MORNING UPDATE: Man Securities Issues Alerts for TLAB, SLAB, TSM, CECO, and NEM

October 27 2004 - 10:34AM

PR Newswire (US)

MORNING UPDATE: Man Securities Issues Alerts for TLAB, SLAB, TSM,

CECO, and NEM CHICAGO, Oct. 27 /PRNewswire/ -- Man Securities

issues the following Morning Update at 8:30 AM EDT with new

PriceWatch Alerts for key stocks. (Logo:

http://www.newscom.com/cgi-bin/prnh/20020214/MANSECLOGO ) Before

the open... PriceWatch Alerts for TLAB, SLAB, TSM, CECO, and NEM,

Market Overview, Today's Economic Calendar, and the Quote Of The

Day. QUOTE OF THE DAY "By its nature, the campaign season is

forcing the nation to focus on its problems." -- Tony Crescenzi,

analyst, Miller Tabak & Co. New PriceWatch Alerts for TLAB,

SLAB, TSM, CECO, and NEM... PRICEWATCH ALERTS - HIGH RETURN COVERED

CALL OPTIONS -- Tellabs Inc. (NASDAQ:TLAB) Last Price 8.36 - JAN

7.50 CALL OPTION@ $1.20 -> 4.7 % Return assigned* -- Silicon

Labs (NASDAQ:SLAB) Last Price 27.88 - JAN 22.50 CALL OPTION@ $6.30

-> 4.3 % Return assigned* -- Taiwan Semiconductor Manufacturing

Co. (NYSE:TSM) Last Price 7.07 - JAN 6.62 CALL OPTION@ $0.75 ->

4.7 % Return assigned* -- Career Education Corp. (NASDAQ:CECO) Last

Price 27.94 - NOV 25.00 CALL OPTION@ $4.20 -> 5.3 % Return

assigned* -- Newmont Mining Corp. (NYSE:NEM) Last Price 47.79 - JAN

47.50 CALL OPTION@ $3.10 -> 6.3 % Return assigned* * To learn

more about how to use these alerts and for our FREE report, "The 18

Warning Signs That Tell You When To Dump A Stock", go to:

http://www.investorsobserver.com/mu18 (Note: You may need to copy

the link above into your browser then press the [ENTER] key) ** For

the FREE report, "Is Your Investment Portfolio Disaster Proof? -

Insights, Stocks, And Strategies." go to:

http://www.investorsobserver.com/FREEDP NOTE: All stocks and

options shown are examples only. These are not recommendations to

buy or sell any security. MARKET OVERVIEW If early trade is any

indication, overseas markets look to assemble their second session

of positive postings. Buoyed by a relief rally by U.S. insurers

yesterday, 13 of the 15 markets that we track are currently holding

positive numbers. The cumulative average return on the group stands

at a plus 0.350 percent. Second quarter labor costs in the

Euro-Zone were revised lower to 2.1 percent over the corresponding

period of 2003 from the initial estimate of plus 2.2 percent. This

would mark a significant slowdown in cost from the 2.7 percent

year-over-year rise booked in the first quarter. Italian business

confidence rose only slightly in October as a drop in inventories

and positive production forecasts were offset by a fall in the

current orders portfolio. Business confidence in the Euro-Zone's

third-largest economy rose to 91 from 90.7 in September. The

Mortgage Bankers Association (MBA) is already out with its weekly

figures showing that the Refinancing Index for the week ending

October 23 rose by 3.6 percent on top of the prior week's 10.6

percent advance. The Purchase Index declined by 4.4 percent,

however, pulling the Market Index into negative territory at minus

0.8 percent. At 2:00 p.m., Federal Reserve Beige Book for use at

the November 10 Federal Open Market Committee (FOMC) monetary

policy meeting is scheduled for release. The data is a synopsis of

the state of the economy prepared by one of the 12 Federal Reserve

banks and can help the investing public in their second-guessing as

to what the Fed will do and say when it does indeed meet again on

November 10. By my calculations, the overnight futures contract is

currently indicating a 60 percent chance of another 25-basis point

hike to 2.00 percent. Let's use that as a starting point in our

countdown and see how the Beige Book alters that perception. Be

prepared for the investing week ahead with Bernie Schaeffer's FREE

Monday Morning Outlook. For more details and to sign up, go to:

http://www.investorsobserver.com/freemo DYNAMIC MARKET

OPPORTUNITIES Amid high oil prices, terrorism and elections, it's

been a fine year for the travel industry. According to the Travel

Industry Association of America, this year is expected to be the

best for travel since the September 11 attacks crippled the

industry three years ago. The group projects a 7% sales spike to

$592.6 billion. It will also be the first time since 2000 that

every sub- sector of the industry reports a gain for the year. Even

the turbulent airline sector is expected to post a 5% rise in

domestic passenger volume. International passenger volume to/from

the US is up 15% over last year. Hotel revenue per available room

climbed 7.5% from January-September this year. This bodes well for

companies like Cendant Corp. Cendant recently acquired online

travel operator Orbitz for $1.25 billion -- a deal that vaulted the

company from fifth to second in terms of biggest US travel

operators. Only Expedia is higher than Cendant. And with a whole

host of travel-related companies under its wing, including Avis,

Budget, Ramada, and Days Inn, the future looks bright for Cendant.

Last week, it reported a 5% increase in quarterly revenues, with

net income jumping 19%. And fourth quarter earnings are set to

climb a further 14%, thanks partly to the Orbitz acquisition. Its

PEG ratio sits at 0.8, meaning the stock is still actually

undervalued, relative to its price-to-earnings growth. And over the

last 12 months, Cendant has generated a remarkable $9.6 billion in

free cashflow. The chances for continued solid growth look

excellent. Receive incisive economic/market commentary, profitable

advice and access to a network of leading investment exports.

Simply follow this link: http://www.investorsobserver.com/agora2

TODAY'S ECONOMIC CALENDAR 7:00 a.m.: Mortgage Bankers Association

(MBA) Refinancing Index for the week ending October 23 (last plus

10.6 percent). 8:30 a.m.: September Durable Goods Orders (last

minus 0.5 percent). 10:00 a.m.: September New Home Sales (last plus

9.4 percent). 2:00 p.m.: Federal Reserve Beige Book for use in

November 10 FOMC meeting. Man Securities is one of the world's

leading option order execution firms. Man's in-house broker team

offers a level of personal service and experience unavailable from

no-frills discount brokers. To improve your understanding of option

pricing get Man's FREE Margin/Option Wizard software at:

http://www.investorsobserver.com/mancd . Member CBOE/NASD/SPIC.

This Morning Update was prepared with data and information provided

by: InvestorsObserver.com -- Better Strategies for Making Money

-> For Investors With a Sense of Humor. Only $1 for your first

month plus seven free bonuses worth over $420, see:

http://www.investorsobserver.com/must 247profits.com: You'll get

exclusive financial commentary, access to a global network of

experts and undiscovered stock alerts. Register NOW for the FREE

247profits e-Dispatch. Go to:

http://www.investorsobserver.com/agora Schaeffer's Investment

Research -- Sign up for your FREE e-weekly, Monday Morning Outlook,

Bernie Schaeffer's look ahead at the markets. Sign Up Now

http://www.investorsobserver.com/freemo PowerOptionsPlus -- The

Best Way To Find, Compare, Analyze, and Make Money On Options

Investments. For a 14-Day FREE trial and 5 FREE bonuses go to:

http://www.poweroptionsplus.com/ All stocks and options shown are

examples only. These are not recommendations to buy or sell any

security and they do not represent in any way a positive or

negative outlook for any security. Potential returns do not take

into account your trade size, brokerage commissions or taxes which

will affect actual investment returns. Stocks and options involve

risk and are not suitable for all investors and investing in

options carries substantial risk. Prior to buying or selling

options, a person must receive a copy of Characteristics and Risks

of Standardized Options available from Sharon at 800-837-6212 or at

http://www.cboe.com/Resources/Intro.asp . Privacy policy available

upon request.

http://www.newscom.com/cgi-bin/prnh/20020214/MANSECLOGO

http://photoarchive.ap.org/ DATASOURCE: Man Securities CONTACT:

Michael Lavelle of Man Securities, +1-800-837-6212 Web site:

http://www.mansecurities.com/mu.html

Copyright

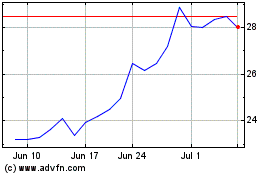

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Sep 2024 to Oct 2024

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Oct 2023 to Oct 2024