Career Education Corporation (NASDAQ:CECO) today reported

consolidated revenue from continuing operations of $437.2 million

and consolidated income from continuing operations of $31.4

million, or $0.34 per diluted share, during the fourth quarter of

2007. For the full year of 2007, consolidated revenue from

continuing operations was $1.7 billion and consolidated income from

continuing operations was $95.5 million, or $1.01 per diluted

share. �We finished 2007 with many successful accomplishments

resulting in continued improvement in many of our key metrics,�

said Gary E. McCullough, president and chief executive officer. �As

2008 begins, we are working aggressively to address our challenges

and take advantage of our opportunities for improvement. In the

past 60 days, we have made the decision to teach-out 11 schools, we

have moved to streamline our operations and we are working hard to

ensure that students continue to have access to affordable

financing to allow them to graduate and succeed in their careers.

Our aim is to create a stronger company that will deliver

sustainable, long-term growth and value to all of our

stakeholders.� RESULTS OF CONTINUING OPERATIONS As previously

reported in November 2006, the company entered into a process of

selling 11 of its schools and campuses, including McIntosh College,

Lehigh Valley College and the nine campuses that comprise the Gibbs

division. The results of these 11 schools and campuses are

reflected in this release as discontinued operations. Except as

otherwise noted, financial data and non-financial metrics reflected

in this release exclude discontinued operations. Three Months Ended

December 31, 2007 Consolidated revenue was $437.2 million during

the fourth quarter of 2007, a 0.6 percent increase from

consolidated revenue of $434.7 million during the fourth quarter of

2006. Revenue generated by the University segment�s fully-online

platforms decreased 4.0 percent to $125.3 million during the fourth

quarter of 2007, from $130.5 million during the fourth quarter of

2006. � Consolidated operating income decreased to $38.4 million

during the fourth quarter of 2007, from $42.5 million during the

fourth quarter of 2006. Operating profit margin percentage was 8.8

percent during the fourth quarter of 2007, a 1.0 percentage point

decrease relative to an operating profit margin percentage of 9.8

percent during the fourth quarter of 2006. The decrease in

operating profit margin percentage was primarily due to an increase

in legal reserves in the Health Education segment, an increase in

bad debt as a percentage of revenue and non-cash, pre-tax charges

related to the impairments of certain long-lived assets of $5.8

million in the fourth quarter of 2007 compared to $4.4 million in

the fourth quarter of 2006. � The decrease in the fourth quarter

2007 operating profit margin percentage was offset, in part, by a

reduction in admissions representative headcount and improved

representative productivity, a decline in administration expense

due to a reduction in corporate spending, and improved efficiency

in advertising. � The University segment's fully-online platforms'

operating income decreased $1.8 million to $27.0 million during the

fourth quarter of 2007, from $28.8 million during the fourth

quarter of 2006. Consolidated income from continuing operations

during the fourth quarter of 2007 was $31.4 million, or $0.34 per

diluted share, compared to consolidated income from continuing

operations of $37.1 million, or $0.39 per diluted share, during the

fourth quarter of 2006. Twelve Months Ended December 31, 2007

Consolidated revenue was $1.7 billion during the twelve months

ended December 31, 2007, compared to $1.8 billion during the twelve

months ended December 31, 2006. Revenue generated by the University

segment�s fully-online platforms decreased 19.9 percent, to $527.8

million during the twelve months ended December 31, 2007, from

$658.6 million during the twelve months ended December 31, 2006.

Consolidated operating income declined to $120.4 million during the

twelve months ended December 31, 2007, from $156.8 million during

the twelve months ended December 31, 2006. Operating income margin

percentage was 7.2 percent during the twelve months ended December

31, 2007, compared to 8.7 percent during the twelve months ended

December 31, 2006. Consolidated income from continuing operations

during the twelve months ended December 31, 2007, was $95.5

million, or $1.01 per diluted share, relative to $88.4 million, or

$0.90 per diluted share, during the twelve months ended December

31, 2006. Consolidated income from continuing operations during the

twelve months ended December 31, 2006 included a goodwill and

intangible asset impairment charge in the Health Education segment

of $83.5 million, net of income tax benefit of $2.8 million.

Provision for income taxes during 2007 was $48.2 million, compared

to provision for income taxes during 2006 of $89.3 million. This

represented an effective income tax rate of 50.3 percent for the

twelve months ended December 31, 2006. The effective income tax

rate for 2006 was attributable to the fact that only $8.0 million

of the total $86.3 million Health Education segment goodwill and

intangible asset impairment charges recognized during 2006 was

deductible for income tax reporting purposes. Excluding the effect

of the Health Education segment goodwill and intangible asset

impairment charges, the company�s effective income tax rate for

2006 would have been 34.2 percent, compared to an effective income

tax rate of 33.5 percent in 2007. RESULTS OF DISCONTINUED

OPERATIONS Loss from discontinued operations associated with the 11

schools and campuses held for sale was $35.9 million, net of tax,

during 2007, compared to a loss from discontinued operations of

$41.9 million, net of tax, during 2006. During 2007, the company

recorded an impairment charge of $19.9 million, net of income tax

benefit of $11.0 million, to reduce the carrying value of net

assets held for sale to fair value less costs to sell. During 2006,

the company recorded an acceleration of rent expense for excess and

unused leased space of $6.0 million, net of income tax benefit of

$3.2 million, a goodwill and intangible asset impairment charge of

$6.8 million, net of income tax benefit of $3.6 million and a

charge of $7.3 million, net of income tax benefit of $3.9 million,

to reduce the carrying value of net assets held for sale to fair

value less costs to sell. UPDATE ON SCHOOLS HELD FOR SALE In

November 2007, the company announced that it was examining other

alternatives previously contemplated for each of the 11 schools

held for sale, including continued operation of certain schools,

conversion to alternative brands, teach-outs, or sale of individual

schools. The company�s leadership worked diligently to attract

viable buyers and through early February 2008 attempted to

structure a transaction that made sense for all constituents.

