MORNING UPDATE: brokersXpress, LLC issues alerts for BAC, GSF, MAT, CHKP, and HAS

April 18 2005 - 10:33AM

PR Newswire (US)

MORNING UPDATE: brokersXpress, LLC issues alerts for BAC, GSF, MAT,

CHKP, and HAS CHICAGO, April 18 /PRNewswire/ -- brokersXpress, LLC

issues the following Morning Update at 8:30 AM EDT with new

PriceWatch Alerts for key stocks. Before the open... PriceWatch

Alerts for BAC, GSF, MAT, CHKP, and HAS, Market Overview, Today's

Economic Calendar, and the Quote Of The Day. QUOTE OF THE DAY "I

think we're headed for continued above trend line noninflationary

growth...with strong jobs pickup and strong GDP growth." -- John

Snow, Treasury Secretary, United States Of America New PriceWatch

Alerts for BAC, GSF, MAT, CHKP, and HAS... PRICEWATCH ALERTS - HIGH

RETURN COVERED CALL OPTIONS ----------- -- BankAmerica Corp.

(NYSE:BAC) Last Price 44.28 - AUG 45.00 CALL OPTION@ $1.40 ->

4.9 % Return assigned* -- GlobalSantaFe Corp. (NYSE:GSF) Last Price

33.83 - JUL 32.50 CALL OPTION@ $2.95 -> 5.2 % Return assigned*

-- Mattel Inc. (NYSE:MAT) Last Price 18.67 - OCT 17.50 CALL OPTION@

$2.05 -> 5.3 % Return assigned* -- Check Point Software

Technologies Ltd. (NASDAQ:CHKP) Last Price 21.80 - JUL 20.00 CALL

OPTION@ $2.65 -> 4.4 % Return assigned* -- Hasbro Inc.

(NYSE:HAS) Last Price 19.29 - JUL 20.00 CALL OPTION@ $0.65 ->

7.3 % Return assigned* * To learn more about how to use these

alerts and for our FREE report, "The 18 Warning Signs That Tell You

When To Dump A Stock ", go to:

http://www.investorsobserver.com/mu18 (Note: You may need to copy

the link above into your browser then press the [ENTER] key) ** For

the FREE report, "Is Your Investment Portfolio Disaster Proof? -

Insights, Stocks, And Strategies." go to:

http://www.investorsobserver.com/FREEDP NOTE: All stocks and

options shown are examples only. These are not recommendations to

buy or sell any security. NEWS LEADERS AND LAGGARDS So far today,

Adobe Systems Inc., Honeywell International Inc., and Macromedia

Inc. lead the list of companies with the most news stories while

Hanover Compressor and Liberty Media Corp. are showing a spike in

news. Bank of America Corp., 3M Co., and Eli Lilly and Co. have the

highest srtIndex scores to top the list of companies with positive

news while Hasbro Inc. and Cameco Corp. lead the list of companies

with negative news reports. Avid Technology Inc. has popped up with

a high positive news sraIndex score. For the FREE article titled,

"Earnings Season Decoded - An Essential 15 Point Checklist For

Finding Winning Stocks." go to:

http://www.wallstreetsecretsplus.com/go/freemu/ MARKET OVERVIEW

Overseas trading is once again heavily skewed toward the negative

side, as not one of the markets that we follow is in positive

territory at the moment. The cumulative average return on the group

stands at a 2.125-percent loss. Mounting tensions between China and

Japan spurred heavy losses in the Asian markets, while poor

earnings reports in Europe are extending losses there so far today.

The May contract on sweet crude oil lost 0.64 on Friday. Energy

Department data suggests that gas prices spiked in March, as

customers dished out $2.12 per gallon when the tanks were running

low. In February, gasoline cost roughly $1.95 per gallon, 8.7

percent lower than the cost in March. In early market trading, the

May futures contract on crude oil dropped below $50 per barrel, and

was last seen trading at $49.96, down 53 cents from Friday's close.

Be prepared for the investing week ahead with Bernie Schaeffer's

FREE Monday Morning Outlook. For more details and to sign up, go

to: http://www.investorsobserver.com/freemo DYNAMIC MARKET

OPPORTUNITIES There was good news for US manufacturers and

exporters last Friday. At a crucial meeting, the International

Trade Commission voted 4-2 to allow the US to maintain its

five-year period of trade tariffs on steel imports from Japan,

Brazil and Russia. Had it not done so, there's a good chance that

removal of the levies, which range from 20-50%, would have had an

unfair impact on the US - an unfortunate situation, given that the

steel industry is currently experiencing a major bull market.

Surging demand is outstripping supply across the globe, as the

economies of US, China and many others continue to expand solidly.

