MORNING UPDATE: Man Securities Inc. Issues Alerts for RIMM, TIVO, CHKP, TOY, and GS

March 16 2005 - 9:28AM

PR Newswire (US)

MORNING UPDATE: Man Securities Inc. Issues Alerts for RIMM, TIVO,

CHKP, TOY, and GS CHICAGO, March 16 /PRNewswire/ -- Man Securities

issues the following Morning Update at 8:30 AM EST with new

PriceWatch Alerts for key stocks. (Logo:

http://www.newscom.com/cgi-bin/prnh/20020214/MANSECLOGO ) Before

the open... PriceWatch Alerts for RIMM, TIVO, CHKP, TOY, and GS,

Market Overview, Today's Economic Calendar, and the Quote Of The

Day. QUOTE OF THE DAY "We believe that energy prices will remain at

much higher levels than the market currently expects." -- Rob

Lutts, chief investment officer, Cabot Money Management New

PriceWatch Alerts for RIMM, TIVO, CHKP, TOY, and GS... PRICEWATCH

ALERTS - HIGH RETURN COVERED CALL OPTIONS -- Research In Motion

Ltd. (NASDAQ:RIMM) Last Price 67.09 - APR 65.00 CALL OPTION@ $6.00

-> 6.4 % Return assigned* -- TiVo Inc. (NASDAQ:TIVO) Last Price

6.70 - MAY 5.00 CALL OPTION@ $1.90 -> 4.2 % Return assigned* --

Check Point Software Technologies Ltd. (NASDAQ:CHKP) Last Price

21.08 - JUL 20.00 CALL OPTION@ $2.30 -> 6.5 % Return assigned*

-- Toys R Us, Inc. (NYSE:TOY) Last Price 24.09 - JUN 25.00 CALL

OPTION@ $0.65 -> 6.7 % Return assigned* -- Goldman Sachs Group

(The) (NYSE:GS) Last Price 110.54 - JUL 110.00 CALL OPTION@ $5.60

-> 4.8 % Return assigned* * To learn more about how to use these

alerts and for our FREE report, "The 18 Warning Signs That Tell You

When To Dump A Stock ", go to:

http://www.investorsobserver.com/mu18 (Note: You may need to copy

the link above into your browser then press the [ENTER] key) ** For

the FREE report, "Is Your Investment Portfolio Disaster Proof? -

Insights, Stocks, And Strategies." go to:

http://www.investorsobserver.com/FREEDP NOTE: All stocks and

options shown are examples only. These are not recommendations to

buy or sell any security. NEWS LEADERS AND LAGGARDS So far today,

General Motors Corp., Tribune Co., and Research In Motion Ltd. lead

the list of companies with the most news stories while Shopping.com

Ltd. and Akamai Technologies Inc. are showing a spike in news. Toys

R Us, Inc., Campbell Soup Co., and Apple Computer Inc. have the

highest srtIndex scores to top the list of companies with positive

news while MicroStrategy Inc. and Albertson's Inc. lead the list of

companies with negative news reports. Michaels Stores Inc. has

popped up with a high positive news sraIndex score. For the FREE

article titled, "Earnings Season Decoded - An Essential 15 Point

Checklist For Finding Winning Stocks." go to:

http://www.wallstreetsecretsplus.com/go/freemu/ MARKET OVERVIEW

Overseas markets are looking strong, as 4 of the 15 that we track

are currently higher with the cumulative average return standing at

negative 0.368 percent. The dollar has slipped in Asia but has

stayed in its relatively narrow range ahead of the U.S. current

account data later today. In Japan, the country's Cabinet Office

revised its index of coincident economic indicators up to 90.0

percent for January. The reading for the month, released last week,

stood at 88.9 percent. Today we will find out about crude oil

inventories from the Energy Department and the American Petroleum

Institute. The Street expects an increase of 1-2 million barrels in

crude, a drop of 1-2 million barrels in distillates, and a smaller

drop of 500,000 - 1.5 million barrels in gasoline inventories. Some

pressure is being put on black gold by the cold weather, which is

expected to last for another two weeks Be prepared for the

investing week ahead with Bernie Schaeffer's FREE Monday Morning

Outlook. For more details and to sign up, go to:

http://www.investorsobserver.com/freemo DYNAMIC MARKET

OPPORTUNITIES A new survey from research firm Manpower Inc. shows

that US employers are set to boost the pace of hiring during the

second quarter at the same pace as the first. While that's positive

news, it's only slightly higher than during Q2 2004, with 30% of

the 16,000 employers questioned saying that they plan to recruit

additional staff. While that doesn't represent explosive growth

from a year ago, just 7% said they would reduce payrolls. Moreover,

job growth improved in all four US regions, with the increases

spread across all ten sub sectors of the survey. The solid job

growth, coupled with rising property prices and a relatively robust

stock market is driving personal wealth higher. According to the

Federal Reserve's latest quarterly "Flow of Funds" report, net US

household wealth rose by US$2 trillion during the fourth quarter of

2004 to a record US$48.5 trillion. Impressively, the figure set a

new record in each quarter of 2004. There's a reasonable chance

consumers will be able to retain more of that wealth, too, since

the Fed also revealed that fourth quarter household debt grew 9.4%,

compared with an 11.5% expansion during the third quarter. However,

full-year debt rose by 11%, versus 10% in 2003. Besides the US

report, Manpower released data from 20 other countries, including

Canada, Australia, New Zealand, Germany, China and Mexico -- a

total of 40,000 companies. And the results show an upbeat

employment outlook in 18 of them. Germany was one of only two

countries (with the Netherlands) to report negative growth, which

is no surprise considering its 12.6% unemployment rate is the

highest since World War II. The strength of the euro was cited as a

big reason for the job market woes in both nations. Receive

incisive economic/market commentary, profitable advice and access

to a network of leading investment exports. Simply follow this

link: http://www.investorsobserver.com/agora2 TODAY'S ECONOMIC

CALENDAR 8.30 a.m.: February Housing Starts 9.15 a.m.: February

Industrial Production 9.15 a.m.: February Capacity Utilization

Actively track stocks with Quote.com's QCharts and get the real

time quotes and streaming technical charts you need to keep up with

the market. For your free 30-day trial go to:

http://www.investorsobserver.com/MUQuote1 Man Securities Inc. is

one of the world's leading option order execution firms. Man's

in-house broker team offers a level of personal service and

experience unavailable from no-frills discount brokers. To improve

your understanding of option pricing get Man's FREE Margin/Option

Wizard software at: http://www.investorsobserver.com/mancd. Member

CBOE/NASD/SPIC. CRD# 6731 This Morning Update was prepared with

data and information provided by: InvestorsObserver.com - Better

Strategies for Making Money -> For Investors With a Sense of

Humor. Only $1 for your first month plus seven free bonuses worth

over $420, see: http://www.investorsobserver.com/must Quote.com

QCharts- Real time quotes and streaming technical charts to keep

you up with the market. Analyze, predict, and stay ahead. for a

Free 30 day trial go to: http://www.investorsobserver.com/MUQuote2

247profits.com: You'll get exclusive financial commentary, access

to a global network of experts and undiscovered stock alerts.

Register NOW for the FREE 247profits e-Dispatch. Go to:

http://www.investorsobserver.com/agora Schaeffer's Investment

Research - Sign up for your FREE e-weekly, Monday Morning Outlook,

Bernie Schaeffer's look ahead at the markets. Sign Up Now

http://www.investorsobserver.com/freemo PowerOptionsPlus - The Best

Way To Find, Compare, Analyze, and Make Money On Options

Investments. For a 14-Day FREE trial and 5 FREE bonuses go to:

http://www.investorsobserver.com/poweropt All stocks and options

shown are examples only. These are not recommendations to buy or

sell any security and they do not represent in any way a positive

or negative outlook for any security. Potential returns do not take

into account your trade size, brokerage commissions or taxes which

will affect actual investment returns. Stocks and options involve

risk and are not suitable for all investors and investing in

options carries substantial risk. Prior to buying or selling

options, a person must receive a copy of Characteristics and Risks

of Standardized Options available from Sharon at 800-837-6212 or at

http://www.cboe.com/Resources/Intro.asp. Privacy policy available

upon request.

http://www.newscom.com/cgi-bin/prnh/20020214/MANSECLOGO

http://photoarchive.ap.org/ DATASOURCE: Man Securities CONTACT:

John Gannon of Man Securities Inc., +1-800-837-6212 Web site:

http://www.mansecurities.com/mu.html

Copyright

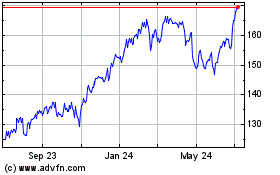

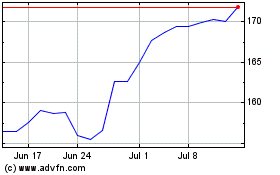

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From May 2024 to Jun 2024

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From Jun 2023 to Jun 2024