Despite the company�s efforts, it could not find a suitable

arrangement that would be acceptable to purchasers and protect the

short and long-term interests of the schools� students, faculty and

staff. On February 15, 2008, the company announced plans to teach

out all of the programs at nine of the 11 schools held for sale,

which include: Gibbs College Livingston, Gibbs College Norwalk,

Gibbs College of Boston, Gibbs College Cranston, Katharine Gibbs

School New York, Katharine Gibbs School Norristown, Katharine Gibbs

School Piscataway, Lehigh Valley College and McIntosh

College/Atlantic Culinary Academy. The other two schools held for

sale, Gibbs College Vienna and Katharine Gibbs School Melville,

will remain with the company. The campuses will be converted to

Sanford Brown schools focusing on allied health programs. During

the first quarter of 2008, the nine schools that are being taught

out will be included in continuing operations as part of a new

financial reporting segment, Transitional Schools, and the two

schools being converted to Sanford Brown schools will be reported

within the Health Education segment. CORPORATE RESTRUCTURING On

February 12, 2008, the company announced a company-wide

restructuring as part of its long-term growth strategy. Estimated

savings from these workforce reductions during 2008 are expected to

be approximately $18 to $20 million, net of severance, from the

elimination of approximately 220 positions. In addition, the

company has restructured into strategic business units (SBUs),

which will enhance brand focus and operational alignment within

each business segment. The SBUs are: Culinary Arts, Health

Education, Art & Design, University, International and

Transitional Schools. UPDATE ON STUDENT LENDING On January 18,

2008, the company received notification from Sallie Mae that Sallie

Mae was terminating its discount loan program. Sallie Mae has

agreed to extend the termination date of the agreement to March 31,

2008, with an increased discount rate for the interim period from

25 percent to 44 percent. In addition, Sallie Mae informed the

company on February 14, 2008 that it would no longer continue to

offer recourse loans to our existing students entering their second

or subsequent academic terms. Sallie Mae has advised the company

that it intends to continue to provide loans through FFELP and

private loan non-recourse programs to qualifying students. These

lending changes are expected to have a material financial impact on

the company. CONSOLIDATED CASH FLOWS AND FINANCIAL POSITION Cash

Flows Cash provided by operating activities was $222.1 million

during 2007, compared to cash provided by operating activities of

$216.4 million during 2006. Capital expenditures decreased to $57.6

million during 2007, from $69.5 million during 2006. Capital

expenditures represented 3.2 percent of total consolidated revenue,

including revenue generated by schools and campuses held for sale,

during 2007. Financial Position As of December 31, 2007 and

December 31, 2006, cash and cash equivalents and investments

totaled $382.1 million and $447.6 million, respectively. This

decrease includes the use of approximately $224.3 million by the

company during the twelve months ended December 31, 2007 to

repurchase approximately 7.4 million shares of its common stock,

offset by net cash flow from operations. Days sales outstanding

(DSO) were 14 days as of December 31, 2007, an increase of three

days from a DSO of 11 days as of December 31, 2006. Stock

Repurchase Program The company�s Board of Directors has authorized

the use of a total of $800.2 million to repurchase outstanding

shares of the company�s common stock. Stock repurchases under this

program may be made on the open market or in privately negotiated

transactions from time to time, depending on factors, including

market conditions and corporate and regulatory requirements. The

stock repurchase program does not have an expiration date and may

be suspended or discontinued at any time. During the fourth quarter

of 2007, the company repurchased 2.5 million shares of its common

stock for approximately $74.9 million at an average price of $29.47

per share. Since the inception of the program, the company has

repurchased 18.2 million shares of its common stock for

approximately $590.5 million. As of December 31, 2007,

approximately $209.7 million was available under the stock

repurchase program to repurchase outstanding shares of the

company�s common stock. POPULATION AND NEW STUDENT START DATA

Student Population Total student population by reportable segment

as of January 31, 2008 and 2007, were as follows: �

PopulationJanuary 31, 2008 (1) � PopulationJanuary 31, 2007 (1) �

PercentageDifference Academy (2) 8,400 � 7,500 � 12 % Colleges

7,700 � 8,700 � (11 %) Culinary Arts 10,900 � 10,900 � - � Health

Education 13,500 � 11,600 � 16 % International (3) 8,600 � 7,600 �

13 % University (4) 40,400 � 38,400 � 5 % CEC Consolidated 89,500 �

84,700 � 6 % (1) Segment and CEC consolidated student population

data does not include the student population of schools held for

sale or schools in the process of a teach-out. (2) As of January

31, 2008, the Academy segment population included approximately 440

students who were taking classes in fully-online academic programs

offered by Academy segment schools. There were no Academy segment

fully-online students as of January 31, 2007. (3) As of January 31,

2008 and 2007, the International segment population included

student population for Istituto Marangoni. (4) As of January 31,

2008 and 2007, the University segment population included

approximately 31,500 students and 28,600 students, respectively,

who were taking classes in fully-online academic programs offered

by University segment schools. New Student Starts New student