Without the tariffs, however, it would have allowed foreign

competitors to sell their steel at below-market prices and led to a

rise in cheap imports. Elsewhere, the US housing market appears to

be losing some steam - at least in southern California. Following a

remarkable 14-month run in which home prices appreciated at least

20% or more each month, March finally saw price inflation of "just"

18.6%. That's according to the latest survey from DataQuick

Information Systems in La Jolla. While it was pretty obvious such

hefty gains couldn't continue forever, the March figure

nevertheless shows a very strong regional market, which essentially

serves as a snapshot of many other areas in the US. Mortgage

financer Freddie Mac just reported that 30-year mortgage rates fell

to a one-month low of 5.9%, another factor helping to drive the

market. In Los Angeles and Orange counties, the number of homes

available for sale today is just half the total from six months

ago. That not only shows a fierce demand for homes, but also that

current inventory is tight. In fact, Orange County is the most

expensive market, with the median price an extraordinary US$565,000

following a 16.5% jump in the year to March. Los Angeles County's

median price soared over 17% to US$440,000. Read more analysis from

the 247Profits Group every trading day with the FREE 247Profits

e-Dispatch, featuring insightful economic commentary, profitable

investment recommendations, and full access to a leading team of

financial experts. Register for free here:

http://www.investorsobserver.com/TP TODAY'S ECONOMIC CALENDAR 1:00

P.M. US April NAHB Housing Index The Mankus Lavelle Group is an

independent brokerage branch of brokersXpress, LLC, a wholly owned

subsidiary of optionsXpress Holdings, Inc. The Mankus Lavelle Group

has some of the most experienced, respected options professionals

in the industry. Both novice option investors and experienced

traders are attracted to MLG. Less experienced investors appreciate

Mankus Lavelle Group's friendly expert guidance while more seasoned

investors value Mankus Lavelle Group's highly trained staff of

option experts. To improve your understanding of options get a free

option kit at: http://www.mlgos.com/. If you are familiar with

stock investing but not sure what options can do for you, call

1-800-230-5570 for a FREE 3-point portfolio check up. Securities

offered through brokersXpress, LLC Member NASD/SPIC. Corporate

Office: 39 South LaSalle Street o Suite 220 o Chicago, Illinois

60603-1608 brokersXpressSM is the online broker-dealer for

independent reps and advisors. Powered by the award-winning

technology of optionsXpress(R), its parent company, brokersXpress

provides a leading-edge trading platform particularly powerful for

reps and advisors who employ option strategies. For more

information on how partnering with brokersXpress can empower your

business to new levels, contact us confidentially by e-mail at .

Member NASD/SPIC. CRD# 127081 This Morning Update was prepared with

data and information provided by: InvestorsObserver.com - Better

Strategies for Making Money -> For Investors With a Sense of

Humor. Only $1 for your first month plus seven free bonuses worth

over $420, see: http://www.investorsobserver.com/must Quote.com

QCharts- Real time quotes and streaming technical charts to keep

you up with the market. Analyze, predict, and stay ahead. for a

Free 30 day trial go to: http://www.investorsobserver.com/MUQuote2

247profits.com: You'll get exclusive financial commentary, access

to a global network of experts and undiscovered stock alerts.

Register NOW for the FREE 247profits e-Dispatch. Go to:

http://www.investorsobserver.com/agora Schaeffer's Investment

Research - Sign up for your FREE e-weekly, Monday Morning Outlook,

Bernie Schaeffer's look ahead at the markets. Sign Up Now

http://www.investorsobserver.com/freemo PowerOptionsPlus - The Best

Way To Find, Compare, Analyze, and Make Money On Options

Investments. For a 14-Day FREE trial and 5 FREE bonuses go to:

http://www.investorsobserver.com/poweropt All stocks and options

shown are examples only. These are not recommendations to buy or

sell any security and they do not represent in any way a positive

or negative outlook for any security. Potential returns do not take

into account your trade size, brokerage commissions or taxes which

will affect actual investment returns. Stocks and options involve

risk and are not suitable for all investors and investing in

options carries substantial risk. Prior to buying or selling

options, a person must receive a copy of Characteristics and Risks

of Standardized Options available from Michael at 800-230-5570 or

at http://www.cboe.com/Resources/Intro.asp. Privacy policy

available upon request. DATASOURCE: brokersXpress, LLC CONTACT:

Mike Lavelle of Mankus-Lavelle Group, +1-800-230-5570

Copyright

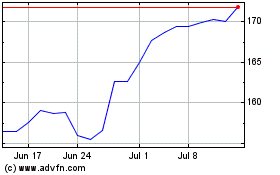

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From May 2024 to Jun 2024

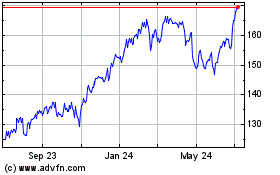

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From Jun 2023 to Jun 2024