UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM 8-A

_________________________

FOR REGISTRATION OF CERTAIN CLASSES OF SECURITIES

PURSUANT TO SECTION 12(b) OR (g) OF THE

SECURITIES EXCHANGE ACT OF 1934

Charter Communications, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of incorporation or organization)

|

43-1857213

(I.R.S. Employer Identification No.)

|

|

12405 Powerscourt Drive

St. Louis, Missouri 63131

(Address of principal executive offices and zip code)

|

_________________________

Securities to be registered pursuant to Section 12(b) of the Act:

Title of each class

to be so registered

|

|

Name of each exchange on which

each class is to be registered

|

|

Class A Common Stock, par value $0.001 per share

|

|

The NASDAQ Stock Market LLC

|

If this form relates to the registration of a class of securities pursuant to Section 12(b) of the Exchange Act and is effective pursuant to General Instruction A.(c), check the following box.

T

If this form relates to the registration of a class of securities pursuant to Section 12(g) of the Exchange Act and is effective pursuant to General Instruction A.(d), check the following box.

¨

Securities Act registration statement file number to which this form relates: 333-164105

Securities to be registered pursuant to Section 12(g) of the Act: None

Item 1. Description of Registrant’s Securities to be Registered

This registration statement registers under Section 12(b) of the Securities Exchange Act of 1934, as amended Class A Common Stock, par value $0.001 per share (the “Class A Common Stock”), of Charter Communications, Inc. (the “Registrant” or “Charter”). The Registrant also has Class B Common Stock, par value $0.001 per share (the “Class B Common Stock”) outstanding (together with the Class A Common Stock, “Common Stock”).

To the extent permitted by applicable Delaware law, the shares of Class A Common Stock are uncertificated, and transfer will be reflected by book-entry, unless a physical certificate is requested by a holder.

Voting Rights

Holders of shares of Charter’s capital stock are entitled to vote on all matters submitted to a vote of Charter’s stockholders, including the election of directors, as follows:

• shares of Class A Common Stock are entitled to one vote per share; and

• shares of the Registrant’s Class B Common Stock are entitled to a number of votes per share, which at all times when shares of Class B Common Stock are outstanding represent 35% of the combined voting power of the Company’s capital stock, on a fully diluted basis.

Mr. Paul Allen and entities affiliated with Mr. Allen hold in excess of 35% of the combined voting power of the capital stock of Charter and have the right to elect four of 11 members of the board of directors. There may be additional holders of significant voting power in Charter, though pursuant to the Amended and Restated Certificate of Incorporation, prior to September 15, 2014, the votes attributable to each share of Class A Common Stock held by any holder (other than Mr. Allen and certain of his affiliates) will be automatically reduced pro rata among all shares of Class A Common Stock held by such holder and (if applicable) shares of Class A Common Stock held by any other holder (other than Mr. Allen and certain of his affiliates) included in any “person” or “group” with such holder so that no “person” or “group” (other than Mr. Allen and certain of his affiliates) is or becomes the holder or beneficial owner (as such term is used in Rule 13d-3 and Rule 13d-5 under the Exchange Act, except that in calculating the beneficial ownership of any particular “person” (as such term is used in Section 13(d) of the Exchange Act) such “person” shall be deemed to have beneficial ownership of all securities that such “person” has the right to acquire, whether such right is currently exercisable or is exercisable only upon the occurrence of a subsequent condition), directly or indirectly, of more than 34.9% of the combined voting power of the capital stock of Charter, subject to waiver by the disinterested members of the board of directors as provided in the Amended and Restated Certificate of Incorporation. We refer to this voting power limitation as the Voting Threshold. Holders of Class B Common Stock (other than Mr. Allen and certain of his affiliates) are also subject to a reduction of their voting power to comply with the Voting Threshold.

The holders of Common Stock and their respective affiliates do not have cumulative voting rights.

