BCOV's Q2 Loss Narrower Than Expected - Analyst Blog

July 29 2013 - 10:46AM

Zacks

Brightcove Inc. (BCOV)

reported a loss of 8 cents per share in the second quarter of 2013,

narrower than the Zacks Consensus Estimate of a loss of 12 cents

and the year-ago quarter loss of 14 cents.

Revenues

Revenues jumped 24.4% from the year-ago quarter to $26.9 million,

slightly better than the consensus mark. Revenues were better than

management guided range of $25.7 to $26.2 million.

The year-over-year increase was primarily driven by a 23.4% surge

in Subscription and Support revenues and a 47.0% jump in

Professional Services and Other revenues.

Brighcove’s revenues from premium offerings jumped 22.0% year over

year to $24.2 million. Premium refers to Brighcove’s traditional

video cloud customers, the enterprise edition of app cloud and

Zencoder customers on annual contracts. Revenues from volume

offerings surged 47.0% year over year to $2.7 million.

Brightcove’s customer base expanded 36.0% from the year-ago quarter

to 6386, which includes 1706 premium customers and 4680 volume

customers. Brightcove added/renewed contracts with major companies

that include the likes of Allstate Insurance, Campbell Soup

(CPB) and International Business

Machines (IBM).

During the quarter, Brightcove’s product was chosen by Yahoo! 7,

which is a joint venture between Yahoo!

(YHOO) and Australia based Seven

Networks. The company expanded its customer base by adding The

Motley Fool and Japanese media company, Asahi Shimbun.

Revenues from non-media customers (62% of total revenue) grew 29.0%

year over year, while revenues from media customers (38% of total

revenue) increased 18% from the year-ago quarter. Recurring dollar

retention rate was 103% in the second quarter.

Region wise, revenues from North America (59% of total revenue)

increased 16.0% year over year to $15.8 million. Europe (24% of

total revenue) jumped 22.0% year over year to $6.5 million.

Asia-Pacific including Japan (17% of total revenue) soared 71.0%

from the year-ago quarter to $4.6 million.

Margins

Gross margin contracted 340 basis points (“bps”) on a

year-over-year basis to 66.8% in the reported quarter.

Operating expenses as percentage of revenues were 76.1%, much lower

than 86.0% reported in the year-ago quarter. Research &

development, sales & marketing and general & administrative

expenses as percentage of revenues declined 260 bps, 510 bps and

210 bps, respectively.

Loss from operations (including stock-based compensation) was $2.3

million, narrower than $3.4 million reported in the year-ago

quarter on a higher revenue base.

Net loss (including stock based compensation) of $2.5 million was

narrower than a loss of $3.9 million incurred in the prior-year

quarter.

Balance Sheet and Cash Flow

Exiting the second quarter, Brightcove had cash, cash equivalents

and investments of $30.5 million, up from $26.9 million reported in

the first quarter. Brightcove’s cash flow from operations was $2.8

million in the second quarter. Free cash flow was $2.0 million in

the quarter.

Outlook

For the third quarter, Brightcove expects revenues in the range of

$26.8 million to $27.3 million. Non-GAAP operating loss is expected

to be $0.9 million to $1.2 million. Non-GAAP loss is expected in

the range of 5 cents to 6 cents per share.

For fiscal 2013, Brightcove raised its revenue outlook. Currently,

revenues are expected to be in the range of $106.3 million to

$107.5 million (prior outlook $104.0 million to $106.0

million).

Non-GAAP loss is expected to be $3.0 million to $4.0 million

(better than prior outlook of $3.3 million to $4.8 million). Net

loss is expected in the range of 13 cents to 18 cents (better than

prior outlook of 15 cents to 22 cents) per share.

Recommendation

We believe that strong demand for cloud-based solutions, security

and mobile products, and online videos along with strategic

acquisitions are the positives for the stock over the long term.

However, intense competition and sluggish macro-economic

environment are the near-term headwinds.

Currently, Brightcove has a Zacks Rank #2 (Buy).

BRIGHTCOVE (BCOV): Free Stock Analysis Report

CAMPBELL SOUP (CPB): Free Stock Analysis Report

INTL BUS MACH (IBM): Free Stock Analysis Report

YAHOO! INC (YHOO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

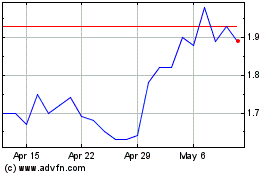

Brightcove (NASDAQ:BCOV)

Historical Stock Chart

From Jun 2024 to Jul 2024

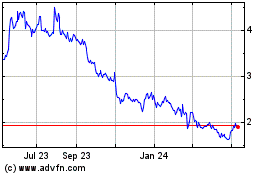

Brightcove (NASDAQ:BCOV)

Historical Stock Chart

From Jul 2023 to Jul 2024