Century Aluminum Company (NASDAQ: CENX) reported a net loss of

$31.1 million ($0.35 per basic and diluted common share) for the

fourth quarter of 2011. Financial results were positively impacted

by an unrealized gain on forward contracts of $2.4 million

primarily related to the mark to market of aluminum price

protection options. Cost of sales for the quarter included a $6.3

million charge for lower of cost or market inventory adjustments.

For the fourth quarter of 2010, the company reported net income

of $65.3 million ($0.65 per basic and $0.64 per diluted common

share). Financial results were negatively impacted by an unrealized

loss on forward contracts of $5.6 million primarily related to the

mark to market of aluminum price protection options and by a

contractual termination pension benefit charge of $4.6 million due

to the continued curtailment of the Ravenswood facility. Changes to

the Century of West Virginia retiree medical benefits program

increased quarterly results by $56.7 million with an associated

discrete tax benefit of $2.0 million. Cost of sales for the quarter

included a $15.9 million net after-tax charge for the portion of

power costs at Hawesville paid by the previous power supplier per

the terms of the power agreements.

For 2011, the company reported net income of $11.3 million

($0.11 per basic and diluted common share). Financial results were

negatively impacted by a $7.7 million charge in the second quarter

related to the contractual impact of changes in the company's Board

of Directors and the executive management team, a charge of $2.9

million related to an insurance receivable, and a charge of $0.8

million related to the early retirement of debt. Changes to the

Century of West Virginia retiree medical benefits program increased

results by $18.3 million with an associated discrete tax benefit of

$4.2 million. An unrealized gain on forward contracts, primarily

related to the mark to market of aluminum price protection options,

positively impacted results by $0.8 million. Cost of sales included

an $8.6 million charge related to the restart of a curtailed

potline at the Hawesville, KY smelter, and a $19.8 million charge

for lower of cost or market inventory adjustments.

For 2010, the company reported net income of $60.0 million

($0.59 per basic and diluted common share). Financial results were

negatively impacted by an unrealized loss on forward contracts of

$10.0 million primarily related to the mark to market of aluminum

price protection options and by a contractual termination pension

benefit charge of $4.6 million due to the continued curtailment of

the Ravenswood facility. Changes to the Century of West Virginia

retiree medical benefits program increased results by $56.7 million

with an associated discrete tax benefit of $2.0 million. Tax

benefits related to the release of tax reserves no longer required

positively impacted results by $2.1 million. Cost of sales included

a $63.2 million net after-tax charge for the portion of power costs

at Hawesville paid by the previous power supplier per the terms of

the power agreements.

Sales for the fourth quarter of 2011 were $318.2 million

compared with $316.9 million for the fourth quarter of 2010.

Shipments of primary aluminum for the 2011 fourth quarter were

155,649 tonnes compared with 148,923 tonnes shipped in the year-ago

quarter. Sales for 2011 were $1,356 million compared with $1,169

million for 2010, and total 2011 primary aluminum shipments of

602,142 tonnes compared with 585,395 tonnes shipped in 2010.

"We continue to see generally favorable conditions in our

markets," commented Michael Bless, President and Chief Executive

Officer. "Trends in end customer demand remain good across a range

of key segments. In the U.S., physical premiums remain supportive

and interest in higher margin specialty products continues to be

strong. The increase in large-user power costs, pervasive across

developed economies, is a serious ongoing challenge which is

threatening the long-term competitiveness of what would otherwise

be very good businesses. We are spending considerable effort to

address this challenge to our U.S. smelters. Broader market

conditions remain volatile, and will continue to be sensitive to,

amongst other developments, the environment in the Eurozone and in

the Chinese economy. With this background, we plan to invest in

2012 in growing and improving our businesses, while continuing to

prepare for reasonable contingencies.

