UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

____________________________

SCHEDULE

13D

U

nder the

Securities Exchange Act of 1934

(Amendment

No. 13)*

|

Charter

Communications, Inc.

|

|

(Name

of Issuer)

|

|

Class

A Common Stock

|

|

(Title

of Class of Securities)

|

|

16117M107

|

|

(CUSIP

Number)

|

|

W.

Lance Conn

Charter

Investment, Inc.

505

Fifth Avenue South, Suite 900

Seattle,

Washington 98104

(206)

342-2000

|

|

(Name,

Address and Telephone Number of Person Authorized to

Receive

Notices and Communications)

|

|

March

30, 2009

|

|

(Date

of Event Which Requires Filing of This Statement)

|

If

the filing person has previously filed a statement on Schedule 13G to report the

acquisition that is the subject of this Schedule 13D, and is filing this

schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box

[ ].

Note

: Schedules

filed in paper format shall include a signed original and five copies of the

schedule, including all exhibits. See §240.13d-7 for other parties to

whom copies are to be sent.

*The

remainder of this cover page shall be filled out for a reporting person’s

initial filing on this form with respect to the subject class of securities, and

for any subsequent amendment containing information which would alter

disclosures provided in a prior cover page.

The

information required on the remainder of this cover page shall not be deemed to

be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934

(“Act”) or otherwise subject to the liabilities of that section of the Act but

shall be subject to all other provisions of the Act (however,

see

the

Notes

).

CUSIP

NO. 16117M107

|

1.

|

Names

of Reporting Persons. Paul G. Allen

|

|

2.

|

Check

the Appropriate Box if a Member of a Group (see

Instructions)

|

|

(A)

|

[X]

|

|

|

(B)

|

[

]

|

|

3.

|

SEC

Use Only

|

|

4.

|

Source

of Funds (see Instructions)

PF

|

|

5.

|

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or

2(e) [__]

|

|

6.

|

Citizenship

or Place of Organization

United

States of America

|

|

Number

of Shares Beneficially Owned by Each Reporting Person

With

|

7.

|

Sole

Voting Power

406,236,644

Shares (1)

|

|

8.

|

Shared

Voting Power

-0-

Shares

|

|

9.

|

Sole

Dispositive Power

406,236,644

Shares (1)

|

|

10.

|

Shared

Dispositive Power

-0-

Shares

|

|

11.

|

Aggregate

Amount Beneficially Owned by Each Reporting Person

406,236,644

Shares (1)

|

|

12.

|

Check

if the Aggregate Amount In Row (11) Excludes Certain Shares (See

Instructions)[__]

|

|

13.

|

Percent

of Class Represented by Amount in Row 11

52.18%

beneficial ownership of Class A Common Stock (2) / 91.09% voting power

(3)

|

|

14.

|

Type

Of Reporting Person (See Instructions)

IN

|

(1)

Represents (A) 28,467,421 shares of Class A Common Stock of the Issuer held

directly by Mr. Allen, (B) 10,000 vested options to acquire shares of Class A

Common Stock of the Issuer, (C) 64,356 shares of unvested restricted stock, and

(D) shares of Class A Common Stock of the Issuer into which the following

interests may be converted: (a) 50,000 shares of Class B Common Stock of the

Issuer held directly by Paul G. Allen, (b) 362,813,315 Class A Common Membership

Units (“Class A Units”) of Charter Communications Holding Company, LLC (“Charter

Holdco”) held by Charter Investment, Inc. (“CII”) including the exchange of the

CCHC Note into 38,512,836 Class A Units, and (c) 14,831,552 Class C

Common Membership Units (“Class C Units”) of Charter Holdco held by

CII. CII has an exchange option with the Issuer giving it the right

to exchange both its Class A Units and Class C Units (Class A Units and Class C

Units collectively, the “Class B Common Stock

Equivalents”)

for shares of Class B Common Stock of the Issuer on a one-for-one

basis. Class B Common Stock of the Issuer is convertible at any time

into Class A Common Stock of the Issuer on a one-for-one basis. Mr.

Allen is the sole stockholder of CII. Mr. Allen is therefore deemed

to have beneficial ownership of all of the Class B Common Stock Equivalents held

by CII. Because Mr. Allen is the ultimate controlling person of CII,

he is a beneficial owner who effectively has sole voting power with respect to

the Class B Common Stock Equivalents held by CII; however, because CII is the

record holder of such Class B Common Stock Equivalents, CII may be deemed to

share voting power with Mr. Allen over such Class B Common Stock

Equivalents.

