0001672909

Canterbury Park Holding Corp

false

--12-31

FY

2022

19,250

19,250

0.01

0.01

10,000,000

10,000,000

4,888,975

4,888,975

4,812,085

4,812,085

6

0

0

2,303

3,117

6

0

0

0

0

108,000

1

4

0

0

22,339

23,795

7

5

166,400

166,400

166,400

4

2

Finance lease assets are net of accumulated amortization of $106,586 and $79,524 for the years ended December 31,

2022 and 2021, respectively.

00016729092022-01-012022-12-31

iso4217:USD

00016729092022-06-30

xbrli:shares

00016729092023-03-21

thunderdome:item

00016729092022-12-31

00016729092021-12-31

iso4217:USDxbrli:shares

0001672909us-gaap:CasinoMember2022-01-012022-12-31

0001672909us-gaap:CasinoMember2021-01-012021-12-31

0001672909cphc:ParimutuelMember2022-01-012022-12-31

0001672909cphc:ParimutuelMember2021-01-012021-12-31

0001672909us-gaap:FoodAndBeverageMember2022-01-012022-12-31

0001672909us-gaap:FoodAndBeverageMember2021-01-012021-12-31

0001672909us-gaap:ProductAndServiceOtherMember2022-01-012022-12-31

0001672909us-gaap:ProductAndServiceOtherMember2021-01-012021-12-31

00016729092021-01-012021-12-31

0001672909cphc:OtherParimutuelExpensesMember2022-01-012022-12-31

0001672909cphc:OtherParimutuelExpensesMember2021-01-012021-12-31

0001672909us-gaap:PublicUtilitiesMember2022-01-012022-12-31

0001672909us-gaap:PublicUtilitiesMember2021-01-012021-12-31

0001672909us-gaap:CommonStockMember2020-12-31

0001672909us-gaap:AdditionalPaidInCapitalMember2020-12-31

0001672909us-gaap:RetainedEarningsMember2020-12-31

00016729092020-12-31

0001672909us-gaap:CommonStockMember2021-01-012021-12-31

0001672909us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-31

0001672909us-gaap:RetainedEarningsMember2021-01-012021-12-31

0001672909us-gaap:CommonStockMember2021-12-31

0001672909us-gaap:AdditionalPaidInCapitalMember2021-12-31

0001672909us-gaap:RetainedEarningsMember2021-12-31

0001672909us-gaap:CommonStockMember2022-01-012022-12-31

0001672909us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-31

0001672909us-gaap:RetainedEarningsMember2022-01-012022-12-31

0001672909us-gaap:CommonStockMember2022-12-31

0001672909us-gaap:AdditionalPaidInCapitalMember2022-12-31

0001672909us-gaap:RetainedEarningsMember2022-12-31

xbrli:pure

utr:Y

0001672909us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2022-01-012022-12-31

0001672909us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2022-01-012022-12-31

0001672909us-gaap:BuildingMembersrt:MinimumMember2022-01-012022-12-31

0001672909us-gaap:BuildingMembersrt:MaximumMember2022-01-012022-12-31

0001672909us-gaap:LandMember2022-12-31

0001672909us-gaap:LandMember2021-12-31

0001672909us-gaap:BuildingAndBuildingImprovementsMember2022-12-31

0001672909us-gaap:BuildingAndBuildingImprovementsMember2021-12-31

0001672909us-gaap:FurnitureAndFixturesMember2022-12-31

0001672909us-gaap:FurnitureAndFixturesMember2021-12-31

0001672909us-gaap:ConstructionInProgressMember2022-12-31

0001672909us-gaap:ConstructionInProgressMember2021-12-31

0001672909us-gaap:EmployeeStockOptionMember2022-01-012022-12-31

0001672909us-gaap:EmployeeStockOptionMember2021-01-012021-12-31

0001672909cphc:LongTermIncentiveAndRestrictedStockUnitMember2022-01-012022-12-31

0001672909cphc:LongTermIncentiveAndRestrictedStockUnitMember2021-01-012021-12-31

0001672909cphc:EmployeeStockPurchasePlanMember2022-01-012022-12-31

0001672909cphc:EmployeeStockPurchasePlanMember2022-12-31

utr:M

0001672909cphc:KSOPMember2022-01-012022-12-31

0001672909cphc:StockRepurchaseProgramMember2007-12-31

0001672909cphc:StockRepurchaseProgramMember2007-01-012011-12-31

0001672909cphc:StockRepurchaseProgramMember2012-12-31

0001672909cphc:StockRepurchaseProgramMember2021-01-012021-12-31

0001672909cphc:StockRepurchaseProgramMember2022-01-012022-12-31

0001672909cphc:SalariesAndBenefitsMember2022-01-012022-12-31

0001672909cphc:SalariesAndBenefitsMember2021-01-012021-12-31

0001672909cphc:StockPlan1994Member2022-12-31

0001672909cphc:CphcLongTermIncentivePlanLtiPlanMember2022-01-012022-12-31

0001672909cphc:EmployeeDeferredStockAwardMembercphc:CphcLongTermIncentivePlanLtiPlanMember2022-01-012022-12-31

0001672909cphc:EmployeeDeferredStockAwardMembercphc:CphcLongTermIncentivePlanLtiPlanMember2021-01-012021-12-31

0001672909cphc:NonemployeeBoardMemberStockOptionAndRestrictedStockMembersrt:DirectorMember2022-01-012022-12-31

0001672909cphc:NonemployeeBoardMemberStockOptionAndRestrictedStockMember2021-12-31

0001672909cphc:NonemployeeBoardMemberStockOptionAndRestrictedStockMember2022-01-012022-12-31

0001672909cphc:NonemployeeBoardMemberStockOptionAndRestrictedStockMember2022-12-31

0001672909cphc:EmployeeDeferredStockAwardMember2022-01-012022-12-31

0001672909cphc:EmployeeDeferredStockAwardMember2021-01-012021-12-31

0001672909cphc:EmployeeDeferredStockAwardMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2022-01-012022-12-31

0001672909cphc:EmployeeDeferredStockAwardMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2022-01-012022-12-31

0001672909cphc:EmployeeDeferredStockAwardMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2022-01-012022-12-31

0001672909cphc:EmployeeDeferredStockAwardMember2021-12-31

0001672909cphc:EmployeeDeferredStockAwardMember2022-12-31

0001672909us-gaap:EmployeeStockOptionMember2022-01-012022-12-31

0001672909us-gaap:EmployeeStockOptionMember2021-01-012021-12-31

0001672909us-gaap:RevolvingCreditFacilityMember2022-12-31

0001672909cphc:LandBuildingsAndEquipmentNetMember2022-12-31

0001672909cphc:LandBuildingsAndEquipmentNetMember2021-12-31

0001672909cphc:OperatingLeaseRightofuseAssetsMember2022-12-31

0001672909cphc:OperatingLeaseRightofuseAssetsMember2021-12-31

00016729092014-03-302014-03-30

0001672909cphc:NewTotalizatorProviderMember2022-03-012022-03-01

0001672909cphc:NewTotalizatorProviderMember2022-01-012022-12-31

0001672909cphc:NewTotalizatorProviderMember2022-12-31

0001672909cphc:IndemnityAgreementMember2021-12-21

0001672909cphc:IndemnityAgreementMember2022-10-27

0001672909cphc:MinnesotaRacingCommissionBondMember2022-12-31

0001672909us-gaap:OperatingSegmentsMembercphc:HorseRacingMember2022-01-012022-12-31

0001672909us-gaap:OperatingSegmentsMembercphc:CardCasinoMember2022-01-012022-12-31

0001672909us-gaap:OperatingSegmentsMembercphc:FoodAndBeverageSegmentMember2022-01-012022-12-31

0001672909us-gaap:OperatingSegmentsMembercphc:DevelopmentMember2022-01-012022-12-31

0001672909us-gaap:OperatingSegmentsMember2022-01-012022-12-31

0001672909us-gaap:IntersegmentEliminationMembercphc:HorseRacingMember2022-01-012022-12-31

