Loss Widens at Central Garden - Analyst Blog

February 03 2012 - 7:30AM

Zacks

Central Garden & Pet

Company (CENT) recently reported sluggish first-quarter

2012 results, battered by higher input costs, altered product mix

and the seasonal nature of the lawn and garden category.

The company’s quarterly loss of 27

cents a share widened from a loss of 16 cents per share delivered

in the prior-year quarter. The analyst covered by Zacks had

expected the company to deliver a loss of 26 cents per share in the

reported quarter.

However, total revenue for the

quarter increased 7% to $302.1 million, reflecting sales growth in

garden and pet products segment. Moreover, the company’s reported

net sales surpassed the Zacks Consensus Revenue Estimate of $290

million.

During the reported quarter, gross

profit shrinked 2.8% to $80.7 million, whereas gross margin

contracted 280 basis points to 26.7%. The decline reflected a rise

in raw material costs and sales of lower margin products. Total

operating loss for the quarter was $11.3 million, indicating a

significant widening of loss from the year-ago quarter.

Central Garden & Pet, one of

the leading producers and marketers of premium and value-oriented

products, focuses on the lawn & garden and pet supplies markets

in the U.S.

Garden Products segment sales

increased 8% year over year to $102.8 million. However, due to high

raw material costs for bird feed and by product mix, the segment

reported an operating loss of $11.1 million during the quarter. The

reported operating result was even worst from the prior-year

quarter, where it reported a loss of $8 million.

According to the company, the

Garden Products segment’s branded product sales came in at $89.9

million, whereas sales of other manufacturers’ products came in at

$12.9 million during the quarter.

Pet Products segment sales

increased 7% to $199.3 million. However, the segment’s operating

income decreased 14.9% to $9.7 million from $11.4 million,

reflecting a continued rise in raw material costs and higher trade

and consumer spending.

The segment’s branded product sales

came in at $156.6 million, whereas sales of other manufacturers’

products were $42.7 million during the quarter.

Central Garden & Pet, which

faces stiff competition from The Scotts Miracle-Gro

Company (SMG), ended the quarter with cash and cash

equivalents of $10.3 million, long-term debt of $460.3 million and

shareholders’ equity of $424.5 million.

The company bought back 2.6 million

shares for $20.9 million during the quarter under review, under its

$100 million share repurchase program approved in June 2011.

Currently, we maintain a long-term

‘Neutral’ recommendation on the stock. Moreover, Central Garden

& Pet has a Zacks #2 Rank, which translates into a short-term

‘Buy’ rating.

CENTRAL GARDEN (CENT): Free Stock Analysis Report

SCOTTS MIRCL-GR (SMG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

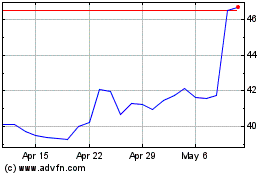

Central Garden and Pet (NASDAQ:CENT)

Historical Stock Chart

From May 2024 to Jun 2024

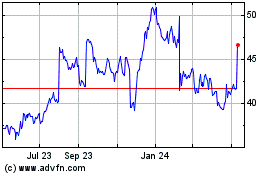

Central Garden and Pet (NASDAQ:CENT)

Historical Stock Chart

From Jun 2023 to Jun 2024