starts by reportable segment during the fourth quarter of 2007 and

2006, were as follows: � Fourth quarter2007 (1) � Fourth

quarter2006 (1) � PercentageDifference Academy (2) 2,060 � 1,830 �

13 % Colleges 630 � 710 � (11 %) Culinary Arts 2,410 � 2,370 � 2 %

Health Education 2,940 � 2,790 � 5 % International (3) 2,340 �

1,060 � 121 % University (4) 12,310 � 11,480 � 7 % CEC Consolidated

22,690 � 20,240 � 12 % (1) Segment and CEC consolidated student

starts data does not include student starts of schools held for

sale or schools in the process of a teach-out. (2) Academy segment

new student starts include approximately 250 students who began

taking classes in fully-online academic programs offered by the

Academy segment schools during the fourth quarter of 2007. There

were no Academy segment fully-online student starts during the

fourth quarter of 2006. (3) International segment new student

starts include students who began taking classes at Istituto

Marangoni schools during the fourth quarter of 2007. There were no

Istituto Marangoni student starts during the fourth quarter of

2006. (4) University segment new student starts includes

approximately 10,500 students and 9,380 students, respectively, who

began taking classes in fully-online academic programs offered by

the University segment schools during the fourth quarter of 2007

and 2006. CONFERENCE CALL INFORMATION Career Education Corporation

will host a conference call on February 21, 2008 at 10:00 AM

(Eastern Time). Interested parties can access the live webcast of

the conference call at www.careered.com. Participants can also

listen to the conference call by dialing 866-314-4865 (domestic) or

617-213-8050 (international) and citing code 45616178. Please

log-in or dial-in at least ten minutes prior to the conference call

start time to ensure a connection. An archived version of the

conference call webcast will be accessible for 90 days at

www.careered.com. A replay of the conference call will also be

available for seven days by calling 888-286-8010 (domestic) or

617-801-6888 (international) and citing code 48600506. About Career

Education Corporation The colleges, schools, and universities that

are part of the Career Education Corporation (CEC) family offer

high quality education to a diverse population of approximately

90,000 students across the world in a variety of career-oriented

disciplines. The more than 75 campuses that serve these students

are located throughout the U.S. and in France, Italy, and the

United Kingdom, and offer doctoral, master's, bachelor's, and

associate degrees and diploma and certificate programs.

Approximately one-third of its students attend the web-based

virtual campuses of American InterContinental University Online and

Colorado Technical University Online. CEC is an industry leader

whose gold-standard brands are recognized globally. Those brands

include, among others, the Le Cordon Bleu Schools North America;

Harrington College of Design; Brooks Institute; International

Academy of Design; American InterContinental University; Colorado

Technical University and Sanford-Brown Institutes and Colleges.

Through its schools, CEC is committed to providing quality

education, enabling students to graduate and pursue rewarding

careers. For more information, see the company�s website at

www.careered.com. The company's website includes a detailed listing

of individual campus locations and web links to its more than 75

colleges, schools, and universities. Except for the historical and

present factual information contained herein, the matters set forth

in this release, including statements identified by words such as

"anticipate," "believe," "plan," "expect," "intend," "project,"

"will," and similar expressions, are forward-looking statements as

defined in Section 21E of the Securities Exchange Act of 1934, as

amended. These statements are based on information currently

available to us and are subject to various risks, uncertainties and

other factors that could cause our actual growth, results of

operations, performance and business prospects, and opportunities

to differ materially from those expressed in, or implied by, these

statements. Except as expressly required by the federal securities

laws, we undertake no obligation to update such factors or to

publicly announce the results of any of the forward-looking

statements contained herein to reflect future events, developments,

or changed circumstances or for any other reason. These risks and

uncertainties, the outcome of which could materially and adversely

affect our financial condition and operations, include, but are not

limited to, the following: risks associated with unfavorable

changes in the cost or availability of financing, including

alternative loans, for our students; potential higher bad debt

expense or reduced revenue associated with requiring students to

pay more of their educational expenses while in school; increased

competition; the effectiveness of our regulatory compliance

efforts; future financial and operational results, including the

impact of the impairment of goodwill and other intangible assets;

risks related to our ability to comply with accrediting agency

requirements or obtain accrediting agency approvals; risks related

to our ability to comply with, and the impact of changes in,

legislation and regulations that affect our ability to participate

in student financial aid programs; costs, risks, and effects of

legal and administrative proceedings and investigations and

governmental regulations, and class action and other lawsuits;

costs, risks and uncertainties associated with our company-wide

restructuring, including risks and uncertainties associated with

changes in management and reporting responsibilities; costs and

difficulties related to the integration of acquired businesses;