0001672909us-gaap:IntersegmentEliminationMembercphc:CardCasinoMember2022-01-012022-12-31

0001672909us-gaap:IntersegmentEliminationMembercphc:FoodAndBeverageSegmentMember2022-01-012022-12-31

0001672909us-gaap:IntersegmentEliminationMembercphc:DevelopmentMember2022-01-012022-12-31

0001672909us-gaap:IntersegmentEliminationMember2022-01-012022-12-31

0001672909cphc:HorseRacingMember2022-01-012022-12-31

0001672909cphc:CardCasinoMember2022-01-012022-12-31

0001672909cphc:FoodAndBeverageSegmentMember2022-01-012022-12-31

0001672909cphc:DevelopmentMember2022-01-012022-12-31

0001672909us-gaap:OperatingSegmentsMembercphc:HorseRacingMember2022-12-31

0001672909us-gaap:OperatingSegmentsMembercphc:CardCasinoMember2022-12-31

0001672909us-gaap:OperatingSegmentsMembercphc:FoodAndBeverageSegmentMember2022-12-31

0001672909us-gaap:OperatingSegmentsMembercphc:DevelopmentMember2022-12-31

0001672909us-gaap:OperatingSegmentsMember2022-12-31

0001672909us-gaap:OperatingSegmentsMembercphc:HorseRacingMember2021-01-012021-12-31

0001672909us-gaap:OperatingSegmentsMembercphc:CardCasinoMember2021-01-012021-12-31

0001672909us-gaap:OperatingSegmentsMembercphc:FoodAndBeverageSegmentMember2021-01-012021-12-31

0001672909us-gaap:OperatingSegmentsMembercphc:DevelopmentMember2021-01-012021-12-31

0001672909us-gaap:OperatingSegmentsMember2021-01-012021-12-31

0001672909us-gaap:IntersegmentEliminationMembercphc:HorseRacingMember2021-01-012021-12-31

0001672909us-gaap:IntersegmentEliminationMembercphc:CardCasinoMember2021-01-012021-12-31

0001672909us-gaap:IntersegmentEliminationMembercphc:FoodAndBeverageSegmentMember2021-01-012021-12-31

0001672909us-gaap:IntersegmentEliminationMembercphc:DevelopmentMember2021-01-012021-12-31

0001672909us-gaap:IntersegmentEliminationMember2021-01-012021-12-31

0001672909us-gaap:OperatingSegmentsMembercphc:HorseRacingMember2021-12-31

0001672909us-gaap:OperatingSegmentsMembercphc:CardCasinoMember2021-12-31

0001672909us-gaap:OperatingSegmentsMembercphc:FoodAndBeverageSegmentMember2021-12-31

0001672909us-gaap:OperatingSegmentsMembercphc:DevelopmentMember2021-12-31

0001672909us-gaap:OperatingSegmentsMember2021-12-31

0001672909srt:ReportableLegalEntitiesMember2022-01-012022-12-31

0001672909srt:ReportableLegalEntitiesMember2021-01-012021-12-31

0001672909srt:ReportableLegalEntitiesMember2022-12-31

0001672909srt:ReportableLegalEntitiesMember2021-12-31

0001672909us-gaap:IntersegmentEliminationMember2022-12-31

0001672909us-gaap:IntersegmentEliminationMember2021-12-31

0001672909cphc:CooperativeMarketingAgreementCMA1Member2022-12-31

0001672909cphc:CooperativeMarketingAgreementCMA1Member2022-12-31

0001672909us-gaap:ProductAndServiceOtherMembercphc:CooperativeMarketingAgreementCMA1Member2022-01-012022-12-31

0001672909cphc:CooperativeMarketingAgreementCMA1Member2022-01-012022-12-31

0001672909us-gaap:ProductAndServiceOtherMembercphc:CooperativeMarketingAgreementCMA1Member2021-01-012021-12-31

0001672909cphc:CooperativeMarketingAgreementCMA1Member2021-01-012021-12-31

utr:acre

0001672909cphc:DoranCanterburyIiMember2018-09-27

0001672909cphc:DoranCanterburyIiMember2022-01-012022-12-31

0001672909cphc:DoranCanterburyIiMember2021-01-012021-12-31

0001672909cphc:DoranCanterburyIiMember2022-12-31

0001672909cphc:DoranCanterburyIiMember2021-12-31

0001672909cphc:IndemnityAgreementMember2022-12-31

0001672909cphc:DoranCanterburyIiMember2020-07-30

0001672909cphc:DoranCanterburyIiLlcMembercphc:DoranCanterburyIiMember2020-07-30

0001672909cphc:CanterburyDBSVMember2020-06-16

0001672909cphc:CanterburyDBSVMember2022-01-012022-12-31

0001672909cphc:CanterburyDBSVMember2021-01-012021-12-31

00016729092022-01-252022-01-25

00016729092022-01-25

0001672909us-gaap:StateAndLocalJurisdictionMember2022-12-31

0001672909us-gaap:StateAndLocalJurisdictionMember2021-12-31

00016729092020-04-07

00016729092020-04-072020-04-07

00016729092021-04-30

00016729092021-04-012021-04-30

00016729092022-05-20

00016729092022-05-202022-05-20

00016729092020-04-15

00016729092020-04-152020-04-15

0001672909us-gaap:LandMember2022-01-012022-12-31

0001672909us-gaap:LandMember2021-01-012021-12-31

0001672909cphc:DoranCanterburyIAndIiJointVenturesMember2022-12-31

0001672909cphc:DoranCanterburyIAndIiJointVenturesMemberus-gaap:PrimeRateMember2022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ☒ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022

OR

| ☐ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition period from ______ to ______

Commission File Number: 001-37858

| CANTERBURY PARK HOLDING CORPORATION |

| (Exact Name of Registrant as Specified in its Charter) |

| Minnesota | | 47-5349765 |

| (State or Other Jurisdiction

of Incorporation or Organization) | | (I.R.S. Employer

Identification No.) |

| | 1100 Canterbury Road Shakopee, MN 55379 | |

| | (Address of principal executive offices and zip code) | |

| | Registrant’s telephone number, including area code: (952) 445-7223 | |

| | | |

| | Securities registered pursuant to Section 12(b) of the Act: | |

| Title of Each Class | Symbol | Name of Exchange on which Registered |

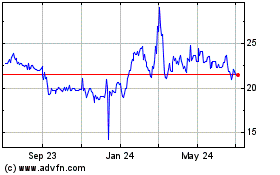

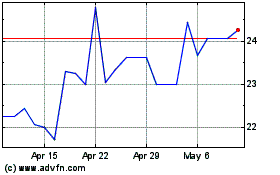

| Common Stock, $.01 par value | CPHC | Nasdaq Stock Market |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Non-accelerated filer | ☒ |

| Accelerated filer | ☐ | Smaller reporting company | ☒ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

The aggregate market value of common stock held by non-affiliates based on the price at which the Company’s common stock was last sold on the Nasdaq Global Market, on June 30, 2022, the end of the registrant’s most recently completed second fiscal quarter, was $79,222,296. On March 21, 2023, the Company had 4,896,894 shares of common stock, $.01 par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company’s definitive Proxy Statement for its 2023 Annual Meeting of Shareholders, which will be filed within 120 days of the Company's fiscal year end of December 31, 2022, are incorporated by reference into Part III of this Form 10-K.

CANTERBURY PARK HOLDING CORPORATION

FORM 10-K ANNUAL REPORT

FOR THE YEAR ENDED December 31, 2022

TABLE OF CONTENTS

Item 1. BUSINESS

Available Information

The SEC maintains a website at http://www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers, including Canterbury Park Holding Corporation, that file electronically with the Securities and Exchange Commission (SEC). The Company files annual reports, quarterly reports, proxy statements and other documents with the SEC under the Securities Exchange Act of 1934 (Exchange Act).

We also make available free of charge through our website (www.canterburypark.com) the reports and other documents that we file with the SEC, including the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and, if applicable, amendments to those reports filed or furnished pursuant to the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the SEC.