"We are pleased with the Company's recent performance,"

continued Bless. "Though we always expect continuing improvement,

safety trends have been gratifying these last few months; the Board

and I would like to acknowledge the efforts of all employees toward

this, our first priority. As forecast, Hawesville returned to near

full production by year-end. Key performance indicators have

continued to improve, conversion costs have fallen, metal quality

has improved and fourth quarter production was up 12 percent versus

the third quarter. Across our businesses, we have begun to see some

abatement in the recent significant increases in raw material

costs. In Iceland, Grundartangi had an excellent quarter, and has

fully recovered from the temporary instability caused by the power

interruption in early January. In late December, we received the

ruling related to the arbitration with one of the power suppliers

for the new plant at Helguvik. The ruling was generally favorable

to Nordural and we are now in discussions with both power suppliers

aimed at reaching, over the next several months, final agreements

which will allow us to recommence major project activity."

Century Aluminum Company owns primary aluminum capacity in the

United States and Iceland. Century's corporate offices are located

in Monterey, Calif. More information can be found at

www.centuryaluminum.com.

Century Aluminum's quarterly conference call is scheduled for

5:00 p.m. Eastern time today. To listen to the conference call and

to view related presentation materials, go to

www.centuryaluminum.com and click on the conference call link on

the homepage.

Certified Advisors for the First North market of the OMX Nordic

Exchange Iceland hf. for Global Depositary Receipts in Iceland:

Atli B. Gudmundsson, Senior Manager -- Corporate Finance, NBI hf.

Steingrimur Helgason, Director -- Corporate Finance, NBI hf.

Cautionary Statement This press release

and comments made by Century management on the quarterly conference

call contain "forward-looking statements" within the meaning of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements are statements about future, not past, events and

involve certain important risks and uncertainties, any of which

could cause our actual results to differ materially from those

expressed in our forward-looking statements, including, without

limitation, declines in aluminum prices or increases in our

operating costs; deterioration of global or local financial and

economic conditions; additional delays in the completion of our

Helguvik, Iceland smelter, including our ability to secure a

reliable power supply and our ability to successfully manage and/or

improve performance at each of our operating smelters.

Forward-looking statements in this press release include, without

limitation, statements regarding future market and economic

conditions, including the continuance of demand, pricing and cost

trends in the aluminum market; our plans to invest in and grow our

business in 2012; and our ability reach final agreements with the

power suppliers to our Helguvik, Iceland smelter and recommence

major project activity. More information about these risks,

uncertainties and assumptions can be found in the risk factors and

forward-looking statements cautionary language contained in our

Annual Report on Form 10-K and in other filings made with the

Securities and Exchange Commission. We do not undertake, and

specifically disclaim, any obligation to revise any forward-looking

statements to reflect the occurrence of future events or

circumstances.

Century Aluminum Company

Consolidated Statements of Operations

(in Thousands, Except Per Share Amounts)

(Unaudited)

Three months ended Year ended

December 31, December 31,

---------------------- ----------------------

2011 2010 2011 2010

---------- ---------- ---------- ----------

NET SALES:

Third-party customers $ 193,992 $ 205,547 $ 791,993 $ 755,863

Related parties 124,172 111,304 564,431 413,408

---------- ---------- ---------- ----------

318,164 316,851 1,356,424 1,169,271

COST OF GOODS SOLD 331,796 275,716 1,266,902 1,056,875

---------- ---------- ---------- ----------

GROSS PROFIT (LOSS) (13,632) 41,135 89,522 112,396

OTHER OPERATING EXPENSES

(INCOME) - NET 4,624 (49,591) (3,806) (37,386)

SELLING, GENERAL AND

ADMINISTRATIVE EXPENSES 8,916 11,101 46,032 46,802

---------- ---------- ---------- ----------

OPERATING INCOME (LOSS) (27,172) 79,625 47,296 102,980

INTEREST EXPENSE - THIRD

PARTY - NET (5,934) (6,171) (24,791) (25,010)

INTEREST INCOME - RELATED

PARTY 61 115 303 448

NET GAIN (LOSS) ON FORWARD

CONTRACTS 3,067 (5,681) 804 (10,495)

OTHER INCOME (EXPENSE) - NET 225 (598) (1,373) (377)

---------- ---------- ---------- ----------

INCOME (LOSS) BEFORE INCOME

TAXES AND EQUITY

IN EARNINGS OF JOINT

VENTURES (29,753) 67,290 22,239 67,546

INCOME TAX EXPENSE (2,213) (2,803) (14,359) (11,133)