risks related to our ability to manage and continue growth; risks

related to the sale or teach-out of any campuses; risks related to

general economic conditions including credit market conditions and

other risk factors relating to our industry and business and the

factors discussed in our Annual Report on Form 10-K for the year

ended December 31, 2006, and from time to time in our other reports

filed with the Securities and Exchange Commission. CAREER EDUCATION

CORPORATION AND SUBSIDIARIES UNAUDITED CONSOLIDATED BALANCE SHEETS

(In thousands) � � � December 31, December 31, 2007 2006 � ASSETS

CURRENT ASSETS: Cash and cash equivalents $ 215,478 $ 187,853

Investments 166,618 � 259,766 � Total cash and cash equivalents and

investments 382,096 447,619 Receivables: Students, net of allowance

for doubtful accounts of $32,805 and $28,709 as of December 31,

2007, and December 31, 2006, respectively 56,756 48,564 Other, net

7,948 8,094 Prepaid expenses 47,809 29,621 Inventories 15,031

16,853 Deferred income tax assets 26,842 11,357 Other current

assets 16,276 32,064 Assets held for sale 47,849 � 63,156 � Total

current assets 600,607 657,328 PROPERTY AND EQUIPMENT, net 332,205

352,270 GOODWILL 383,844 349,760 INTANGIBLE ASSETS, net 44,395

33,984 DEFERRED INCOME TAX ASSETS 34,113 2,096 OTHER ASSETS 17,336

� 30,225 � TOTAL ASSETS $ 1,412,500 � $ 1,425,663 � � LIABILITIES

AND STOCKHOLDERS' EQUITY CURRENT LIABILITIES: Current maturities of

long-term debt $ 11,843 $ 12,098 Accounts payable 26,038 30,095

Accrued expenses: Payroll and related benefits 27,790 27,012 Income

taxes 19,572 - Other 100,441 78,885 Deferred tuition revenue

151,626 132,186 Deferred income tax liabilities 13,212 -

Liabilities held for sale 33,301 � 31,879 � Total current

liabilities 383,823 � 312,155 � � LONG-TERM LIABILITIES: Long-term

debt, net of current maturities 2,178 2,763 Deferred rent

obligations 91,320 90,360 Deferred income tax liabilities 32,823

16,527 Other 4,633 � 7,980 � Total long-term liabilities 130,954 �

117,630 � � SHARE-BASED AWARDS SUBJECT TO REDEMPTION 11,615 13,477

� STOCKHOLDERS' EQUITY: Common stock 930 1,069 Additional paid-in

capital 207,294 666,780 Accumulated other comprehensive income

16,304 5,683 Retained earnings 736,603 675,188 Cost of shares in

treasury (75,023 ) (366,319 ) Total stockholders' equity 886,108 �

982,401 � TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ 1,412,500 �

$ 1,425,663 � CAREER EDUCATION CORPORATION AND SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF INCOME (In thousands, except

per share amounts and percentages) � � � � � � � For the Three

MonthsEnded December 31, % of % of 2007 Revenue 2006 Revenue �

REVENUE: Tuition and registration fees $ 417,273 95.5 % $ 413,883

95.2 % Other 19,885 � 4.5 % 20,797 � 4.8 % Total revenue 437,158 �

100.0 % 434,680 � 100.0 % � OPERATING EXPENSES: Educational

services and facilities 155,882 35.7 % 144,972 33.3 % General and

administrative 216,620 49.5 % 222,452 51.2 % Depreciation and

amortization 20,439 4.7 % 20,353 4.7 % Goodwill and asset

impairment 5,821 � 1.3 % 4,390 � 1.0 % Total operating expenses

398,762 � 91.2 % 392,167 � 90.2 % Operating income 38,396 � 8.8 %

42,513 � 9.8 % � OTHER INCOME (EXPENSE): Interest income 5,843 1.3

% 5,555 1.3 % Interest expense (286 ) 0.0 % (898 ) -0.2 % Share of

affiliate earnings 1,865 0.4 % 1,857 0.4 % Miscellaneous expense

(10 ) 0.0 % (157 ) -0.1 % Total other income, net 7,412 � 1.7 %

6,357 � 1.4 % � Income from continuing operations before provision

for income taxes 45,808 10.5 % 48,870 11.2 % PROVISION FOR INCOME

TAXES 14,410 � 3.3 % 11,786 � 2.7 % � INCOME FROM CONTINUING

OPERATIONS $ 31,398 7.2 % $ 37,084 8.5 % � DISCONTINUED OPERATIONS:

Loss from discontinued operations, net of income tax benefit

(22,567 ) -5.2 % (16,422 ) -3.7 % � NET INCOME $ 8,831 � 2.0 % $

20,662 � 4.8 % � NET INCOME PER SHARE - DILUTED: Income from

continuing operations $ 0.34 $ 0.39 Loss from discontinued

operations (0.24 ) (0.17 ) Net income $ 0.10 � $ 0.21 � � DILUTED

WEIGHTED AVERAGE SHARES OUTSTANDING: 92,412 � 96,333 � CAREER

EDUCATION CORPORATION AND SUBSIDIARIES UNAUDITED CONSOLIDATED

STATEMENTS OF INCOME (In thousands, except per share amounts and

percentages) � � � � � � � For the Year Ended December 31, % of %

of 2007 Revenue 2006 Revenue � REVENUE: Tuition and registration

fees $ 1,595,326 95.3 % $ 1,724,872 95.5 % Other 79,556 � 4.7 %

80,946 � 4.5 % Total revenue 1,674,882 � 100.0 % 1,805,818 � 100.0

% � OPERATING EXPENSES: Educational services and facilities 593,659

35.4 % 563,244 31.2 % General and administrative 876,801 52.4 %

918,090 50.8 % Depreciation and amortization 78,183 4.7 % 77,495

4.3 % Goodwill and asset impairment 5,821 � 0.3 % 90,150 � 5.0 %

Total operating expenses 1,554,464 � 92.8 % 1,648,979 � 91.3 %

Operating income 120,418 � 7.2 % 156,839 � 8.7 % � OTHER INCOME

(EXPENSE): Interest income 18,948 1.1 % 19,002 1.0 % Interest

expense (1,185 ) -0.1 % (1,905 ) -0.1 % Share of affiliate earnings

4,735 0.3 % 3,966 0.2 % Miscellaneous income (expense) 761 � 0.1 %

(127 ) 0.0 % Total other income, net 23,259 � 1.4 % 20,936 � 1.1 %

� Income from continuing operations before provision for income

taxes 143,677 8.6 % 177,775 9.8 % PROVISION FOR INCOME TAXES 48,175

� 2.9 % 89,336 � 4.9 % � INCOME FROM CONTINUING OPERATIONS $ 95,502

5.7 % $ 88,439 4.9 % � DISCONTINUED OPERATIONS: Loss from

discontinued operations, net of income tax benefit (35,949 ) -2.1 %

(41,870 ) -2.3 % � NET INCOME $ 59,553 � 3.6 % $ 46,569 � 2.6 % �

NET INCOME PER SHARE - DILUTED: Income from continuing operations $

1.01 $ 0.90 Loss from discontinued operations (0.38 ) (0.43 ) Net

income $ 0.63 � $ 0.47 � � DILUTED WEIGHTED AVERAGE SHARES

OUTSTANDING: 94,407 � 98,065 � CAREER EDUCATION CORPORATION AND

SUBSIDIARIES UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS (In

thousands) � � � � � � � For the Year EndedDecember 31, 2007 2006 �

CASH FLOWS FROM OPERATING ACTIVITIES OF CONTINUING OPERATIONS: Net

income $ 59,553 $ 46,569 Adjustments to reconcile net income to net

cash provided by operating activities: Goodwill and asset

impairment 36,765 111,725 Depreciation and amortization expense

78,183 86,415 Bad debt expense 46,619 60,654 Compensation expense

related to share-based awards 15,504 17,090 (Gain) loss on

disposition of property and equipment (124 ) 716 Deferred income

taxes (20,832 ) (30,018 ) Share of affiliate earnings, net of

dividends received (2,791 ) (1,306 ) Other 301 2,995 Changes in

operating assets and liabilities: Students receivables, gross

(37,519 ) 26,589 Allowance for doubtful accounts (42,842 ) (73,465

) Other receivables, net 133 (4,251 ) Inventories, prepaid

expenses, and other current assets 5,066 (837 ) Deposits and other

non-current assets 20,051 1,146 Accounts payable (5,840 ) 3,026

Accrued expenses, deferred rent obligations 30,253 (25,067 )

Deferred tuition revenue 39,595 � (5,591 ) Net cash provided by

operating activities 222,075 � 216,390 � � CASH FLOWS FROM

INVESTING ACTIVITIES: Business acquisitions, net of acquired cash

(30,324 ) - Acquisition transaction costs (1,984 ) - Purchases of

property and equipment (57,586 ) (69,473 ) Purchases of

available-for-sale investments (644,977 ) (938,033 ) Sales of

available-for-sale investments 740,108 950,508 Other (424 ) 545 �

Net cash provided by (used in) investing activities 4,813 � (56,453

) � CASH FLOWS FROM FINANCING ACTIVITIES: Purchase of treasury

stock (224,264 ) (166,161 ) Issuance of common stock 34,486 37,676

Tax benefit associated with stock option exercises 5,945 20,763 �

Payments of revolving loans (1,297 ) (3,517 ) Payments of capital

lease obligations and other long-term debt (588 ) - � Net cash used

in financing activities (185,718 ) (111,239 ) � � EFFECT OF FOREIGN

CURRENCY EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS: 6,717

� 8,810 � � NET INCREASE IN CASH AND CASH EQUIVALENTS 47,887 57,508

DISCONTINUED OPERATIONS CASH ACTIVITY INCLUDED ABOVE: Add: Cash

balance of discontinued operations at beginning of the year 1,964

3,095 Less: Cash balance of discontinued operations at end of the

year 22,226 1,964 CASH AND CASH EQUIVALENTS, beginning of the

period 187,853 � 129,214 � CASH AND CASH EQUIVALENTS, end of the

period $ 215,478 � $ 187,853 � CAREER EDUCATION CORPORATION

SELECTED SEGMENT INFORMATION - CONTINUING OPERATIONS (Dollars in

thousands) � � � � � For the Three Months Ended December 31, 2007

2006 � REVENUE: Academy segment $ 47,457 $ 44,416 Colleges segment

48,574 58,842 Culinary Arts segment 94,047 93,927 Health Education

segment 50,155 44,426 International segment (1) 32,585 18,341

University segment 164,334 174,320 Corporate and other (2) 6 � 408

� $ 437,158 � $ 434,680 � � SEGMENT PROFIT (LOSS): Academy segment

(3) $ (2,260 ) $ 6,980 Colleges segment (4) 7,805 10,313 Culinary

Arts segment 15,016 18,912 Health Education segment (5) (984 )

1,122 International segment 9,448 5,529 University segment 22,391

23,640 Corporate and other (2) (13,020 ) (23,983 ) $ 38,396 � $

42,513 � � SEGMENT PROFIT PERCENTAGE: Academy segment -4.8 % 15.7 %

Colleges segment 16.1 % 17.5 % Culinary Arts segment 16.0 % 20.1 %

Health Education segment -2.0 % 2.5 % International segment 29.0 %

30.1 % University segment 13.6 % 13.6 % � � � � � � � � (1) �

International segment for the three months ended December 31, 2007

includes the results of Istituto Marangoni, which we acquired in

January 2007. (2) Operating results of Blish.com and Chefs.com are

included in Corporate and other. (3) Academy segment loss for the

three months ended December 31, 2007 includes an asset impairment

charge of approximately $5.5 million. (4) Colleges segment profit

for the three months ended December 31, 2007 and 2006, includes

asset impairment charges of approximately $0.3 million and $3.8

million, respectively. (5) Health Education segment loss for the

three months ended December 31, 2007 includes approximately $6.5

million in increased legal reserves. CAREER EDUCATION CORPORATION

SELECTED SEGMENT INFORMATION - CONTINUING OPERATIONS (Dollars in

thousands) � � � � � For the Year Ended December 31, 2007 2006 �

REVENUE: Academy segment $ 170,917 $ 164,548 Colleges segment

184,355 218,840 Culinary Arts segment 365,789 364,169 Health

Education segment 189,017 168,896 International segment (1) 81,907

50,895 University segment 682,750 837,576 Corporate and other (2)

147 � 894 � $ 1,674,882 � $ 1,805,818 � � SEGMENT PROFIT (LOSS):