Overview

Canterbury Park Holding Corporation (the “Company,” “we,” “our,” or “us”) is the holding company for and parent company of two subsidiaries, Canterbury Park Entertainment LLC (“Canterbury Entertainment”) and Canterbury Development (“Canterbury Development”) and an indirect subsidiary Canterbury Park Concessions, Inc. which is wholly-owned by Canterbury Entertainment. As used herein, the term “Company” or “we” includes Canterbury Park Holding Corporation and its subsidiaries unless the context indicates otherwise.

We divide our business into four segments: (i) horse racing, (ii) Casino, (iii) food and beverage, and (iv) real estate development. The horse racing segment represents our pari-mutuel wagering operations on simulcast and live horse races; the Casino segment represents our unbanked card operations; the food and beverage segment includes concessions, catering, and events services provided at the Racetrack; and the development segment represents our real estate development operations. We conduct our (i) horse racing, (ii) Casino, and (iii) food and beverage segments through Canterbury Entertainment. We conduct our real estate development segment through Canterbury Development.

Canterbury Park Entertainment

Through Canterbury Entertainment, we host pari-mutuel wagering on thoroughbred and quarter horse races and “unbanked” card games at our Canterbury Park Racetrack and Casino facility (the “Racetrack”) in Shakopee, Minnesota, which is approximately 25 miles southwest of downtown Minneapolis. The Racetrack is the only facility in the State of Minnesota that offers live pari-mutuel thoroughbred and quarter horse racing. Our pari-mutuel wagering operations include both wagering on thoroughbred and quarter horse races during live meets at the Racetrack and year-round wagering on races held at out-of-state racetracks that are televised simultaneously at the Racetrack (“simulcasting”). Unbanked card games, in which patrons compete against each other, are hosted in the Casino at the Racetrack. The Casino has historically operated 24 hours a day, seven days a week and has historically offered both poker and table games at up to 80 tables. We also derive revenues from related services and activities, such as food and beverage, parking, advertising signage, publication sales, and catering and events held at the Racetrack. The ownership and operation of the Racetrack and the Casino are significantly regulated by the Minnesota Racing Commission (“MRC”). Canterbury Entertainment is the direct owner of all land, facilities, and substantially all other assets related to our pari-mutuel wagering, Casino, concessions and other related businesses (“Racetrack Operations”), and is subject to direct regulation by the MRC. We own approximately 300 acres of land as of December 31, 2022, in Shakopee, Minnesota where the Racetrack is located.

Traditionally, our revenues have been principally derived from three activities: Casino operations, wagering on live and simulcast horse races, and food and beverage sales. For the year ended December 31, 2022, revenues from Casino operations represented 60.2% of total revenues, wagering on horse races generated 26.3% of total revenues, and food and beverage revenue represented 13.5% of total revenues. These components of revenue are described in more detail below.

In the first half of 2021, the continuing COVID-19 pandemic had a negative impact on the financial condition and operations of the segments within Canterbury Entertainment, although to a much lesser extent than 2020. We temporarily suspended all Casino, simulcast, and special event operations at Canterbury Park for a total of approximately one week at the beginning of January 2021. Additionally, effective May 28, 2021, all capacity limits, restrictions on large gatherings, and other restrictions, which had been implemented in response to the impact of the COVID-19 pandemic, were lifted and our Racetrack began operating under pre-pandemic guidelines. Our Casino also began operating without capacity restrictions effective May 28, 2021, but we maintained throughout the balance of 2021 and throughout 2022 and intend to maintain certain operational changes and improvements initiated in 2020 in response to the COVID-19 pandemic. In 2022, our horse racing, Casino, and food and beverage operations were not subject to any COVID-19 related closures or capacity limitations.

Horse Racing Operations

The Company’s horse racing operations consist of year-round simulcasting of horse races from around the U.S. and internationally, and wagering on live thoroughbred and quarter horse races (“live meets”) held on a seasonal basis beginning in May and generally concluding in September each year. At the Racetrack, various aspects of our operations are subject to approval by the MRC and the organization that represents a majority of the owners and trainers of the horses who race at the Racetrack, which is the Minnesota Horsemen’s Benevolent and Protective Association (“MHBPA”).

All of the wagering on simulcast and live horse races at the Racetrack is pari-mutuel wagering. In pari-mutuel wagering, bettors wager against each other in a pool, rather than against the operator of the facility or with preset odds. From the total handle wagered, the Minnesota Pari-Mutuel Horse Racing Act (the “Minnesota Racing Act”) specifies the maximum percentage, referred to as the “takeout,” that may be withheld by the Racetrack, with the balance returned to the winning bettors.

Pari-mutuel wagering can be divided into two categories: straight wagering pools and multiple wagering pools, which are also referred to as “exotic” wagering pools. Examples of straight wagers include: “win,” “place,” and “show.” Examples of exotic wagers include: “daily double,” “exacta,” ”trifecta,” and “pick four.”

The amount of takeout earned by the Company on pari-mutuel wagering depends on where the race is run and the form of wager (straight or exotic). The total maximum takeouts are 17% from straight wagering pools and 23% from exotic wagering pools. From this takeout, Minnesota law requires deductions for purses, pari-mutuel taxes, and payments to the Minnesota Breeders’ Fund (“MBF”). The balance of the takeout remaining after these deductions is commonly referred to as the “retainage.”

While the Minnesota Racing Act regulates that a minimum of 8.4% of the live racing handle be paid as purses to the owners of the horses, purse contributions from other sources are governed by a Horse Association Agreement dated June 4, 2012 by and among the Company, the Shakopee Mdewakanton Sioux Community (“SMSC”), a federally recognized Indian tribe, and the horsepersons’ associations: the MHBPA, the Minnesota Thoroughbred Association (“MTA”) and the Minnesota Quarter Horse Racing Association (“MQHRA”). The MHBPA is the horseperson’s organization representing the majority of horsepersons at the Racetrack.

In addition, the MBF receives 1% of the handle. The current pari-mutuel tax applicable to wagering on all simulcast and live races is 6% of takeout in excess of $12 million during the twelve-month period beginning July 1 and ending the following June 30.

Net revenues from pari-mutuel wagering on live races run at the Racetrack consist of the total amount wagered, less the amounts paid (i) to winning patrons, (ii) for purses, (iii) to the MBF and (iv) for pari-mutuel taxes to the State of Minnesota. Net revenues from pari-mutuel wagering on races being run at out-of-state racetracks and simulcast to the Racetrack have similar expenses but also include a host fee payment to the host track. The host fee, which is calculated as a percentage of monies wagered (generally 3.0% to 10.0%), is negotiated with the host track and must comply with state laws governing the host track. Pari-mutuel revenues also include commission and breakage revenues on live on-track and simulcast racing, fees received from out-of-state racetracks for wagering on our live races and proceeds from unredeemed pari-mutuel tickets.

Additionally, Minnesota Advanced Deposit Wagering (“ADW”) legislation allows Minnesota residents to engage in pari-mutuel wagering on out-of-state horse races online with a prefunded account through an ADW provider. The Company collects a percentage of monies wagered (generally 2.75% to 5.0%) by Minnesota residents through the ADW provider as a source market fee. The Company pays 28% of the collected revenues to another Minnesota-based horse track, and records the remaining 72% as revenues and records expenses of at least 50% for purses and breeders’ awards.

For the years ended

December 31, 2022 and 2021, the Racetrack hos

ted 64 and 65 days, respectively, of live racing beginning in May and concluding in September. In 2022, the Company had one day of live racing cancelled due to inclement weather. Currently, Minnesota law requires the Company to schedule a minimum of 125 days of live racing annually, unless a majority of horsepersons at the Racetrack agree to a fewer number of live racing days. Pursuant to a consent and waiver dated June 1, 2020, the MHBPA agreed to waive the minimum of 125 days of racing required in 2020, provided that there were 65 scheduled live racing days each year beginning in 2021.

