput performance.

- Check Point Abra -- a secure virtual

desktop solution deployed from an encrypted USB stick that provides

companies with a secure and affordable alternative to allowing

third-party PC's access to the network.

- ZoneAlarm DataLock Automated Encryption for

Small Businesses and Consumers -- equipped with Pre-boot

Authentication, ZoneAlarm DataLock prevents unauthorized users from

accessing stored information, automatically encrypting all hard

drive content to protect private and confidential data on laptops

and netbooks.

During the first quarter, Check Point won several awards and

industry accolades.

For the sixth time, Check Point won the SC Magazine Reader Trust

Award for Best Enterprise Firewall.

In the Asia Pacific region, Check Point earned five awards --

two PC Market Hong Kong Best of I.T. Awards, one for Check Point

Endpoint Security and the other for Check Point UTM-1 Total

Security Appliances; CRN India named Check Point Channel Champion

for overall network security; and PC3 Platinum Brand Election 2009

in Hong Kong recognized both Check Point Endpoint Security and

Check Point SSL VPN Solutions.

Check Point's vice president of global field operations, Amnon

Bar-Lev, was named a 2010 Channel Chief by the Everything Channel's

CRN for the third consecutive year.

Mr. Shwed concluded, "The first quarter marked a great start for

the year. We posted record results and further expanded our

addressable market by entering two new exciting markets: secure

virtual desktop with Abra and Data Loss Prevention with our DLP

solution. With the introduction of these latest technology

innovations and security solutions, Check Point is well positioned

to address the security needs of any size business."

Conference Call and Webcast Information Check Point will host a

conference call with the investment community on April 26, 2010 at

8:30 AM ET/5:30 AM PT. To listen to the live webcast, please visit

Check Point's website at http://www.checkpoint.com/ir. A replay of

the conference call will be available through May 3, 2010 at the

company's website http://www.checkpoint.com/ir or by telephone at

+1 201.612.7415, passcode # 348753, account # 215.

About Check Point Software Technologies

Ltd. Check Point Software Technologies Ltd.

(www.checkpoint.com), the worldwide leader in securing the

Internet, is the only vendor able to deliver Total Security for

networks, data and endpoints, unified under a single management

framework. Check Point provides customers with uncompromised

protection against all types of threats, reduces security

complexity and lowers total cost of ownership. Check Point first

pioneered the industry with FireWall-1 and its patented Stateful

Inspection technology. Today, Check Point continues to innovate

with the development of the Software Blade architecture. The

dynamic Software Blade architecture delivers secure, flexible and

simple solutions that can be fully customized to meet the exact

security needs of any organization or environment. Check Point

customers include tens of thousands of businesses and organizations

of all sizes including all Fortune 100 companies. Check Point's

award-winning ZoneAlarm solutions protect millions of consumers

from hackers, spyware and identity theft.

©2010 Check Point Software Technologies Ltd.

All rights reserved

Use of Non-GAAP Financial Information In addition to reporting

financial results in accordance with generally accepted accounting

principles, or GAAP, Check Point uses non-GAAP measures of

operating income, operating margin, net income and earnings per

share, which are adjusted from results based on GAAP to exclude

non-cash equity-based compensation charges, amortization of

acquired intangible assets and the related tax affects. Management

uses both GAAP and non-GAAP information in evaluating and operating

business internally and as such has determined that it is important

to provide this information to investors. Check Point's management

also believes the non-GAAP financial information provided in this

release is useful to investors' understanding and assessment of

Check Point's on-going core operations and prospects for the

future. The presentation of this non-GAAP financial information is

not intended to be considered in isolation or as a substitute for

results prepared in accordance with GAAP.

CHECK POINT SOFTWARE TECHNOLOGIES LTD.

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

(In thousands, except per share amounts)

Three Months Ended

------------------------

March 31,

------------------------

2010 2009

----------- -----------

(unaudited) (unaudited)

Revenues:

Products and licenses $ 91,038 $ 71,744

Software updates, maintenance and services 154,039 123,268

----------- -----------

Total revenues 245,077 195,012

----------- -----------

Operating expenses:

Cost of products and licenses 16,505 7,686

Cost of software updates, maintenance and

services 12,245 7,769

Amortization of technology 8,066 5,800

----------- -----------

Total cost of revenues 36,816 21,255

Research and development 24,322 19,787

Selling and marketing 54,776 47,072

General and administrative 13,302 14,617

----------- -----------

Total operating expenses 129,216 102,731

----------- -----------

Operating income 115,861 92,281

Financial income, net 7,193 8,413

----------- -----------

Income before income taxes 123,054 100,694

Taxes on income 25,013 19,773

----------- -----------

Net income $ 98,041 $ 80,921

=========== ===========

Earnings per share (basic) $ 0.47 $ 0.39

=========== ===========

Number of shares used in computing earnings per

share (basic) 209,014 210,153

=========== ===========

Earnings per share (diluted) $ 0.46 $ 0.38

=========== ===========

Number of shares used in computing earnings per

share (diluted) 213,523 212,083

=========== ===========

CHECK POINT SOFTWARE TECHNOLOGIES LTD.

