- Statement of Beneficial Ownership (SC 13D)

March 26 2010 - 2:02PM

Edgar (US Regulatory)

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

|

|

Washington, D.C. 20549

|

|

|

|

|

|

|

|

SCHEDULE 13D

|

|

Under the Securities Exchange Act

of 1934

Canterbury

Park Holding Corporation.

(Name of Issuer)

(Title of Class of

Securities)

(CUSIP Number)

John

L. Morgan

605

Highway 169 N., Suite 400

Minneapolis,

Minnesota 55441

Telephone

Number (763) 520-8500

(Name, Address and

Telephone Number of Person

Authorized to Receive Notices and Communications)

(Date of Event Which

Requires Filing of this Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13(d)-1(g),

check the following box.

o

Note

: Schedules filed in paper format shall include a signed original and

five copies of the schedule, including all exhibits. See Rule 13d-7 for other

parties to whom copies are to be sent.

*

The remainder of this cover page shall be

filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing

information which would alter the disclosures provided in a prior cover page.

The information required in the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of

the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the

liabilities of that section of the Act but shall be subject to all other

provisions of the Act (however, see the Notes).

|

CUSIP No.

13811E 10 1

|

|

|

|

|

1

|

Names of Reporting

Persons

John L. Morgan

|

|

|

|

|

2

|

Check the Appropriate Box

if a Member of a Group (See Instructions)

|

|

|

|

(a)

|

o

|

|

|

|

(b)

|

o

|

|

|

|

|

3

|

SEC Use Only

|

|

|

|

|

4

|

Source of Funds (See Instructions)

PF

|

|

|

|

|

5

|

Check if Disclosure of Legal Proceedings Is

Required Pursuant to Items 2(d) or 2(e)

o

|

|

|

|

|

6

|

Citizenship or Place of Organization

United States

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7

|

Sole Voting Power

200,127

|

|

|

|

8

|

Shared Voting Power

0

|

|

|

|

9

|

Sole Dispositive Power

200,127

|

|

|

|

10

|

Shared Dispositive Power

0

|

|

|

|

|

11

|

Aggregate Amount

Beneficially Owned by Each Reporting Person

200,127

|

|

|

|

|

12

|

Check Box if the Aggregate

Amount in Row (11) Excludes Certain Shares (See Instructions)

o

|

|

|

|

|

13

|

Percent of Class

Represented by Amount in Row (11)

5.0%

|

|

|

|

|

14

|

Type of Reporting Person

(See Instructions)

IN

|

|

|

|

|

|

|

|

2

|

Item 1.

|

Security and Issuer.

|

|

|

(a)

Title of Class of Securities: Common Stock, par value $0.01 per share

(“common stock”)

(b)

Name of Issuer:

Canterbury Park Holding Corporation (the “Company”)

(c)

Address of Issuer’s Principal Executive

Offices: 1100 Canterbury Road,

Shakopee, Minnesota 55379

|

|

|

|

|

Item 2.

|

Identity and Background.

|

|

|

(a)

Name of Person Filing: John L. Morgan

(b)

Residence or Business Address:

|

|

Name

|

|

Business Address

|

|

John L. Morgan

|

|

Winmark Corporation

605 Highway 169 N., Suite 400

Minneapolis, Minnesota 55441

|

|

|

(c)

Present

Principal Occupation or Employment:

|

|

Name

|

|

Employment

|

|

John L. Morgan

|

|

Chairman and Chief

Executive Officer of Winmark Corporation

|

|

|

(d)

Conviction in a criminal proceeding during the last

five years: None.

(e)

Subject, during the last five years, to a judgment,

decree or final order enjoining future violations of, or prohibiting or

mandating activities subject to federal or state securities laws: None.

(f)

Citizenship:

Resident of Minnesota, Citizen of the United States.

|

|

|

|

|

Item 3.

|

Source and Amount of Funds or Other

Consideration.

|

|

|

Personal funds were used to purchase 200,127

shares.

|

|

|

|

|

Item 4.

|

Purpose of the Transaction.

|

|

|

Mr. Morgan has purchased the shares of common stock

in the Company for investment purposes.

Mr. Morgan has no plans with respect to the Company that would result

in:

·

extraordinary

corporate transaction;

·

sale or

transfer of a material amount of assets;

·

change in the

board or management;

·

change in the

capitalization or dividend policy;

·

other

material change in business or corporate structure;

·

changes in

charter or bylaws;

|

3

|

|

·

delisting;

·

termination

of registration; or

·

similar

actions.