From June 4, 2012 to December 31, 2022, we were a party to a Cooperative Marketing Agreement (“CMA”) with the Shakopee Mdewakanton Sioux Community (“SMSC”), a federally recognized Indian tribe. The primary purpose of the CMA was to increase purses paid during live horse racing at Canterbury Park’s Racetrack in order to strengthen Minnesota’s thoroughbred and quarter horse industry. During the term of the CMA, the Company agreed not to promote or lobby the Minnesota legislature for expanded gambling authority and would support the SMSC’s lobbying efforts against expanding gambling authority.

On June 1, 2020, we entered into a Fifth Amendment Agreement to the CMA, which became effective on June 8, 2020 upon MRC approval. Under the Fifth Amendment, the SMSC paid an annual purse enhancement of $7,280,000 for 2022, which was the same amount payable with respect to 2021. Additionally, the SMSC paid an annual marketing payment under the CMA of $1,620,000 for each of 2021 and 2022. Following the expiration of the CMA on December 31, 2022, we will not receive any purse enhancement, marketing payments or other amounts under the CMA.

If, for any reason, the Horse Association Agreement is terminated or we otherwise cease to benefit from the Horse Association Agreement, the Company’s operations could be adversely affected by a decrease in the daily purses, potential reduction in the quality of horses, lower attendance, lower overall average amount wagered (“handle”), and substantially greater operating expenses.

Simulcasting is the process by which live horse races held at one facility (the “host track”) are transmitted simultaneously to other locations to allow patrons at each receiving location (the “guest track”) to place wagers on races transmitted from the host track. Monies are collected at the guest track and the information with respect to the total amount wagered is electronically transmitted to the host track. All of the amounts wagered at guest tracks are combined into the appropriate pools at the host track with the final odds and payouts based upon all the monies in the respective pools.

The Company is able to offer simulcast racing from up to 20 racetracks per day, seven days a week, 364 days per year, including Churchill Downs, Santa Anita, Gulfstream Park, Belmont Park, and Saratoga Racecourse. In addition, races of national interest, such as the Kentucky Derby, the Preakness Stakes, the Belmont Stakes, and the Breeders’ Cup supplement the regular simulcast program. The Company regularly evaluates its agreements with other racetracks to offer the most popular simulcast signals of live horse racing that are reasonably available.

Under federal and state law, in order to conduct simulcast operations either as a host or guest track, the Company must obtain the consent of the MRC and the MHBPA as the organization that represents a majority of the owners and trainers of the horses who race at the Racetrack. As these consents are obtained annually, no assurance can be given that the MRC and the MHBPA will allow the Company to conduct simulcast operations either as a host or guest track in 2023 or future years. If either the MRC or the MHBPA do not consent, the Company’s operations could be adversely affected by a decrease in pari-mutuel revenue, potential reduction in the quality of horses, lower attendance, and lower overall handle.

The Casino may offer gaming 24 hours per day, seven days per week, and offers two forms of unbanked card games: poker and table games.

Poker games, including Texas Hold ‘Em, Stud, and Omaha, with betting limits per hand ranging between $2 and $100, are currently offered in the poker room. A dealer employed by the Company regulates the play of the game at each table and deals the cards but does not participate in play. In poker games, the Company is allowed to deduct a percentage from the accumulated wagers and impose other charges for hosting the activity but does not have an interest in the outcome of a game. The Company may add additional prizes, awards, or money to any game for promotional purposes.

As of March 2023, the Casino was offering the following table games: Blackjack, Mississippi Stud, Fortune Pai Gow, Three Card Poker, Four Card Poker, Ultimate Texas Hold ‘Em, EZ Baccarat, Criss Cross Poker, Free Bet Blackjack, and I Luv Suits. The Company has the option to offer banked games under the Minnesota law governing Casino operations but currently only offers “unbanked” games. “Unbanked” refers to a wagering system or game where wagers lost in card games are accumulated into a player pool liability for purposes of enhancing the total amount paid back to winning players. The Company can only serve as custodian of the player pool, may not have an active interest in any card game, and does not recognize amounts that dealers “win” or “lose” during the course of play as revenue.

The primary source of table games revenue is a percentage of the buy in received from the players, aggregated up to 20% per day, as defined by the MRC regulations, as compensation for providing the Casino facility and services, referred to as “collection revenue.” In addition, several table games offer a progressive jackpot. The player has the option of playing the jackpot with the opportunity to win some or the entire jackpot amount, depending upon the player’s hand.

The primary source of poker revenue the Company collects is a “rake” of 5-10%, depending on the limit of the game, of the poker pot up to a maximum of $4 per hand. In addition, poker games offer progressive jackpots for most games. In order to fund the poker jackpot pools, the dealer withholds $2 from each final pot in excess of the $15 minimum.

Under Minnesota law, the Company is required to pay 10% of the first $6 million of gross Casino revenues towards purses for live horse racing at the Racetrack. After meeting the $6 million threshold, the Company must pay 14% of gross Casino revenues as purse monies. Of funds allocated for purses, the Company pays 10% of the purse monies to the Minnesota Breeders’ Fund (the “MBF”), which is a fund apportioned by the MRC among various purposes related to Minnesota’s horse breeding and horse racing industries. The remaining 90% of purse monies are divided between thoroughbred (90%) and quarter horse (10%) purse funds.

Food and Beverage Operations

We derive revenue from our food and beverage operations through sales at concession stands, restaurant and buffet, bars, and other food venues. The Company currently offers two, year-round café style restaurants and full service bars within the Casino and simulcast area. The Casino offers tableside menu service generally 24 hours a day. Our Triple Crown Club offers lounge services along with a buffet restaurant. During live racing, a wide variety of concession style food and beverage options are available to our guests.

The food and beverage operations also include our catering and events services. We have one of the largest event spaces in the Twin Cities with more than 100,000 square feet of available space. Our facilities provide a variety of purposes for year-round events and other activities. Our event space has been used for craft shows, trade shows, pool and poker tournaments, automobile and other utility vehicle shows, major art shows, and fundraisers. Our outdoor spaces have been used for concerts, snowmobile races, and other competitions. The infield of the Racetrack is also used as a concert and event area. In addition to event space, we offer space in our horse stable area for rent for boat storage during the winter months.

Development Operations

Beginning in 2015, we began executing our development plan for Company land that was not necessary to conduct our Racetrack Operations (grandstand, racetrack, stable area, parking areas, and land for other facilities including the expo center). Canterbury Development is not subject to direct regulation by the MRC. Originally, approximately 140 acres were considered underutilized and were targeted for real estate development by Canterbury Development complementary with our Racetrack Operations.

In 2022, Canterbury Development continued to pursue various development opportunities for the underutilized land in a project known as Canterbury Commons™. Canterbury Development continues to pursue various mixed use development opportunities, such as residential development, office, restaurants, hotel, entertainment, and retail operations. As of December 31, 2022, Canterbury Development has contributed approximately 36 acres of land to three separate joint ventures described below.

In addition, we have agreed to sell several parcels of land to third parties that will then develop the property as described below. Although we will have no continuing ownership in these land sales, we believe the future developments of this property contribute to the overall vitality of Canterbury Commons and drive visitation and spend to Canterbury Park.

The following is a summary of our real estate development projects within Canterbury Commons as of December 31, 2022:

● Our first real estate development project in Canterbury Commons began in 2018 with a joint venture agreement between Canterbury Development and an affiliate of Doran Companies (“Doran”) for the development of the upscale Triple Crown Residences at Canterbury Park.

○ In September 2018, Canterbury Development contributed approximately 13 acres of land as its equity contribution in the Doran Canterbury I joint venture and became a 27.4% equity member. Construction of the 321-unit Phase I, which was developed pursuant to the first joint venture agreement, began in late 2018 with initial occupancy on part of the building in June 2020.

Remaining units were completed and available for occupancy by the end of 2020.

○ In August 2020, Doran exercised its option for Phase II of the project, which will include an additional 305 residential units, and the Company entered into a second joint venture agreement with Doran. Pursuant to this second agreement, in early August 2020, the Company transferred roughly 10 acres of land to the second joint venture with Doran. In addition to receiving 27.4% ownership in the Doran Phase II joint venture, the exchange resulted in the repayment of a $2.9 million note receivable which was on the Company’s balance sheet as a related party receivable as of June 30, 2020. Groundwork on the Doran Canterbury II site began in October 2020, paving the way for the ground-up construction of the second phase of apartments, which began construction in March 2022.

