Charter Communications Announces NASDAQ Delisting Notification

March 30 2009 - 6:40PM

PR Newswire (US)

ST. LOUIS, March 30 /PRNewswire-FirstCall/ -- Charter

Communications, Inc. (NASDAQ:CHTR) ("Charter," the "Company")

announced that the NASDAQ Stock Market ("NASDAQ") on March 27

notified the Company that NASDAQ will suspend and delist trading of

the Company's common stock on the NASDAQ Stock Market, effective

with the open of business on April 7, 2009. The notice follows the

Company's announcement that it has commenced the next phase of its

previously announced financial restructuring by filing its

pre-arranged plan of reorganization and Chapter 11 petitions in the

United States Bankruptcy Court for the Southern District of New

York. The Company does not intend to appeal NASDAQ's delisting

decision and expects that its common stock will be quoted on the

OTC Bulletin Board or in the "Pink Sheets" effective April 7, 2009,

but there is no assurance as quotes on the "Pink Sheets" are

dependent upon the actions of third parties. About Charter

Communications Charter Communications, Inc. is a leading broadband

communications company and the fourth-largest cable operator in the

United States. Charter provides a full range of advanced broadband

services, including advanced Charter Digital Cable(R) video

entertainment programming, Charter High-Speed(R) Internet access,

and Charter Telephone(R). Charter Business(TM) similarly provides

scalable, tailored, and cost-effective broadband communications

solutions to business organizations, such as business-to-business

Internet access, data networking, video and music entertainment

services, and business telephone. Charter's advertising sales and

production services are sold under the Charter Media(R) brand. More

information about Charter can be found at http://www.charter.com/.

Cautionary Statement Regarding Forward-Looking Statements: This

release includes forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended, regarding,

among other things, our plans, strategies and prospects, both

business and financial. Although we believe that our plans,

intentions and expectations reflected in or suggested by these

forward-looking statements are reasonable, we cannot assure you

that we will achieve or realize these plans, intentions or

expectations. Forward-looking statements are inherently subject to

risks, uncertainties and assumptions including, without limitation,

the factors described under "Risk Factors" from time to time in our

filings with the Securities and Exchange Commission ("SEC"). Many

of the forward-looking statements contained in this release may be

identified by the use of forward-looking words such as "believe,"

"expect," "anticipate," "should," "plans," "will," "may," "intend,"

"estimated," "aim," "on track," "target," "opportunity" and

"potential," among others. Important factors that could cause

actual results to differ materially from the forward-looking

statements we make in this release are set forth in other reports

or documents that we file from time to time with the SEC, including

our quarterly reports on Form 10-Q filed in 2008 and our most

recent annual report on Form 10-K, and include, but are not limited

to: -- the completion of the Company's restructuring including the

outcome and impact on our business of the proceedings under Chapter

11 of the Bankruptcy Code; -- the ability of the Company to satisfy

closing conditions under the agreements-in-principle and

Pre-Arranged Plan and related documents and to have the

Pre-Arranged Plan confirmed by the bankruptcy court; -- the

availability of and access to, in general, funds to meet interest

payment obligations under our debt and to fund our operations and

necessary capital expenditures, either through cash on hand, cash

flows from operating activities, further borrowings or other

sources and, in particular, our ability to fund debt obligations

(by dividend, investment or otherwise) to the applicable obligor of

such debt; -- our ability to comply with all covenants in our

indentures and credit facilities, any violation of which, if not

cured in a timely manner, could trigger a default of our other

obligations under cross-default provisions; -- our ability to repay

debt prior to or when it becomes due and/or successfully access the

capital or credit markets to refinance that debt through new

issuances, exchange offers or otherwise, including restructuring

our balance sheet and leverage position, especially given recent

volatility and disruption in the capital and credit markets; -- the

impact of competition from other distributors, including incumbent

telephone companies, direct broadcast satellite operators, wireless

broadband providers, and digital subscriber line ("DSL") providers;

-- difficulties in growing, further introducing, and operating our

telephone services, while adequately meeting customer expectations

for the reliability of voice services; -- our ability to adequately

meet demand for installations and customer service; -- our ability

to sustain and grow revenues and cash flows from operating

activities by offering video, high-speed Internet, telephone and

other services, and to maintain and grow our customer base,

particularly in the face of increasingly aggressive competition; --

our ability to obtain programming at reasonable prices or to

adequately raise prices to offset the effects of higher programming

costs; -- general business conditions, economic uncertainty or

downturn, including the recent volatility and disruption in the

capital and credit markets and the significant downturn in the

housing sector and overall economy; and -- the effects of

governmental regulation on our business. All forward-looking

statements attributable to us or any person acting on our behalf

are expressly qualified in their entirety by this cautionary

statement. We are under no duty or obligation to update any of the

forward-looking statements after the date of this release.

Contacts: Media: Anita Lamont, 314-543-2215 Charter Communications,

Inc. Andy Brimmer / Sharon Stern Joele Frank, Wilkinson Brimmer

Katcher 212-355-4449 or Analysts: Mary Jo Moehle, 314-543-2397

Charter Communications, Inc. DATASOURCE: Charter Communications,

Inc. CONTACT: Media, Anita Lamont, +1-314-543-2215, Charter

Communications, Inc.; or Andy Brimmer or Sharon Stern, Joele Frank,

Wilkinson Brimmer Katcher, +1-212-355-4449; or Analysts, Mary Jo

Moehle, +1-314-543-2397, Charter Communications, Inc. Web Site:

http://www.charter.com/

Copyright

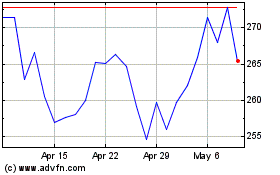

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From May 2024 to Jun 2024

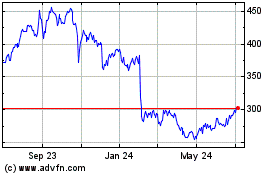

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jun 2023 to Jun 2024