Pursuant to Charter’s amended and restated bylaws, the number of members of the board of directors shall be fixed at 11 members. Except for the initial board of directors, which was appointed pursuant to the terms of the Plan, for as long as shares of Class B Common Stock are outstanding, holders of Class B Common Stock have the right to elect 35% of the members of the board of directors (rounded up to the next whole number), and all other members of the board of directors will be elected by majority vote of the holders of Class A Common Stock (and any series of preferred stock then entitled to vote at an

election of the directors). In addition, members of the board of directors elected by holders of Class B Common Stock have no less than proportionate representation on each committee of the board of directors, subject to applicable SEC and stock exchange rules and except for any committee formed solely for the purpose of reviewing, recommending and/or authorizing any transaction in which holders of Class B Common Stock or their affiliates (other than Charter or its subsidiaries) are interested parties.

Under Charter’s Amended and Restated Certificate of Incorporation, (i) any director may be removed for cause by the affirmative vote of a majority of the voting power of the outstanding Class A Common Stock and Class B Common Stock (and any series of preferred stock then entitled to vote at an election of directors), voting together as a single class, (ii) any director elected by the holders of Class B Common Stock voting separately as a class may be removed from office, without cause, solely by the vote of a majority of the voting power of the outstanding Class B Common Stock, voting as a separate class, and (iii) any director elected by the vote of the holders of Class A Common Stock voting separately as a class (including holders of voting preferred stock, as applicable) may be removed from office, without cause, solely by the vote of a majority of the voting power of the outstanding Class A Common Stock, voting separately as a class (including any holders of voting preferred stock entitled to vote thereon).

Dividend Rights

Subject to limitations under Delaware law, preferences that may apply to any outstanding shares of preferred stock, and contractual restrictions, holders of each class of Common Stock are entitled to receive ratably dividends or other distributions when and if declared by the board of directors. In addition to such restrictions, whether any future dividends are paid to Charter’s stockholders will depend on decisions that will be made by the board of directors and will depend on then existing conditions, including Charter’s financial condition, contractual restrictions, corporate law restrictions, capital requirements and business prospects. The ability of the board of directors to declare dividends also will be subject to the rights of any holders of outstanding shares of Charter’s preferred stock, including the Series A Preferred Stock, and the availability of sufficient funds under the Delaware General Corporation Law ("DGCL") to pay dividends. For a more complete description of the dividend rights of holders of shares of Charter’s preferred stock, see the section titled “Preferred Stock” below.

Liquidation Rights

In the event of any liquidation, dissolution or winding up of Charter, the holders of Class A Common Stock and Class B Common Stock will be entitled to share pari passu in the net assets of Charter available after the payment of all debts and other liabilities and subject to the prior rights of any outstanding class of Charter’s preferred stock.

Preemptive Rights

Pursuant to Charter’ amended and restated certificate of incorporation, the holders of Class A Common Stock and Class B Common Stock have no preemptive rights.

Anti-Takeover Provisions

Charter’s amended and restated certificate of incorporation provides that the board of directors may impose restrictions on the trading of Charter’s stock if (i) Charter has experienced an “owner shift” as determined for purposes of Section 382 of the Internal Revenue Code of 1986, as amended, of at least 25 percentage points and (ii) the equity value of Charter has fallen below $3.2 billion. These restrictions, which are intended to preserve Charter’s ability to use its net operating losses, which we refer to as NOLs, may prohibit any person from acquiring stock of Charter if such person is a “5% shareholder” or would

become a “5% shareholder” as a result of such acquisition. The restrictions will not operate to prevent any stockholder from disposing of shares and are subject to certain other exceptions relating to shares of Common Stock issued or issuable under the Plan. The board of director’s ability to impose these restrictions will terminate on November 30, 2014.

In addition, the amended and restated certificate of incorporation, in addition to any affirmative vote required by law or Charter’s amended and restated bylaws, a “business combination” (as defined in Charter’s amended and restated certificate of incorporation) involving as a party, or proposed by or on behalf of, an “interested stockholder,” an “affiliate,” or an “associate” of the “interested stockholder” (each as defined in Charter’s amended and restated certificate of incorporation) or a person who upon consummation of the “business combination” would become an “affiliate” or “associate” of an “interested stockholder” requires, unless prohibited by law, that (i) a majority of the members of the board of directors who are not an “affiliate” or “associate” or representative of an “interested stockholder” must determine that the “business combination,” including the consideration, is fair to the Company and its stockholders (other than any “interested stockholder” or its “affiliates and associates); and (ii) holders of a majority of the votes entitled to be cast by holders of all of the then outstanding shares of “voting stock” (as defined in Charter’s amended and restated certificate of incorporation), voting together as a single class (excluding voting stock beneficially owned by any “interested stockholder” or its “affiliate” or “associate”) must approve the transaction.