○ As a result of these joint ventures, Canterbury Development holds a 27.4% equity interest in Doran Canterbury I, LLC governed by an operating agreement effective as of March 1, 2018 with Doran Shakopee LLC, and Canterbury Development holds a 27.4% equity interest in Doran Canterbury II, LLC governed by an operating agreement effective as of July 30, 2020 with Doran Shakopee LLC and amended October 1, 2021.

● Development work related to the Company’s joint venture with Greystone Construction (“Greystone”) is also underway on the southwest portion of the Canterbury Commons site. Pursuant to this joint venture, Greystone is developing a 13-acre land parcel with potential uses expected to include hospitality, dining, residential, commercial and service-oriented retail. The land and infrastructure improvements were completed in 2021.

○ Greystone’s development work to date is primarily for a new 28,000 square foot office building, with Greystone occupying the second floor as its new corporate headquarters. The project was completed in the 2021 third quarter and a lease was executed for the majority of the s

pace resulting in 84% building occupancy. The joint venture is governed by an operating agreement with an affiliate of Greystone and Canterbury Development, as the two members of a Minnesota limited liability company named Canterbury DBSV Development, LLC (Canterbury DBSV). Canterbury Development’s equity contribution to Canterbury DBSV was approximately 13 acres of land, which was contributed to Canterbury DBSV on July 1, 2020. In connection with its contribution, Canterbury Development became a 61.87% equity member in Canterbury DBSV.

○ Additionally, during the fourth quarter of 2022, Canterbury DBSV transferred 1.46 acres of land as an equity contribution into a joint venture. The joint venture is governed by an operating agreement with Winners Circle Drive, LLC and Canterbury DBSV, as the two members of a Minnesota limited liability company named SW Gateway, LLC. In connection with its contribution, Canterbury DBSV became a 45.9% equity member in SW Gateway, LLC. The land will be used for the development of a new 11,000 square foot building to be occupied by a local restaurant and brewery.

○ Finally, during the fourth quarter of 2022, Canterbury DBSV sold 1.68 acres of land to A&M Kerber Holdings, LLC for total consideration of approximately $925,000 for the construction of a Next Steps Learning Center and child care facility.

● In April 2020, Canterbury Development entered into two agreements to sell approximately 14 acres of land on the west side of the Racetrack to Pulte Homes of Minnesota ("Pulte") and Lifestyle Communities for total consideration of approximately $3,500,000. Closing of the Lifestyle Communities and the first phase of the Pulte transactions occurred in April 2021, totaling approximately 9.8 acres. The closing of phase two of the Pulte transaction and the sale of the remaining 4.2 acres occurred in June 2022.

○ Development approvals by Pulte on 109 new for sale row homes and townhome residences at Canterbury Commons was completed in late 2020. The project received its approvals from the City of Shakopee in a joint planned urban development application with Lifestyle Communities who is located adjacent to the townhome project. Ground improvements and utility work commenced in early 2021 for both projects. Lifestyle Communities will be a 4-story 56-unit age restricted active senior cooperative community. The building is programmed with over 5,000 square feet of amenity spaces and outdoor spaces. Pulte has initiated ground up construction of a number of townhome buildings and its first model units were completed in the first quarter of 2022.

● In September 2021, the Company entered into a purchase agreement to sell approximately 40 acres of land on the northeast corner of the Racetrack to Minneapolis-based Swervo Development Corporation ("Swervo"). Swervo intends to construct a 19,000 seat amphitheater as part of the Canterbury Commons development. Closing of the land sale is expected to occur in the first half of 2023. The Company and Swervo received regulatory approval of the amphitheater development in the 2022 fourth quarter. Canterbury plans to invest in significant improvements to its horse stabling area in connection with the land sale and amphitheater development. We have finalized our stable area improvement plan, and are awaiting grading and utility permits from the city to begin the barn relocation and redevelopment process. This $1

5 million barn area redevelopment project will continue the Company’s ongoing commitment to provide quality horse racing in the state of Minnesota as well as allow for future development of Canterbury’s underutilized land.

In addition to the aforementioned projects, the Company continues to make progress with developer and partner selection for the other development opportunities within Canterbury Commons. The initial development portfolio was weighted heavily in the residential segment with nearly 900 units of multifamily and over 100 units of for sale townhomes. The Company anticipates more opportunity and focus in the entertainment, office, retail, and hospitality segments in the later phases of the Canterbury Commons development. Canterbury expects to make additional announcements of new partners for this phase in the future.

See footnote 12 of the consolidated financial statements for more detailed information on recent transactions and development activity.

Competition

The Company faces direct competition from Running Aces Harness Park ("Running Aces") in Columbus Township, Anoka County, Minnesota, a racetrack and card room that is located approximately 50 miles from Canterbury Park. Running Aces offers pari-mutuel wagering on live races of standardbred (“harness”) horses on a seasonal basis and year round wagering on simulcasting of all breeds of horse races. In addition to pari-mutuel wagering, Running Aces operates a card room that directly competes with the Company’s Casino.

The Company operates in a highly competitive wagering and gaming environment with a large number of participants. The Company competes with competitive wagering operations and activities that include tribal casinos, state-sponsored lotteries, and other forms of legalized gaming in the U.S. and other jurisdictions. The Company competes with a number of tribal casinos in the State of Minnesota that offer video slot machines, table games, and both banked and unbanked card games, including Minnesota’s largest casino, Mystic Lake, which is located approximately four miles from the Racetrack and which is owned by the Shakopee Mdewakanton Sioux Community.

Additionally, Internet-based interactive gaming and wagering is growing rapidly and adversely affects all forms of wagering offered by the Company. Legislation became effective November 1, 2016 in Minnesota that allowed the Company to begin collecting source market fees from companies that offer ADW wagering. These companies provide legal simulcast horse wagering over the internet. The legislation now allows the Company to recoup a percentage of all simulcast horse racing wagers made by Minnesota residents over the internet on out-of-state races.

The Minnesota legislature may consider bills to legalize sports betting in the State of Minnesota. If sports betting were legalized in Minnesota for tribal casinos and through mobile applications operated by the tribes, we would experience increased competition from the tribal casinos which could divert customers from our Casino and Racetrack and thus adversely affect our financial condition, results of operations and cash flows.

The Company also faces indirect competition from a variety of sources for discretionary consumer spending including spectator sports and other entertainment and gaming options. In the Minneapolis-Saint Paul metropolitan area, competition includes a wide range of live and televised professional and collegiate sporting events. In addition, live horse racing competes with a wide variety of summer attractions, including amusement parks, sporting events, and other local activities.

Finally, the Company competes with racetracks located throughout the United States in securing horses to run at the Racetrack. Attracting owners and trainers that can bring high quality horses to our Racetrack is largely dependent on our ability to offer competitive purses. The Company experiences significant competition for horses from racetracks located near Des Moines, Iowa and Chicago, Illinois. We expect this competition to continue for the foreseeable future.

Canterbury Development and its joint ventures face competition from developers of other residential, mixed use, office, retail, hotel and entertainment spaces around Shakopee, Minnesota and elsewhere in Minnesota. These other developers may be larger and have more resources than Canterbury Development or than Canterbury Development and its developer partners on a combined basis. The leasing of real estate is highly competitive. The principal competitive factors are rent, location, lease term, lease concessions, services provided and the nature and condition of the property to be leased. The Canterbury Development joint ventures will directly compete with all owners, developers and operators of similar space in the areas in which our properties are located. The number of competitive multifamily properties in our particular market could adversely affect lease rates at residential properties in Canterbury Commons, as well as the rents able to be charged. In addition, other forms of residential properties, including single family housing and town homes, provide housing alternatives to potential residents of luxury apartment communities like our Triple Crown Residences at Canterbury Park. Likewise, the competition for high quality tenants for retail, office and other spaces is intense. In order to be successful, our real estate joint ventures must have high lease rates, competitive rental rates, and maintain high occupancy rates with a financially stable tenant base.