(2)

The calculation of the percentage assumes that: (i) the 50,000 shares of Class B

Common Stock held by Mr. Allen have been converted into shares of Class A Common

Stock and (ii) all Class B Common Stock Equivalents held by CII or that CII has

the right to acquire have been exchanged for shares of Class A Common

Stock.

(3)

Each share of Class B Common Stock of the Issuer has the right to a number of

votes determined by multiplying (i) ten, and (ii) the sum of (1) the total

number of shares of Class B Common Stock outstanding, and (2) the aggregate

number of Class B Common Stock Equivalents, and dividing the product by the

total number of shares of Class B Common Stock outstanding. The

calculation of this percentage assumes that Mr. Allen’s equity interests are

retained in the form that maximizes voting power (i.e., the 50,000 shares of

Class B Common Stock held by Mr. Allen have not been converted into shares of

Class A Common Stock and that the Class B Common Stock Equivalents beneficially

owned by Mr. Allen through CII have not been exchanged for shares of Class B

Common Stock or Class A Common Stock).

CUSIP

NO. 16117M107

|

1.

|

Names

of Reporting Persons. Charter Investment,

Inc.

|

|

2.

|

Check

the Appropriate Box if a Member of a Group (see

Instructions)

|

|

(A)

|

[X]

|

|

|

(B)

|

[

]

|

|

3.

|

SEC

Use Only

|

|

4.

|

Source

of Funds (see Instructions)

AF

|

|

5.

|

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or

2(e) [__]

|

|

6.

|

Citizenship

or Place of Organization

State

of Delaware

|

|

Number

of Shares Beneficially Owned by Each Reporting Person

With

|

7.

|

Sole

Voting Power

-0-

Shares

|

|

8.

|

Shared

Voting Power

377,644,867

Shares

(1)

|

|

9.

|

Sole

Dispositive Power

-0-

Shares

|

|

10.

|

Shared

Dispositive Power

377,644,867

Shares

(1)

|

|

11.

|

Aggregate

Amount Beneficially Owned by Each Reporting Person

377,644,867

Shares

(1)

|

|

12.

|

Check

if the Aggregate Amount In Row (11) Excludes Certain Shares (See

Instructions) [__]

|

|

13.

|

Percent

of Class Represented by Amount in Row 11

48.51%

beneficial ownership of Class A Common Stock (2) / 0.0% voting power

(3)

|

|

14.

|

Type

Of Reporting Person (See Instructions)

CO

|

(1)

Represents Class A Common Membership Units (“Class A Units”) and Class C Common

Membership Units (“Class C Units” and together with Class A Units, the “Class B

Stock Common Equivalents”) of Charter Communications Holding Company, LLC

(“Charter Holdco”) directly held by Charter Investment, Inc. (“CII”). Assumes

the exchange of the CCHC Note into 38,512,836 Class A Units. CII has

an exchange option with the Issuer giving it the right to exchange its Class B

Stock Common Equivalents for shares of Class B Common Stock of the Issuer on a

one-for-one basis. Class B Common Stock of the Issuer is convertible

at any time into Class A Common Stock of the Issuer on a one-for-one

basis. Paul G. Allen is the sole stockholder of CII and is therefore

deemed to have beneficial ownership of all of the Class B Common Equivalents

that CII owns. Because Mr. Allen is the ultimate controlling person

of CII, he is a beneficial owner who effectively has sole voting

power

with respect to the Class B Common Stock Equivalents held by CII; however,

because CII is the record holder of such Class B Common Stock Equivalents, CII

may be deemed to share voting power with Mr. Allen over such Class B Common

Stock Equivalents.

(2)

The calculation of this percentage assumes that all Class B Common Stock

Equivalents held by CII or that CII has the right to acquire have been exchanged

for shares of Class A Common Stock.

(3)

Each share of Class B Common Stock of the Issuer has the right to a number of

votes determined by multiplying (i) ten, and (ii) the sum of (1) the total

number of shares of Class B Common Stock outstanding, and (2) the aggregate

number of Class B Common Stock Equivalents, and dividing the product by the

total number of shares of Class B Common Stock outstanding. The

calculation of this percentage assumes that Mr. Allen’s equity interests are

retained in the form that maximizes voting power (i.e., the 50,000 shares of

Class B Common Stock held by Mr. Allen have not been converted into shares of

Class A Common Stock and that the Class B Common Stock Equivalents owned by CII

have not been exchanged for shares of Class B Common Stock or Class A Common

Stock).