Academy segment (3) $ 3,390 $ 13,808 Colleges segment (4) 9,001

32,331 Culinary Arts segment 49,133 60,646 Health Education segment

(5) 6,980 (82,551 ) International segment (1) 13,024 11,456

University segment (6) 91,342 204,623 Corporate and other (2)

(52,452 ) (83,474 ) $ 120,418 � $ 156,839 � � SEGMENT PROFIT (LOSS)

PERCENTAGE: Academy segment 2.0 % 8.4 % Colleges segment 4.9 % 14.8

% Culinary Arts segment 13.4 % 16.7 % Health Education segment 3.7

% -48.9 % International segment 15.9 % 22.5 % University segment

13.4 % 24.4 % � � � � � � � � (1) � International segment for the

twelve months ended December 31, 2007 includes the results of

Istituto Marangoni, which we acquired in January 2007. (2)

Operating results of Blish.com and Chefs.com are included in

Corporate and other. (3) Academy segment profit for the twelve

months ended December 31, 2007 includes an asset impairment charge

of approximately $5.5 million (4) Colleges segment profit for the

twelve months ended December 31, 2007 and 2006, includes asset

impairment charge of approximately $0.3 million and $3.8 million,

respectively. In addition, results for the twelve months ended

December 31, 2007 include approximately $8.4 million in increased

legal reserves. (5) Health Education segment income (loss) for the

twelve months ended December 31, 2007 and 2006, includes

approximately $6.5 million in increased legal reserves and

approximately $86.3 million in goodwill and other intangible asset

impairment charges, respectively. (6) Operating profit margin

percentage information for the University segment's on-ground and

online platforms for the three and twelve months ended December 31,

2007 and 2006 were as follows: � � For the Three MonthsEnded � For

the YearEnded December 31, December 31, 2007 � 2006 2007 � 2006

Operating Profit (Loss) Margin Percentage: On-ground universities

-11.9 % -11.8 % -17.4 % -5.9 % AIU Online 14.9 % 25.6 % 23.9 % 32.7

% CTU Online 29.0 % 16.5 % 20.3 % 18.8 % CAREER EDUCATION

CORPORATION SELECTED ACCOUNTS RECEIVABLE AND ALLOWANCE INFORMATION

- CONTINUING OPERATIONS (Dollars in thousands) � � � � � � DAYS

SALES OUTSTANDING � For the Year Ended December 31, 2007 2006 � �

Total revenue $ 1,674,882 $ 1,805,818 Number of days in the year

365 365 Total revenue per day $ 4,589 $ 4,947 Total receivables,

net $ 64,704 $ 56,658 Days sales outstanding 14 11 � � ALLOWANCE AS

A PERCENTAGE OF STUDENT RECEIVABLES � December 31, 2007 2006 � �

Allowance for doubtful accounts $ 32,805 $ 28,709 Gross student

receivables $ 89,561 $ 77,273 Allowance as a percentage of student

receivables 36.6 % 37.2 % � � STUDENT RECEIVABLES VALUATION

ALLOWANCE � Balance, Beginning Charges Amounts Written- Balance,

End of Period to Expense Off Other of Period � For the year ended

December 31, 2007 $ 28,709 $ 42,170 $ (38,083 ) $ 9 $ 32,805 � For

the year ended December 31, 2006 $ 38,223 $ 55,856 $ (65,370 ) $ -

$ 28,709 � � BAD DEBT EXPENSE BY SEGMENT: � For the Year Ended

December 31, % Change 2007 % of Segment Revenue 2006 % of Segment

Revenue 2007 vs. 2006 � Bad debt expense by segment: University

segment $ 15,006 2.2 % $ 37,083 4.4 % -60 % Culinary Arts segment

11,839 3.2 % 5,207 1.4 % 127 % Colleges segment 1,536 0.8 % 1,606

0.7 % -4 % Health Education segment 9,686 5.1 % 6,099 3.6 % 59 %

Academy segment 3,630 2.1 % 2,875 1.7 % 26 % International segment

333 0.4 % 783 1.5 % -57 % Corporate and other 140 � N/A 2,203 � N/A

-94 % Total bad debt expense $ 42,170 � 2.5 % $ 55,856 � 3.1 % -25

% CAREER EDUCATION CORPORATION SUMMARY OF FUNDING SOURCES � � � For

the Year Ended December 31, 2007 2006 � Title IV Program funding

Stafford loans 45.4 % 42.5 % Grants 11.2 % 9.1 % PLUS loans 6.5 %

7.8 % Total Title IV Program funding 63.1 % 59.4 % � Private loans

Non-recourse loans 15.0 % 19.7 % Sallie Mae recourse loans 2.7 %

1.9 % Stillwater recourse loans 0.0 % 0.2 % Total private loans

17.7 % 21.8 % � Scholarships, Grants and Other 3.1 % 2.6 % Cash

Payments 16.1 % 16.2 % � Total Tuition Receipts 100.0 % 100.0 %

CAREER EDUCATION CORPORATION AND SUBSIDIARIES SELECTED FINANCIAL

DATA REGARDING ASSETS HELD FOR SALE (In thousands) � � � � � � � �

For the Three Months Ended December 31, 2007 For the Three Months

Ended December 31, 2006 Gibbs Colleges Gibbs Colleges Held for Sale

Held for Sale Total Held for Sale Held for Sale Total � Total

revenue $ 23,577 $ 6,534 $ 30,111 $ 28,154 $ 8,162 $ 36,316 Total

operating expenses (1) 54,648 10,522 65,170 46,997 12,463 59,460

Loss from operations (31,071 ) (3,988 ) (35,059 ) (18,843 ) (4,301

) (23,144 ) Total other expense (19 ) - (19 ) (4 ) (126 ) (130 )