We may again in the future seek developers or other partners for joint venture arrangements or opportunities for Canterbury Development to develop our properties. We will be competing with other property owners, both around Shakopee and elsewhere, for high quality builders, commercial and residential real estate firms, and developers that share our vision for Canterbury Commons. We have in the past and may agree in the future to sell parcels of land to third parties that will then develop the properties and in that case, we will also be in competition with other sellers of properties for purchasers. Although we will have no continuing ownership in these land sales, we believe that the ability to effectively compete for tenants will be a factor in the purchasers’ selection of our property over other competing properties for their developments.

Regulation and Regulatory Changes

General

The ownership and operation of the Racetrack in Minnesota is subject to significant regulation by the MRC under the Minnesota Racing Act and the rules adopted by the MRC. The Minnesota Racing Act governs the allocation of each wagering pool to winning bettors, the Racetrack, purses, pari-mutuel taxes, and the MBF, and empowers the MRC to license and regulate substantially all aspects of horse racing in the State. The MRC, among other things, grants operating licenses to racetracks after an application process and public hearings, licenses all racetrack employees, jockeys, trainers, veterinarians, and other participants, regulates the transfer of ownership interests in licenses, allocates live race days and simulcast-only race days, approves race programs, regulates the conduct of races, sets specifications for the racing ovals, animal facilities, employee quarters and public areas of racetracks, regulates the types of wagers on horse races, and approves significant contractual arrangements with racetracks, including management agreements, simulcast arrangements, and totalizator contracts.

A federal statute, the Interstate Horse Racing Act of 1978, also requires that a racetrack must obtain the consent of the group representing the horsepersons (owners and trainers) racing the breed of horses that race a majority of the time at the racetrack (which is the MHBPA), and the consent of the state agency regulating the racetrack (in Minnesota, the MRC), in order to transmit simulcast signals of its live races or to receive and use simulcast signals from other racetracks.

Issuance of Class A and Class B Licenses to the Company

The Company holds a Class A License, issued by the MRC, that allows the Company to own and operate the Racetrack. The Class A License is effective until revoked, suspended by the MRC, or relinquished by the licensee. Currently, the fee for a Class A License is $252,000 per fiscal year.

The Company also holds a Class B License, issued by the MRC, that allows the Company to sponsor and manage horse racing on which pari-mutuel wagering is conducted at its Class A licensed racetrack and on other horse races run at out-of-state locations as authorized by the MRC. The Class B License is renewable each year by the MRC after a public hearing (if required by the MRC). Currently, the fee for the Class B License is $500 for each assigned race day on which live racing is actually conducted and $100 for each day on which simulcasting is authorized and actually takes place.

In addition, the law requires that the Company reimburse the MRC for actual costs, including stewards, state veterinarians and drug testing, related to the regulating of live racing. For fiscal years ended December 31, 2022 and 2021, the Company paid $152,000 and $172,000 respectively, to the MRC as reimbursement for costs of regulating live racing operations.

The MRC is also authorized by the Racing Act to regulate Casino operations. The law requires that the Company reimburse the MRC for its actual costs, including personnel costs, of regulating the Casino. For fiscal years ended December 31, 2022 and 2021, the Company paid $248,000 and $247,000, respectively, to the MRC as reimbursement for costs of regulating Casino operations.

On January 19, 2000, the MRC issued an additional Class B License to the Company that authorized the Company to host unbanked card games. The Class B License is renewable each year by the MRC after a public hearing (if required by the MRC). Currently, the Class B License fee of $10,000 per calendar year is included in the Class A License fee of $253,000 per calendar year.

Limitation on the Number of Class A and Class B Licenses

Pursuant to the Racing Act, so long as the Racetrack maintains its Class A License, no other Class A License may be issued to allow an entity to own and operate a racetrack in the seven county metropolitan area where thoroughbred and quarter horses are raced. However, the Racing Act provides that the MRC may issue an additional Class A License within the seven-county metropolitan area, if the additional license is issued for a facility that, among other conditions, is located more than 20 miles from the Racetrack, contains a track no larger than five-eighths of a mile in circumference, and is used exclusively for harness racing. In January 2005, this additional Class A license was issued for the location that later became known as Running Aces (see “Competition” above).

Limitation on Ownership and Management of an Entity that holds a Class A or Class B License

The Racing Act requires prior MRC approval of all officers, directors, 5% shareholders or other persons having a present or future direct or indirect financial or management interest in any person applying for a Class A or Class B license, and if a change of ownership of more than 5% of the licensee’s shares is made after an application is filed or the license issued, the applicant or licensee must notify the MRC of the changes within five days of this occurrence and provide the information required by the Racing Act.

Advanced Deposit Wagering Legislation

Minnesota ADW legislation that became effective November 1, 2016, requires ADW providers to be licensed by the MRC and established licensing criteria and regulatory oversight of ADW providers doing business in the State of Minnesota. The law allows licensed racetracks to negotiate separate agreements with the ADW providers to remit source market fees to those racetracks. The ADW source market revenue to the Company totaled approximately $1,511,000 and $1,382,000 for the fiscal years ended December 31, 2022 and 2021, respectively. As part of the agreement, 50% of source market fees is allocated to purse accounts and the MBF.

Horseracing Integrity and Safety Act

The Horseracing Integrity and Safety Act (HISA), which was passed at the end of 2020 and amended in late 2022, creates uniform national standards for thoroughbred racing in the areas of racetrack safety and medication. The Horseracing Integrity and Safety Authority was established to enforce HISA and operates under the oversight of the Federal Trade Commission. In addition to oversight by the MRC, our Racetracks and their participants are subject to the HISA equine safety, welfare and drug testing rules and regulations established by the Horseracing Integrity and Safety Authority under HISA.

Sports Betting

As of the date of filing this Form 10-K, the Minnesota legislature is considering a bill to legalize sports betting in Minnesota at tribal casinos and online through mobile applications operated by the tribes. It is not certain whether this bill will be adopted into law. If sports betting were legalized in Minnesota for tribal casinos and through mobile applications operated by the tribes, we would experience increased competition from the tribal casinos which could divert customers from our Casino and Racetrack and thus adversely affect our financial condition, results of operations and cash flows.

Local Regulation

The Company’s operations are subject to state and local laws, regulations, ordinances, and other provisions affecting zoning, public health, and other matters that may have the effect of restricting the uses to which the Company’s land and other assets may be used. Also, any development of the Racetrack site and Canterbury Commons is, among other things, subject to applicable zoning ordinances and requires approval by the City of Shakopee and other authorities. There can be no assurance these approvals will be obtained for any future development the Company proposes.

Minimum Wage Legislation

Minnesota has adopted a minimum wage law that sets the minimum hourly wage that must be paid to most Company employees. Beginning January 1, 2018, the minimum wage increases at the beginning of each year by the rate of inflation with a maximum increase of up to 2.5% per year. The minimum wage for 2022 was $10.33 per hour and for 2023 is $10.59 per hour. This legislation has had an adverse financial impact on the Company by increasing expenses and we expect will continue to have an adverse impact on the Company. From time to time, we have implemented measures to partially mitigate the impact of increases in the minimum wage by raising our prices and reducing our employee count. These measures could themselves have an adverse effect because higher prices and diminished service levels may discourage customers from visiting the Racetrack.

Cooperative Marketing Agreement

On June 4, 2012, the Company entered into the CMA with the SMSC. The primary purpose of the CMA was to increase purses paid during live horse racing at Canterbury Park’s Racetrack in order to strengthen Minnesota’s thoroughbred and quarter horse through horse industry. Under the CMA, as amended, this was achieved through “Purse Enhancement Payments to Horsemen” paid directly to the MHBPA.

Because the Company conducted a more limited 2020 live race meet due to the COVID-19 pandemic, the Company and SMSC entered into the Fifth Amendment Agreement (“Fifth Amendment”) to the CMA effective June 8, 2020.