---------- ---------- ---------- ----------

INCOME (LOSS) BEFORE EQUITY

IN EARNINGS OF JOINT

VENTURES (31,966) 64,487 7,880 56,413

EQUITY IN EARNINGS OF JOINT

VENTURES 859 793 3,445 3,558

---------- ---------- ---------- ----------

NET INCOME (LOSS) $ (31,107) $ 65,280 $ 11,325 $ 59,971

========== ========== ========== ==========

Net Income (Loss) Allocated

to Common Shareholders $ (31,107) $ 59,939 $ 10,404 $ 55,046

EARNINGS (LOSS) PER COMMON

SHARE

Basic $ (0.35) $ 0.65 $ 0.11 $ 0.59

Diluted $ (0.35) $ 0.64 $ 0.11 $ 0.59

WEIGHTED AVERAGE COMMON

SHARES OUTSTANDING

Basic 89,352 92,742 91,854 92,676

Diluted 89,352 93,414 92,257 92,302

Century Aluminum Company

Consolidated Balance Sheets

(Dollars in Thousands)

(Unaudited)

December 31, December 31,

ASSETS 2011 2010

------------ ------------

Current Assets:

Cash and cash equivalents $ 183,401 $ 304,296

Restricted cash - 3,673

Accounts receivable - net 47,647 43,903

Due from affiliates 44,665 51,006

Inventories 171,961 155,908

Prepaid and other current assets 40,646 18,292

------------ ------------

Total current assets 488,320 577,078

Property, plant and equipment - net 1,218,225 1,256,970

Due from affiliates - less current portion - 6,054

Other assets 104,549 82,954

------------ ------------

Total $ 1,811,094 $ 1,923,056

============ ============

LIABILITIES AND SHAREHOLDERS' EQUITY

Current Liabilities:

Accounts payable, trade $ 86,172 $ 88,004

Due to affiliates 41,904 45,381

Accrued and other current liabilities 40,776 41,495

Accrued employee benefits costs - current

portion 16,698 26,682

Convertible senior notes - 45,483

Industrial revenue bonds 7,815 7,815

------------ ------------

Total current liabilities 193,365 254,860

------------ ------------

Senior notes payable 249,512 248,530

Accrued pension benefits costs - less current

portion 70,899 37,795

Accrued postretirement benefits costs - less

current portion 128,078 103,744

Other liabilities 40,005 37,612

Deferred taxes 90,958 85,999

------------ ------------

Total noncurrent liabilities 579,452 513,680

------------ ------------

Shareholders' Equity:

Series A preferred stock (one cent par value,

5,000,000 shares authorized; 80,718 and

82,515 shares issued and outstanding at

December 31, 2011 and December 31, 2010,

respectively) 1 1

Common stock (one cent par value, 195,000,000

shares authorized; 93,230,848 issued and

88,844,327 outstanding as of December 31,

2011; 92,771,864 shares issued and

outstanding as of December 31, 2010) 932 928

Additional paid-in capital 2,506,842 2,503,907

Treasury stock, at cost (45,891) -

Accumulated other comprehensive loss (134,588) (49,976)

Accumulated deficit (1,289,019) (1,300,344)

------------ ------------

Total shareholders' equity 1,038,277 1,154,516

------------ ------------

Total $ 1,811,094 $ 1,923,056

============ ============

Century Aluminum Company

Consolidated Statements of Cash Flows

(Dollars in Thousands)

(Unaudited)

Year ended

December 31,

--------------------------

2011 2010

------------ ------------

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income $ 11,325 $ 59,971

Adjustments to reconcile net income to net

cash provided by (used in) operating

activities:

Unrealized net (gain) loss on forward

contracts (750) 10,030

Realized benefit of contractual receivable - 55,703

Accrued and other plant curtailment costs -

net (13,928) (56,010)

Lower of cost or market inventory

adjustment 19,766 (426)