Loss before income tax benefit (31,090 ) (3,988 ) (35,078 ) (18,847

) (4,427 ) (23,274 ) Income tax benefit (11,069 ) (1,442 ) (12,511

) (5,497 ) (1,355 ) (6,852 ) Net loss from dis-continued operations

$ (20,021 ) $ (2,546 ) $ (22,567 ) $ (13,350 ) $ (3,072 ) $ (16,422

) � For the Twelve Months Ended December 31, 2007 For the Twelve

Months Ended December 31, 2006 Gibbs Colleges Gibbs Colleges Held

for Sale Held for Sale Total Held for Sale Held for Sale Total �

Total revenue $ 95,361 $ 25,491 $ 120,852 $ 110,242 $ 32,738 $

142,980 Total operating expenses (2) 141,906 34,452 176,358 164,291

42,464 206,755 Loss from operations (46,545 ) (8,961 ) (55,506 )

(54,049 ) (9,726 ) (63,775 ) Total other expense (8 ) 6 (2 ) (25 )

(126 ) (151 ) Loss before income tax benefit (46,553 ) (8,955 )

(55,508 ) (54,074 ) (9,852 ) (63,926 ) Income tax benefit (16,404 )

(3,155 ) (19,559 ) (18,672 ) (3,384 ) (22,056 ) Net loss from

dis-continued operations $ (30,149 ) $ (5,800 ) $ (35,949 ) $

(35,402 ) $ (6,468 ) $ (41,870 ) � � (1) Included in operating

expenses for the three months ended December 31, 2007 and 2006,

were approximately $30.9 million and $11.2 million, respectively,

of goodwill and asset impairment charges. � (2) Included in

operating expenses for the twelve months ended December 31, 2007

and 2006, were approximately $30.9 million and $21.6 million,

respectively, of goodwill and asset impairment charges. � CAREER

EDUCATION CORPORATION SUPPLEMENTAL START-UP FINANCIAL INFORMATION

(In thousands) � � � � � Revenues Operating Income (Loss) For the

Three Months For the Three Months Ended December 31, Ended December

31, 2007 2006 2007 2006 Culinary Arts segment (1) $ 2,757 $ 2,022 $

(2,301 ) $ (1,335 ) Health Education segment (2) - 2,025 - 151

Academy segment (3) 3,668 - (1,485 ) (1,160 ) $ 6,425 $ 4,047 $

(3,786 ) $ (2,344 ) � � Revenues Operating Income (Loss) For the

Twelve Months For the Twelve Months Ended December 31, Ended

December 31, 2007 2006 2007 2006 Culinary Arts segment (1) $ 5,540

$ 5,454 $ (8,967 ) $ (6,929 ) Health Education segment (2) - 5,513

- 112 Academy segment (3) 6,282 - (7,828 ) (3,745 ) $ 11,822 $

10,967 $ (16,795 ) $ (10,562 ) (1) � For the three and twelve

months ended December 31, 2007, Culinary Arts segment start-up

campuses includes LCB Dallas, TX; LCB Boston, MA; and Kitchen

Academy campuses in St. Peters, MO; Seattle, WA; and Sacramento,

CA. For the three and twelve months ended December 31, 2006,

Culinary Arts segment start-up campuses includes LCB Dallas, TX;

LCB Boston, MA; and Kitchen Academy campuses in St. Peters, MO;

Seattle, WA; Hollywood, CA; and Sacramento, CA. � (2) For the three

and twelve months ended December 31, 2006, Health Education segment

start-up campuses include SBC Milwaukee, WI. � (3) For the three

and twelve months ended December 31, 2007, Academy segment start-up

campuses include IADT Sacramento, CA, San Antonio, TX, and IADT

Online Tampa, FL. For the three and twelve months ended December

31, 2006, Academy segment start-up campuses includes IADT

Sacramento, CA and San Antonio, TX. CAREER EDUCATION CORPORATION

2007 TEACH-OUT SEGMENT INFORMATION - CONTINUING OPERATIONS (Dollars

in thousands) � � � � � � � � For the Three Months Ended, For the

Twelve Months Ended March 31,2007 June 30,2007 September 30,2007

December 31,2007 December 31,2007 REVENUE: Academy segment (1) $

8,107 $ 7,372 $ 6,507 $ 7,992 $ 29,978 Colleges segment (2) 4,040

3,393 2,759 2,742 12,934 Health Education segment (3) 174 � 85 � 12

� - � 271 � $ 12,321 � $ 10,850 � $ 9,278 � $ 10,734 � $ 43,183 � �

SEGMENT INCOME (LOSS): Academy segment (1) $ 106 $ (1,125 ) $ (769

) $ (8,278 ) $ (10,066 ) Colleges segment (2) (2,068 ) (6,437 )

(808 ) (1,195 ) (10,508 ) Health Education segment (3) (300 ) (281

) (357 ) - � (938 ) $ (2,262 ) $ (7,843 ) $ (1,934 ) $ (9,473 ) $

(21,512 ) � SEGMENT LOSS PERCENTAGE: Academy segment 1.3 % -15.3 %

-11.8 % -103.6 % -33.6 % Colleges segment -51.2 % -189.7 % -29.3 %

-43.6 % -81.2 % Health Education segment -172.4 % -330.6 % -2975.0

% N/A -346.1 % � STUDENT STARTS: Academy segment 323 270 260 592

1,445 Colleges segment 78 68 2 - 148 Health Education segment - � -

� N/A � N/A � - � 401 � 338 � 262 � 592 � 1,593 � � STUDENT

POPULATION AS OF: April 30,2007 July 31,2007 October 31,2007

January 31,2008 Academy segment 1,825 1,479 1,747 1,319 Colleges

segment 692 495 389 283 Health Education segment 36 � 6 � N/A � N/A

� 2,553 � 1,980 � 2,136 � 1,602 � � (1) Academy segment revenue and

segment income(loss) for the three and twelve months ended December

31, 2007 includes IADT Pittsburgh, Pennsylvania and IADT Toronto,

Canada campuses. IADT Pittsburgh and IADT Toronto are expected to

be taught out by December 2008 and April 2009, respectively. � (2)