RECONCILIATION OF NON-GAAP TO GAAP FINANCIAL INFORMATION

(In thousands, except per share amounts)

--------------------------

Three Months Ended

--------------------------

March 31,

--------------------------

2010 2009

------------ ------------

(unaudited) (unaudited)

GAAP operating income $ 115,861 $ 92,281

Stock-based compensation (1) 8,933 7,803

Amortization of intangible assets (2) 12,763 8,893

------------ ------------

Non-GAAP operating income $ 137,557 $ 108,977

============ ============

GAAP net income $ 98,041 $ 80,921

Stock-based compensation (1) 8,933 7,803

Amortization of intangible assets (2) 12,763 8,893

Taxes on the above items (3) (2,948) (2,123)

------------ ------------

Non-GAAP net income $ 116,789 $ 95,494

============ ============

GAAP Earnings per share (diluted) $ 0.46 $ 0.38

Stock-based compensation (1) 0.04 0.04

Amortization of intangible assets (2) 0.06 0.04

Taxes on the above items (3) (0.01) (0.01)

------------ ------------

Non-GAAP Earnings per share (diluted) $ 0.55 $ 0.45

============ ============

Number of shares used in computing Non-GAAP

earnings per share (diluted) 213,523 212,083

============ ============

(1) Stock-based compensation:

Cost of products and licenses $ 11 $ 8

Cost of software updates, maintenance and

services 227 193

Research and development 1,648 1,258

Selling and marketing 2,246 1,740

General and administrative 4,801 4,604

------------ ------------

8,933 7,803

------------ ------------

(2) Amortization of intangible assets:

Amortization of technology 8,066 5,800

Research and development 685 -

Selling and marketing 4,012 3,093

------------ ------------

12,763 8,893

------------ ------------

(3) Taxes on the above items (2,948) (2,123)

------------ ------------

Total, net $ 18,748 $ 14,573

============ ============

CHECK POINT SOFTWARE TECHNOLOGIES LTD.

CONDENSED CONSOLIDATED BALANCE SHEET DATA

(In thousands)

ASSETS

March 31, December 31,

2010 2009

------------- -------------

(unaudited) (audited)

Current assets:

Cash and cash equivalents $ 588,266 $ 414,085

Marketable securities 453,935 469,913

Trade receivables, net 183,305 283,668

Prepaid expenses and other current assets 36,478 34,544

------------- -------------

Total current assets 1,261,984 1,202,210

------------- -------------

Long-term assets:

Marketable securities 1,009,537 963,001

Property and equipment, net 37,991 38,936

Severance pay fund 6,301 6,314

Deferred tax asset, net 16,685 16,307

Other intangible assets, net 101,429 114,192

Goodwill 708,458 708,458

Other assets 17,833 20,176

------------- -------------

Total long-term assets 1,898,234 1,867,384

------------- -------------

Total assets $ 3,160,218 $ 3,069,594

============= =============

LIABILITIES AND

SHAREHOLDERS' EQUITY

Current liabilities:

Deferred revenues $ 380,879 $ 384,255

Trade payables and other accrued

liabilities 165,507 169,011

------------- -------------

Total current liabilities 546,386 553,266

------------- -------------

Long-term deferred revenues 38,898 41,005

Income tax accrual 140,300 132,908

Deferred tax liability, net 9,466 11,636

Accrued severance pay 11,213 11,061

------------- -------------

Total liabilities 746,263 749,876

------------- -------------

Shareholders' equity:

Share capital 774 774

Additional paid-in capital 546,446 527,874

Treasury shares at cost (1,223,531) (1,199,752)

Accumulated other comprehensive income 15,888 12,555

Retained earnings 3,074,378 2,978,267

------------- -------------

Total shareholders' equity 2,413,955 2,319,718

------------- -------------

Total liabilities and shareholders' equity $ 3,160,218 $ 3,069,594

============= =============

Total cash and cash equivalents and

marketable securities $ 2,051,738 $ 1,846,999

============= =============

CHECK POINT SOFTWARE TECHNOLOGIES LTD.

SELECTED CONSOLIDATED CASH FLOW DATA

(In thousands)

Three Months Ended

----------------------------

March 31,

----------------------------

2010 2009

------------- -------------

(unaudited) (unaudited)

Cash flow from operating activities:

Net income $ 98,041 $ 80,921

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization of property,

plant and equipment 1,841 2,812

Amortization of intangible assets 12,763 8,893

Stock-based compensation 8,933 7,803

Increase in trade and other receivables, net 100,043 80,707

Increase (decrease) in deferred revenues,

trade payables and other accrued liabilities 409 (6,884)

Realized loss on marketable securities - 1,896

Excess tax benefit from stock-based

compensation (1,833) (2,471)

Deferred income taxes, net (2,392) (1,890)

------------- -------------

Net cash provided by operating activities 217,805 171,787

------------- -------------

Cash flow from investing activities:

Investment in property and equipment (896) (1,394)

------------- -------------

Net cash used in investing activities (896) (1,394)

------------- -------------

Cash flow from financing activities:

Proceeds from issuance of shares upon exercise

of options 32,060 23,789

Purchase of treasury shares (50,000) (52,288)

Excess tax benefit from stock-based

compensation 1,833 2,471

------------- -------------

Net cash used in financing activities (16,107) (26,028)

------------- -------------

Unrealized gain on marketable securities, net 3,937 2,622

------------- -------------

Increase in cash and cash equivalents and

marketable securities 204,739 146,987

Cash and cash equivalents and marketable

securities at the beginning of the period 1,846,999 1,443,832

------------- -------------

Cash and cash equivalents and marketable

securities at the end of the period $ 2,051,738 $ 1,590,819

============= =============

INVESTOR CONTACT: Kip E. Meintzer Check Point Software

Technologies +1 650.628.2040 ir@checkpoint.com MEDIA

CONTACT: Amber Rensen Check Point Software Technologies +1

650.628.2070 press@checkpoint.com

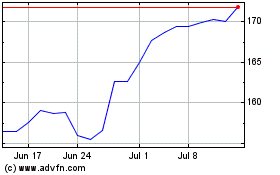

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From Jun 2024 to Jul 2024

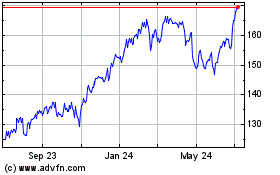

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From Jul 2023 to Jul 2024