Depreciation and amortization 62,194 63,550

Debt discount amortization 1,857 3,150

Deferred income taxes 2,494 15,552

Pension and other postretirement benefits (28,757) 14,578

Stock-based compensation 2,856 1,905

Non-cash loss on early extinguishment of

debt 763 -

Non-cash contingent obligation - 13,091

Undistributed earnings of joint ventures (3,445) (3,558)

Change in operating assets and liabilities:

Accounts receivable - net (3,744) (6,197)

Due from affiliates 10,694 (38,191)

Inventories (35,819) (24,009)

Prepaid and other current assets (20,791) 13,412

Accounts payable, trade (904) 11,674

Due to affiliates (3,477) 12,685

Accrued and other current liabilities 425 (1,758)

Other - net (3,695) (13,642)

------------ ------------

Net cash provided by (used in) operating

activities (2,936) 131,510

------------ ------------

CASH FLOWS FROM INVESTING ACTIVITIES:

Purchase of property, plant and equipment (20,100) (12,241)

Nordural expansion (12,882) (19,227)

Investments in and advances to joint ventures (113) (32)

Payment received on advances from joint

ventures 3,056 -

Proceeds from sale of property, plant and

equipment 1,471 823

Restricted and other cash deposits 3,673 5,206

------------ ------------

Net cash used in investing activities (24,895) (25,471)

------------ ------------

CASH FLOWS FROM FINANCING ACTIVITIES:

Repayment of debt (47,067) -

Repayment of contingent obligation (189) -

Borrowing under revolving credit facility 15,900 -

Repayment under revolving credit facility (15,900) -

Repurchase of common stock (45,891) -

Issuance of common stock - net 83 23

------------ ------------

Net cash provided by (used in) financing

activities (93,064) 23

------------ ------------

CHANGE IN CASH AND CASH EQUIVALENTS (120,895) 106,062

CASH AND CASH EQUIVALENTS, BEGINNING OF YEAR 304,296 198,234

------------ ------------

CASH AND CASH EQUIVALENTS, END OF YEAR $ 183,401 $ 304,296

============ ============

Century Aluminum Company

Selected Operating Data

(Unaudited)

SHIPMENTS - PRIMARY ALUMINUM

Direct (1) Toll

----------------------------- -----------------------------

Metric (000) Metric (000) (000)

Tons Pounds $/Pound Tons Pounds Revenue

--------- --------- --------- --------- --------- ---------

2011

4th Quarter 87,665 193,269 $ 1.06 67,984 149,877 $ 112,411

3rd Quarter 82,236 181,299 1.19 68,596 151,229 129,369

2nd Quarter 84,509 186,310 1.26 66,974 147,652 132,113

1st Quarter 80,479 177,426 1.17 63,699 140,432 117,658

--------- --------- --------- --------- --------- ---------

Total 334,889 738,304 $ 1.17 267,253 589,190 $ 491,551

--------- --------- --------- --------- --------- ---------

2010

4th Quarter 83,073 183,145 $ 1.10 65,850 145,172 $ 114,513

3rd Quarter 81,693 180,102 0.99 65,523 144,454 100,231

2nd Quarter 76,521 168,700 1.04 68,058 150,043 112,523

1st Quarter 76,653 168,990 1.04 68,024 149,968 109,659

--------- --------- --------- --------- --------- ---------

Total 317,940 700,937 $ 1.04 267,455 589,637 $ 436,926

--------- --------- --------- --------- --------- ---------

(1) Does not include Toll shipments from Nordural

Grundartangi

Contacts: Lindsey Berryhill (media) 831-642-9364 Shelly

Harrison (investors) 831-642-9357

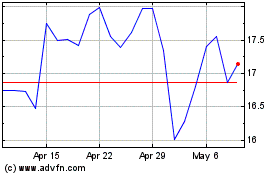

Century Aluminum (NASDAQ:CENX)

Historical Stock Chart

From Apr 2024 to May 2024

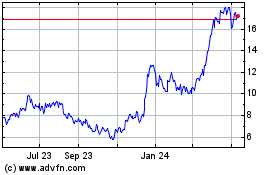

Century Aluminum (NASDAQ:CENX)

Historical Stock Chart

From May 2023 to May 2024