0001277250false00012772502023-08-012023-08-01iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 1, 2023

CHARGE ENTERPRISES, INC. |

(Exact name of registrant as specified in its charter) |

Delaware | | 001-41354 | | 90-0471969 |

(State or other jurisdiction of incorporation) | | (Commission file number) | | (I.R.S. Employer Identification No.) |

125 Park Avenue, 25th Floor New York, NY | | 10017 |

(Address of principal executive offices) | | (Zip Code) |

(212) 921-2100

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common stock, par value $0.0001 | | CRGE | | Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter):

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On August 1, 2023, Charge Enterprises, Inc. (sometimes referred to herein as “we,” “us,” “our”, “Company” or similar terms), through its wholly-owned subsidiary Nextridge, Inc. (“Buyer”), acquired all of the membership interests of Greenspeed Energy Solutions, L.L.C., a Georgia limited liability company (“Greenspeed”), from its sole member, Paul M. Williams (the “Seller”) pursuant to a Unit Purchase Agreement (the “Purchase Agreement”), dated as of August 1, 2023, by and among the Company, Buyer, the Seller and Greenspeed (the “Greenspeed Acquisition”). Greenspeed, founded in 2006 and headquartered in Georgia, has established itself as a leading provider in the sustainable energy space, providing customers across the United States with turnkey solutions for EV charging infrastructure, efficient commercial lighting, solar, and battery storage. Mr. Williams will become an employee of the Company and remain with the business moving forward as President and CEO of Greenspeed.

In connection with the Greenspeed Acquisition, we paid the Seller an aggregate cash amount of $6,000,000 plus 2,085,263 shares of our Common Stock, par value $0.0001 per share, which represents an aggregate value of $2,000,000 based on the 30 day volume weighted average market price ending on the trading day immediately prior to August 1, 2023 (the “Consideration Shares”). The Purchase Agreement also contained a customary working capital adjustment as well as two potential earnout payments to the Seller up to a maximum amount each of $3,500,000 if certain EBITDA performance targets are reached by Greenspeed in the twelve-month periods beginning October 1, 2023 and 2024.

The Consideration Shares were issued in reliance on an exemption from registration under Section 4(a)(2) the Securities Act of 1933, as amended (the “Securities Act”), and Rule 506(b) of Regulation D promulgated thereunder.

As security against possible post-closing indemnification claims, the Seller entered into an Indemnity Holdback Pledge Agreement with Buyer (the “Pledge Agreement”), pursuant to which the Seller pledged 50% of the Consideration Shares to Buyer. The pledge will expire with respect to half of the pledged shares on the 9-month anniversary of the closing and on the 18-month anniversary of the closing for the remaining pledged shares, less any then-disputed amounts on the 18-month anniversary. The Company also entered into a Leak-Out Agreement with the Seller (the “Leak-Out Agreement”), which prohibits any sales of the Consideration Shares for a period of 18-months following the closing and places additional limitations on sales through the end of 2025.

The Purchase Agreement contains customary representations, warranties and covenants, and indemnification provisions between the Company and Buyer, on one hand, and the Seller on the other. The representations survive for 18 months following the closing, except for certain fundamental representations, as described in the Purchase Agreement. The Purchase Agreement contains non-competition, non-solicit restrictions on the Seller for a period of five years as well as a customary non-disparagement provision. For any indemnification claims, the Purchase Agreement contains a deductible of $50,000 and a general cap on indemnity by the Seller of $2,000,000 (except for fundamental representations which have a cap of $6,000,000 plus the value of the Consideration Shares and earn-out funds and for fraud, willful misconduct and related exceptions).

The foregoing descriptions of the Purchase Agreement, Pledge Agreement and Leak-Out Agreement do not purport to be complete and are qualified in their entirety by reference to the Purchase Agreement, Pledge Agreement or Leak-Out Agreement, copies of which are filed as Exhibit 2.1, 10.1 and 10.2 to this Current Report on Form 8-K, respectively. The representations, warranties and covenants contained in the Purchase Agreement were made only for purposes of such agreements and as of specific dates, were solely for the benefit of the parties to the Purchase Agreement, and may be subject to limitations agreed upon by the contracting parties. The representations, warranties and covenants in the Purchase Agreement are also modified in part by the related schedules thereto which are not filed publicly and which may be subject to a contractual standard of materiality different from that generally applicable to stockholders and were used for the purpose of allocating risk among the parties rather than establishing matters as facts. The Company does not believe that these schedules contain information that is material to an investment decision. Investors are not third-party beneficiaries under the Purchase Agreement and should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the parties thereto or any of their respective affiliates.

Item 2.01. Completion of Acquisition of Dispositions of Assets.

The information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference in response to this Item 2.01.

Item 2.02. Results of Operations and Financial Conditions.

On August 1, 2023, the Company also announced that, as a result of the Greenspeed Acquisition, it had acquired approximately $12 million in additional infrastructure backlog as of June 30, 2023.

Item 3.02. Unregistered Sales of Equity Securities.

The information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference in response to this Item 3.02.

Item 7.01. Regulation FD Disclosure

On August 1, 2023, we issued a press release regarding the Greenspeed Acquisition described above under Item 1.01 of this Current Report on Form 8-K. A copy of this press release is furnished as an Exhibit to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

Exhibit Number | | Description |

2.1*+ | | Unit Purchase Agreement, by and among Charge Enterprises, Inc., Nextridge, Inc., Greenspeed Energy Solutions, L.L.C. and Paul Williams dated August 1, 2023. |

10.1+ | | Indemnity Holdback Agreement, by and among Nextridge, Inc. and Paul Williams, dated August 1, 2023. |

10.2+ | | Leak-Out Agreement, by and between Charge Enterprises, Inc. and Paul Williams, dated August 1, 2023. |

99.1 | | Press Release dated August 1, 2023 (furnished herewith). |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

* Certain schedules and exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company agrees to furnish supplementally a copy of any omitted schedule or exhibit to the SEC upon its request.

+ Certain personal identifiable information has been omitted pursuant to Item 601(a)(6) of Regulation S-K. The Company hereby agrees to furnish the omitted information to the SEC upon request.

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this Form 8-K to be signed on its behalf by the undersigned duly authorized.

Dated: August 1, 2023

| | CHARGE ENTERPRISES, INC. | |

| | | | |

| By: | /s/ Leah Schweller | |

| | Leah Schweller | |

| | | Chief Financial Officer | |

nullnullnullnull

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

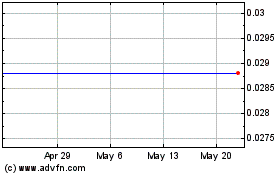

Charge Enterprises (NASDAQ:CRGE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Charge Enterprises (NASDAQ:CRGE)

Historical Stock Chart

From Jul 2023 to Jul 2024