Colleges segment revenue and segment loss for the three and twelve

months ended December 31, 2007 includes Brooks College, Long Beach

and Sunnyvale, California campuses. Brooks College, Long Beach and

Brooks College, Sunnyvale are expected to be taught out by December

2008 and June 2008, respectively. � (3) Health Education segment

revenue and segment loss for the three and nine months ended

September 30, 2007 includes SBI Springfield, Massachusetts. SBI

Springfield completed its teach out in September 2007. CAREER

EDUCATION CORPORATION 2006 TEACH-OUT SEGMENT INFORMATION -

CONTINUING OPERATIONS (Dollars in thousands) � � � � � � � � For

the Three Months Ended For the Twelve Months Ended March 31,2006

June 30,2006 September 30,2006 December 31,2006 December 31,2006

REVENUE: Academy segment (1) $ 9,127 $ 8,292 $ 7,154 $ 8,723 $

33,296 Colleges segment (2) 5,348 4,402 4,892 5,557 20,199 Health

Education segment (3) 716 � 702 � 655 � 401 � 2,474 � $ 15,191 � $

13,396 � $ 12,701 � $ 14,681 � $ 55,969 � SEGMENT INCOME (LOSS):

Academy segment (1) $ (7 ) $ (1,068 ) $ (1,260 ) $ 513 $ (1,822 )

Colleges segment (2) (1,928 ) (2,142 ) (1,563 ) (4,038 ) (9,671 )

Health Education segment (3) (117 ) (289 ) (322 ) (166 ) (894 ) $

(2,052 ) $ (3,499 ) $ (3,145 ) $ (3,691 ) $ (12,387 ) � SEGMENT

LOSS PERCENTAGE: Academy segment -0.1 % -12.9 % -17.6 % 5.9 % -5.5

% College segment -36.1 % -48.7 % -32.0 % -72.7 % -47.9 % Health

Education segment -16.3 % -41.2 % -49.2 % -41.4 % -36.1 % � STUDENT

STARTS: Academy segment 436 333 339 691 1,799 College segment 140

126 199 218 683 Health Education segment 76 � 55 � 47 � 0 � 178 �

652 � 514 � 585 � 909 � 2,660 � � STUDENT POPULATION AS OF: April

30,2006 July 31,2006 October 31,2006 January 31,2007 Academy

segment 2,142 1,777 2,177 2,031 College segment 890 865 953 816

Health Education segment 199 � 187 � 131 � 67 � 3,231 � 2,829 �

3,261 � 2,914 � � (1) Academy segment revenue and segment

income(loss) for the three and twelve months ended December 31,

2006 includes IADT Pittsburgh, Pennsylvania and IADT Toronto,

Canada campuses. IADT Pittsburgh and IADT Toronto are expected to

be taught out by December 2008 and April 2009, respectively. � (2)

Colleges segment revenue and segment loss for the three and twelve

months ended December 31, 2006 includes Brooks College, Long Beach

and Sunnyvale, California campuses. Brooks College, Long Beach and

Brooks College, Sunnyvale are expected to be taught out by December

2008 and June 2008, respectively. � (3) Health Education segment

revenue and segment loss for the three and twelve months ended

December 31, 2006 include SBI Springfield, Massachusetts. SBI

Springfield completed its teach out in September 2007. CAREER

EDUCATION CORPORATION AND SUBSIDIARIES SELECTED QUARTERLY DATA FOR

UNIVERSITY SEGMENT � � � � � � � � � 2008 2007 1Q 2Q 3Q 4Q 1Q 2Q 3Q

4Q Revenue earning days AIU Online 78 84 83 70 84 84 77 70 CTU

Online 77 77 77 77 77 77 77 77 Total 155 161 160 147 161 161 154

147 � � AIU Online CTU Online 2008 2007 2008 2007 Start Grad Start

Grad Start Grad Start Grad � January 1/7 none 1/1 none 1/6 none 1/7

none February 2/11 2/10 2/11 2/4 2/20 2/12 2/21 2/13 March 3/24

3/16 3/18 3/17 none 3/29 none 3/31 Total 1Q dates 3 2 3 2 2 2 2 2 �

April 4/28 4/27 4/29 4/21 4/6 none 4/8 none May none none none none

5/21 5/13 5/23 5/15 June 6/9 6/1 6/3 6/2 none 6/28 none 6/30 Total

2Q dates 2 2 2 2 2 2 2 2 � July 7/21 7/13 7/15 7/7 7/6 none 7/8

none August 8/25 8/24 8/19 8/18 8/20 8/12 8/22 8/14 September none

9/28 none 9/22 none 9/27 none 9/29 Total 3Q dates 2 3 2 3 2 2 2 2 �

October 10/6 none 10/7 none 10/5 none 10/7 none November 11/10 11/9

11/11 11/10 11/19 11/11 11/21 11/13 December none 12/14 none 12/15

none 12/27 none 12/29 Total 4Q dates 2 2 2 2 2 2 2 2

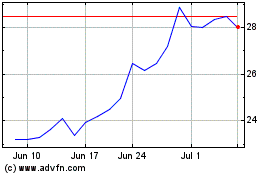

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Sep 2024 to Oct 2024

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Oct 2023 to Oct 2024