This

Amendment No. 13 to Schedule 13D amends the Schedule 13D originally filed with

the Securities and Exchange Commission (the “SEC”) on November 22, 1999, as

amended by the first amendment, as filed with the SEC on December 20, 1999, the

second amendment, as filed with the SEC on September 13, 2000, the third

amendment, as filed with the SEC on March 11, 2002, the fourth amendment, as

filed with the SEC on May 17, 2002, the fifth amendment, as filed with the SEC

on July 3, 2002, the sixth amendment, as filed with the SEC on August 8, 2002,

the seventh amendment, as filed with the SEC on December 15, 2003, the

eighth amendment, as filed with the SEC on November 9, 2005, the ninth

amendment, as filed with the SEC on August 15, 2007, the tenth amendment, as

filed with the SEC on December 24, 2008, the eleventh amendment, as filed with

the SEC on January 6, 2009, and the twelfth amendment, as filed with the SEC on

February 13, 2009 (as amended, the “Schedule 13D”). Capitalized terms

not otherwise defined herein shall have the meaning ascribed thereto in the

Schedule 13D.

|

Item

4.

|

Purpose

of Transaction.

|

Item

4 is supplemented as follows:

On

March 27, 2009, the Issuer, Charter Investment, Inc. (

“

CII

”

) and certain

direct and indirect subsidiaries of the Issuer (collectively, the “Debtors”)

filed petitions for relief under chapter 11 of title 11 of the United States

Code in the United States Bankruptcy Court for the Southern District of New York

(the “Bankruptcy Court”) and, on the same day, filed a proposed joint plan of

reorganization (the “Joint Plan”), pursuant to which the Debtors expect to

implement a financial restructuring. The Joint Plan, a copy of which

is available at www.kccllc.net/charter, is substantially consistent with the

terms described in Amendment No. 12 to Schedule 13D filed by the Reporting

Persons on February 13, 2009, including the Restructuring Agreement and Term

Sheet attached thereto as Exhibit 10.26.

On

March 30, 2009, in ruling on a motion filed by the Issuer to protect its net

operating losses and other tax attributes, the Bankruptcy Court entered an

interim order requiring all substantial shareholders, including Mr. Allen, to

follow certain procedures before effectuating any transfer of securities of the

Issuer that would result in a decrease in the amount of Class A Common Stock of

the Issuer or securities convertible or exchangeable into Class A Common Stock

of the Issuer that such shareholders beneficially own. In accordance

with such procedures, on March 30, 2009, Mr. Allen filed a declaration of his

intent to transfer shares of Class A Common Stock of the Issuer (the

“Declaration of Intent to Sell, Trade or Otherwise Transfer Common Stock”) with

the Bankruptcy Court. Pursuant to the Declaration of Intent to Sell,

Trade or Otherwise Transfer Common Stock, Mr. Allen proposes to sell, trade or

otherwise transfer 28,467,421 shares of Class A Common Stock of the

Issuer (the “Proposed Sale of Class A Common Stock”). A

copy of the Declaration of Intent to Sell, Trade or Otherwise Transfer Common

Stock is filed as Exhibit 10.27 to this Amendment and incorporated herein by

reference in its entirety.

The

Issuer has 15 calendar days from receipt of the Declaration of Intent to Sell,

Trade or Otherwise Transfer Common Stock to file an objection, if

any, to the Proposed Sale of Class A Common Stock with the Bankruptcy

Court. If the Issuer does not file such an objection within such

15-day period or the Issuer waives the restrictions and procedures relating to

the Proposed Sale of Class A Common Stock, Mr. Allen may proceed with the

Proposed Sale of Class A Common Stock. If, on the other hand, the

Issuer files such an objection within such 15-day period, Mr. Allen may not

proceed with the Proposed Sale of Class A Common Stock unless and until any such

objection by the Issuer is withdrawn or until the end of the tenth calendar day

after the Bankruptcy Court enters an order overruling such

objection.