Mr. Morgan may from time

to time acquire additional shares of common stock (or securities exercisable

for or convertible into common stock) in the open market or in privately

negotiated transactions, subject to availability of common stock at prices

deemed favorable, based on the Company’s business or financial condition and

other factors and conditions that Mr. Morgan deems appropriate. Alternatively, Mr. Morgan may sell all or a

portion of the common stock reported herein (and any shares he may acquire in

the future) in privately negotiated transactions or in the open market. In addition, Mr. Morgan may formulate other

purposes, plans or proposals regarding the Company or any of its securities

to the extent deemed advisable in light of general investment and trading

policies, market conditions or other factors.

|

|

|

|

|

Item 5.

|

Interest in Securities of Issuer

|

|

|

(a)

Aggregate number and

percentage of class beneficially owned:

As

of March 23, 2010, Mr. Morgan may be deemed to be the beneficial

owner of

200,127

shares of common stock.

Based

on calculations made in accordance with Rule 13d-3(d), Mr. Morgan

may be deemed the beneficial owner of 5.0% of the Company’s common

stock. This calculation is based on

3,998,196 shares of common stock outstanding, as of November 13, 2009,

reported in the Company’s Quarterly Report for the quarterly period ended September 30,

2009 filed with the Commission on November 13, 2009.

(b)

Voting and Dispositive Power:

Mr. Morgan

has sole voting and dispositive power over 200,127 shares that may be deemed

to be beneficially owned by him as of March 23, 2010.

(c)

Transactions within the

past 60 days: The information

concerning transactions in the Common Stock effected by Mr. Morgan in

the past sixty (60) days is set forth in Appendix A hereto and incorporated

herein by reference. All of the

transactions were open market purchases.

(d)

Right to Direct the

Receipt of Dividends: Not applicable.

(e)

Last

Date on Which Reporting Person Ceased to be a 5% Holder: Not Applicable.

|

|

|

|

|

Item 6.

|

Contracts, Arrangements, Understandings or

Relationships with Respect to Securities of the Issuer.

|

|

|

None.

|

4

|

Item 7.

|

Material to be Filed as Exhibits.

|

|

|

None.

|

Signature

After reasonable inquiry and to the best of his

knowledge and belief, the undersigned certify that the information set forth in

this statement is true, complete and correct.

Dated:

March 24, 2010

|

|

Name

|

/s/ John L. Morgan

|

|

|

|

John L. Morgan

|

5

Appendix

A

Transactions by Mr. Morgan

in Canterbury Park Holding Corporation during the past 60 days:

|

Date

|

|

Number of Shares

Purchased

|

|

Price Per

Share

|

|

|

01/22/2010

|

|

1,000

|

|

$

|

7.11

|

|

|

01/29/2010

|

|

300

|

|

$

|

7.23

|

|

|

02/03/2010

|

|

1,000

|

|

$

|

7.16

|

|

|

02/08/2010

|

|

500

|

|

$

|

7.11

|

|

|

02/17/2010

|

|

400

|

|

$

|

7.32

|

|

|

02/19/2010

|

|

500

|

|

$

|

7.32

|

|

|

02/22/2010

|

|

440

|

|

$

|

7.07

|

|

|

03/04/2010

|

|

200

|

|

$

|

8.34

|

|

|

03/04/2010

|

|

200

|

|

$

|

8.42

|

|

|

03/04/2010

|

|

300

|

|

$

|

8.44

|

|

|

03/04/2010

|

|

300

|

|

$

|

8.41

|

|

|

03/09/2010

|

|

200

|

|

$

|

8.48

|

|

|

03/09/2010

|

|

200

|

|

$

|

8.45

|

|

|

03/09/2010

|

|

370

|

|

$

|

8.52

|

|

|

03/10/2010

|

|

99

|

|

$

|

8.86

|

|

|

03/10/2010

|

|

100

|

|

$

|

8.90

|

|

|

03/10/2010

|

|

100

|

|

$

|

8.92

|

|

|

03/10/2010

|

|

100

|

|

$

|

8.97

|

|

|

03/10/2010

|

|

200

|

|

$

|

8.92

|

|

|

03/10/2010

|

|

401

|

|

$

|

8.89

|

|

|

03/23/2010

|

|

1,000

|

|

$

|

7.31

|

|

6

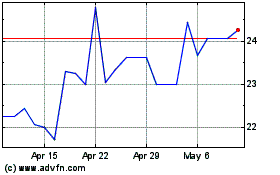

Canterbury Park (NASDAQ:CPHC)

Historical Stock Chart

From May 2024 to Jun 2024

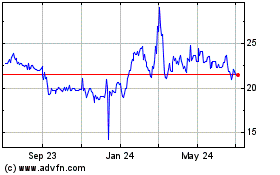

Canterbury Park (NASDAQ:CPHC)

Historical Stock Chart

From Jun 2023 to Jun 2024