Under the CMA, as amended, SMSC also agreed to make “Marketing Payments” to the Company relating to joint marketing efforts for the mutual benefit of the Company and SMSC, including signage, joint promotions, player benefits, and events.

Pursuant to the Fifth Amendment, SMSC was obligated to make annual purse enhancements of $7,380,000 and an annual marketing payment of $1,620,000 for both 2021 and 2022.

The purse enhancement payments to horsemen had no direct impact on the Company’s consolidated financial statements or operations. See the Management's Discussion and Analysis Section of this Form 10-K and footnote 11 of the consolidated financial statements for more detailed information on the CMA.

The CMA expired by its terms on December 31, 2022. Following the expiration of the CMA on December 31, 2022, we will not receive any purse enhancement, marketing payments or other amounts under the CMA.

Marketing

The Company’s primary market is the seven-county Minneapolis-Saint Paul metropolitan area (Hennepin, Ramsey, Anoka, Washington, Dakota, Scott, and Carver) plus the two counties to the south of the Racetrack and Casino (Le Sueur and Rice). The City of Shakopee, located in the southwestern portion of the metropolitan area, is one of the fastest growing communities in the region, and Scott County is one of the fastest growing counties in the country.

To support its pari-mutuel horse racing, Casino, and catering and events businesses, the Company conducts year-round marketing efforts to maintain the loyalty of existing customers and attract new players to the property. The Company uses radio, television, digital advertising, social media, print advertising, and direct marketing to communicate to its audiences. In addition to its regular advertising and communication program, the Company conducts numerous special promotions, handicapping contests, and poker tournaments to attract incremental visits. The Company also uses a robust player rewards and database marketing program to enhance the loyalty of its guests.

The Company continues to focus on creating a premier guest experience as the core element of its marketing efforts. This includes delivering great customer service, developing new food and beverage offerings, creating fan education programs, and providing entertainment opportunities that go beyond the traditional pari-mutuel wagering and card playing activities.

Human Capital and Team Members

Talent Management

At December 31, 2022, the Company had 241 full-time team members and 512 part-time team members. The Company adds approximately 350 team members on a seasonal basis for live racing operations from early May until early September. The impact of the COVID-19 pandemic on the entertainment industry, and actions that we and others in the industry took in response to COVID-19 (including implementing furloughs, reduced work week schedules, temporarily pay reductions, and eliminating a number of job positions) have adversely affected our ability to attract and retain team members. As entertainment demand recovers from the lows seen in the early months of the COVID-19 pandemic, we have seen and continue to see industry-wide labor shortages causing challenges in hiring or re-hiring for certain positions. In response, we have enhanced our recruitment and retention efforts and increased compensation where needed to maintain competitiveness in this extremely difficult market.

We also offer benefits to eligible employees, including participation in our KSOP Plan (the “KSOP”) that includes the Employee Stock Ownership Plan (the “ESOP”) and the 401(k) Plan. Beginning January 1, 2016, the matching of employee contributions were issued in Company stock, which we believe aligns the interests of Company employees with our shareholders and allows employees to participate in the success that they help create at our company.

Our success depends in large part upon our ability to attract, retain, train, lead, and motivate skilled team members. To facilitate the recruitment, development, and retention of our valuable team members, we strive to make Canterbury Park a diverse, inclusive, and safe workplace, with opportunities for our team to grow and develop. The Company offers training and development opportunities for team members to enhance leadership and communication skills. The Company also has created various internal committees, including a specific rewards and recognition committee to support our team member recognition programs. To help retain talent, we measure team member engagement, including conducting regular engagement surveys to all team members. The most recent survey was conducted in 2022 and reflected an engagement level among our team members that exceeded the average engagement levels of benchmarked companies.

Health and Safety

During 2021 and 2022, we continued to focus significant attention to enhancing health and safety protocols, including in response to COVID-19 pandemic. In addition, our employee guidelines and policies are founded on our cornerstones of safety, service, courtesy, cleanliness, and integrity. We are committed to equal opportunity employment and prohibit harassment or discrimination of any kind. We have adopted an open door policy to encourage an honest employer-associate relationship which includes a confidential hotline available to all employees.

Executive Officers

The executive officers of the Company, their ages and their positions with the Company at March 15, 2023 are as follows:

| Name |

|

Age |

|

Position with Company |

| Randall D. Sampson |

|

64 |

|

President, CEO, and Chairman of the Board |

| |

|

|

|

|

| Randy J. Dehmer |

|

40 |

|

Senior Vice President of Finance and CFO |

Randall D. Sampson has been President and Chief Executive Officer since the formation of the Company in March 1994. Mr. Sampson was also named Chairman of the Board on October 3, 2019. He has been active in horse industry associations, currently serving as Director of the Thoroughbred Racetracks of America and is a past Vice President of the Thoroughbred Racetracks of America and past President of the Minnesota Thoroughbred Association. Mr. Sampson also currently serves as a director of Pineapple Energy Inc. (NASDAQ:PEGY), a growing domestic operator and consolidator of residential solar, battery storage, and grid service solutions based in Minnetonka, Minnesota.

Randy J. Dehmer was hired as Vice President of Finance and Chief Financial Officer in May 2019, and promoted to Senior Vice President of Finance in September 2021. Mr. Dehmer worked for the Company from December 2007 to August 2013, most recently serving as controller from March 2012 to August 2013. Prior to rejoining the Company, he served as financial controller for Clearfield, Inc. (Nasdaq: CLFD), which designs, manufactures and distributes fiber protection, fiber management and fiber delivery solutions, from September 2013 to May 2019. Mr. Dehmer also currently serves as a director on the Shakopee Chamber of Commerce board.

Item 1A. RISK FACTORS

In addition to risks and uncertainties in the ordinary course of business that are common to all businesses, important factors that are specific to our industry and us could materially affect our business, results of operations and financial condition and the market price of our common stock. Although we believe that we have identified and discussed below the material risk factors affecting our business, there may be additional risks and uncertainties that are not presently known or that are not currently believed to be material that may adversely affect our business, results of operations and financial condition, or the market price of our common stock.

Risk Factors Related to Horse Racing and Gaming Generally

Our business is sensitive to reductions in discretionary consumer spending as a result of downturns in the economy and other factors outside of our control.

Our business is particularly sensitive to downturns in the economy and the associated impact on discretionary spending on entertainment, gaming and other leisure activities. Our in-person visitors are predominately local, so we compete for more day-to-day discretionary spending as compared with destination spending. Decreases in discretionary consumer spending or consumer preferences brought about by factors such as perceived or actual general economic conditions or the economic conditions in the Twin Cities or Minnesota specifically, effects of declines in consumer confidence in the economy, any future employment and credit crisis, the impact of high and prolonged inflation, particularly with respect to housing, energy and food costs, the increased cost of travel, decreased disposable consumer income and wealth, fears of war and future acts of terrorism, or widespread illnesses or epidemics, including COVID-19, can have a material adverse effect on discretionary spending and other areas of economic behavior that directly impact the gaming and entertainment industries in general and could further reduce customer demand in our casino, Racetrack and food and beverage segments, which may negatively impact our revenues and operating cash flow.

Because purse enhancement payments and marketing payments under our CMA with SMSC will not continue after December 31, 2022, we are likely to experience decreased revenue and profitability from live racing.

Following the expiration of the CMA on December 31, 2022, we will not receive any purse enhancement, marketing payments or other amounts under the CMA. In 2022, the SMSC paid an annual purse enhancement of $7,280,000 and an annual marketing payment of $1,620,000. The purse enhancement payments were paid directly to the MHBPA and accordingly, such payments had no direct impact on the Company’s consolidated financial statements or operations. The marketing payments under the CMA offset the Company’s expense relating to certain marketing efforts, including signage, promotions, player benefits, and events.

Accordingly, due to the lack of an annual purse enhancement, the purses we are able to offer for our live racing events after December 31, 2022 are likely to be smaller than they have been in the past. This may result in a decrease in field size and decrease in wagering on live races (particularly out-of-state handle), which ultimately result in a decrease in revenue from live racing. For the year ended December 31, 2022, pari-mutuel revenue was $10,958,000, or 16.4%, of total revenues.