If

Mr. Allen is permitted to proceed with the Proposed Sale of Class A Common

Stock, Mr. Allen intends to dispose of the shares in one or

more private transactions or pursuant to Rule 144 under the Securities Act

of 1933, as amended.

|

Item

5.

|

Interest

in Securities of the Issuer.

|

Item

5 is amended as follows:

(a)

As of March 30, 2009 (the “Reporting Date”), Mr. Allen beneficially owns

406,236,644 shares of Class A Common Stock of the Issuer, which consists of (i)

28,467,421 shares of Class A Common Stock of the Issuer held directly by Mr.

Allen, (ii) 10,000 vested options on shares of Class A Common Stock of the

Issuer, (iii) 64,356 shares of unvested restricted stock, and (iv) shares of

Class A Common Stock of the Issuer into which the following interests may be

converted: (a) 50,000 shares of Class B Common Stock of the Issuer held directly

by Mr. Allen, (b) 362,813,315 Class A Common Membership Units (“Class A Units”)

of Charter Communications Holding Company, LLC (“Charter Holdco”) held by CII,

including as successor by merger to Vulcan Cable III Inc. (“Vulcan Cable”) and

including the exchange of the CCHC Note into 38,512,836 Class A Units, and (c)

14,831,552 Class C Common Membership Units (“Class C Units”) of Charter Holdco

held by CII, including as successor by merger to Vulcan Cable. CII

has an exchange option with the Issuer giving it the right to exchange its Class

A Units and Class C Units (collectively, the “Class B Common Stock Equivalents”)

for shares of Class B Common Stock of the Issuer on a one-for-one

basis. Class B Common Stock of the Issuer is convertible at any time

into Class A Common Stock of the Issuer on a one-for-one basis.

As

of the Reporting Date, Mr. Allen’s beneficial ownership represents approximately

52.18% of the shares of the Issuer’s outstanding Class A Common Stock, assuming

conversion of all Class B Common Stock and Class B Common Stock Equivalents, and

approximately 91.09% of the voting power of the Issuer’s outstanding Class A

Common Stock assuming no conversion of Class B Common Stock and the Class B

Common Stock Equivalents. The calculation of these percentages

assumes that 400,801,768 shares of Class A Common Stock of the Issuer are issued

and outstanding, as reported in the most recent Form 10-K of the

Issuer.

(b)

Mr. Allen is deemed to have sole voting and dispositive power with respect to

the 406,236,644 shares of Class A Common Stock that he beneficially owns

directly and indirectly through CII (which he controls). Because Mr. Allen is

the ultimate controlling person of CII, CII is deemed to have shared voting and

dispositive power with Mr. Allen over the 377,644,867 shares of Class A Common

Stock beneficially owned by CII through its ownership of 362,813,315 Class A

Units (including the exchange of the CCHC Note into 38,512,836 Class A Units)

and 14,831,552 Class C Units of Charter Holdco.

|

Item

7.

|

Material

to be Filed as Exhibits.

|

|

10.27

|

Declaration

of Intent to Sell, Trade or Otherwise Transfer Common Stock by Paul G.

Allen, dated March 30, 2009.

|

SIGNATURES

After

reasonable inquiry and to the best of my knowledge and belief, I certify that

the information set forth in this statement is true, complete and

correct.

|

Dated: March

31, 2009

|

PAUL

G. ALLEN

|

|

|

|

|

|

|

By:

|

/s/

W. Lance Conn, by Power of Attorney

|

|

|

|

|

|

|

|

|

|

Dated: March

31, 2009

|

CHARTER

INVESTMENT, INC.

|

|

|

|

|

|

|

By:

|

/s/

W. Lance Conn

|

|

|

|

|

|

|

Name:

W. Lance Conn

Title: Vice

President

|

EXHIBIT

INDEX

|

10.27

|

Declaration

of Intent to Sell, Trade or Otherwise Transfer Common Stock by Paul G.

Allen, dated March 30, 2009.

|

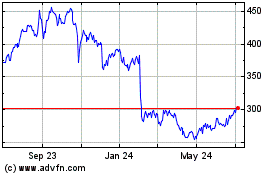

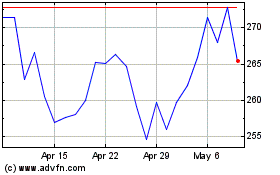

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From May 2024 to Jun 2024

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jun 2023 to Jun 2024