Section 203 of the DGCL provides that if a person acquires 15% or more of the voting stock of a Delaware corporation, such person becomes an “interested stockholder” and may not engage in certain “business combinations” with the corporation for a period of three years from the time such person acquired 15% or more of the corporation’s voting stock, unless: (1) the board of directors approves the acquisition of stock or the merger transaction before the time that the person becomes an interested stockholder, (2) the interested stockholder owns at least 85% of the outstanding voting stock of the corporation at the time the merger transaction commences (excluding voting stock owned by directors who are also officers and certain employee stock plans), or (3) the merger transaction is approved by the board of directors and by the affirmative vote at a meeting, not by written consent, of stockholders of 2/3 of the holders of the outstanding voting stock which is not owned by the interested stockholder. A Delaware corporation may elect in its certificate of incorporation or bylaws not to be governed by this particular Delaware law, or “opt-out.” We have not elected to “opt-out.”

Preferred Stock

Under the terms of Charter’s amended and restated certificate of incorporation, the board of directors is authorized to issue from time to time up to an aggregate of 250 million shares of series of preferred stock and to fix or alter the designations, preferences, rights and any qualifications, limitations or restrictions of the shares of each series, including the dividend rights, dividend rates, conversion rights, voting rights, rights and terms of redemption (including sinking fund provisions), redemption price or prices, liquidation preferences and the number of shares constituting any series. These additional shares may be used for a variety of corporate purposes, including future public offerings, to raise additional capital or to facilitate acquisitions. If the board of directors decides to issue shares of preferred stock to persons supportive of current management, this could render more difficult or discourage an attempt to obtain control of the company by means of a merger, tender offer, proxy contest or otherwise. Authorized but unissued shares of preferred stock also could be used to dilute the stock ownership of persons seeking to obtain control of Charter.

Shares of Common Stock are not subject to calls or assessments.

The foregoing description of the Class A Common Stock is qualified in its entirety by the full terms of the Class A Common Stock, as set forth in the exhibits to this registration statement which are incorporated by reference in this Item 1.

Item 2. Exhibits

|

Exhibit No.

|

Description

|

|

3.1

|

Amended and Restated Certificate of Incorporation of Charter Communications, Inc.(incorporated by reference to Exhibit 3.1 of the Registrant’s Current Report Form 8-K filed on August 20, 2010).

|

|

3.2

|

Amended and Restated Bylaws of Charter Communications, Inc. (incorporated by reference to Exhibit 3.2 of the Registrant’s Current Report Form 8-K filed on December 4, 2009).

|

SIGNATURE

Pursuant to the requirements of Section 12 of the Securities Exchange Act of 1934, the Registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereto duly authorized.

|

Date: September 14, 2010

|

CHARTER COMMUNICATIONS, INC.

By:

/s/ Kevin D. Howard

Kevin D. Howard, Senior Vice President -

Finance, Interim Chief Financial Officer,

Controller and Chief Accounting Officer

|

Exhibit Table

|

Exhibit No.

|

Description

|

|

3.1

|

Amended and Restated Certificate of Incorporation of Charter Communications, Inc.(incorporated by reference to Exhibit 3.1 of the Registrant’s Current Report Form 8-K filed on August 20, 2010).

|

|

3.2

|

Amended and Restated Bylaws of Charter Communications, Inc. (incorporated by reference to Exhibit 3.2 of the Registrant’s Current Report Form 8-K filed on December 4, 2009).

|

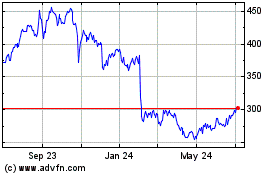

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From May 2024 to Jun 2024

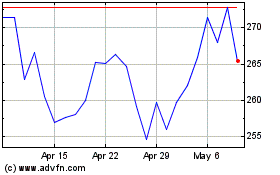

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jun 2023 to Jun 2024