If revenue decreases from live racing, the profitability of live racing will likely also decrease due to the fixed expenses relating to live racing and the lack of marketing payments under the CMA. We also will bear increased marketing expenses relating to our casino and food and beverage segments without the marketing payments under the CMA. While we are pursuing initiatives to strengthen the financial returns of live racing at the Racetrack and to manage our marketing spend, there can be no assurance that we will identify and implement initiatives that will advance these goals in a cost-effective or timely manner or at all.

We may not be able to attract a sufficient number of horses and trainers to achieve above average field sizes.

We believe that patrons prefer to wager on races with a number of horses in the race (the “field”) at or above the national average. A failure to offer races with adequate fields results in less wagering on our horse races. Our ability to attract adequate fields depends on several factors. First, it depends on our ability to offer and fund competitive purses. Second, it depends on the overall horse population available for racing. Various factors have led to declines in the horse population in some areas of the country, including competition from racetracks in other areas, increased costs, and changing economic returns for owners and breeders, and the spread of various debilitating and contagious equine diseases. If our racetrack is faced with a sustained outbreak of a contagious equine disease, it could have a material impact on our profitability.

Finally, if we are unable to attract horse owners to stable and race their horses at our racetrack by offering a competitive environment, including high-quality facilities, a well-maintained racetrack, comfortable conditions for backstretch personnel involved in the care and training of horses stabled at our racetrack, and a competitive purse structure, our profitability could also decrease. We also face increased competition for horses and trainers from racetracks that are licensed to operate slot machines and other electronic gaming machines that provide these racetracks an advantage in generating new additional revenues for race purses and capital improvements. While our ability to offer adequate fields to patrons during our live meets was substantially strengthened by the purse enhancement payments that were made under the CMA through 2022, our inability to attract adequate fields, for whatever reason, could have a material adverse impact on our business, financial condition, and results of operations.

We face significant competition, both directly from other racing and gaming operations and indirectly from other forms of entertainment and leisure time activities, which could have a material adverse effect on our operations.

We face intense competition in our market, particularly competition from Running Aces in Columbus Township, Anoka County, Minnesota, a racetrack and card room that is located approximately 50 miles from Canterbury Park.

We also compete with Native American owned casinos. These Native American facilities have the advantage of being exempt from some state and federal taxes and state regulation of indoor smoking, and have the ability to offer a wider variety of gaming products.

Internet-based interactive gaming and wagering, both legal and illegal, is growing rapidly and we anticipate competition in this area will become more intense as new Internet-based ventures enter our industry and as state and federal regulations on Internet-based activities are clarified. Additionally, we compete with other forms of gambling, including betting on professional sports, spectator sports, other forms of entertainment, and other racetracks throughout the country.

We expect competition for our existing and future operations to increase from Running Aces, existing tribal casinos, and racetracks that are able to subsidize their purses with alternative gaming revenues. Competition for simulcasting customers will be intense given the 2016 legalization of online internet wagering on horse racing in Minnesota, through ADW providers. In addition, several of our tribal gaming competitors in Minnesota have substantially larger marketing and financial resources than we do and this competition may increase if sports betting is legalized in Minnesota at tribal casinos and online through mobile applications operated by the tribes. Increased competition from the tribal casinos could divert customers from our Casino and Racetrack and thus adversely affect our financial condition, results of operations and cash flows.

Nationally, the popularity of horse racing has declined.

There has been a general decline in the number of people wagering on live horse races at North American racetracks, either in person or via simulcasting, due to a number of factors, including increased competition from other wagering and entertainment alternatives as discussed above. According to industry sources, pari-mutuel handle declined 27% from 2007 to 2011 and has been relatively stable since 2011, experiencing less than a 1% decline between 2011 and 2019. Pari-mutuel handle declined more than 1% in 2020 due the COVID-19 pandemic, however, pari-mutuel handle returned to pre-pandemic levels in 2021. Declining interest in horse racing has had a negative impact on revenues and profitability in our racing business. However, as a result of the purse enhancement payments and marketing payments we received under the CMA, we outperformed the industry as it relates to field size, live handle, and simulcast handle in 2022. Regardless, we recognize that a general decline in interest in horse racing and pari-mutuel wagering could have a material adverse impact on our business, financial condition and results of operations in future years.

A lack of confidence in the integrity of our core businesses could affect our ability to retain our customers and engage with new customers.

The integrity of horse racing, casino gaming, and pari-mutuel wagering industries must be perceived as fair to patrons and the public at large. To prevent cheating or erroneous payouts, oversight processes must be in place to ensure that these activities cannot be manipulated. A loss of confidence in the fairness of our industries could have a material adverse impact on our business.

Horse racing is an inherently dangerous sport and our racetrack is subject to personal injury litigation.

Although we carry jockey accident insurance at our racetrack to cover personal jockey injuries that may occur during races or daily workouts, there are certain exclusions to our insurance coverage, and we are still subject to litigation from injured participants. We renew our insurance policies on an annual basis. The cost of coverage may become so high that we may need to further reduce our policy limits or agree to certain exclusions from our coverage. Our results may be affected by the outcome of litigation, as this litigation could be costly and time consuming and could divert our management and key personnel from our business operations.

Our business depends on using totalizator services.

Our customers use information provided by a third party vendor that accumulates wagers, records sales, calculates payoffs, and displays wagering data in a secure manner to patrons who wager on our horse races. Any failure to keep this technology current could limit our ability to serve patrons effectively or develop new forms of wagering or affect the security of the wagering process, thus affecting patron confidence in our product. A perceived lack of integrity in the wagering systems could result in a decline in bettor confidence and could lead to a decline in the amount wagered on horse racing. In addition, a totalizator system failure could cause a considerable loss of revenue if betting machines are unavailable for a significant period of time or during an event with high betting volume.

Inclement weather and other conditions may affect our ability to conduct live racing.

Since horse racing is conducted outdoors, unfavorable weather conditions, including extremely high and low temperatures, high winds, storms, tornadoes and hurricanes, could cause events to be postponed or canceled or attendance to be lower, resulting in reduced wagering. Our operations, as well as the racetracks from which we receive simulcast signals, are subject to reduced patronage, disruptions, or complete cessation of operations due to weather conditions, natural disasters, and other casualties. If a business interruption were to occur due to inclement weather and continue for a significant length of time at our racetrack, it could have a material adverse impact on our business, financial condition, and results of operations. The Company maintains insurance for incremental weather conditions that would help mitigate the financial impact on our business.

Our business and operations have been, and may in the future, be adversely affected by epidemics, pandemics, outbreaks of disease, and other adverse public health developments, including COVID-19.

Due to the COVID-19 pandemic, we temporarily suspended all Card Casino, simulcast, and food and beverage operations at Canterbury Park or operated with capacity and other restrictions throughout much of 2020 and the first half of 2021, although to a much lesser extent than 2020. These suspension of operations and capacity restrictions caused significant disruptions to our ability to generate revenues, profitability, and cash flows and had a material adverse impact on our financial condition, results of operations, and cash flows. While we have returned to more normalized operations, there remains continuing logistical challenges faced by the entire gaming industry resulting from COVID-19-related labor shortages and supply chain disruptions. Future disruptions, as well as significant negative economic trends, due to the COVID-19 pandemic or other widespread illnesses or epidemics, may adversely affect our stock price.

Epidemics, pandemics, outbreaks of novel diseases, and other adverse public health developments may arise at any time. Such developments, including the COVID-19 pandemic, have had, and in the future may have, an adverse effect on our business, financial condition and results of operations. These effects include a potentially negative impact on the availability of our key personnel, labor shortages and increased turnover, temporary closures of Canterbury Park or the businesses of our business partners, third-party service providers or other vendors, and interruption of domestic and global supply chains, distribution channels and liquidity and capital or financial markets. The impact of a widespread illnesses or epidemics, including COVID-19, may also have the effect of exacerbating many of the other risks we face.

Risks Related to Government Regulation of our Horse Racing and Gaming Generally