Glencore Fiscal Year Net Income Up 39% As Metal, Mineral Prices Rise

March 03 2011 - 2:56AM

Dow Jones News

Swiss commodities group Glencore International AG reported a 39%

rise in full-year net income before exceptional items due to a

strong performance in both its industrial and marketing divisions

stemming from better commodity prices.

Net income excluding exceptional items was $3.80 billion last

year, compared with $2.72 billion during the same period a year

earlier, Glencore said.

Revenue was up 36.3% to $144.98 billion from $106.36

billion.

Meanwhile earnings before interest and taxes and exceptional

items, or Ebit, rose 60% to $5.29 billion. The contribution from

industrial assets was up 72% to $2.95 billion. The contribution

from marketing activities was up 47% to $2.34 billion.

Privately-owned Glencore said the largest contribution to Ebit

was in the metals and minerals segment, which benefited from

stronger metals prices and improving market sentiment in end-user

industries such as automotives and construction.

Its balance sheet is underpinned by cash and undrawn bank

facilities of about $4.22 billion at year-end. Net debt was $14.8

billion but coverage ratios improved, the company said.

The Baar, Switzerland-based group is considering listing its

shares in London and Hong Kong sometime in the second quarter of

this year. Glencore set in motion the possibility of an initial

public offering when it issued a $2.2 billion convertible bond at

the tail end of the global financial crisis.

-By Alex MacDonald, Dow Jones Newswires; 44 20 7842 9328;

alex.macdonald@dowjones.com

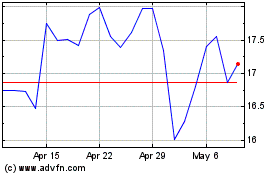

Century Aluminum (NASDAQ:CENX)

Historical Stock Chart

From May 2024 to Jun 2024

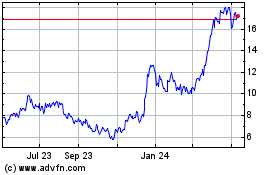

Century Aluminum (NASDAQ:CENX)

Historical Stock Chart

From Jun 2023 to Jun 2024