Aluminum Industry Faces Lofty Expectations in 2011

January 17 2011 - 11:25AM

Marketwired

Aluminum prices have surged close to 40 percent over the last six

months, fuelled by a weak US dollar and a recent declaration by the

Federal Reserve to buy $600 billion of Treasuries. Strong demand

from emerging markets should keep aluminum prices rising for at

least the early part of 2011. While global aluminum demand is

increasing, significant production growth, as well as high aluminum

inventories will likely limit aluminum prices from skyrocketing.

The Bedford Report examines the outlook for companies in the

Aluminum industry and provides research reports on Alcoa, Inc.

(NYSE: AA) and Century Aluminum Co. (NASDAQ: CENX). Access to the

full company reports can be found at:

www.bedfordreport.com/2011-01-AA

www.bedfordreport.com/2011-01-CENX

Emerging markets have been a huge source of revenue as

populations and economies in China, Brazil and Russia have become

richer, leading to higher levels of building. One of the

fundamental reasons for the turnaround in the aluminum industry has

been the continued production discipline demonstrated by China.

From 2002 to 2008, China had been a net exporter of aluminum, but

has since become a net importer.

The Bedford Report releases regular market updates on the

aluminum industry so investors can stay ahead of the crowd and make

the best investment decisions to maximize their returns. Take a few

minutes to register with us free at www.bedfordreport.com and get

exclusive access to our numerous analyst reports and industry

newsletters.

Last week industry giant Alcoa unofficially kicked off earnings

season. The Pittsburgh based company reported a fourth quarter

profit of $258 million or 24 cents a share, compared with a year

earlier loss of $277 million, or 28 cents a share. Revenues grew

around 4 percent to $5.65 billion as a result of higher aluminum

prices.

Alcoa's Chief Executive, Klaus Kleinfeld, raised his projection

of the growth rate for global aluminum demand to 12 percent,

compared to projections of 13% made last year. China's aluminum

demand is expected to grow by approximately 15 percent in 2011

after skyrocketing more than 20 percent last year.

The Bedford Report provides Analyst Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. The Bedford Report has not been compensated by any of the

above- mentioned publicly traded companies. The Bedford Report is

compensated by other third party organizations for advertising

services. We act as an independent research portal and are aware

that all investment entails inherent risks. Please view the full

disclaimer at http://www.bedfordreport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: The Bedford Report Email Contact

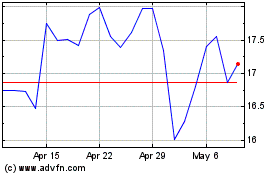

Century Aluminum (NASDAQ:CENX)

Historical Stock Chart

From May 2024 to Jun 2024

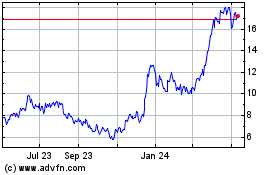

Century Aluminum (NASDAQ:CENX)

Historical Stock Chart

From Jun 2023 to Jun 2024