MORNING UPDATE: Man Securities Inc. Issues Alerts for NTAP, DE, IPG, IMH, and CECO

February 16 2005 - 9:35AM

PR Newswire (US)

MORNING UPDATE: Man Securities Inc. Issues Alerts for NTAP, DE,

IPG, IMH, and CECO CHICAGO, Feb. 16 /PRNewswire/ -- Man Securities

issues the following Morning Update at 8:30 AM EST with new

PriceWatch Alerts for key stocks. (Logo:

http://www.newscom.com/cgi-bin/prnh/20020214/MANSECLOGO ) Before

the open... PriceWatch Alerts for NTAP, DE, IPG, IMH, and CECO,

Market Overview, Today's Economic Calendar, and the Quote Of The

Day. QUOTE OF THE DAY "The stage is set for further economic

expansion and I expect inflation will remain modest as it has for a

good number of years now." -- Gary Stern, President, Minneapolis

Federal Reserve Bank. New PriceWatch Alerts for NTAP, DE, IPG, IMH,

and CECO... PRICEWATCH ALERTS - HIGH RETURN COVERED CALL OPTIONS --

Network Appliance Corp. (NASDAQ:NTAP) Last Price 34.36 - JUN 30.00

CALL OPTION@ $6.00 -> 5.8 % Return assigned* -- Deere & Co.

(NYSE:DE) Last Price 66.10 - JUN 65.00 CALL OPTION@ $3.90 -> 4.5

% Return assigned* -- Interpublic Group (NYSE:IPG) Last Price 13.44

- JUL 12.50 CALL OPTION@ $1.60 -> 5.6 % Return assigned* --

Impac Mortgage Holdings, Inc. (NYSE:IMH) Last Price 20.15 - APR

20.00 CALL OPTION@ $1.05 -> 4.7 % Return assigned* -- Career

Education Corp. (NASDAQ:CECO) Last Price 39.21 - APR 35.00 CALL

OPTION@ $6.10 -> 5.7 % Return assigned* * To learn more about

how to use these alerts and for our FREE report, "The 18 Warning

Signs That Tell You When To Dump A Stock ", go to:

http://www.investorsobserver.com/mu18 (Note: You may need to copy

the link above into your browser then press the [ENTER] key) ** For

the FREE report, "Is Your Investment Portfolio Disaster Proof? -

Insights, Stocks, And Strategies." go to:

http://www.investorsobserver.com/FREEDP NOTE: All stocks and

options shown are examples only. These are not recommendations to

buy or sell any security. NEWS LEADERS AND LAGGARDS So far today,

Applied Materials Inc., Coca-Cola Co., and Audible Inc. lead the

list of companies with the most news stories while Ultimate

Electronics Inc. and Moody's Corp. are showing a spike in news.

Network Appliance Corp., Applied Materials Inc., and Petrofund

Energy Trust have the highest srtIndex scores to top the list of

companies with positive news while BE Aerospace Inc. and Eyetech

Pharmaceuticals Inc. lead the list of companies with negative news

reports. McAfee Inc. has popped up with a high positive news

sraIndex score. For the FREE article titled, "Earnings Season

Decoded - An Essential 15 Point Checklist For Finding Winning

Stocks." go to: http://www.wallstreetsecretsplus.com/go/freemu/

MARKET OVERVIEW Overseas markets are decidedly lower this morning

with only two of the 15 markets that we track currently in positive

territory. In Europe, the Frankfurt DAX is currently down 0.45

percent while the London FTSE is lower by 0.14 percent. In Asia,

the Japanese Nikkei closed the session down 0.38 percent. The

economic calendar today is quite full and includes reports on

January housing starts, industrial production, and capacity

utilization. In addition, Fed Chairman Greenspan will begin the

first day of a two-day testimony before Congress in which he will

talk about the current state of the U.S. economy. Be prepared for

the investing week ahead with Bernie Schaeffer's FREE Monday

Morning Outlook. For more details and to sign up, go to:

http://www.investorsobserver.com/freemo DYNAMIC MARKET

OPPORTUNITIES The Commerce Department confirmed the theory that

January is the weakest month of the year for retailers. The figures

showed a sharp pullback last month, compared with December 2004. As

consumers decreased their spending after the holiday buying season,

sales slipped 0.3% to US$347.7 billion, following a healthy 1.1%

gain in December. It was the biggest overall decline since August

2004. The culprit was the unpredictable auto sector, which

sputtered badly, sending sales down 3.3% -- the biggest drop since

June -- as dealers reduced incentives and consumers felt compelled

to pay off credit card debt rather than buy a new car. That

combination contributed to a large downward correction from the 4%

sales gain posted in December. Even regular top performers

struggled to sell vehicles. Honda endured a poor 10% sales fall,

while Toyota sales slipped 2%. Fortunately, fellow Japanese

manufacturer Nissan enjoyed a 6% rise. As for the American

companies, Ford couldn't break its depressing streak, with sales

declining for the eighth straight month in January, this time by

12%. And while General Motors took a slight gain, the company still

said inventories are too high and announced a further 2% production

cutback, bringing the total over the past year to 9%. Investors are

also concerned about a possible downgrade to GM's credit rating

from Standard and Poor's later this year. This has Lehman Brothers

moving to adjust its credit rating parameters by July to avoid

doing the same -- a situation that could rattle the corporate bond

market and bring investor risk tolerance down from current high

levels. Excluding the dire auto sales results, retail sales rose

0.6%. That was slightly higher than economists' forecasts, with

apparel sales posting a strong 1.8% gain. Over the past 12 months,

retail sales have climbed 7.2% following a 3.8% gain in consumer

spending last year -- the most since 2000. Economists believe that

figure will slow slightly to around 3.5% this year. Receive

incisive economic/market commentary, profitable advice and access

to a network of leading investment exports. Simply follow this

link: http://www.investorsobserver.com/agora2 TODAY'S ECONOMIC

CALENDAR 7:00 a.m.: MBA Refinancing Index for week ending February

12 (last plus 7.8 percent) 8:30 a.m.: January Housing Starts (last

plus 10.9 percent) 9:15 a.m.: January Indus Production (last plus

0.8 percent) 9:15 a.m.: January Capacity Utilization (last 79.2

percent) 10:00 a.m.: Fed Chairman Greenspan delivers semi-annual

monetary report to US Senate Banking panel in Washington 10:00

a.m.: Treasury Secretary Snow speaks at President's Advisory Panel

on Federal Tax Reform meeting in Washington 10:00 a.m.: Asst

Treasury Secretary Zarate testifies on terror financing before US

House Financial Services panel in Washington Man Securities Inc. is

one of the world's leading option order execution firms. Man's

in-house broker team offers a level of personal service and

experience unavailable from no-frills discount brokers. To improve

your understanding of option pricing get Man's FREE "Margin/Option

Wizard software at: http://www.investorsobserver.com/mancd. Member

CBOE/NASD/SPIC. CRD# 6731 This Morning Update was prepared with

data and information provided by: InvestorsObserver.com - Better

Strategies for Making Money -> For Investors With a Sense of

Humor. Only $1 for your first month plus seven free bonuses worth

over $420, see: http://www.investorsobserver.com/must

247profits.com: You'll get exclusive financial commentary, access

to a global network of experts and undiscovered stock alerts.

Register NOW for the FREE 247profits e-Dispatch. Go to:

http://www.investorsobserver.com/agora Schaeffer's Investment

Research - Sign up for your FREE e-weekly, Monday Morning Outlook,

Bernie Schaeffer's look ahead at the markets. Sign Up Now

http://www.investorsobserver.com/freemo PowerOptionsPlus - The Best

Way To Find, Compare, Analyze, and Make Money On Options

Investments. For a 14-Day FREE trial and 5 FREE bonuses go to:

http://www.poweroptionsplus.com/ All stocks and options shown are

examples only. These are not recommendations to buy or sell any

security and they do not represent in any way a positive or

negative outlook for any security. Potential returns do not take

into account your trade size, brokerage commissions or taxes which

will affect actual investment returns. Stocks and options involve

risk and are not suitable for all investors and investing in

options carries substantial risk. Prior to buying or selling

options, a person must receive a copy of Characteristics and Risks

of Standardized Options available from Sharon at 800-837-6212 or at

http://www.cboe.com/Resources/Intro.asp. Privacy policy available

upon request.

http://www.newscom.com/cgi-bin/prnh/20020214/MANSECLOGO

http://photoarchive.ap.org/ DATASOURCE: Man Securities CONTACT:

John Gannon of Man Securities Inc., +1-800-837-6212 Web site:

http://www.mansecurities.com/mu.html

Copyright

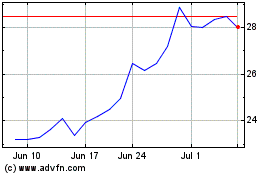

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Sep 2024 to Oct 2024

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Oct 2023 to Oct 2024